Press release

Key Players in the Loan Origination Software Market: Share Positioning & Investor Performance Outlook

The global loan origination software market is at the heart of the digital lending revolution, reshaping how banks, credit unions, and fintechs originate, assess, and manage loans. As regulatory compliance tightens and customer expectations for instant credit approvals grow, the market is witnessing widespread adoption of AI-driven decisioning, automated underwriting, and cloud-based deployment models.This article explores the leading companies shaping the loan origination software landscape, their competitive positioning, and the emerging investment trends driving innovation and growth in digital lending ecosystems.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8072

Top Companies & Their Strategies

The loan origination software market features a diverse mix of established financial technology vendors, emerging SaaS innovators, and digital banking solution providers. These companies are focusing on automation, scalability, and compliance-ready platforms to meet evolving lending demands across consumer, SME, and mortgage segments.

1. Ellie Mae (ICE Mortgage Technology) - A leading force in digital mortgage origination, Ellie Mae-now part of ICE Mortgage Technology-has built its reputation around end-to-end automation and compliance intelligence. Its Encompass platform enables lenders to streamline loan workflows, reduce manual intervention, and ensure adherence to changing regulatory frameworks. The company's integration of AI and data analytics enhances borrower profiling and credit risk assessment, positioning it as a technology partner for the world's top mortgage originators.

2. Fiserv, Inc. - Fiserv remains one of the most influential players in financial services technology, offering comprehensive digital lending and origination suites. Its LoanServ and Originate solutions are known for flexibility, multi-channel deployment, and seamless integration with core banking systems. Fiserv's strength lies in its ability to deliver modular platforms that suit both traditional banks and fintech lenders, backed by robust compliance management and real-time loan tracking.

3. Finastra - Finastra's Fusion Mortgagebot and Fusion Loan IQ platforms position it as a global leader in loan origination software across retail and commercial segments. The company's cloud-based model supports scalability and faster time-to-market for financial institutions undergoing digital transformation. Its open APIs and ecosystem partnerships enable third-party integrations-critical for fintech collaboration and embedded lending experiences.

4. FICO (Fair Isaac Corporation) - FICO leverages its globally recognized credit scoring and decision analytics expertise to power intelligent loan origination systems. Its FICO Origination Manager integrates credit decisioning, predictive modeling, and fraud detection, allowing lenders to make faster and more accurate loan approvals. The company's strong reputation in risk management and data analytics provides a competitive edge in both developed and emerging markets.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-8072

5. Temenos AG - Temenos combines digital banking capabilities with powerful origination modules that support personal, mortgage, and corporate lending. Its cloud-native architecture, microservices-based design, and low-code development environment help banks accelerate digital deployment. Temenos' competitive differentiation lies in its real-time analytics and scalability, serving large-tier banks across Europe, the Middle East, and Asia-Pacific.

6. nCino, Inc. - A fast-growing disruptor in the digital lending software space, nCino offers a cloud-based Bank Operating System that transforms origination through automation and data transparency. Built on Salesforce architecture, nCino integrates customer relationship management (CRM) with loan processing, compliance checks, and analytics. Its dominance in the North American banking sector continues to expand globally through strategic partnerships and cloud migrations.

7. MeridianLink, Inc. - MeridianLink serves community banks, credit unions, and online lenders with highly configurable loan origination and account opening software. Its LOS platform emphasizes digital onboarding, cross-selling, and decision automation. The company's customer-centric design and affordable cloud delivery make it a go-to solution for small and mid-sized lenders aiming to digitize without complex integrations.

8. Tavant Technologies - Tavant's AI-powered Touchless LendingTM platform represents the frontier of automation in origination. The company uses machine learning to process unstructured data, accelerate loan approvals, and enhance compliance verification. Its technology is widely adopted by mortgage lenders and financial institutions seeking data-driven efficiency gains. Tavant's focus on user experience and analytics-driven decisioning has earned it recognition as a next-generation fintech innovator.

➤ View our Loan Origination Software Market Report Overview here: https://www.researchnester.com/reports/loan-origination-software-market/8072

SWOT Analysis

Strengths - Leading vendors in the loan origination software market benefit from deep financial technology expertise, global client bases, and robust integration capabilities. Their platforms are increasingly cloud-native, scalable, and compliant with international banking standards such as Basel III and GDPR. The incorporation of AI, machine learning, and predictive analytics enhances underwriting accuracy and reduces credit risk. Strong brand trust and recurring SaaS revenues further strengthen their competitive advantage.

Weaknesses - High implementation costs and long integration timelines can pose barriers for smaller institutions. Many legacy banks still operate on outdated core systems, making full integration with new digital origination platforms complex. Additionally, some software vendors face challenges maintaining data privacy across regions with diverse compliance requirements. The heavy reliance on cloud infrastructure also introduces potential cybersecurity and operational risks.

Opportunities - The digital transformation of banking presents vast opportunities for innovation in loan origination software. Rising fintech collaboration, open banking initiatives, and embedded finance models are fueling demand for flexible APIs and plug-and-play solutions. Emerging markets in Asia-Pacific, Africa, and Latin America offer significant growth potential as digital lending accelerates. AI-driven credit scoring for the underbanked, blockchain-based loan verification, and digital identity integration represent the next phase of value creation.

Threats - Intensifying competition from fintech startups and non-traditional lenders continues to reshape market dynamics. Data breaches, regulatory changes in consumer protection, and tightening data sovereignty laws can disrupt operations. Additionally, the rapid pace of technological evolution requires continuous R&D investment-posing financial strain on smaller vendors. Vendor consolidation through mergers and acquisitions may also limit differentiation for mid-tier providers.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-8072

Investment Opportunities & Trends

The loan origination software market is experiencing strong investment momentum as financial institutions prioritize automation, compliance, and digital engagement. Venture capital and private equity firms are actively funding fintech platforms that deliver scalable SaaS-based origination systems and AI-led underwriting tools.

1. Technology Integration & AI-Driven Automation: Investors are focusing on companies developing AI-based decision engines, document automation, and intelligent workflow management. Machine learning models that enhance credit scoring and fraud detection are receiving strong funding support. Automation of KYC (Know Your Customer) and AML (Anti-Money Laundering) processes is another key investment theme, reducing processing times and operational costs for lenders.

2. Cloud Migration & SaaS Delivery Models: Financial institutions are rapidly transitioning from on-premise legacy systems to cloud-native loan origination solutions. The scalability, security, and subscription-based economics of SaaS platforms are attracting both banks and non-bank lenders. Cloud infrastructure providers are also forming alliances with LOS vendors to co-develop regionally compliant solutions, further accelerating adoption.

3. Mergers & Acquisitions (M&A): The market is witnessing strategic consolidation as large financial software firms acquire niche fintech startups to strengthen product portfolios. For instance, ICE Mortgage Technology's acquisition of Ellie Mae redefined the digital mortgage space, while MeridianLink's expansion through smaller platform acquisitions has enhanced its reach across credit unions and community banks. Such deals enable end-to-end integration from loan origination to servicing.

4. Regional Expansion & Regulatory Enablement: Asia-Pacific and the Middle East are emerging as hotbeds for investment, driven by growing fintech ecosystems, supportive regulatory sandboxes, and rising consumer credit demand. Governments promoting digital identity and eKYC frameworks-such as India's Aadhaar-based lending-are catalyzing adoption of modern origination software. Regional localization and compliance automation have become essential differentiators for vendors entering these markets.

Notable Market Developments in the Last 12 Months

• nCino expanded partnerships with major U.S. regional banks, launching AI-powered credit decisioning modules integrated with Salesforce.

• Finastra announced new cloud-native origination APIs, enabling fintechs to embed digital lending capabilities directly into their platforms.

• MeridianLink acquired a customer data analytics firm to enhance personalized loan offers and cross-selling capabilities.

• Tavant introduced Touchless LendingTM 2.0, enhancing straight-through processing with next-gen AI algorithms.

• Fiserv strengthened its global presence through collaborations with cloud infrastructure providers for secure LOS deployments in emerging markets.

• Regulatory bodies in Europe and North America issued new guidelines for digital lending compliance, prompting vendors to upgrade risk and audit modules.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8072

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Key Players in the Loan Origination Software Market: Share Positioning & Investor Performance Outlook here

News-ID: 4257586 • Views: …

More Releases from Research Nester Pvt Ltd

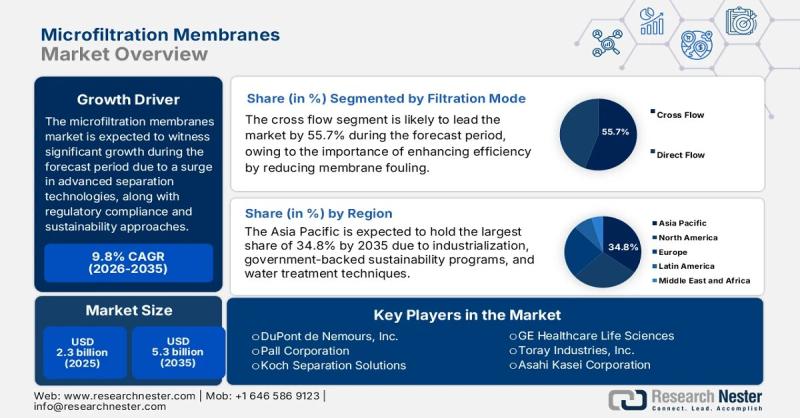

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…