Press release

Peer-to-Peer Lending Platform Business Project Report: Business Opportunities 2025

Peer-to-Peer Lending Platform Business Plan & Project Report OverviewIMARC Group's "Peer-to-Peer Lending Platform Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful peer-to-peer lending platform business. The critical areas, including market trends, investment opportunities, revenue models, and financial forecasts, are discussed in this in-depth report and are therefore useful resources to entrepreneurs, consultants and investors. Whether evaluating the viability of a new venture or streamlining an existing one, the report gives an in-depth analysis of all the ingredients that make it successful, starting with business formation and profitability over time.

What is a Peer-to-Peer Lending Platform Business?

A Peer-to-Peer Lending Platform is a specialized financial technology establishment designed to deliver comprehensive, digital-first lending and borrowing experiences. These platforms emphasize direct lending connections using advanced matching algorithms, credit risk assessment tools, automated loan processing, investor portfolio diversification, borrower verification systems, and technology-driven financial services, catering to borrowers and investors seeking alternative financing solutions.

They offer a variety of services including personal loan facilitation, business financing options, invoice financing, consumer credit products, investment portfolio management, automated lending programs, credit risk analysis, financial analytics dashboards, and personalized wealth-building support programs for individuals and businesses seeking efficient capital access.

The category encompasses consumer lending platforms, business loan marketplaces, invoice factoring networks, and investment-focused P2P exchanges, each prioritizing transparent interest rate pricing, comprehensive borrower assessment, investor risk management, automated loan servicing, financial education resources, community engagement initiatives, investor webinars, and holistic platform user engagement.

To achieve these goals, Peer-to-Peer Lending Platforms integrate state-of-the-art loan origination systems, AI-powered credit scoring models, advanced risk assessment algorithms, automated payment processing solutions, investor matching technology, portfolio management dashboards, regulatory compliance tools, and data-driven lending analytics.

Depending on their positioning, these establishments may operate as specialized consumer lending platforms, business financing marketplaces, institutional P2P networks, or comprehensive alternative finance centers, delivering complete lending and investment experiences tailored to diverse credit profiles, funding requirements, and levels of financial sophistication.

Request for a Sample Report: https://www.imarcgroup.com/peer-to-peer-lending-platform-business-plan-project-report/requestsample

Peer-to-Peer Lending Platform Business Market Trends and Growth Drivers

The trends and drivers of a Peer-to-Peer Lending Platform business are shaped by the rising demand for alternative financing options among underserved borrowers, growing investor appetite for higher-yield investment opportunities, and the increasing adoption of fintech solutions that bypass traditional banking intermediaries. These factors, combined with a stronger focus on financial inclusion through technology, are fuelling demand for digital lending alternatives. Contributing to this shift is the expanding interest in marketplace lending, automated investment strategies, data-driven credit assessment, and alternative credit scoring models, along with user preference for transparent fee structures, rapid loan approvals, and convenient access to capital within the evolving digital finance ecosystem.

To meet these demands, operators are investing in advanced loan origination technology, AI-powered underwriting systems, fraud detection infrastructure, investor protection platforms, and compliance with financial services regulations. These investments not only enhance the user experience but also strengthen business outcomes by aligning with broader trends in financial technology and regulatory compliance.

Revenue diversification is another critical factor in building financial resilience. In addition to direct origination fees and servicing charges, income streams may include investor platform fees, late payment penalties, premium membership subscriptions, loan insurance products, credit enhancement services, white-label platform licensing, and institutional partnership arrangements.

Location and regulatory environment play a vital role in success. Platforms positioned in jurisdictions with favorable fintech regulations, strong legal frameworks for debt collection, access to credit data providers, and concentrations of tech-savvy borrowers and investors benefit from steady transaction volume and regulatory certainty. At the same time, robust technology infrastructure, compliance with lending regulations, and adherence to consumer protection standards ensure operational excellence and user trust.

However, the business also faces risk factors, such as rapidly evolving financial regulations that can affect platform operations, intense competition from traditional banks expanding into digital lending and other P2P platforms, dependence on economic conditions affecting borrower repayment and default rates, and regulatory challenges related to lending licenses and cross-border compliance requirements.

A successful Peer-to-Peer Lending Platform business model requires careful financial planning-including capital investment in technology infrastructure and secure payment systems, procurement of credit data and verification tools, and adoption of automated loan management platforms. It also demands skilled technology professionals and credit analysts, supported by effective marketing strategies to build brand awareness, foster loyalty, and establish long-term relationships with borrowers, investors, institutional partners, and financial advisors. By delivering competitive interest rates, transparent risk assessments, and exceptional user experiences, these businesses can strengthen financial inclusion while encouraging users to embrace responsible borrowing and investment practices.

Report Coverage

The Peer-to-Peer Lending Platform Business Plan and Project Report includes the following areas of focus:

• Business Model & Operations Plan

• Technical Feasibility

• Financial Feasibility

• Market Analysis

• Marketing & Sales Strategy

• Risk Assessment & Mitigation

• Licensing & Certification Requirements

The comprehensive nature of this report ensures that all aspects of the business are covered, from market trends and risk mitigation to regulatory requirements and platform-focused user acquisition strategies.

Key Elements of Peer-to-Peer Lending Platform Business Setup

Business Model & Operations Plan

A solid business model is crucial to a successful venture. The report covers:

• Service Overview: A breakdown of loan origination processing, credit risk assessment, borrower verification, investor matching algorithms, automated loan servicing, payment processing, collection management, portfolio analytics, and customer support services offered

• Service Workflow: How each borrower application, credit evaluation, loan approval, investor funding, disbursement process, repayment collection, and dispute resolution process is managed

• Revenue Model: An exploration of the mechanisms driving revenue across multiple fee structures and lending products

• SOPs & Service Standards: Guidelines for consistent credit assessment quality, regulatory compliance, data security practices, and platform user satisfaction

This section ensures that all operational and user service aspects are clearly defined, making it easier to scale and maintain service quality.

Buy Report Now: https://www.imarcgroup.com/checkout?id=43128&method=1911

Technical Feasibility

Setting up a successful business requires proper technology and operational infrastructure planning. The report includes:

• Location Selection Criteria: Key factors to consider when choosing operational jurisdictions and target borrower-investor markets

• Space & Costs: Estimations for required office space, technology infrastructure, customer service centers, and associated costs

• Equipment & Systems: Identifying essential loan management software, credit scoring platforms, payment processing systems, and fraud detection technology

• Platform & Security Setup: Guidelines for creating advanced lending technology infrastructure and compliance-focused user experience systems

• Utility Requirements & Costs: Understanding the cybersecurity infrastructure and utilities necessary to run P2P lending operations

• Human Resources & Wages: Estimating staffing needs, roles, and compensation for credit analysts, software engineers, compliance officers, customer support staff, and management personnel

This section provides practical, actionable insights into the technology and operational infrastructure needed for setting up your business, ensuring platform security and regulatory excellence.

Financial Feasibility

The Peer-to-Peer Lending Platform Business Plan and Project Report provides a detailed analysis of the financial landscape, including:

• Capital Investments & Operating Costs: Breakdown of initial and ongoing investments

• Revenue & Expenditure Projections: Projected income and cost estimates for the first five years

• Profit & Loss Analysis: A clear picture of expected financial outcomes

• Taxation & Depreciation: Understanding tax obligations and technology depreciation

• ROI, NPV & Sensitivity Analysis: Comprehensive financial evaluations to assess profitability

This in-depth financial analysis supports effective decision-making and helps secure funding, making it an essential tool for evaluating the business's potential.

Market Insights & Strategy

Market Analysis

A deep dive into the peer-to-peer lending platform market, including:

• Industry Trends & Segmentation: Identifying emerging trends and key market segments across personal loans, business financing, consumer credit, invoice factoring, real estate lending, and student loan refinancing

• Regional Demand & Cost Structure: Regional variations in P2P lending adoption and regulatory frameworks affecting platform operations

• Competitive Landscape: An analysis of the competitive environment including established P2P lending platforms, traditional banks offering marketplace lending, fintech startups, and credit unions with digital lending programs

Profiles of Key Players

The report provides detailed profiles of leading players in the industry, offering a valuable benchmark for new businesses. It highlights their strategies, loan products, technology platforms, and market positioning, helping you identify strategic opportunities and areas for differentiation.

Capital & Operational Expenditure Breakdown

The report includes a comprehensive breakdown of both capital and operational costs, helping you plan for financial success. The detailed estimates for technology development, licensing, and operating costs ensure you're well-prepared for both initial investments and ongoing expenses.

• Capital Expenditure (CapEx): Focused on platform development and design, server infrastructure and cloud services, loan management software, credit scoring systems, payment processing integration, cybersecurity infrastructure, and regulatory compliance technology

• Operational Expenditure (OpEx): Covers ongoing costs like staff salaries, technology maintenance and hosting fees, credit data subscriptions, marketing expenses, regulatory licensing fees, loan loss provisions, customer support operations, and legal compliance costs

Financial projections ensure you're prepared for cost fluctuations, including adjustments for regulatory changes, technology upgrades, default rate variations, and competitive market pressures over time.

Profitability Projections

The report outlines a detailed profitability analysis over the first five years of operations, including projections for:

• Total revenue from origination fees, servicing charges, investor platform fees, and ancillary services, expenditure breakdown, gross profit, and net profit

• Profit margins for each revenue stream and year of operation

• Revenue per loan projections and market penetration growth estimates

These projections offer a clear picture of the expected financial performance and profitability of the business, allowing for better planning and informed decision-making.

Request For Customization: https://www.imarcgroup.com/request?type=report&id=43128&flag=E

Our expertise includes:

• Market Entry and Expansion Strategy

• Feasibility Studies and Business Planning

• Company Incorporation and Fintech Platform Setup Support

• Regulatory and Licensing Navigation

• Competitive Analysis and Benchmarking

• Industry Partnership Development

• Branding, Marketing, and Platform-Focused User Strategy

About Us

IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Peer-to-Peer Lending Platform Business Project Report: Business Opportunities 2025 here

News-ID: 4257337 • Views: …

More Releases from IMARC Group

Amino Acid Production Plant Cost 2026: CapEx, OpEx & ROI Analysis

Setting up an Amino Acid Production Plant positions investors in a rapidly growing industrial segment, driven by increasing global demand for amino acids across multiple end-use sectors. Amino acids are organic compounds that form the building blocks of proteins and play critical roles in metabolism, enzyme function, and nutritional supplementation. The integrated manufacturing process involves raw material handling (such as glucose, molasses, or corn syrup), fermentation or chemical synthesis, purification,…

Flow Battery Manufacturing Plant Cost 2026: Feasibility Study and Profitability …

Setting up a Flow Battery Manufacturing Plant positions investors in a rapidly expanding segment of the energy storage industry. Flow batteries are electrochemical storage systems where energy is stored in liquid electrolytes that flow through electrochemical cells. They offer unique advantages including long cycle life, modular scalability, high safety, and the ability to discharge fully without damage. These attributes make them ideal for grid-scale energy storage, renewable energy integration, EV…

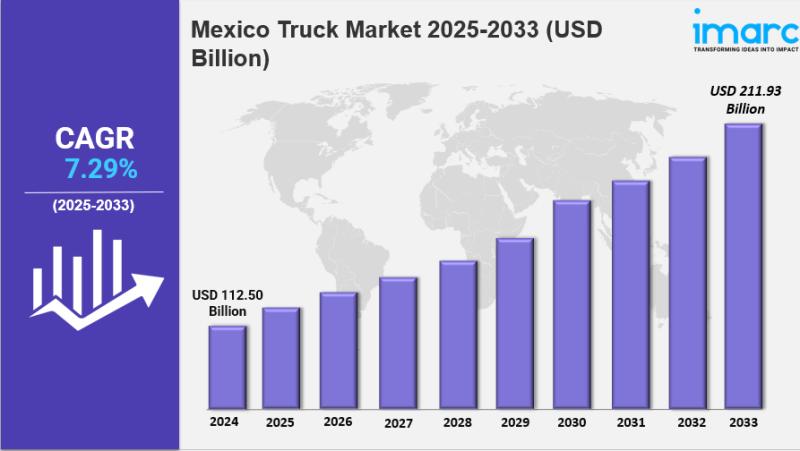

Mexico Truck Market Size, Share, Industry Overview, Trends and Forecast 2033

IMARC Group has recently released a new research study titled "Mexico Truck Market Size, Share, Trends and Forecast by Vehicle Type, Tonnage Capacity, Fuel Type, Application, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Truck Market Overview

The Mexico truck market size reached USD 112.50 Billion in 2024. Looking forward, IMARC Group expects…

Cigarette Manufacturing Plant Cost 2026: Industry Overview and Profitability Ass …

Setting up a Cigarette Manufacturing Plant positions investors in a globally significant and high-volume industry with enduring consumer demand. Despite increasing regulatory scrutiny in some regions, the cigarette market remains one of the world's largest consumer goods industries, supported by entrenched user behaviour, brand loyalty, and established retail delivery networks. Producers benefit from repeat purchase patterns and broad distribution channels across retail, wholesale, and duty-free markets. The cigarette value chain…

More Releases for Platform

Global Process Automation (DPA) Software Market Size, Share and Forecast By Key …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to the Market Research Intellect, the global Process Automation (DPA) Software market is projected to grow at a robust compound annual growth rate (CAGR) of 7.55% from 2024 to 2031. Starting with a valuation of 15.06 Billion in 2024, the market is expected to reach approximately 23.31 Billion by 2031, driven by factors such as Process Automation (DPA) Software and Process Automation (DPA) Software. This significant…

Global Smart City Platforms Market Size - By Product Type(Connectivity Managemen …

Smart City Platforms Market Insights: Trends, Drivers, and Outlook 2024 - 2031

Smart City Platforms Market Scope: Unveiling Today's Trends

Smart City Platforms are integrated digital systems designed to enhance urban management and improve the quality of life for residents. The market for these platforms is witnessing significant growth driven by increasing urbanization, government initiatives for smart city developments, and advancements in IoT, big data, and AI technologies. The current market size…

Banking as a Digital Platform Market Exhibits a Stunning Growth | Alkami Platfor …

According to HTF Market Intelligence, the Banking as a Digital Platform market to witness a CAGR of 8.2% during the forecast period (2024-2030).The Latest published a market study on Global Banking as a Digital Platform Market provides an overview of the current market dynamics in the Global Banking as a Digital Platform space, as well as what our survey respondents- all outsourcing decision-makers- predict the market will look like in…

Process Automation (DPA) Software Market 2022 Analysis by Key Players - KiSSFLOW …

Process Automation (DPA) Software Market Scope and Overview

Digital process automation (DPA) software is an emerging market of tools containing features found in many technologies, including a number of process automation and rapid application development software technologies.

The most recent research report provides in-depth analysis of all segments, categories, and regional and national markets studied in the Process Automation (DPA) Software Market study, as well as thorough data on all regional markets.…

Internet of Robotic Things (IoRT) Market Growing Up By Platform: Device Manageme …

Acumen Research and Consulting has announced the addition of the "Internet of Robotic Things (IoRT) Market” report to their offering.

The Internet of Robotic Things (IoRT) Market Report 2018 is an in depth study analyzing the current state of the Internet of Robotic Things (IoRT) Market. It provides brief overview of the market focusing on definitions, market segmentation, end-use applications and industry chain analysis. The study on Internet of Robotic Things…

Process Automation (DPA) Software- A Market Worth Observing Growth | Nintex Plat …

The latest 94+ page survey report on Global Process Automation (DPA) Software Market is released by HTF MI covering various players of the industry selected from global geographies like North America, Europe, China, Japan, Southeast Asia, India & Central & South America. A perfect mix of quantitative & qualitative Market information highlighting developments, industry challenges that competitors are facing along with gaps and opportunity available and would trend in Process…