Press release

Liquefied Natural Gas Prices 2025: Global Trend & Analysis

Japan Liquefied Natural Gas Prices Movement 2025:During the second quarter of 2025, liquefied natural gas (LNG) prices in Japan reached 595 USD/MT in June. The market was influenced by fluctuations in spot procurement activity driven by seasonal temperature variations affecting power generation demand. Oil-indexed contract adjustments impacted long-term pricing, while shipping costs reflected trends in charter rates and vessel availability across Asia-Pacific routes. Additionally, currency movements against the US dollar affected import expenses, and inventory management was shaped by regasification schedules and storage capacity. Supply variations from key producers in Oceania and the Middle East also influenced overall market conditions.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/liquefied-natural-gas-pricing-report/requestsample

China Liquefied Natural Gas Prices Movement 2025:

During the second quarter of 2025, liquefied natural gas prices in China reached 575 USD/MT in June. Pricing dynamics were guided by seasonal demand changes from industrial and residential consumers, alongside adjustments in spot procurement volumes in response to domestic production and pipeline gas supply. Import costs were affected by fluctuations in shipping and port handling charges, while exchange rate movements against the US dollar impacted total landed costs. Supply from key Asian and Middle Eastern exporters influenced market balance, and storage utilization rates shaped procurement strategies. Furthermore, environmental policy enforcement moderated industrial sector demand.

Brazil Liquefied Natural Gas Prices Movement 2025:

During the second quarter of 2025, liquefied natural gas prices in Brazil stood at 530 USD/MT in June. The price trend was influenced by import demand fluctuations from the power sector, tied to variations in hydropower generation output. Spot purchases depended on global supply availability, mainly from the U.S. and West Africa, while maritime freight rates and bunker fuel prices influenced transportation costs. Currency volatility against the U.S. dollar affected import purchasing power, and port scheduling efficiency impacted delivery timelines. Seasonal shifts in temperature and industrial activity further guided consumption levels.

Argentina Liquefied Natural Gas Prices Movement 2025:

During the second quarter of 2025, liquefied natural gas prices in Argentina reached 650 USD/MT in June. The market saw higher prices due to increased import needs driven by seasonal heating demand and limited domestic gas production. Spot cargo procurement relied heavily on availability from the Atlantic Basin and U.S. suppliers. Freight rate fluctuations and vessel charter constraints raised landed costs, while currency depreciation against the U.S. dollar inflated import expenses. The efficiency of regasification terminals influenced supply continuity, and domestic energy policies alongside industrial activity trends shaped overall LNG purchasing strategies.

Spain Liquefied Natural Gas Prices Movement 2025:

During the second quarter of 2025, liquefied natural gas prices in Spain reached 635 USD/MT in June. Market conditions were impacted by changes in procurement volumes from the power and industrial sectors. Spot cargo supply from North Africa, the U.S., and the Middle East shaped availability, while shipping and port handling expenses added to cost pressures. Currency fluctuations against the U.S. dollar influenced import economics, and storage management affected purchasing schedules. Seasonal variations in power demand and maintenance at LNG terminals further dictated procurement timing and overall market dynamics.

Note: The analysis can be tailored to align with the customer's specific needs.

Purchase Options: https://www.imarcgroup.com/checkout?id=24296&method=1925

• Biannual Updates: For 2 Deliverables, Billed Annually

• Quarterly Updates: For 4 Deliverables, Billed Annually

• Monthly Updates: For 12 Deliverables, Billed Annually

We Also Provide News and Historical Data of Liquefied Natural Gas

• Historical Data: Comprehensive historical pricing and market trends.

• Quarterly Analysis: Detailed insights into price fluctuations and market dynamics.

• Regional and Global Data: Coverage of key markets and their performance.

• Forecast Comparisons: Historical data paired with future market projections.

• Customizable Reports: Tailored analysis to meet specific business needs.

What is Liquefied Natural Gas (LNG)?

Liquefied Natural Gas (LNG) is natural gas that has been cooled to around -162°C (-260°F) to transform it into a liquid state. This process significantly reduces its volume, making it easier and more efficient to store and transport over long distances, especially to regions without pipeline infrastructure. LNG is primarily composed of methane, with small quantities of ethane, propane, and nitrogen. It plays a crucial role in meeting global energy needs by serving as a cleaner-burning alternative to coal and oil, helping countries transition toward lower carbon emissions.

Factors Affecting Liquefied Natural Gas Supply and Prices

Several key factors influence the global LNG supply and pricing trends:

• Seasonal Demand Variations: Energy demand fluctuates with weather changes, increasing in colder months for heating and warmer months for power generation.

• Crude Oil Prices: Many long-term LNG contracts are oil-indexed, making LNG prices sensitive to movements in global crude oil benchmarks.

• Shipping and Freight Costs: LNG transportation costs are influenced by charter rates, fuel prices, and vessel availability.

• Currency Exchange Rates: Fluctuations in exchange rates, especially against the U.S. dollar, affect import and export costs.

• Supply Chain Disruptions: Maintenance shutdowns, technical failures, or geopolitical tensions in exporting countries can limit supply.

• Production and Export Capacity: Expansion projects or constraints in Oceania, the Middle East, and North America directly impact global availability and pricing.

Liquefied Natural Gas Index and Trend 2025

In 2025, LNG prices showed regional variations driven by changes in demand patterns, freight costs, and production levels. Asian markets, including Japan and China, witnessed moderate price fluctuations due to varying power generation demand and procurement activities. European prices were affected by competition between pipeline gas and imported LNG, along with storage inventory levels. Meanwhile, Latin American nations, such as Brazil and Argentina, saw prices influenced by seasonal electricity generation and currency movements. The overall trend in 2025 reflected a gradual recovery in demand following stable supply from major exporters.

Future and Current Demand Outlook

The demand for LNG in 2025 remained strong, particularly across Asia-Pacific, where it is used to support industrial, residential, and energy needs. Countries like China, Japan, and South Korea continued to lead consumption due to their energy diversification strategies. In Europe, LNG demand was driven by energy security concerns and efforts to reduce coal dependency. Emerging markets in South America also expanded LNG imports for power generation and industrial use.

Looking ahead, future demand is expected to grow steadily as nations pursue cleaner energy transitions and invest in regasification infrastructure. The global LNG trade is projected to increase, supported by new liquefaction projects in the U.S., Qatar, and Africa.

Current Uses of Liquefied Natural Gas

LNG is widely utilized across multiple sectors:

• Power Generation: Acts as a reliable fuel for electricity production, offering a cleaner alternative to coal.

• Industrial Applications: Used in manufacturing, chemical processing, and metal industries for heat generation.

• Transportation Fuel: Increasingly adopted for marine and heavy-duty vehicles due to lower emissions.

• Residential and Commercial Use: Supports heating, cooking, and energy supply in urban regions.

Overall, Liquefied Natural Gas (LNG) continues to play a vital role in the global energy mix, supporting sustainability goals while ensuring energy security and economic growth.

Speak to An Analyst: https://www.imarcgroup.com/request?type=report&id=24296&flag=C

Key Coverage:

• Market Analysis

•Market Breakup by Region

•Demand Supply Analysis by Type

•Demand Supply Analysis by Application

•Demand Supply Analysis of Raw Materials

•Price Analysis

•Spot Prices by Major Ports

•Price Breakup

•Price Trends by Region

•Factors influencing the Price Trends

•Market Drivers, Restraints, and Opportunities

•Competitive Landscape

•Recent Developments

•Global Event Analysis

How IMARC Pricing Database Can Help

The latest IMARC Group study, "Liquefied Natural Gas Prices, Trend, Chart, Demand, Market Analysis, News, Historical and Forecast Data 2025 Edition," presents a detailed analysis of Liquefied Natural Gas price trend, offering key insights into global Liquefied Natural Gas market dynamics. This report includes comprehensive price charts, which trace historical data and highlights major shifts in the market.

The analysis delves into the factors driving these trends, including raw material costs, production fluctuations, and geopolitical influences. Moreover, the report examines Liquefied Natural Gas demand, illustrating how consumer behavior and industrial needs affect overall market dynamics. By exploring the intricate relationship between supply and demand, the prices report uncovers critical factors influencing current and future prices.

About Us:

IMARC Group is a global management consulting firm that provides a comprehensive suite of services to support market entry and expansion efforts. The company offers detailed market assessments, feasibility studies, regulatory approvals and licensing support, and pricing analysis, including spot pricing and regional price trends. Its expertise spans demand-supply analysis alongside regional insights covering Asia-Pacific, Europe, North America, Latin America, and the Middle East and Africa. IMARC also specializes in competitive landscape evaluations, profiling key market players, and conducting research into market drivers, restraints, and opportunities. IMARC's data-driven approach helps businesses navigate complex markets with precision and confidence.

Contact us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91 120 433 0800

United States: +1-631-791-1145

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Liquefied Natural Gas Prices 2025: Global Trend & Analysis here

News-ID: 4256505 • Views: …

More Releases from IMARC Group

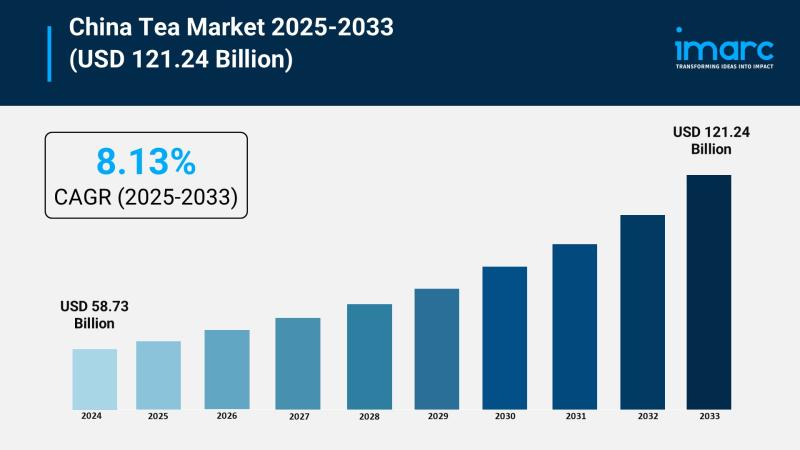

China Tea Market Forecast CAGR of 8.13%, Innovation Trends, and Strategic Insigh …

Market Overview

The China tea market was valued at USD 58.73 Billion in 2024 and is projected to reach USD 121.24 Billion by 2033, growing at a CAGR of 8.13% during 2025-2033. Growth is driven by rising health consciousness, premium product trends, government support, and expanding online retail. Innovation in flavors and packaging attracts younger consumers and global buyers, expanding the market.

Study Assumption Years

• Base Year: 2024

• Historical Year/Period: 2019-2024

• Forecast Year/Period: 2025-2033

China Tea…

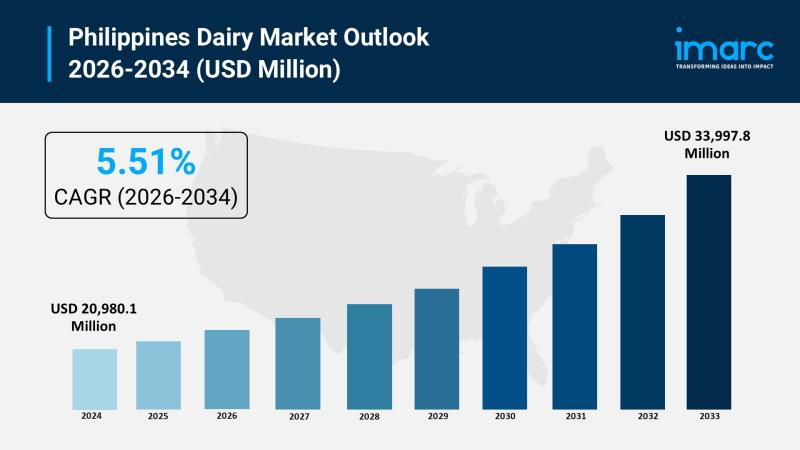

Philippines Dairy Market 2026: Expected to Reach USD 33,997.8 Million by 2034

Market Overview

The Philippines dairy market reached a size of USD 20,980.1 Million and is anticipated to grow to USD 33,997.8 Million by 2034 with a significant growth rate of 5.51%. This expansion is driven by rising demand for nutritious and diverse dairy products, rapid urbanization, increased disposable incomes, improved retail infrastructure, and strong government initiatives promoting local dairy production. Health-conscious consumers and expanding food service sectors further fuel this growth…

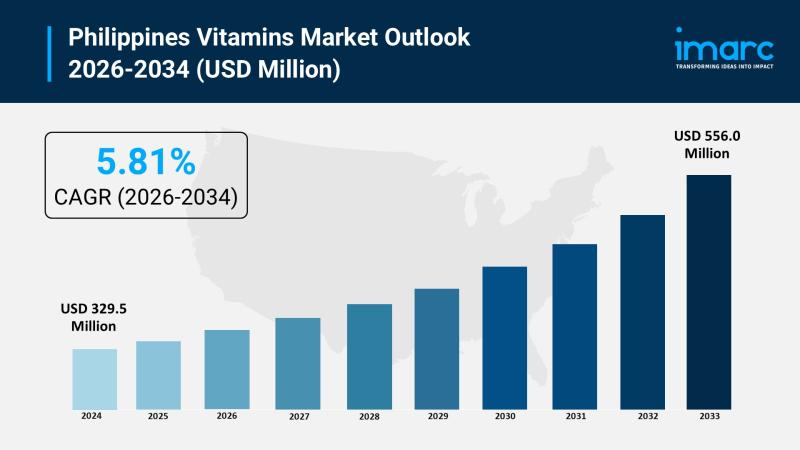

Philippines Vitamins Market 2026 | Projected to Reach USD 556.0 Million by 2034

Market Overview

The Philippines vitamins market was valued at USD 329.5 Million in 2025 and is projected to reach USD 556.0 Million by 2034, growing steadily over the forecast period. The market's growth is driven by increasing health consciousness, a rising geriatric population, and escalating demand for supplements that support immunity, energy, and overall wellness due to proactive health measures. The forecast period for this expansion is 2026-2034, with a CAGR…

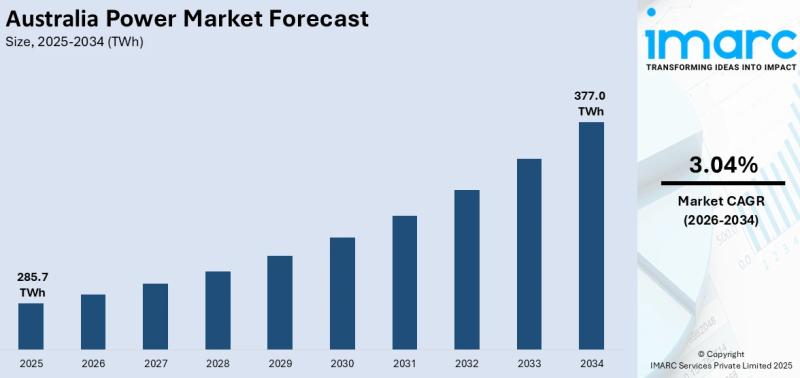

Australia Power Market Projected to Reach TWH 377 by 2034

Market Overview

The Australia power market size reached 285.7 TWh in 2025 and is projected to grow to 377.0 TWh by 2034, with a CAGR of 3.04% during the forecast period of 2026-2034. This growth is driven by rising renewable energy adoption, increased electricity demand, grid modernization, battery storage expansion, transition from coal plants, and government incentives for clean power. Key strategies such as virtual power plant integration and investments in…

More Releases for Liquefied

Key Trends Reshaping the Liquefied Natural Gas Compressor Market: Innovative Tec …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

Liquefied Natural Gas Compressor Market Size Growth Forecast: What to Expect by 2025?

The market size of the liquefied natural gas compressor has witnessed robust growth in the recent past. It is projected to expand from $4.25 billion in 2024 to $4.48 billion in 2025, demonstrating a compound annual…

Lng Liquefied Natural Gas And Lpg Liquefied Petroleum Gas Market Size by Type, A …

USA, New Jersey- According to Market Research Intellect, the global Lng Liquefied Natural Gas And Lpg Liquefied Petroleum Gas market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

Due to stricter emission laws and growing environmental concerns, the need for cleaner-burning fuels is driving the steady…

Liquefied Natural Gas (LNG) Carrier Market

The Liquefied Natural Gas (LNG) carrier market plays a significant role in the global energy sector. LNG carriers are specialized vessels designed to transport liquefied natural gas from production facilities to end users across the world. These ships are an essential link in the LNG supply chain, providing a means for countries and companies to deliver natural gas efficiently. The LNG carrier market has seen rapid growth over the past…

Small Scale Liquefied Natural Gas (LNG) Market

Liquefied pure gasoline that is processed on a small scale in industrial models with constrained capacity is referred to as small-scale LNG. After being cooled to extremely low temperatures, the gasoline is transformed into an odourless, colourless liquid that can be re-gasified for a variety of uses. Small-scale LNG is more environmentally friendly than oil and diesel, and it is typically utilised to address the needs of isolated industrial and…

Liquefied Natural Gas Market (CAGR of 5.00%) 2030: Liquefied Natural Gas Industr …

According to ChemAnalyst report, "Liquefied Natural Gas Market Analysis: Plant Capacity, Production, Operating Efficiency, Demand & Supply, End Use, Distribution Channel, Region, Competition, Trade, Market Analysis, 2015-2030", Liquefied Natural Gas (LNG) market has witnessed significant growth as it reached 390 million tonnes in 2020 and is anticipated to achieve a healthy global CAGR of 5.00% in the forecast period until 2030. Due to rapid industrialization and urbanization, the demand of…

LNG (Liquefied Natural Gas) and LPG (Liquefied Petroleum Gas) Market 2022 | Deta …

The research reports on “LNG (Liquefied Natural Gas) and LPG (Liquefied Petroleum Gas) Market” report gives detailed overview of factors that affect global business scope. LNG (Liquefied Natural Gas) and LPG (Liquefied Petroleum Gas) Market report shows the latest market insights with upcoming trends and breakdowns of products and services. This report provides statistics on the market situation, size, regions and growth factors. An exclusive data offered in this report…