Press release

Cross-Border Payments Market Dominance: Top Firms Strengthening Share & Investment Appeal

The cross-border payments market is transforming rapidly as globalization, e-commerce expansion, and financial digitalization reshape the movement of money across borders. Traditional banking networks, once the backbone of international transactions, are being challenged by fintech disruptors offering faster, cheaper, and more transparent payment solutions. As businesses and consumers increasingly demand real-time, low-cost international transfers, the market is witnessing a convergence of financial institutions, payment networks, and blockchain innovators competing for dominance. This article explores key players shaping the global cross-border payments ecosystem, presents a comprehensive SWOT analysis, and highlights current investment trends and opportunities defining the future of this dynamic sector.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8121

Top Companies & Their Strategies

SWIFT

SWIFT (Society for Worldwide Interbank Financial Telecommunication) remains the most established player in global cross-border transactions. The organization connects more than 11,000 institutions across 200+ countries, providing secure financial messaging services. Its strategy focuses on enhancing transaction transparency and speed through the SWIFT gpi (Global Payments Innovation) initiative, which improves payment traceability and settlement times. SWIFT's vast global network, trust among financial institutions, and regulatory compliance expertise give it an enduring competitive advantage, though its traditional model faces growing competition from blockchain-based networks.

Visa Inc.

Visa is expanding beyond its traditional card-based ecosystem into global money movement solutions. Through Visa B2B Connect and Visa Direct, the company facilitates business-to-business and peer-to-peer cross-border transactions with improved efficiency and reduced friction. Visa's strength lies in its extensive network, global brand trust, and partnerships with banks and fintechs. The company's strategy emphasizes interoperability between digital wallets, blockchain integration, and real-time settlement capabilities across multiple currencies.

Mastercard Inc.

Mastercard is a major force in the cross-border payments market, driven by its Cross-Border Services platform, which supports account-to-account and card-based transfers globally. The company has acquired several fintechs, including Transfast and HomeSend, to enhance its remittance and payment corridor reach. Mastercard's competitive advantage stems from its strong compliance infrastructure, global presence, and continuous investments in AI-driven fraud detection and digital identity verification. Its focus on API-based integration and multi-rail payments positions it well in the evolving landscape.

PayPal Holdings Inc.

PayPal continues to be a dominant player in digital cross-border commerce, connecting over 400 million users worldwide. Its subsidiaries Xoom and Hyperwallet facilitate global remittances and freelancer payments, respectively. PayPal's key strength lies in its vast user base, merchant integration, and strong brand recognition. Its strategy focuses on enhancing mobile-first payment experiences, expanding cryptocurrency payment options, and improving interoperability across regions. By integrating digital wallets and real-time settlement features, PayPal bridges the gap between traditional finance and emerging fintech.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-8121

Ripple Labs Inc.

Ripple is a leading blockchain-based cross-border payments provider offering near-instant transactions via its RippleNet network. Its On-Demand Liquidity (ODL) solution leverages XRP as a bridge currency to enable cost-efficient and fast global transfers. Ripple's strength lies in blockchain innovation, speed, and cost efficiency, attracting partnerships with financial institutions seeking alternatives to traditional correspondent banking. Despite facing regulatory scrutiny in the U.S., Ripple continues to expand in regions like Asia-Pacific, Latin America, and the Middle East.

Wise (formerly TransferWise)

Wise has revolutionized personal and small-business cross-border payments through its transparent, low-cost model. By leveraging local banking networks instead of the traditional SWIFT system, Wise minimizes transfer fees and delays. Its strengths include real exchange rates, user-centric digital experience, and cost leadership. The company's strategy focuses on global expansion through its Wise Business and Wise Platform APIs, allowing other institutions to embed its cross-border payment capabilities.

Western Union

Western Union remains one of the largest remittance service providers, with an extensive agent network spanning over 200 countries. The company is modernizing its operations by digitizing its transfer network, expanding into mobile app-based transactions, and forming fintech partnerships. Its established brand trust and physical presence in remote regions remain unmatched. However, Western Union's transformation strategy now hinges on cost optimization and deeper integration with digital ecosystems to compete with newer fintech entrants.

Revolut

Revolut is an emerging disruptor offering multi-currency accounts, low-cost international transfers, and real-time foreign exchange. Its mobile-first, app-based platform appeals to tech-savvy consumers and freelancers seeking transparent, global money management. Revolut's strength lies in innovation speed, UX design, and data-driven product development. With growing regulatory approvals and expansion into new markets, Revolut represents the next generation of digital cross-border payment platforms.

➤ View our Cross-border Payments Market Report Overview here: https://www.researchnester.com/reports/cross-border-payments-market/8121

SWOT Analysis

Strengths

Leading companies in the cross-border payments market benefit from strong brand recognition, global networks, and technological innovation. Firms like Visa and Mastercard dominate with their extensive financial infrastructure, while fintechs such as Wise and Revolut excel in offering transparency and low fees. Ripple's blockchain-based approach enables instant settlements, reducing dependency on intermediaries. Collectively, these firms leverage AI, API connectivity, and mobile integration to deliver frictionless global payments with enhanced security and compliance.

Weaknesses

The primary challenge for incumbents lies in legacy infrastructure and reliance on correspondent banking systems that increase transaction costs and settlement delays. Regulatory fragmentation across jurisdictions complicates compliance and slows innovation. Fintech players, though agile, often face hurdles in obtaining global licenses, managing liquidity, and maintaining profitability amid intense pricing competition. Additionally, cybersecurity threats and fraud risks remain persistent challenges across digital payment ecosystems.

Opportunities

The cross-border payments market presents vast growth potential in areas such as real-time payments, digital remittances, and B2B cross-border commerce. The rapid expansion of e-commerce, gig economy platforms, and digital banking creates significant demand for seamless international transactions. Emerging technologies like blockchain, (Central Bank Digital Currencies), and AI-driven compliance offer transformative opportunities. Regions such as Asia-Pacific, Africa, and Latin America are becoming prime destinations for digital payment investments, supported by favorable fintech regulations and mobile-first economies.

Threats

Major threats include geopolitical tensions, evolving regulatory landscapes, and competitive pressures from decentralized finance (DeFi) systems. Increasing data protection requirements such as GDPR and evolving anti-money laundering (AML) frameworks can increase operational costs. Traditional banks are forming alliances with fintech firms, intensifying competition. Moreover, cybersecurity vulnerabilities, fraud risks, and fluctuating exchange rates can disrupt cross-border payment operations and erode consumer trust.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-8121

Investment Opportunities & Trends

Mergers & Acquisitions Driving Consolidation

The cross-border payments sector is undergoing significant consolidation as established financial institutions acquire fintech startups to enhance their technological capabilities. Mastercard's acquisition of Transfast and Visa's purchase of Currencycloud exemplify the trend of traditional players strengthening their multi-rail payment ecosystems. These deals enable legacy firms to expand their remittance networks and API-based digital payment infrastructure.

Startup Funding & Fintech Expansion

Venture capital investment continues to pour into cross-border payment startups offering niche and innovative solutions. Firms such as Airwallex, Nium, and Thunes have raised substantial funding rounds to scale global remittance and B2B platforms. These startups are focusing on real-time cross-border transfers, compliance automation, and embedded payment APIs for businesses. The fintech investment surge highlights growing investor confidence in cross-border financial technology as a driver of global economic integration.

Technological Advancements & Integration

Technology integration remains a defining trend. Blockchain, AI, and cloud computing are being deployed to improve transparency, speed, and security. Ripple's ODL solution exemplifies blockchain's ability to reduce liquidity constraints, while Visa and Mastercard are piloting blockchain-based settlement networks. AI-driven fraud detection and real-time compliance tools are enhancing security, while APIs and open banking standards are enabling interoperability across payment systems.

Regional Expansion Hotspots

Regions such as Asia-Pacific and Africa are attracting the most capital, driven by the proliferation of mobile banking and government support for fintech innovation. In Asia, players like Ant Group, Grab Financial, and Paytm are extending their services into cross-border commerce. In Africa, partnerships between mobile money providers and international fintech firms are transforming remittance corridors. Latin America, with its rising digital adoption, is also becoming a critical growth region for cross-border payments.

Recent Developments

In the past year, several notable industry events have reshaped the cross-border payments landscape:

Visa expanded its Visa Direct capabilities in partnership with major banks and fintechs.

Ripple partnered with financial institutions in the Middle East to expand its blockchain-powered corridors.

Mastercard launched its Crypto Credential framework to enhance digital asset-based payments.

PayPal rolled out international crypto-to-fiat payment features for merchants.

Wise extended its Wise Platform API to new banking partners worldwide.

Western Union deepened its digital remittance offerings through new app-based functionalities.

These developments underline a market transitioning from traditional money transfer models to digital, real-time, and blockchain-enabled networks.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8121

Related News -

https://www.linkedin.com/pulse/how-network-forensics-market-strengthening-global-cybersecurity-vxnnf

https://www.linkedin.com/pulse/what-driving-rapid-transformation-global-biscuits-market-schof

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cross-Border Payments Market Dominance: Top Firms Strengthening Share & Investment Appeal here

News-ID: 4257659 • Views: …

More Releases from Research Nester Pvt Ltd

Lutein and Zeaxanthin Market - Key Players, Capability Assessment & M&A Indicato …

The lutein and zeaxanthin market has expanded steadily as demand for eye-health supplements, functional foods, and preventive nutrition increases across global consumer segments. Lutein and zeaxanthin, two essential carotenoids concentrated in the retina, are widely recognized for their protective roles against oxidative stress, age-related macular degeneration (AMD), blue-light exposure, and general visual fatigue. Their adoption has accelerated with the rise of digital lifestyles, an aging population, and growing clinical evidence…

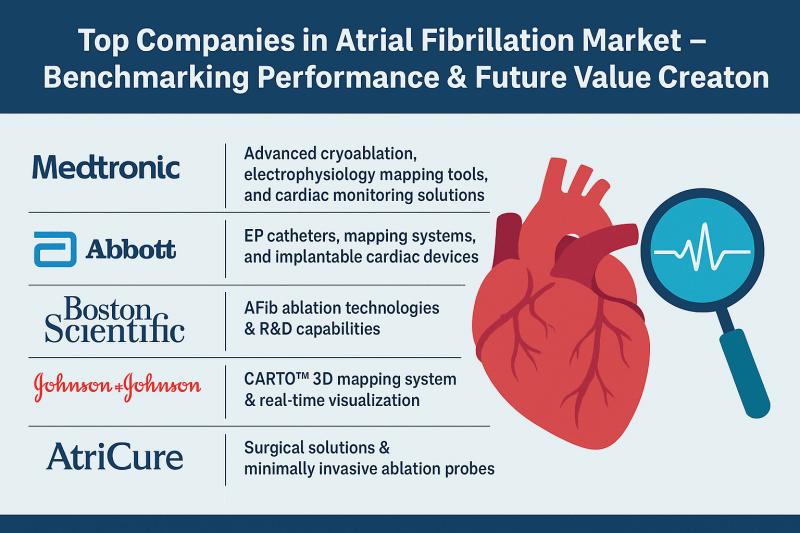

Top Companies in Atrial Fibrillation Market - Benchmarking Performance & Future …

The atrial fibrillation market is undergoing a period of rapid transformation as diagnostic technologies, catheter-based therapies, and antiarrhythmic solutions continue to advance. Atrial fibrillation (AFib) is one of the most prevalent cardiac arrhythmias globally, prompting significant demand for improved detection, early intervention, and minimally invasive treatment. The shift toward advanced ablation systems, AI-enabled diagnostics, wearable monitoring, and next-generation electro-mapping tools has strengthened competition across the market. Companies are expanding their…

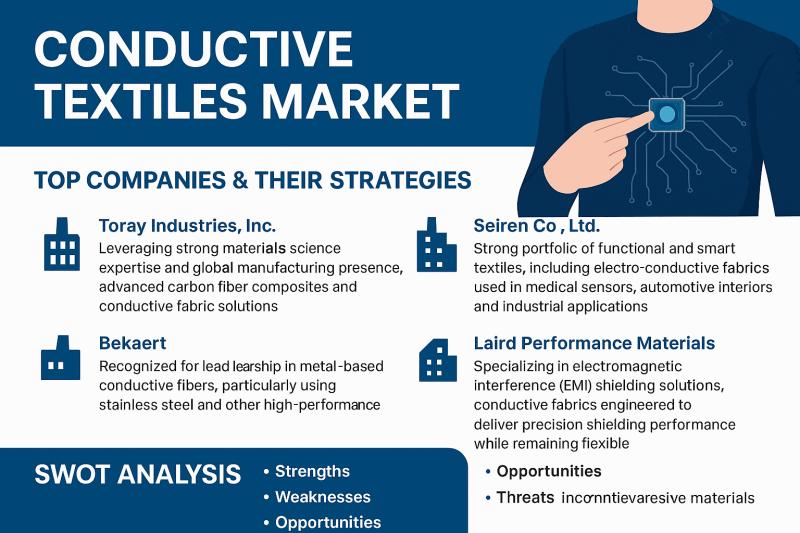

Conductive Textiles Market - Top Companies, SWOT Deep Dive & Capital Flow Trends

The conductive textiles market is undergoing a rapid transformation as wearable electronics, smart apparel, and advanced sensor-integrated fabrics move from niche applications to mainstream adoption. Conductive textiles-engineered using conductive polymers, metal-coated fibers, or intrinsically conductive yarns-have become integral to next-generation healthcare wearables, military gear, automotive interiors, and consumer smart devices. As industries push for lighter, flexible, and more energy-efficient electronic systems, conductive materials embedded within fabrics are emerging as a…

Global Osteosynthesis Devices Market: Top Companies, Market Share Rankings & Inv …

The osteosynthesis devices market continues to evolve as orthopedic care moves toward minimally invasive procedures, biologically compatible materials, and technology-enabled implants. These devices-ranging from plates and screws to intramedullary nails and fixation systems-are essential for treating fractures, deformities, and complex bone injuries. Companies operating in this space are adopting strategies centered around product innovation, clinical efficacy, and expansion into fast-growing regions. As trauma care volumes rise in both developed and…

More Releases for Visa

E-Visa Market May Set New Growth Story | Semlex, Egypt E-Visa, Qatar E-Visa

HTF MI recently introduced Global E-Visa Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2025-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence.

𝐌𝐚𝐣𝐨𝐫 𝐜𝐨𝐦𝐩𝐚𝐧𝐢𝐞𝐬 in E-Visa Market are:

Thales (Gemalto), IDEMIA (France), CGI Group Inc. (Canada), Cox & Kings (India), BLS International (India), TLS Contact (Paris),…

Crypto Credit Card Market Key Players Analysis - Nexo Mastercard, BlockFi Visa C …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Crypto Credit Card Market - (By Type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), By Application (BFSI, Personal Consumption, Business, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."

According to the latest research by InsightAce Analytic, the Global Crypto Credit Card Market is valued at US$ 10.1 billion in 2023, and it…

Visa Center Streamlining Visa Applications Without Consulate Visits

Visa Center is a premier Canadian company specializing in helping clients obtain visas and stay informed about the latest visa regulations.

Image: https://www.getnews.info/uploads/06c09176a81087a4c0d1db13f69be7a9.jpg

The Chinese government has simplified the visa application process, eliminating the need for Canadians to attend consulate appointments for mandatory fingerprinting if they apply for a short-term visa. Previously, all applicants had to visit the Chinese consulate in person, which made the process cumbersome, especially for those living far…

Business Visa Service Market Size in 2023 To 2029 | TLScontact, VFS Global, Frag …

The Business Visa Service research report gives complete information about the trade evolving markets and studies vision across the well-known segments of the markets. The Business Visa Service research report highlights a bunch of constantly changing market situations as well as future evaluations of various factors that totally affect the market. The Business Visa Service research report gives complete data regarding the profitable developing markets and examines insight across the…

Business Visa Service Market Size in 2023 To 2029 | TLScontact, VFS Global, Frag …

The comprehensive report on the Business Visa Service market provides a thorough examination of the various factors that influence industry demand, growth, opportunities, challenges, and limitations. The report analyzes both the global and regional markets, offering insights into their composition and potential. Additionally, it includes information on research and development, new product launches, and feedback from major players in the global and regional markets. Using a systematic approach, the report…

Obtain a visa within quickest possible time with Visa Snap.

United States 25-05-2019. An emergency situation never comes with a warning. In case you are caught in trouble where you have to move to some other country as soon as possible, you would be requiring an emergency visa. Not all agencies issuing are ready to produce a visa under those situations since it is a complicated process. Visa Snap, a One Source Process Company is a reliable and trustworthy rush…