Press release

Cryptocurrency Market Size to Hit USD 6,293.2 Billion in 2033 | Grow CAGR by 9.7%

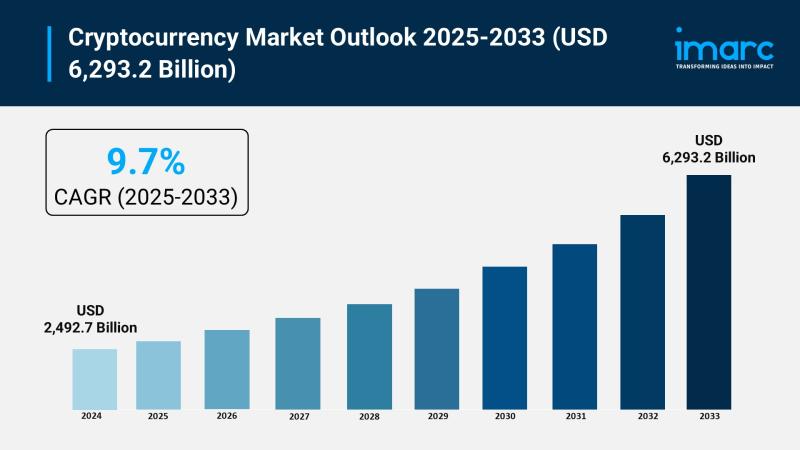

Market Overview:The cryptocurrency market is experiencing rapid growth, driven by institutional investment and regulated products, decentralized finance (DeFi) ecosystem expansion, and global retail adoption and transactional utility. According to IMARC Group's latest research publication, "Cryptocurrency Market Size, Share, Trends and Forecast by Type, Component, Process, Application, and Region, 2025-2033", the global cryptocurrency market size reached USD 2,492.7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6,293.2 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/cryptocurrency-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Cryptocurrency Market

● Institutional Investment and Regulated Products

The entrance of major financial institutions has become a powerful catalyst for market growth, lending significant legitimacy and capital to the sector. This has been strongly propelled by the introduction of regulated investment vehicles, such as spot Bitcoin Exchange-Traded Funds (ETFs). Within months of their launch, cumulative inflows into these regulated products in North America surpassed $50 billion, illustrating that the cryptocurrency asset class can now be packaged to meet the stringent compliance and operational mandates of large public fund managers and life insurers. This structured access allows institutions to allocate billions into digital assets without the operational complexity of managing digital wallets or securing custody themselves, substantially improving liquidity depth and market stability. This validates cryptocurrencies as a recognized asset class, encouraging further corporate and treasury adoption.

● Decentralized Finance (DeFi) Ecosystem Expansion

The burgeoning Decentralized Finance (DeFi) ecosystem is a core driver, attracting users by offering peer-to-peer financial services that circumvent traditional intermediaries. DeFi protocols use smart contracts to facilitate automated lending, borrowing, and trading, creating a more efficient and transparent alternative to legacy banking systems. The expansion of DeFi applications, particularly on platforms like Ethereum, showcases a robust utility beyond simple digital currency trading. As one major example, the total value locked in DeFi protocols has reached levels representing billions of dollars in user funds, demonstrating massive confidence and utility. This continued innovation in financial primitives, coupled with their inherent transparency, appeals to both retail users seeking higher yields and institutional players exploring the efficiency gains of blockchain-based systems.

● Global Retail Adoption and Transactional Utility

Widespread retail adoption, especially in emerging economies and for cross-border remittances, continues to fuel market expansion. Cryptocurrencies offer a fast, low-cost, and censorship-resistant medium for financial exchange, which is highly appealing in regions facing monetary instability or high inflation. For instance, the number of people globally who own cryptocurrency has grown to over 560 million, representing a substantial portion of the world's population. Regionally, Asia accounts for the largest user base, with over 320 million crypto users. This utility-driven adoption extends to cross-border payments, where cryptocurrencies bypass expensive bank fees, and to their increasing acceptance as an official payment method by major corporations, which further integrates them into the broader global economy.

Key Trends in the Cryptocurrency Market

● The Rise of Real-World Asset (RWA) Tokenization

A major emerging trend is the tokenization of Real-World Assets (RWAs), which involves placing ownership rights of tangible assets like real estate, commodities, or bonds onto a blockchain. This process uses smart contracts to fractionate, trade, and settle assets more efficiently. For example, a single piece of prime commercial real estate could be divided into thousands of digital tokens, making it accessible to a much broader pool of global retail investors and significantly improving market liquidity. This allows traditional assets to benefit from the blockchain's 24/7 trading, transparency, and instant settlement capabilities, promising to unlock trillions of dollars in value previously held in illiquid traditional markets. The trend is being driven by established financial firms leveraging blockchain platforms to issue digitized debt and equity.

● Government-Led Digital Currency Initiatives

Central banks around the world are actively developing or piloting their own sovereign digital currencies, known as Central Bank Digital Currencies. This trend represents a governmental embrace of blockchain's underlying technology to modernize financial infrastructure. Currently, four countries have fully launched a Government-Led Digital Currency, and over 20 other nations are engaged in pilot programs to test their feasibility. These digital fiat systems aim to improve the efficiency of payments, reduce the cost of cross-border settlements, and enhance financial inclusion. The results of these pilots will likely shape global monetary policy and the digital infrastructure for interbank and international transactions, potentially bringing the core benefits of distributed ledger technology into mainstream, regulated use.

● The Convergence of AI and Blockchain

The integration of Artificial Intelligence (AI) with blockchain technology is an accelerating trend, creating new use cases for automated trading, enhanced security, and sophisticated data analysis. AI systems are being developed to analyze the massive datasets generated by the crypto market, identifying complex trends, patterns, and anomalies that are undetectable by human traders. This allows for the execution of high-frequency trading strategies and more accurate price forecasting, which leads to optimized returns and reduced human error. Furthermore, AI-powered tools are now being used to bolster compliance and detect fraudulent transactions, which is crucial for building greater user trust. The market is witnessing a trend where large-scale crypto mining power is being repurposed for AI compute workloads, signifying a major convergence of these two cutting-edge technologies.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=2546&flag=E

Leading Companies Operating in the Global Cryptocurrency Industry:

● Advanced Micro Devices Inc.

● Alphapoint Corporation

● Bitfury Holding B.V.

● Coinbase Inc.

● Cryptomove Inc.

● Intel Corporation

● Microsoft Corporation

● Quantstamp Inc.

● Ripple Services Inc.

Cryptocurrency Market Report Segmentation:

By Type:

● Bitcoin

● Ethereum

● Bitcoin Cash

● Ripple

● Litecoin

● Dashcoin

● Others

Bitcoin dominates the market with approximately 72.9% share, serving as a primary entry point for various investors and regarded as digital gold.

By Component:

● Hardware

● Software

Software leads with around 70.0% market share, facilitating applications and protocols essential for managing digital assets and driving innovation in the cryptocurrency ecosystem.

By Process:

● Mining

● Transaction

Transactions account for about 67.6% of the market, representing the primary function of cryptocurrencies as mediums of exchange with high liquidity and fast settlement times.

By Application:

● Trading

● Remittance

● Payment

● Others

Trading leads the market with approximately 40.6% share, encompassing exchanges and speculative activities, characterized by high volumes and dynamic trading strategies.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

Europe holds over 39.5% of the market share, driven by regulatory frameworks and increasing blockchain adoption, particularly in countries like Germany and the UK.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Cryptocurrency Market Size to Hit USD 6,293.2 Billion in 2033 | Grow CAGR by 9.7% here

News-ID: 4256695 • Views: …

More Releases from IMARC Group

Hydrogen Fluoride Manufacturing Plant DPR 2026: Investment Cost, Market Growth & …

Setting up a hydrogen fluoride manufacturing plant positions investors within a strategically important segment of the global specialty chemicals and fluorochemicals industry, driven by increasing demand for semiconductor manufacturing, refrigerant production, and pharmaceutical intermediates. As modern industrial processes advance, electronics manufacturing expands, and the need for high-purity fluorine compounds grows, hydrogen fluoride continues to gain traction across semiconductor fabrication, aluminum production, and petroleum refining worldwide. Rising demand from high-tech industries,…

Vinyl Acetate Ethylene Production Plant Cost 2026: Industry Overview and Profita …

Setting up a Vinyl Acetate Ethylene Production Plant positions investors in one of the most stable and essential segments of the specialty chemicals and polymer value chain, backed by sustained global growth driven by growing construction activity, rising demand for high-performance dry-mix mortars, increasing use in paints and coatings, and the dual-benefit advantages of delivering flexible, low-VOC polymer binder solutions that meet both industrial performance standards and evolving environmental compliance…

Fluff Pulp Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a fluff pulp manufacturing plant positions investors within a strategically important segment of the global hygiene products and absorbent materials industry, driven by increasing demand for disposable hygiene products, absorbent personal care items, and medical applications. As consumer hygiene standards advance, disposable product adoption expands, and the need for high-quality absorbent materials grows, fluff pulp continues to gain traction across baby diapers, adult incontinence products, feminine hygiene items,…

Fire Alarms Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pro …

Setting up a fire alarms manufacturing plant positions investors within a strategically important segment of the global safety and security equipment industry, driven by increasing demand for fire detection and safety systems, stringent building safety regulations, and growing awareness of fire protection measures. As modern construction practices advance, smart building integration expands, and the need for advanced fire safety infrastructure grows, fire alarms continue to gain traction across commercial buildings,…

More Releases for Cryptocurrency

Cryptocurrency Market Report 2024 - Cryptocurrency Market Size, Growth And Analy …

"The Business Research Company recently released a comprehensive report on the Global Cryptocurrency Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample of…

MLM Cryptocurrency Software & Network Marketing

In today's rapidly evolving digital landscape, the intersection of multi-level marketing (MLM) and cryptocurrency has given rise to a powerful synergy. MLM cryptocurrency software, the backbone of this fusion, is changing the way businesses operate and revolutionizing network marketing. This article delves into the world of MLM cryptocurrency software, explaining what it is, its benefits, compensation plans, and challenges, and offering insights into making informed choices.

Introduction to MLM Cryptocurrency Software

MLM,…

Algorithmic Cryptocurrency Trading Platform Aesir Adds Support for top cryptocur …

United States, July 02, 2023 / OpenPr/ - Cryptocurrency trading bot platform Aesir adds Coinbase and Kraken to the list of supported exchanges.

Crypto trading platform Aesir unveils support for top cryptocurrency exchanges Coinbase and Kraken. Users can now algorithmically trade cryptocurrency on Binance, Coinbase and Kraken using Aesir's brand new trading platform.

Aesir (https://aesircrypto.com) provides a unique, user-friendly platform that empowers individuals to develop, test and run algorithmic trading strategies on…

The MooMoney Cryptocurrency Exchange Platform

Are you in search of an upcoming cryptocurrency exchange platform that can make your life easier? Well, it's here.

MooMoney Exchange is an emerging cryptocurrency exchange platform where users can buy, sell, and use various cryptocurrencies, including Bitcoin, Ethereum, and Monero.

What Makes MooMoney Exchange So Great?

There are plenty of cryptocurrency exchange platforms out there for you to choose from-but many of them have restrictions and high fees associated with trading.

In contrast,…

Cryptocurrency Plants For Our Future

In the scenic hinterland behind world famous Byron Bay lies cleared paddocks, once a thriving subtropical wilderness. To the public eye, the drive through Ewingsdale is beautiful, covered in rolling hills and trees along the roadside. Beyond the preserved couple of trees for show, there are huge paddocks from old dairy farms cleared 150 years ago. This clearing and cattle farming has caused mass erosion, extinction and endangerment of native…

Cryptocurrency Trading

In today’s world we have to stay ahead if we don’t want to become the so called “obsolete” to clarify further, we live in a world where we are embarking upon many new technological ideas and concepts of life, that will make our way of life more efficient, safe and secure. One of those technological revolutions is the blockchain and cryptocurrency industry. As we all know blockchain is the foundation…