Press release

Fraud Management In Banking Market Leaders - Competitive Positioning, Strategic Strengths & Investor Outlook

The fraud management in banking market is evolving rapidly as digital transformation reshapes the global financial ecosystem. With the proliferation of online banking, real-time payments, and mobile transactions, banks face growing challenges from sophisticated cyber threats. As financial institutions intensify their efforts to secure customer data and protect assets, fraud management solutions are becoming indispensable. This article provides an in-depth analysis of the leading companies, their competitive positioning, and emerging investment opportunities shaping the future of banking fraud prevention.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8183

Top Companies & Their Strategies

1. FICO (Fair Isaac Corporation)

FICO is a global leader in fraud management and analytics for financial institutions. The company's flagship FICO Falcon Platform leverages artificial intelligence (AI) and machine learning (ML) to detect, score, and prevent fraudulent activities in real time. FICO's strength lies in its deep analytics expertise, vast customer base, and long-standing relationships with banks and credit card issuers. Its focus on adaptive AI models and cross-channel analytics ensures consistent protection across card, online, and mobile transactions.

2. SAS Institute Inc.

SAS offers one of the most comprehensive portfolios in fraud detection and risk management. The SAS Fraud Management Platform is widely adopted by global banks for its robust data integration and real-time decisioning capabilities. SAS's competitive advantage lies in its strong data science capabilities, predictive modeling, and modular deployment flexibility. Its continuous investment in cloud-native architecture and integration with financial crime solutions enhances scalability for large banking networks.

3. ACI Worldwide, Inc.

ACI Worldwide provides banks with real-time fraud detection and payments risk solutions integrated into its ACI Enterprise Payments Platform. The company's strength is its global reach and deep presence in real-time payments, offering fraud solutions across retail, corporate, and digital channels. ACI's recent innovations include machine learning-based transaction monitoring and API-driven fraud orchestration layers that enable banks to tailor risk thresholds dynamically.

4. NICE Actimize (a NICE Ltd. company)

NICE Actimize is a leader in financial crime and compliance management, providing end-to-end fraud prevention systems to major financial institutions. The company's unified platform combines analytics, case management, and real-time transaction monitoring, supported by AI and behavioral biometrics. Its modular, cloud-ready approach enables scalability, while its regulatory compliance features make it a trusted partner for global and regional banks alike.

➤ Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Fraud Management In Banking Market report here → https://www.researchnester.com/sample-request-8183

5. IBM Corporation

IBM plays a pivotal role in the fraud management in banking ecosystem, blending cognitive computing with risk analytics through its IBM Safer Payments solution. Its AI-driven behavioral analytics and Watson-powered insights enhance early fraud detection and decision automation. IBM's global reach and integration expertise across hybrid cloud environments make it a preferred choice for large-scale digital banking transformations focused on resilience and security.

6. Experian plc

Experian has built a strong presence in identity verification and fraud risk scoring. Its CrossCore platform unites identity, fraud, and authentication capabilities into a single cloud-based solution. Experian's strength lies in its data intelligence and credit analytics, enabling banks to combine customer identity validation with behavioral risk assessment. The company's continued investment in AI-driven analytics and partnerships with fintechs further strengthen its fraud management portfolio.

7. RSA Security LLC (part of Symphony Technology Group)

RSA Security specializes in risk-based authentication and transaction monitoring solutions for banks and digital financial institutions. The RSA Fraud and Risk Intelligence Suite offers end-to-end visibility into identity-based threats. Its key differentiators include robust authentication algorithms, adaptive risk scoring, and integration with mobile banking security frameworks. RSA's strong legacy in enterprise security solutions gives it an advantage in addressing both internal and external fraud risks.

8. Feedzai, Inc.

Feedzai, a rapidly growing fintech player, is redefining fraud detection in digital banking through its AI-powered RiskOps Platform. The company offers real-time transaction scoring, anomaly detection, and risk modeling tailored for open banking and fintech ecosystems. Feedzai's strength lies in its advanced machine learning engine and flexible deployment models, making it an attractive choice for both global banks and digital challengers. Its partnerships with Visa, Citi, and other financial giants demonstrate growing market traction.

➤ Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Fraud Management In Banking Market Report Overview here: https://www.researchnester.com/reports/fraud-management-in-banking-market/8183

SWOT Analysis of Leading Companies

Strengths

Leading players in the fraud management in banking market possess strong technological foundations in AI, data analytics, and behavioral modeling. Companies such as FICO, SAS, and NICE Actimize have long-established reputations and trusted relationships with global banks. Their ability to integrate fraud detection seamlessly with compliance and AML (Anti-Money Laundering) solutions enhances their competitive positioning. Additionally, cloud-based and API-driven solutions allow flexible deployments across legacy and digital-first banking environments.

Weaknesses

Despite technological advancements, many solution providers face challenges related to implementation complexity and integration costs. Legacy infrastructure in traditional banks can hinder rapid adoption of modern fraud management tools. Smaller institutions often struggle with high licensing costs and the need for specialized talent to interpret analytics outputs. Moreover, frequent updates to regulatory frameworks require continuous system adaptation, increasing operational burdens for vendors and clients alike.

Opportunities

The market presents significant opportunities through AI innovation, regulatory compliance demands, and fintech collaboration. The increasing adoption of open banking and real-time payments creates new avenues for intelligent fraud orchestration. Cloud-native and SaaS-based fraud management models are enabling banks to scale dynamically while reducing total cost of ownership. Moreover, emerging markets in Asia-Pacific, the Middle East, and Latin America offer expansion opportunities as digital banking ecosystems mature and demand for fraud prevention intensifies.

Threats

The evolving sophistication of cyber threats remains the most critical challenge. Fraudsters increasingly exploit deepfakes, synthetic identities, and social engineering tactics that outpace traditional detection methods. Intense competition among solution providers can lead to pricing pressure and margin erosion. Additionally, data privacy regulations such as GDPR and evolving cross-border compliance laws can restrict data movement, complicating analytics-driven fraud prevention in multinational banking environments.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-8183

Investment Opportunities & Trends

Emerging Investment Themes

Investment activity in the fraud management in banking sector is intensifying as investors seek exposure to cybersecurity, fintech, and risk analytics. Key investment themes include:

• AI and machine learning integration for behavioral analysis and predictive fraud detection.

• Cloud-native fraud platforms offering scalability and faster deployment.

• Cross-industry partnerships between banks, fintechs, and analytics providers.

• Identity verification technologies using biometrics and device intelligence.

These themes are driving venture funding, mergers, and strategic collaborations as the market evolves toward automation and real-time fraud prevention.

M&A Activity and Collaborations

In the past 12 months, several notable transactions have reshaped the competitive landscape:

• Feedzai partnered with Visa to enhance AI-driven fraud prevention for real-time payments.

• NICE Actimize expanded its cloud offering through partnerships with Amazon Web Services (AWS) to accelerate SaaS adoption among mid-tier banks.

• FICO collaborated with Snowflake to enhance data sharing and analytics integration for predictive fraud scoring.

• Experian acquired identity verification startup Mitek Systems' Document Verification Unit, strengthening its position in digital onboarding and fraud prevention.

• IBM launched new hybrid-cloud risk management capabilities, integrating blockchain-based identity verification to reduce synthetic fraud in financial transactions.

Such partnerships and acquisitions reflect the industry's pivot toward AI-based collaboration and platform unification, where data, analytics, and intelligence converge to create a holistic fraud management ecosystem.

Regional Investment Trends

The Asia-Pacific region is emerging as a key growth hub, driven by the surge in mobile banking, digital wallets, and cross-border transactions. Governments across India, Singapore, and Australia are tightening fraud regulations, prompting major banks to invest in advanced fraud monitoring solutions.

In North America and Europe, established financial institutions are prioritizing cloud migration and AI adoption, while fintech startups continue to attract venture capital for developing specialized fraud prevention tools.

Meanwhile, Latin America is witnessing accelerated demand for real-time payments fraud detection, with regional banks adopting AI-based platforms to counter rising digital frauds.

Technological and Regulatory Drivers

Recent advances in biometric authentication, behavioral analytics, and federated learning are transforming the industry. Banks are investing in systems capable of detecting account takeover, insider fraud, and synthetic identities in milliseconds. In parallel, regulatory initiatives such as PSD2 in Europe and the Digital Operational Resilience Act (DORA) are compelling financial institutions to adopt robust, integrated fraud management frameworks.

Additionally, ESG-driven investors are showing increased interest in cybersecurity and fraud prevention companies that promote data transparency, ethical AI, and digital trust. This alignment between regulatory compliance and sustainable innovation is shaping long-term capital inflows into the sector.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8183

➤ Related News -

https://www.linkedin.com/pulse/what-future-fraud-management-banking-market-labdc/

https://www.linkedin.com/pulse/why-does-corporate-travel-insurance-market-mtthc/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Fraud Management In Banking Market Leaders - Competitive Positioning, Strategic Strengths & Investor Outlook here

News-ID: 4257740 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

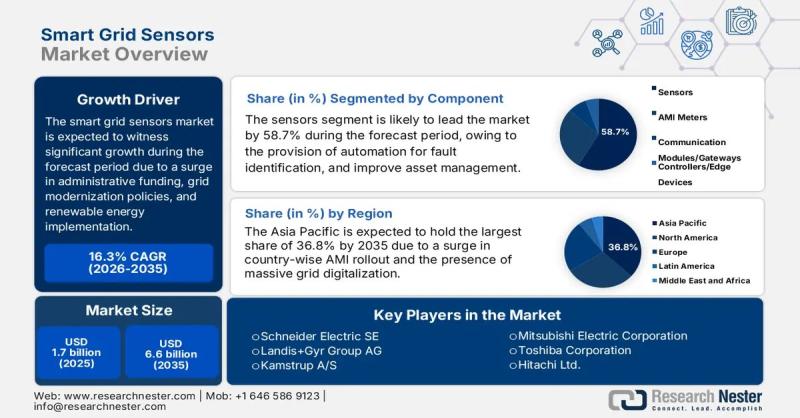

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Fraud

GrayCat PI Joins Global Effort to Spotlight Fraud During International Fraud Awa …

Image: https://www.abnewswire.com/upload/2025/11/dc16cdb8496c72daf00c6802941e27f3.jpg

International Fraud Awareness Week runs November 19-22, 2025 worldwide Oaxaca, Oaxaca, Mexico. $3.1 billion lost to fraud. That figure comes from Occupational Fraud 2024: A Report to the Nations, the latest study from the Association of Certified Fraud Examiners (ACFE), based on 1,921 occupational fraud cases worldwide. The report is available at https://legacy.acfe.com/report-to-the-nations/2024/.

Because fraud remains a persistent and costly threat, GrayCat PI has joined International Fraud Awareness Week [https://graycatpi.com/fraud-week-mexico-2025/],…

New York City Fraud Attorney Russ Kofman Releases Insightful Guide on Welfare Fr …

New York City fraud attorney Russ Kofman (https://www.lebedinkofman.com/are-you-being-investigated-for-welfare-fraud-in-nyc/) of Lebedin Kofman LLP has recently published an enlightening article addressing the complexities surrounding welfare fraud investigations in New York City. The article, aimed at individuals who may be under investigation for welfare fraud, offers crucial legal insight and guidance for navigating this challenging process.

Welfare fraud is no minor offense. It comprises various fraudulent acts to unlawfully obtain public assistance benefits. This…

Fraud Increased by 3% in 2021 - Says Shufti Pro's Global ID Fraud Report

AI-powered digital identity verification solution provider, Shufti Pro, revealed new data in its Global ID Fraud Report 2021 which shows insights from ample research of 11 months of verification. The report highlights the changing fraudulent activities and advanced manipulation techniques that the company faced in 2021. Experts from Shufti Pro have also made fraud predictions that will threaten the corporate sector in 2022.

The ceaseless increase in ID and…

IPTEGO Launching PALLADION Fraud Detection and Prevention for a Real-Time Protec …

IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

Berlin, Germany, February 08, 2012 -- IPTEGO presents PALLADION Fraud Detection & Prevention, an innovative protection for CSPs and their customers against toll fraud.

With PALLADION Fraud Detection & Prevention, IPTEGO provides an answer to a growing demand for more network security when it comes to toll fraud. Today’s Communication Service Providers (CSPs) are…

Online Fraud Prevention – Sentropi

Are security nightmares causing you sleepless nights? Are you worried about how secure your I.T infrastructure is? Sentropi aims to address these ever present security concerns with its uniquely different identification and tracking solution. Sentropi's innovative technology allows you to identify your users with pinpoint accuracy and lets you track fraudsters on any platform, any browser, any time and any where! Hunt down fraudsters by tracking down their computers rather…

Fight Private Placement Program Fraud - PPP Fraud!

Stand up to private placement program fraud!

To set an undertone for the following summary; logic begets logic. No trading platforms nor programs, whether public or private have the freedom of complete exclusion from regulatory oversight, licensing, and governance.

Our firm has significant interest in a few platforms, as principals. There are indeed private financial offerings which have historically delivered very significant performance using "Institutional Leverage, Traders, Risk Management, Clearing & Execution"…