Press release

Australia Digital Payment Market Projected to Reach USD 667.00 Billion by 2033

Market OverviewThe Australia digital payment market size was valued at USD 118.00 Billion in 2024 and is projected to reach USD 667.00 Billion by 2033. The market is expected to grow at a CAGR of 20.90% during the forecast period of 2025-2033. Victoria & Tasmania dominate the market with a 38.3% share due to technological infrastructure and increased e-commerce activity. The growth is driven by rising smartphone reliance, popular mobile wallets, online shopping trends, and demand for peer-to-peer payment apps and BNPL services.

For more details, visit Australia Digital Payment Market

https://www.imarcgroup.com/australia-digital-payment-market

How AI is Reshaping the Future of Australia Mobile Payment Market

• AI enhances transaction security through advanced biometric authentication and real-time fraud detection, thereby boosting consumer confidence.

• Integration of AI enables personalized customer experiences and seamless in-app payments, improving user engagement across platforms like Apple Pay and Google Pay.

• AI-driven analytics support fintech companies in optimizing payment solutions, exemplified by services from Volt's one-click digital payment solution built on the secure PayTo framework.

• Government initiatives such as the Consumer Data Right (CDR) foster innovation in AI applications for open banking and payment services.

• AI facilitates the expansion of payment infrastructure in remote areas by supporting platforms capable of offline and intermittent connectivity payments.

• Partnerships like those between Backbase and MeaWallet use AI-based tokenization technology to enhance payment security and accelerate adoption.

Grab a sample PDF of this report:

https://www.imarcgroup.com/australia-digital-payment-market/requestsample

Australia Digital Payment Market Growth Factors

The presence of a high number of smartphones in the country and a developed technology infrastructure have increased the use of digital payments. Contactless payments and mobile wallet payments have early adopters in Sydney, Melbourne, and Brisbane where tap-and-go payments are now normal. Consumer demand during the pandemic for rapid, easy and hygienic payment options led to rapid adoption of banking and fintech apps with mobile-friendly infrastructure that enables frictionless transactions such as instant bill payments and peer-to-peer transfers. Digital cashless payments are now the primary means of transacting, leading to rapid growth in retail, healthcare and services.

The liberal regulatory environment has resulted in a highly competitive and innovative fintech market. Regulatory proposals such as Open Banking and CDR allow consumers to provide third parties access to their financial data. This has created a new category of personalized and tailored financial products and services. The New Payments Platform (NPP) allows consumers and businesses to make fast, secure real-time bank transfers 24 hours a day, seven days a week, using an easy to remember identifier such as a mobile phone number. This regulatory certainty benefits both existing payments firms and start-ups.

In addition, cybersecurity and rising literacy are the driving forces for the adoption of digital payments. Payment companies are investing in Artificial Intelligence for fraud detection, biometric authentication systems and real-time monitoring of suspicious activities to combat cybercrime and fraud. Improvements in technology have also made older generations more comfortable with digital payments, where they might have been less accepting in the past. Mobile phone wallet applications such as Google Pay and Apple Pay, and near field communication (NFC) point-of-sale terminal readers, have become more commonplace for regular services such as food delivery and ride sharing.

Australia Digital Payment Market Segmentation

Analysis by Component:

• Solutions

• Application Program Interface

• Payment Gateway

• Payment Processing

• Payment Security and Fraud Management

• Transaction Risk Management

• Others

• Services

• Professional Services

• Managed Services

Analysis by Payment Mode:

• Bank Cards

• Digital Currencies

• Digital Wallets

• Net Banking

• Others

Analysis by Deployment Type:

• Cloud-based

• On-premises

Analysis by End Use Industry:

• BFSI

• Healthcare

• IT and Telecom

• Media and Entertainment

• Retail and E-commerce

• Transportation

• Others

Regional Analysis:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Key Players

• Volt

• Afterpay

• Zip

• Banked

• Fiserv

• Visa

• AMP

• Backbase

• MeaWallet

Recent Development & News

• April 2025: Banked acquired UK-based VibePay to increase the adoption of global Pay by Bank services in Australia, integrating AI-driven consumer tools to enhance real-time payment infrastructure.

• April 2025: Fiserv expanded its Australian and New Zealand market presence through the acquisition of Pinch Payments, improving service speed and payment flexibility for various enterprise clients.

• March 2025: Visa collaborated with ANZ, NAB, HSBC, and Westpac to launch Visa B2B Integrated Payments using SAP's platform, streamlining digital business-to-business transactions and improving operational efficiency.

If you require any specific information that is not covered currently within the scope of the report, we will provide the same as a part of the customization.

https://www.imarcgroup.com/request?type=report&id=21969&flag=F

Contact Us

IMARC Group,

134 N 4th St. Brooklyn, NY 11249, USA,

Email: sales@imarcgroup.com,

Tel No: (D) +91 120 433 0800,

United States: +1-201971-6302

About Us

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Digital Payment Market Projected to Reach USD 667.00 Billion by 2033 here

News-ID: 4256894 • Views: …

More Releases from IMARC Group

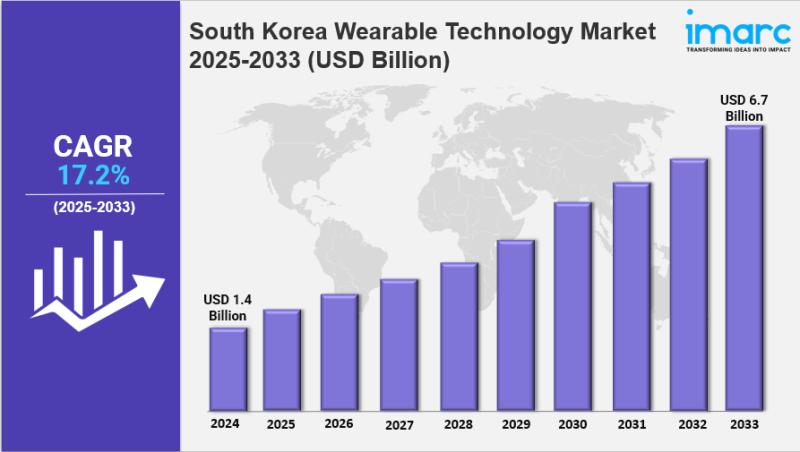

South Korea Wearable Technology Market Size, Share, Industry Overview, Trends an …

IMARC Group has recently released a new research study titled "South Korea Wearable Technology Market Report by Product (Wrist-Wear, Eye-Wear and Head-Wear, Foot-Wear, Neck-Wear, Body-Wear, and Others), Application (Consumer Electronics, Healthcare, Enterprise and Industrial Application, and Others), and Region 2025-2033" This report offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wearable Technology Market Overview

The…

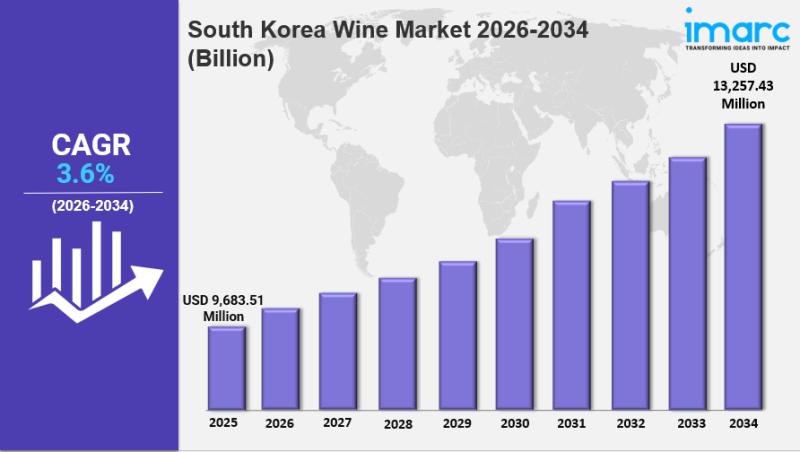

South Korea Wine Market Size, Share, Industry Overview, Trends and Forecast 2026 …

IMARC Group has recently released a new research study titled "South Korea Wine Market Size, Share, Trends and Forecast by Product Type, Color, Distribution Channel, and Region, 2026-2034", which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

South Korea Wine Market Report Overview

The South Korea wine market size was valued at USD 9,683.51 Million in 2025.…

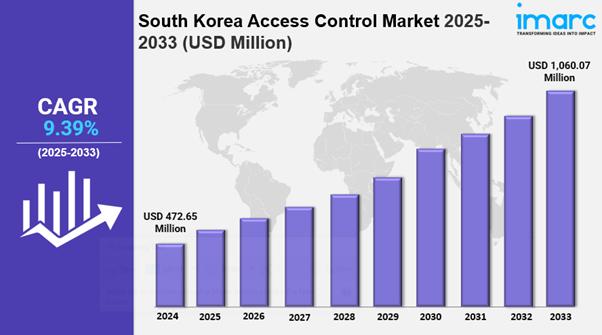

South Korea Access Control Market Size, Share, Industry Overview, Trends and For …

IMARC Group has recently released a new research study titled "South Korea access control market Size, Share, Trends and Forecast by Component, Deployment Mode, SMS Traffic, Application, End User, and Region, 2025-2033", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

South Korea Access Control Market Overview

The South Korea access control market size was valued at USD…

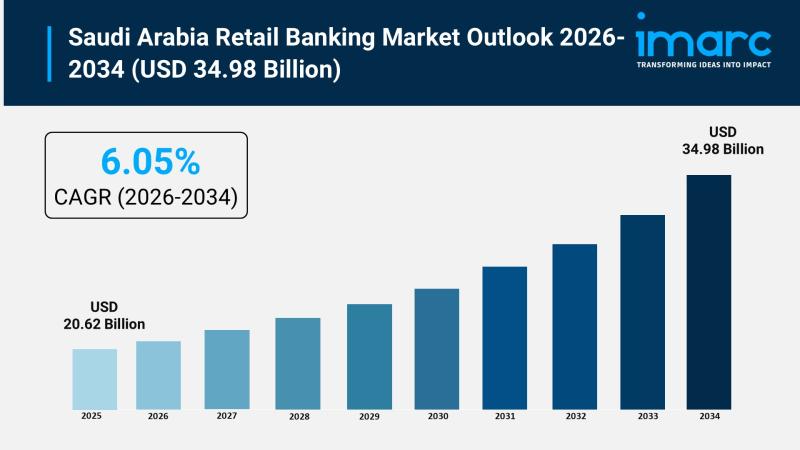

Saudi Arabia Retail Banking Market Predicted to Exceed USD 34.98 Billion by 2034 …

Saudi Arabia Retail Banking Market Overview

Market Size in 2025: USD 20.62 Billion

Market Size in 2034: USD 34.98 Billion

Market Growth Rate 2026-2034: 6.05%

According to IMARC Group's latest research publication, "Saudi Arabia Retail Banking Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2026-2034", The Saudi Arabia retail banking market size was valued at USD 20.62 Billion in 2025. Looking forward, IMARC Group expects the market to reach USD 34.98 Billion by…

More Releases for Pay

Mobile Payment Market to See Thriving Worldwide| Apple Pay • Google Pay • Sa …

Latest Report, titled Mobile Payment Market 2025-2032 Trends, Share, Size, Growth, Opportunity and Forecast 2025-2032, by Coherent Market Insights offers a comprehensive analysis of the industry, which comprises insights on the market analysis. As part of our Black Friday Limited-Time Discount, this premium research report is now available at up to 60% off, offering an exceptional opportunity for businesses, analysts, and stakeholders to access high-value insights at a significantly reduced…

Proximity Payment Market is Going to Boom | Major Giants Apple Pay, Google Pay, …

HTF MI just released the Global Proximity Payment Market Study, a comprehensive analysis of the market that spans more than 143+ pages and describes the product and industry scope as well as the market prognosis and status for 2025-2032. The marketization process is being accelerated by the market study's segmentation by important regions. The market is currently expanding its reach.

𝐌𝐚𝐣𝐨𝐫 Giants in Proximity Payment Market are:

Apple Pay, Google Pay, Samsung…

Mobile Wallet (NFC, Digital Wallet) Market to Witness Stunning Growth | Apple Pa …

HTF MI recently introduced Global Mobile Wallet (NFC, Digital Wallet) Market study with 143+ pages in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status (2024-2032). The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence. Some key players from the complete study are Apple Pay, Google Pay, Samsung Pay, PayPal, Alipay, WeChat Pay,…

Unified Payments Interface (UPI) Market Is Booming Worldwide | Google Pay, Amazo …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2028. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Unified Payments Interface (UPI) Market May See a Big Move | Major Giants Samsun …

The latest study released on the Global Unified Payments Interface (UPI) Market by AMA Research evaluates market size, trend, and forecast to 2027. The Unified Payments Interface (UPI) market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about…

Samsung Pay Market is Booming Worldwide with Samsung Pay, Apple Pay, Google Pay

HTF Market Intelligence released a new research report of 23 pages on title 'Samsung Pay - Competitor Profile' with detailed analysis, forecast and strategies. The study covers key regions that includes North America, LATAM, United States, GCC, Southeast Asia, Europe, APAC, United Kingdom, India or China etc and important players such as Samsung Pay, Apple Pay, Google Pay, Alipay, Tenpay, Samsung Electronics, Visa, Mastercard.

Request a sample report @ https://www.htfmarketreport.com/sample-report/3587660-samsung-pay-competitor-profile

Summary

Samsung…