Press release

Banking as a Service Market Anticipated to Hit USD 70.8 Billion by 2032

Overview of the Banking as a Service MarketThe global Banking as a Service (BaaS) market is poised for robust growth, with its valuation expected to reach USD 22.5 billion in 2025 and further expand to USD 70.8 billion by 2032, reflecting a strong CAGR of 17.8% from 2025 to 2032. BaaS enables third-party providers to offer banking services via APIs, empowering non-banking entities to embed financial capabilities like lending, payments, and digital wallets into their platforms. This model is rapidly reshaping the financial landscape by bridging the gap between fintech innovation and traditional banking infrastructure.

The primary drivers behind this growth include the rising demand for embedded finance, accelerated digital transformation, and the integration of financial services into non-banking ecosystems. Among segments, the platform-based BaaS model dominates, driven by its scalability and seamless API integration. Regionally, North America leads the global market, supported by a mature fintech ecosystem, regulatory support for open banking, and strong adoption by neobanks and tech firms expanding financial offerings.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/33606

Key Highlights from the Report

The global Banking as a Service market is projected to reach USD 70.8 billion by 2032, growing at a CAGR of 17.8%.

North America remains the largest regional market, supported by fintech innovation and favorable regulations.

The platform-based segment dominates the market, driven by the rise of API-driven banking models.

Embedded finance adoption across e-commerce and retail platforms is significantly fueling market growth.

SMEs and startups are key adopters of BaaS solutions to streamline financial processes and enhance customer reach.

Strategic partnerships between banks and fintechs are transforming the global digital financial ecosystem.

Market Segmentation

The Banking as a Service market segmentation is primarily based on product type, end-user, and service model. By product type, the market is categorized into API-based banking services, cloud-based platforms, and white-label banking solutions. The API-based model holds the largest market share, as it allows seamless integration of services like KYC verification, digital payments, and loan management into existing business platforms. This flexibility helps enterprises rapidly deploy financial solutions without investing in core banking infrastructure.

By end-user, the market caters to banks, fintech companies, and non-banking businesses such as e-commerce platforms, retailers, and tech startups. Fintechs remain the most prominent end-users, leveraging BaaS to deliver digital-first financial products. However, non-financial companies are also emerging as fast-growing consumers of BaaS, embedding finance into customer experiences - a trend known as "financialization of everything."

Regional Insights

North America dominates the Banking as a Service market, led by the United States. This region's leadership stems from strong fintech penetration, supportive regulations promoting open banking, and the presence of BaaS pioneers such as Green Dot, Synctera, and Marqeta. The rapid adoption of digital-only banking and embedded finance models has accelerated the regional market's maturity.

Europe ranks second, driven by widespread adoption of the PSD2 (Revised Payment Services Directive) and open banking initiatives that encourage collaboration between traditional banks and fintech players. Meanwhile, Asia-Pacific is emerging as a high-growth region, supported by expanding digital payment networks, a young tech-savvy population, and the rise of neobanks in countries like India, Singapore, and Indonesia.

Market Drivers

One of the primary drivers of the Banking as a Service market is the global rise of embedded finance - the integration of financial services into non-financial platforms. Businesses in retail, travel, and technology are increasingly embedding payments, lending, and insurance products within their platforms to enhance customer convenience and retention. This trend has significantly boosted BaaS adoption among non-bank players seeking to offer seamless financial experiences.

Another strong driver is digital transformation across the banking and financial services industry. Traditional banks are adopting BaaS frameworks to modernize legacy systems, improve scalability, and rapidly launch new digital offerings. Moreover, the growing preference for mobile-first banking experiences among younger consumers is compelling financial institutions to adopt BaaS platforms for agility and innovation.

Lastly, the growing collaboration between banks and fintechs has accelerated the BaaS ecosystem. Strategic partnerships are enabling traditional financial institutions to extend their market reach while fintechs gain access to licensed banking capabilities. This synergy is helping bridge the gap between compliance-heavy banking infrastructure and innovative customer-facing digital solutions.

Read More: https://www.persistencemarketresearch.com/market-research/banking-as-a-service-market.asp

Market Restraints

Despite strong momentum, the Banking as a Service market faces several challenges. Regulatory complexities across regions remain a major restraint. Financial data protection, cross-border compliance, and differing interpretations of open banking standards make it difficult for companies to scale globally.

Additionally, the high cost of integration and maintenance for small and mid-sized enterprises can slow adoption. Implementing secure APIs, managing risk, and maintaining regulatory compliance require substantial resources, limiting participation to larger organizations.

Cybersecurity threats and data breaches are also critical restraints. As BaaS platforms handle sensitive customer data and transaction information, they are prime targets for cyberattacks. Ensuring data integrity, privacy, and secure authentication remains essential to building customer trust and sustaining growth.

Market Opportunities

The Banking as a Service market is ripe with opportunities as digital ecosystems expand globally. The growing adoption of artificial intelligence (AI), machine learning (ML), and blockchain technology in banking infrastructure presents immense potential for enhanced risk management and fraud prevention. AI-powered APIs can help automate financial workflows, improve lending decisions, and personalize customer experiences.

Emerging markets in Asia-Pacific, Latin America, and Africa represent vast untapped opportunities for BaaS providers. The increasing penetration of smartphones, mobile wallets, and internet banking in these regions provides fertile ground for BaaS adoption, especially among unbanked and underbanked populations.

Moreover, the rise of decentralized finance (DeFi) and Web 3.0 ecosystems is expected to open new avenues for BaaS integration. Hybrid models that combine centralized compliance with decentralized innovation could redefine how financial services are delivered and accessed globally.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/33606

Reasons to Buy the Report

✔ Gain comprehensive insights into the global Banking as a Service market trends and forecast growth trajectory through 2032.

✔ Understand key growth drivers, challenges, and emerging opportunities shaping the BaaS landscape.

✔ Identify leading segments, regional hotspots, and technological advancements driving market expansion.

✔ Evaluate major players' strategies, partnerships, and innovation pipelines to guide strategic investment decisions.

✔ Stay informed about regulatory developments and evolving standards in open banking and digital finance.

Frequently Asked Questions (FAQs)

How Big is the Global Banking as a Service Market?

Who are the Key Players in the Global Banking as a Service Market?

What is the Projected Growth Rate of the Banking as a Service Market?

What is the Market Forecast for 2032?

Which Region is Estimated to Dominate the Industry through the Forecast Period?

Company Insights

Key players operating in the global Banking as a Service market include:

Solaris SE

Green Dot Corporation

Marqeta, Inc.

Synctera

Treezor

Fidor Solutions AG

MatchMove Pay Pte. Ltd.

11:FS Foundry

Treasury Prime

ClearBank

Recent Developments

September 2024: Marqeta partnered with fintech firm Stash to launch customizable debit card programs using API-based BaaS solutions.

June 2024: Synctera expanded its Banking as a Service offering to Canada, enabling fintechs to access compliant, ready-to-launch financial infrastructure.

Conclusion

The Banking as a Service market is ushering in a new era of digital financial innovation by empowering businesses across industries to integrate seamless financial services into their offerings. The sector's growth trajectory - from USD 22.5 billion in 2025 to USD 70.8 billion by 2032 - reflects a fundamental transformation in how banking infrastructure is delivered and consumed.

As embedded finance gains momentum and fintech ecosystems mature, BaaS providers will play a central role in defining the future of financial inclusion, operational efficiency, and customer-centric banking. With continuous innovation, strategic partnerships, and supportive regulations, the global Banking as a Service market is set to become one of the most dynamic pillars of the digital economy by 2032.

Related Reports:

Push-to-Talk Over Cellular (PTToC) Market Size https://www.persistencemarketresearch.com/market-research/push-to-talk-over-cellular-market.asp

ISO Certification Market Size https://www.persistencemarketresearch.com/market-research/iso-certification-market.asp

Webtoons Market Size https://www.persistencemarketresearch.com/market-research/webtoons-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking as a Service Market Anticipated to Hit USD 70.8 Billion by 2032 here

News-ID: 4258571 • Views: …

More Releases from Persistence Market Research

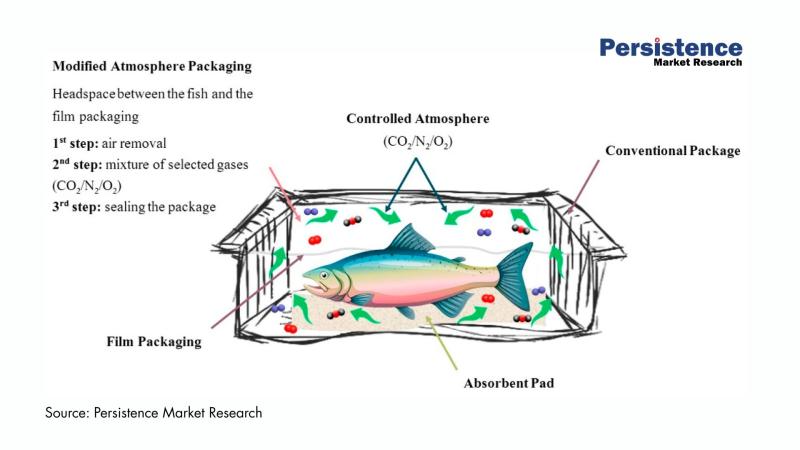

Active Modified Atmospheric Packaging Market to Surpass US$ 37.9 Bn by 2033, Dri …

The global active modified atmospheric packaging market is entering a dynamic growth phase as food manufacturers, healthcare suppliers, and logistics companies intensify their focus on extending product freshness, minimizing waste, and improving supply chain resilience. Active modified atmospheric packaging (AMAP) integrates advanced gas control technologies, moisture regulators, and antimicrobial features to create optimal internal environments for perishable products.

According to the latest study by Persistence Market Research, the global active modified…

Shunt Capacitor Market Expected to Reach US$2.0 Bn by 2033 Driven by Grid Modern …

The global shunt capacitor market is set for sustained growth as power grids worldwide undergo modernization to meet rising electricity demand and improve energy efficiency. According to the latest study by Persistence Market Research, the global shunt capacitor market size is likely to be valued at US$ 1.3 billion in 2026 and is projected to reach US$ 2.0 billion by 2033, expanding at a CAGR of 6% during the forecast…

Tire Cord & Tire Fabrics Market Set to Hit US$9.0 Bn by 2032 Driven by Radializa …

The global tire cord & tire fabrics market is entering a dynamic growth phase as automotive production rebounds, mobility patterns evolve, and manufacturers prioritize high-performance reinforcement materials. Tire cords and fabrics form the structural backbone of tires, providing dimensional stability, strength, and resistance to wear under demanding operating conditions.

According to the latest study by Persistence Market Research, the market is valued at US$5.9 billion in 2025 and is projected to…

Event Tourism Market Set for Exponential Growth through 2032 - PMR Research

The global Event Tourism Market is poised for remarkable expansion, driven by sustained demand for live experiences, increased business travel, hybrid event adoption, and a rebound in international tourism. According to industry projections, the market is expected to grow from an estimated US$1,538.3 billion in 2025 to US$2,631.5 billion by 2032, registering a CAGR of 7.3% over the forecast period.

This robust growth underscores the evolution of event tourism into one…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…