Press release

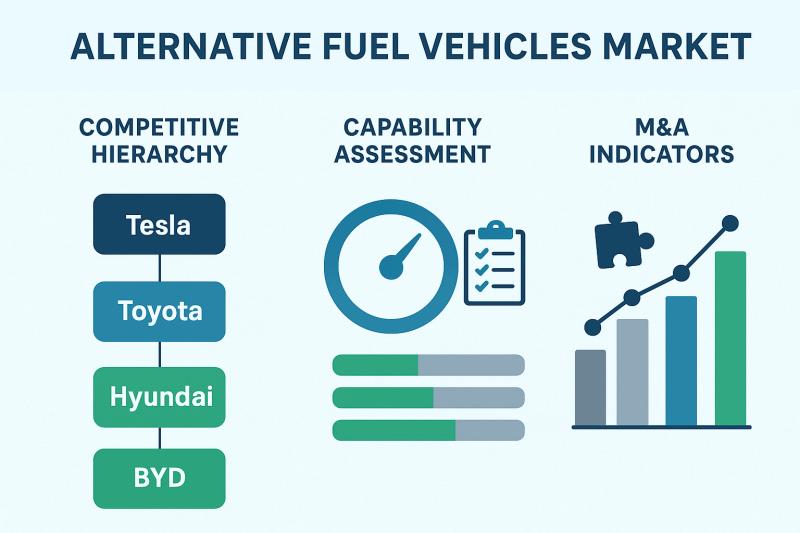

Alternative Fuel Vehicles Market - Competitive Hierarchy, Capability Assessment & M&A Indicators

The Alternative Fuel Vehicles (AFV) Market is at the forefront of the global transition toward sustainable mobility. As environmental regulations tighten and consumers increasingly favor eco-friendly transport, automakers and energy providers are accelerating innovation across electric, hybrid, hydrogen, natural gas, and biofuel-powered vehicles. The AFV landscape today is shaped by technological diversification, cross-industry collaboration, and strategic capital investments aimed at reducing emissions and improving energy efficiency.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7456

Top Companies & Their Strategies

Tesla, Inc.

Tesla remains a trailblazer in the alternative fuel vehicles market through its unwavering focus on battery-electric vehicle (BEV) innovation, vertical integration, and software-driven energy management. The company's strategy revolves around proprietary battery technology, supercharging infrastructure, and energy ecosystem integration via products like Powerwall and Solar Roof. Tesla's global manufacturing footprint-from Gigafactories in the U.S. to Europe and China-enables scale advantages that reinforce its cost competitiveness and market leadership.

Toyota Motor Corporation

Toyota is a diversified leader with a strong portfolio spanning hybrid electric, plug-in hybrid, and hydrogen fuel cell vehicles (FCEVs). Its long-term strategy is rooted in multi-pathway electrification, ensuring flexibility in energy transition. Toyota's continued investment in hydrogen technology, exemplified by the Mirai and partnerships in fuel cell infrastructure, positions it as a major advocate for hydrogen-based mobility ecosystems. Its reliability, broad regional presence, and proven hybrid technology offer a significant competitive edge.

Hyundai Motor Group

Hyundai has emerged as one of the most dynamic players in the alternative fuel vehicles market. The company's strategy combines electric mobility, hydrogen development, and battery innovation. Hyundai's NEXO hydrogen SUV and IONIQ 6 electric sedan highlight its balanced approach to diversified propulsion technologies. Furthermore, its investments in solid-state batteries, EV architecture (E-GMP platform), and fuel cell R&D centers underscore a forward-looking plan for global market penetration.

BYD Company Limited

China's BYD stands out as a vertically integrated manufacturer spanning battery production, electric buses, and passenger EVs. Its strategy emphasizes end-to-end value chain control-from lithium processing to final assembly-ensuring cost efficiency and rapid scalability. BYD's strength lies in lithium-iron-phosphate (LFP) battery chemistry, which offers safety and longevity advantages. Its collaboration with global automakers and expansion into Europe and Latin America reflect its ambition to dominate the global AFV supply chain.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-7456

Honda Motor Co., Ltd.

Honda's AFV strategy focuses on hybrid technology leadership and hydrogen collaboration. The company is scaling its hybrid models across global markets while partnering with General Motors to co-develop next-generation hydrogen fuel cell systems. Honda's strength lies in engineering precision and consistent reliability, supported by investments in flexible production lines capable of accommodating multiple powertrain types. Its cautious yet steady transition strategy ensures resilience amid evolving regulatory and technological landscapes.

General Motors (GM)

GM is aggressively transitioning toward an all-electric future with its Ultium battery platform at the core of its strategy. The company's focus on modular battery systems allows it to power a wide range of vehicles, from compact cars to heavy-duty trucks. Strategic alliances with LG Energy Solution and Honda have strengthened its R&D ecosystem. GM's dual focus on mass-market electrification and software-defined vehicles positions it as a long-term contender in the AFV ecosystem.

Nikola Corporation

Nikola is an emerging disruptor specializing in hydrogen-powered and electric commercial vehicles. The company's strategic advantage lies in its fuel cell truck lineup and development of hydrogen refueling infrastructure across North America. Nikola's partnerships with energy companies and its focus on heavy-duty transport highlight the growing importance of zero-emission logistics solutions. Despite facing early operational challenges, the company remains a significant innovator in the commercial AFV segment.

Rivian Automotive, Inc.

Rivian represents a new generation of electric vehicle startups emphasizing sustainability, adventure-oriented design, and performance. The company's strategy revolves around direct-to-consumer sales, robust software ecosystems, and strategic partnerships-such as its collaboration with Amazon for electric delivery vans. Rivian's brand positioning as a premium, eco-conscious manufacturer enables it to capture high-value segments of the electric SUV and pickup truck markets.

➤ View our Alternative Fuel Vehicles Market Report Overview here: https://www.researchnester.com/reports/alternative-fuel-vehicles-market/7456

SWOT Analysis

Strengths

Leading companies in the Alternative Fuel Vehicles Market possess diversified technological portfolios, strong R&D ecosystems, and expanding infrastructure networks. Tesla and BYD enjoy cost and scale advantages from vertically integrated manufacturing. Toyota and Hyundai maintain resilience through hybrid and hydrogen diversification. GM and Honda benefit from legacy engineering expertise and strategic alliances, while startups like Rivian and Nikola bring agility and innovation. Collectively, these players drive the market's transition by blending innovation, brand equity, and strategic regional expansion.

Weaknesses

The market's leading firms face high R&D expenditure, supply chain dependency, and battery raw material volatility. Manufacturers relying heavily on lithium and rare earth elements face risks from fluctuating commodity prices and limited resource availability. Hydrogen players, despite innovation, struggle with infrastructure insufficiency and high fuel costs. New entrants like Rivian and Nikola encounter capital constraints and production scalability issues, while traditional OEMs must navigate legacy operational structures during the electrification shift.

Opportunities

Global decarbonization efforts and policy-driven incentives present enormous opportunities for AFV expansion. Governments worldwide are investing in EV charging networks, hydrogen corridors, and biofuel blending mandates, creating fertile ground for technological advancement. Key opportunities also lie in energy storage innovation, battery recycling, and cross-sector integration between mobility and renewable energy. Emerging markets in Asia-Pacific, Latin America, and Africa offer strong demand potential due to rising urbanization and government sustainability initiatives.

Threats

Major threats include regulatory uncertainty, intense competition, and rapid technological obsolescence. The pace of innovation in battery chemistry, charging standards, and hydrogen storage may outstrip current investments, creating risks for companies with rigid business models. Additionally, global trade tensions, semiconductor shortages, and energy infrastructure vulnerabilities can disrupt production and deployment. Consumer adoption barriers-such as high upfront costs and limited charging accessibility-continue to challenge mass-market penetration.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-7456

Investment Opportunities & Trends

Surge in EV and Hydrogen Infrastructure Investment

The past year has seen unprecedented investment in electric charging infrastructure and hydrogen fueling networks. Energy companies and governments are jointly investing in corridor-based charging stations, hydrogen production hubs, and renewable power integration. Europe's Alternative Fuels Infrastructure Regulation (AFIR) and the U.S. National Electric Vehicle Infrastructure (NEVI) program are driving large-scale deployments. These policy-backed investments are fueling growth for component manufacturers, grid integrators, and vehicle OEMs alike.

Mergers, Acquisitions, and Strategic Collaborations

M&A activity in the alternative fuel vehicles market continues to intensify as automakers secure technology partnerships and battery sourcing agreements.

GM's partnership with POSCO Future M for cathode material production enhances supply chain resilience.

Hyundai's collaboration with Shell and Air Liquide accelerates hydrogen refueling infrastructure.

BYD's joint ventures with European dealers expand its regional reach.

Tesla's acquisition of battery startups strengthens its in-house cell development capabilities.

These strategic alliances are reshaping competitive dynamics, fostering innovation across both vehicle design and infrastructure ecosystems.

Venture Funding in Startups and Battery Innovation

Venture capital is increasingly targeting battery recycling, solid-state battery development, and alternative propulsion startups. Firms like QuantumScape, StoreDot, and Solid Power have attracted significant funding for next-generation energy storage technologies. Investors are also backing biogas and biofuel-powered mobility solutions, particularly in commercial and agricultural transport. This funding wave underscores growing confidence in multi-fuel mobility ecosystems beyond pure electrification.

Regional Investment Dynamics

Asia-Pacific dominates AFV manufacturing and battery innovation, driven by strong government incentives in China, Japan, and South Korea.

North America is witnessing rapid EV adoption and hydrogen infrastructure expansion, supported by tax credits under the Inflation Reduction Act (IRA).

Europe remains a hub for sustainability-focused investments, with automakers aligning to carbon neutrality targets and expanding renewable energy integration into transportation networks.

These regional variations are shaping localized investment strategies, enabling tailored technology deployments across distinct regulatory environments.

Policy Support and Standardization

Government policies remain the backbone of the AFV industry. The global momentum behind zero-emission vehicle mandates, fuel economy standards, and battery recycling regulations continues to strengthen investor confidence. Standardization efforts for charging connectors, hydrogen storage protocols, and energy labeling are improving interoperability, reducing adoption friction, and enhancing consumer trust in alternative fuel vehicles.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7456

Related News -

https://www.linkedin.com/pulse/what-future-commercial-printing-outsourcing-market-digital-ulq4f

https://www.linkedin.com/pulse/how-5g-infrastructure-market-powering-next-wave-digital-7iwlf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Alternative Fuel Vehicles Market - Competitive Hierarchy, Capability Assessment & M&A Indicators here

News-ID: 4257638 • Views: …

More Releases from Research Nester Pvt Ltd

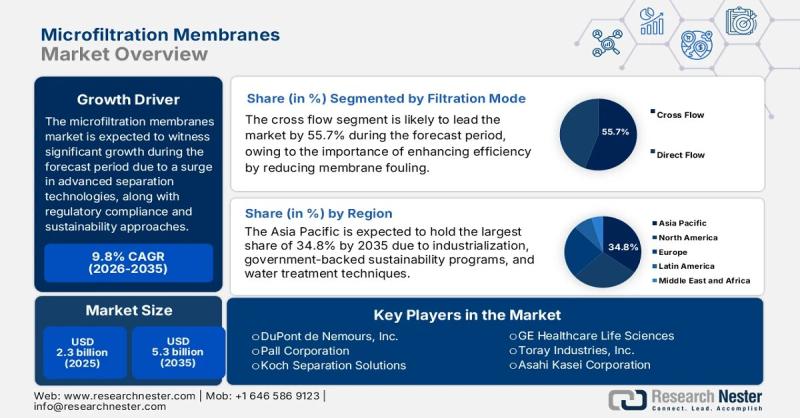

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for AFV

Car Fleet Leasing Market Growing Popularity & Emerging Trends | AutoFlex AFV, Gl …

The latest study released on the Global Car Fleet Leasing Market by HTF MI Research evaluates market size, trend, and forecast to 2030. The Car Fleet Leasing market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the…

Alternative Fuel Vehicles (AFV) Market Size and Forecast

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Alternative Fuel Vehicles (AFV) Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

Alternative Fuel Vehicles (AFV) Market Size And Scope

The global market for Alternative Fuel Vehicles (AFVs) has been experiencing substantial growth, driven by increasing…

Alternative Fuel Vehicles (AFV) Market Current Status and Future Prospects till …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- The global Alternative Fuel Vehicles (AFV) Market is expected to record a CAGR of XX.X% from 2024 to 2031 In 2024, the market size is projected to reach a valuation of USD XX.X Billion. By 2031 the valuation is anticipated to reach USD XX.X Billion.

The impact of manufacturers on the market is significant across various industries, influencing supply chains, consumer choices, and economic growth. Manufacturers are key…

Global Alternative Fuel Vehicles (AFV) Market Forecast 2023-2028 Under Inflation

Alternative Fuel Vehicles (AFV) Market May See a Big Move by 2028

This Alternative Fuel Vehicles (AFV) market report includes discussion guides or questionnaires that are created to acquire useful market information. E-mails, face-to-face, and telephonic discussions are used in the research work. This aids in determining the breadth of the market, business models, industry competitiveness, as well as micro and macro aspects. Economic upheaval and considerable uncertainty have resulted from…

Alternative Fuel Vehicle (AFV) Market Research Report 2023: CAGR, Industry Needs …

An alternative fuel vehicle (AFV) is a vehicle that runs on substances other than the conventional petroleum gas and diesel.

Alternative Fuel Vehicle (AFV) report published by QYResearch reveals that COVID-19 and Russia-Ukraine War impacted the market dually in 2022. Global Alternative Fuel Vehicle (AFV) market is projected to reach US$ 457640 million in 2029, increasing from US$ 168080 million in 2022, with the CAGR of 15.2% during the period of…

Car Fleet Leasing Market Opportunities 2023-2030 | ALD Automotive, AutoFlex AFV, …

According to HTF Market Intelligence, the Global Car Fleet Leasing market to witness a CAGR of 7.2% during forecast period of 2023-2028. The market is segmented by Global Car Fleet Leasing Market Breakdown by Application (IT Industry, Food and Beverage Industry, Pharmaceuticals Industry) by Type (Close End Lease, Open End Lease) and by Geography (North America, South America, Europe, Asia Pacific, MEA). The Car Fleet Leasing market size is estimated…