Press release

How Much Does It Cost to Open a Debt Collection Agency in 2025?

Debt Collection Agency Business Plan & Project Report OverviewIMARC Group's "Debt Collection Agency Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful debt collection agency business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining an existing one, the report gives an in-depth analysis of all the ingredients that make it successful, starting with business formation and profitability over time.

What is a Debt Collection Agency Business?

A Debt Collection Agency is a specialized financial services organization designed to deliver comprehensive, compliance-focused debt recovery solutions. These agencies emphasize professional collection practices using advanced skip tracing, payment negotiation, account management, legal compliance protocols, debtor communication strategies, settlement arrangements, and client reporting systems, catering to creditors seeking efficient recovery of outstanding accounts receivable.

They offer a variety of services including first-party collections, third-party debt recovery, skip tracing and debtor location, payment plan negotiations, settlement administration, legal referral coordination, credit reporting services, compliance monitoring, account reconciliation, and comprehensive recovery support programs for businesses committed to optimizing cash flow and minimizing bad debt write-offs.

The category encompasses commercial collection agencies, consumer debt recovery firms, medical billing collection specialists, and multi-industry receivables management companies, each prioritizing ethical collection practices, regulatory compliance, debtor relations management, performance reporting, technology-enabled workflows, client communication protocols, legal coordination, and transparent client engagement.

To achieve these goals, Debt Collection Agencies integrate state-of-the-art collection management software, automated dialing systems, skip tracing databases, payment processing platforms, compliance monitoring tools, customer relationship management systems, performance analytics dashboards, and client reporting technology.

Depending on their positioning, these establishments may operate as specialized consumer debt agencies, commercial collections firms, healthcare receivables specialists, or comprehensive multi-sector debt recovery organizations, delivering complete collection solutions tailored to diverse debt types, client industries, and levels of account complexity.

Request for a Sample Report: https://www.imarcgroup.com/debt-collection-agency-business-plan-project-report/requestsample

Debt Collection Agency Business Market Trends and Growth Drivers

The trends and drivers of a Debt Collection Agency business are shaped by the rising levels of consumer and commercial debt, growing complexity of credit markets, and the increasing need for businesses to maintain healthy cash flow and minimize financial losses. These factors, combined with a stronger focus on regulatory compliance and ethical collection practices, are fuelling demand for professional debt recovery services. Contributing to this shift is the expanding interest in data-driven collection strategies, artificial intelligence-powered debtor analytics, predictive modeling, and automated communication systems, along with the creditor preference for contingency-based recovery models, transparent reporting, risk mitigation, and convenient access to specialized collection expertise within the evolving financial services ecosystem.

To meet these demands, operators are investing in advanced collection management platforms, compliance automation systems, debtor-friendly communication environments, staff training programs, and compliance with Fair Debt Collection Practices Act (FDCPA) and industry-specific regulatory standards. These investments not only enhance the recovery experience but also strengthen business outcomes by aligning with broader trends in financial technology and consumer protection.

Revenue diversification is another critical factor in building financial resilience. In addition to contingency-based collection fees, income streams may include flat-fee collection services, account placement fees, skip tracing revenues, legal referral commissions, compliance consulting services, debtor education programs, payment processing fees, and portfolio purchasing arrangements.

Location and industry specialization play a vital role in success. Agencies positioned in markets with high concentrations of creditor businesses, healthcare providers, financial institutions, retail operations, and access to legal networks benefit from steady account flow and industry credibility. At the same time, state-of-the-art technology systems, compliance with federal and state collection regulations, and adherence to professional collection standards ensure operational excellence and client trust.

However, the business also faces risk factors, such as rapidly evolving regulatory landscapes that can affect collection practices, intense competition from existing collection agencies and in-house recovery departments, dependence on economic conditions and debtor payment capacity, and regulatory challenges related to consumer protection laws, licensing requirements, and compliance audits.

A successful Debt Collection Agency business model requires careful financial planning-including capital investment in collection technology infrastructure and office facilities, procurement of skip tracing databases and communication systems, and adoption of advanced collection management platforms. It also demands skilled collection specialists and compliance officers, supported by effective marketing strategies to build brand awareness, foster client relationships, and establish long-term partnerships with creditors, financial institutions, healthcare organizations, and business decision-makers. By delivering high-quality recovery rates, innovative collection strategies, and exceptional client experiences, these businesses can strengthen creditor financial health while encouraging debtors to embrace responsible payment resolution practices.

Report Coverage

The Debt Collection Agency Business Plan and Project Report includes the following areas of focus:

• Business Model & Operations Plan

• Technical Feasibility

• Financial Feasibility

• Market Analysis

• Marketing & Sales Strategy

• Risk Assessment & Mitigation

• Licensing & Certification Requirements

The comprehensive nature of this report ensures that all aspects of the business are covered, from market trends and risk mitigation to regulatory requirements and compliance-focused client acquisition strategies.

Key Elements of Debt Collection Agency Business Setup

Business Model & Operations Plan

A solid business model is crucial to a successful venture. The report covers:

• Service Overview: A breakdown of debt recovery services, skip tracing operations, payment negotiation processes, settlement administration, legal referral coordination, compliance monitoring programs, account management systems, debtor communication strategies, and client reporting services offered

• Service Workflow: How each account placement, debtor contact process, payment arrangement, compliance verification, legal escalation, and client feedback process is managed

• Revenue Model: An exploration of the mechanisms driving revenue across multiple collection services and debt recovery programs

• SOPs & Service Standards: Guidelines for consistent collection quality, compliance standards, ethical collection practices, and client satisfaction

This section ensures that all operational and client service aspects are clearly defined, making it easier to scale and maintain service quality.

Buy Report Now: https://www.imarcgroup.com/checkout?id=43308&method=1911

Technical Feasibility

Setting up a successful business requires proper collection operations and compliance infrastructure planning. The report includes:

• Location Selection Criteria: Key factors to consider when choosing office locations and target creditor markets

• Space & Costs: Estimations for required call center space, administrative offices, compliance departments, and associated costs

• Equipment & Systems: Identifying essential collection management software, automated dialing systems, skip tracing databases, and compliance monitoring technology

• Office & Technology Setup: Guidelines for creating advanced debt recovery operations facilities and compliance-focused work environments

• Utility Requirements & Costs: Understanding the telecommunications infrastructure and utilities necessary to run collection operations

• Human Resources & Wages: Estimating staffing needs, roles, and compensation for collection specialists, skip tracers, compliance officers, account managers, and support personnel

This section provides practical, actionable insights into the operational and compliance infrastructure needed for setting up your business, ensuring regulatory excellence and recovery effectiveness.

Financial Feasibility

The Debt Collection Agency Business Plan and Project Report provides a detailed analysis of the financial landscape, including:

• Capital Investments & Operating Costs: Breakdown of initial and ongoing investments

• Revenue & Expenditure Projections: Projected income and cost estimates for the first five years

• Profit & Loss Analysis: A clear picture of expected financial outcomes

• Taxation & Depreciation: Understanding tax obligations and equipment depreciation

• ROI, NPV & Sensitivity Analysis: Comprehensive financial evaluations to assess profitability

This in-depth financial analysis supports effective decision-making and helps secure funding, making it an essential tool for evaluating the business's potential.

Market Insights & Strategy

Market Analysis

A deep dive into the debt collection agency market, including:

• Industry Trends & Segmentation: Identifying emerging trends and key market segments across consumer debt collection, commercial receivables management, medical debt recovery, financial services collections, and specialized industry collection agencies

• Regional Demand & Cost Structure: Regional variations in debt collection adoption and cost factors affecting agency operations

• Competitive Landscape: An analysis of the competitive environment including established collection agencies, specialized recovery firms, in-house creditor departments, and debt purchasing organizations

Profiles of Key Players

The report provides detailed profiles of leading players in the industry, offering a valuable benchmark for new businesses. It highlights their strategies, collection methodologies, technology platforms, and market positioning, helping you identify strategic opportunities and areas for differentiation.

Capital & Operational Expenditure Breakdown

The report includes a comprehensive breakdown of both capital and operational costs, helping you plan for financial success. The detailed estimates for facility development, equipment, and operating costs ensure you're well-prepared for both initial investments and ongoing expenses.

• Capital Expenditure (CapEx): Focused on office space setup and design, collection management software systems, telecommunications infrastructure, computer equipment, compliance monitoring tools, and data security systems

• Operational Expenditure (OpEx): Covers ongoing costs like collector salaries, telecommunications expenses, utilities, marketing costs, licensing and bonding fees, compliance training programs, and facility maintenance

Financial projections ensure you're prepared for cost fluctuations, including adjustments for regulatory compliance costs, technology upgrade requirements, licensing renewal expenses, and competitive market pressures over time.

Profitability Projections

The report outlines a detailed profitability analysis over the first five years of operations, including projections for:

• Total revenue from collection services, account placements, and ancillary programs, expenditure breakdown, gross profit, and net profit

• Profit margins for each revenue stream and year of operation

• Revenue per account projections and market penetration growth estimates

These projections offer a clear picture of the expected financial performance and profitability of the business, allowing for better planning and informed decision-making.

Request For Customization: https://www.imarcgroup.com/request?type=report&id=43308&flag=E

Our expertise includes:

• Market Entry and Expansion Strategy

• Feasibility Studies and Business Planning

• Company Incorporation and Collection Agency Setup Support

• Regulatory and Licensing Navigation

• Competitive Analysis and Benchmarking

• Industry Partnership Development

• Branding, Marketing, and Client-Focused Business Strategy

About Us

IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release How Much Does It Cost to Open a Debt Collection Agency in 2025? here

News-ID: 4257404 • Views: …

More Releases from IMARC Group

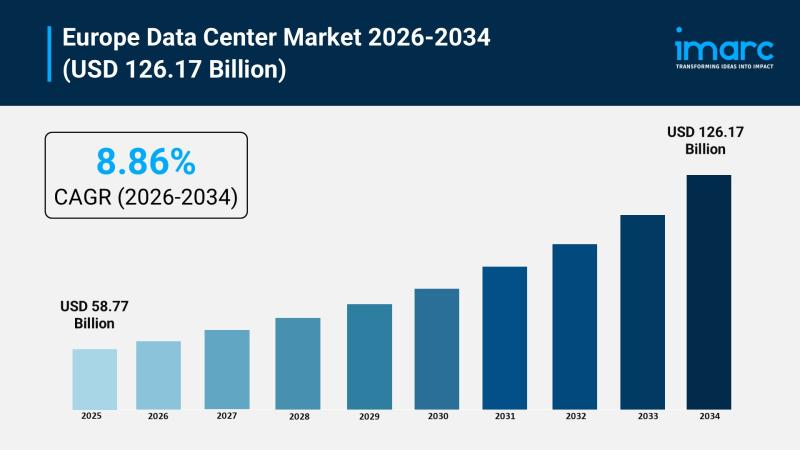

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

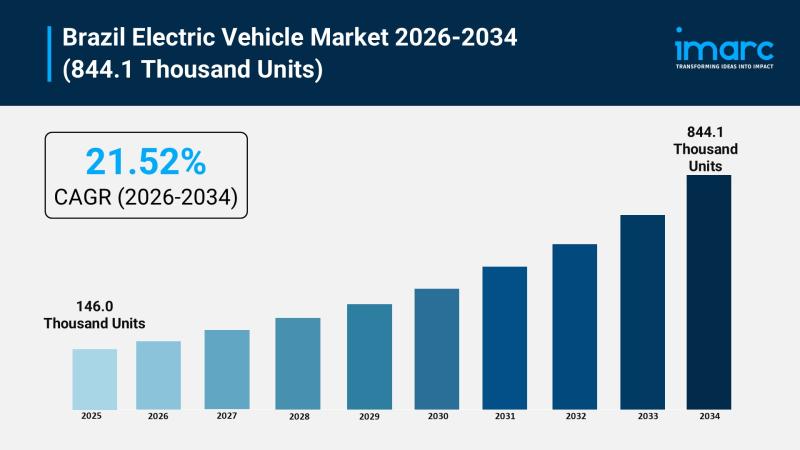

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Collection

Formula Collection That Makes a Difference - altomteknik.dk's Collection Is Comp …

Altomteknik.dk strengthens technical knowledge sharing with a comprehensive and practice-oriented formula collection aimed at the entire technical and industrial sector.

At a time when technological development is accelerating and the demand for documented knowledge, precise calculations, and correct dimensioning has never been greater, access to reliable technical information plays a decisive role. With its updated and comprehensive formula collection, altomteknik.dk positions itself as a central knowledge platform for engineers, technicians, students,…

Transformative book collection

# FOR IMMEDIATE RELEASE

## Transformative Book Collection Offers Path to Financial Freedom and Spiritual Abundance Through 25 Years of Research

### Author Releases Comprehensive Series Blending Financial Wisdom with Divine Intelligence

**ATLANTA, GA** - December 20, 2025 - After more than 25 years of dedicated research and study, a groundbreaking collection of books has been released, offering readers a unique synthesis of financial strategy, personal development, and spiritual wisdom. The collection, now…

Blood Collection Devices Market - Seamless Blood Collection Solutions for Optima …

Newark, New Castle, USA: The "Blood Collection Devices Market" provides a value chain analysis of revenue for the anticipated period from 2023 to 2031. The report will include a full and comprehensive analysis of the business operations of all market leaders in this industry, as well as their in-depth market research, historical market development, and information about their market competitors.

Blood Collection Devices Market: https://www.growthplusreports.com/report/blood-collection-devices-market/8686

This latest report researches the industry structure,…

Debt Collection Solutions Market Insights By Emerging Trends, Future Growth, Rev …

Debt Collection Solutions Market: A thorough analysis of statistics about the current as well as emerging trends offers clarity regarding the Debt Collection Solutions Market dynamics. The report includes Porter's Five Forces to analyze the prominence of various features such as the understanding of both the suppliers and customers, risks posed by various agents, the strength of competition, and promising emerging businesspersons to understand a valuable resource. Also, the report…

Changing Face Collection is now expanding brand for All Women Collection

Changing Face Collection the online apparel store is now expanding its range for all women types to the international ones.

(5 November 2021): Over the years the love for clothing has increased and everyone wants to have for themselves the apparel of their choice. Changing Face Collection is one such leading online store that is offering its customers the attire that makes them feel confident. The online store is now expanding…

Disposable Blood Bags Market Type (Collection Bags (Single Collection Bags, Doub …

Global Disposable Blood Bags Market 2020 report includes extensive Market analysis and industry landscape along with SWOT analysis and PESTEL analysis of the important vendors. The analysis is conducted with a blend of secondary and primary advice for inputs from participants in the industry. Disposable Blood Bags industry report covers the prospects of Disposable Blood Bags in the forecast period of 2020-2026 and the scenario.

The report analyzes the current Market…