Press release

Infrastructure Asset Management Market Size: Key Opportunities and Projections to 2035 | Prominent Players Include IBM Corporation, Siemens AG, Schneider Electric SE, Trimble Inc.

As governments and private operators modernize transportation, utilities, and urban systems, the infrastructure asset management market is becoming a cornerstone of global sustainability and resilience strategies. With cities expanding and aging assets nearing their lifecycle limits, demand for advanced monitoring, digital twin technologies, and predictive maintenance solutions is rising sharply. Companies are prioritizing integrated software platforms, data-driven decision-making, and lifecycle optimization to ensure cost efficiency and asset longevity.This article explores the top companies shaping the global infrastructure asset management market, their strategic positioning, and the emerging investment trends defining this evolving sector.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7480

Top Companies & Their Strategies

The infrastructure asset management landscape blends traditional engineering expertise with cutting-edge digital technologies. Industry leaders are focusing on IoT-enabled monitoring, AI-driven analytics, and cloud-based asset lifecycle solutions to enhance visibility and performance across transportation, energy, and public infrastructure networks.

1. IBM Corporation - IBM's Maximo Application Suite is a global benchmark in enterprise asset management (EAM). The company's strategy revolves around integrating AI, IoT, and hybrid cloud capabilities to offer predictive maintenance and real-time asset performance monitoring. IBM's partnership network across utilities, transportation, and manufacturing gives it an edge in scalability and data analytics. Its strength lies in strong software integration, global presence, and a proven ability to customize for complex infrastructure environments.

2. Siemens AG - Siemens leverages its extensive expertise in automation, energy systems, and digital infrastructure to deliver end-to-end asset management solutions. Through Siemens Xcelerator and its digital twin technology, the company enables customers to simulate, monitor, and optimize infrastructure assets across their lifecycle. Siemens' strategy focuses on sustainable urban infrastructure, smart grid modernization, and predictive analytics - areas supported by strong partnerships with governments and industrial operators.

3. Schneider Electric SE - Schneider Electric's EcoStruxure platform integrates energy management, automation, and software for optimized infrastructure operations. The company's focus on sustainability and digitization makes it a leader in infrastructure resilience. Schneider emphasizes real-time operational intelligence, offering modular, cloud-based solutions that cater to smart cities, utilities, and data centers. Its strength lies in balancing operational efficiency with environmental performance.

4. AECOM - AECOM stands out as a leading infrastructure consulting firm integrating asset management with engineering, design, and construction services. The company's strategy involves delivering end-to-end lifecycle solutions, from planning and risk assessment to operation and renewal. AECOM's strength is its strong project management expertise and ability to tailor digital asset management strategies for transportation networks, water utilities, and energy infrastructure globally.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-7480

5. Bentley Systems, Incorporated - A pioneer in infrastructure software, Bentley Systems focuses on digital twins, 3D modeling, and infrastructure intelligence. Its iTwin Platform enables asset visualization, real-time monitoring, and performance forecasting. Bentley's partnerships with public agencies and engineering firms strengthen its global reach, while its acquisition-driven growth-particularly in cloud and construction analytics-enhances its competitive edge in infrastructure digitization.

6. Trimble Inc. - Trimble combines positioning technology, cloud software, and analytics to enhance infrastructure asset productivity. Its asset lifecycle management solutions are widely used in construction, transportation, and utilities. The company's strategy revolves around precision data, interoperability, and integrated workflow management. Trimble's strengths include strong geographic reach, advanced GPS and sensor capabilities, and consistent innovation in connected infrastructure systems.

7. AtkinsRéalis (formerly SNC-Lavalin) - AtkinsRéalis is expanding its role in infrastructure asset management through its Data, Digital & Technology division. The company's strategy emphasizes digital transformation and sustainable asset lifecycle modeling for transportation, energy, and defense infrastructure. With a global consulting footprint and expertise in predictive analytics, AtkinsRéalis leverages digital twins and integrated data systems to improve cost predictability and performance efficiency for clients worldwide.

8. Oracle Corporation - Oracle's cloud-based Asset Management Cloud is part of its larger infrastructure management suite. The company focuses on integrating data analytics, ERP systems, and AI-driven insights to streamline asset performance, maintenance scheduling, and capital planning. Oracle's strength lies in its vast ecosystem of cloud solutions and deep enterprise integration, which appeal to utilities, governments, and transportation agencies pursuing digital transformation.

➤ View our Infrastructure Asset Management Market Report Overview here: https://www.researchnester.com/reports/infrastructure-asset-management-market/7480

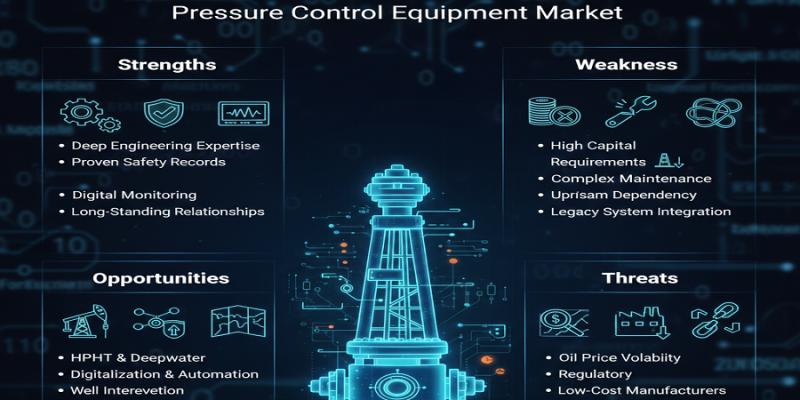

SWOT Analysis

Strengths - Leading players in the infrastructure asset management market benefit from robust technology portfolios combining IoT, AI, and cloud-based analytics. Their deep integration with digital twin and predictive maintenance systems enhances asset visibility, reliability, and sustainability. Global consulting networks and partnerships with public agencies ensure large-scale implementation capabilities. Many companies also leverage cross-sector expertise-from energy to transportation-creating diversified resilience against market fluctuations.

Weaknesses - The market remains capital- and data-intensive, with long implementation cycles and complex integration requirements. Many asset owners struggle with legacy systems, fragmented data sources, and a lack of standardization. High initial costs for deploying advanced digital infrastructure solutions can limit adoption in developing regions. Additionally, dependency on skilled technical personnel and cybersecurity vulnerabilities pose operational challenges for software-led asset management models.

Opportunities - Massive opportunities lie in smart infrastructure modernization, digital twin deployment, and sustainability-driven investments. Governments' emphasis on resilient and climate-adaptive infrastructure offers strong growth potential for technology providers. The rise of AI-driven asset intelligence, cloud-native platforms, and 5G-enabled monitoring is opening new avenues for innovation. Emerging markets in Asia, Africa, and the Middle East present significant potential as urbanization and digital transformation accelerate. Partnerships with real estate, utilities, and renewable energy operators can unlock recurring service revenues and long-term contracts.

Threats - Rising competition from regional technology firms and open-source software providers may pressure pricing and margins. Rapidly changing data privacy and cybersecurity regulations create compliance burdens for multinational firms. Economic slowdowns or budgetary constraints in public infrastructure projects could delay digital transformation initiatives. Additionally, the fragmented nature of infrastructure ownership-spread across public and private entities-complicates standardization and large-scale deployment.

➤ Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-7480

Investment Opportunities & Trends

Investment in the infrastructure asset management market is accelerating as public and private sectors prioritize resilience, sustainability, and digitization. The convergence of AI, cloud computing, and IoT is driving a wave of innovation, while mergers and acquisitions continue to reshape competitive dynamics.

1. Technology Integration

Investors are targeting firms developing AI-powered asset analytics, predictive maintenance software, and digital twin platforms. Startups focused on integrating satellite data, drones, and IoT sensors into asset monitoring systems are drawing significant venture capital. The trend toward platform-based solutions-where asset management, energy optimization, and maintenance planning converge-reflects a key area of technological investment.

2. M&A Activity

Recent years have seen major mergers and acquisitions as large engineering and technology firms consolidate capabilities. Acquisitions of software startups specializing in infrastructure intelligence and data analytics have been common among giants like Bentley Systems, Schneider Electric, and Trimble. These moves aim to build unified digital ecosystems capable of managing entire infrastructure lifecycles under one platform.

3. Regional Expansion

Asia-Pacific and Europe remain key investment destinations due to strong government initiatives in smart infrastructure, renewable energy integration, and sustainable city development. North America continues to attract funding in transportation, utility digitization, and climate-resilient infrastructure. Meanwhile, regions such as Latin America and the Middle East are witnessing early-stage funding for infrastructure digitization aligned with modernization and sustainability programs.

4. Sustainability and Smart Cities

Investors are increasingly prioritizing green infrastructure asset management - integrating energy efficiency, carbon tracking, and sustainable materials management into lifecycle planning. Smart city programs across Europe, Singapore, and the Gulf states are accelerating funding for data-driven asset management systems that enhance efficiency and reduce operational emissions.

Notable Market Developments in the Last 12 Months

• Leading engineering and software firms have expanded partnerships to integrate digital twins and predictive analytics into large-scale transportation and energy projects.

• Governments in Europe and Asia launched national digital infrastructure initiatives, encouraging adoption of AI-driven asset management tools.

• Several acquisitions occurred in the infrastructure analytics and digital twin sectors, underscoring investor confidence in data-centric asset solutions.

• Startups offering IoT-enabled infrastructure monitoring and cloud-native maintenance management platforms secured major funding rounds, signaling continued market vitality.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7480

Related News -

https://www.linkedin.com/pulse/what-key-trends-driving-growth-mobile-bi-market-market-pulse-point-hnxsf

https://www.linkedin.com/pulse/how-online-coaching-software-transforming-learning-obyrf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Infrastructure Asset Management Market Size: Key Opportunities and Projections to 2035 | Prominent Players Include IBM Corporation, Siemens AG, Schneider Electric SE, Trimble Inc. here

News-ID: 4255435 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

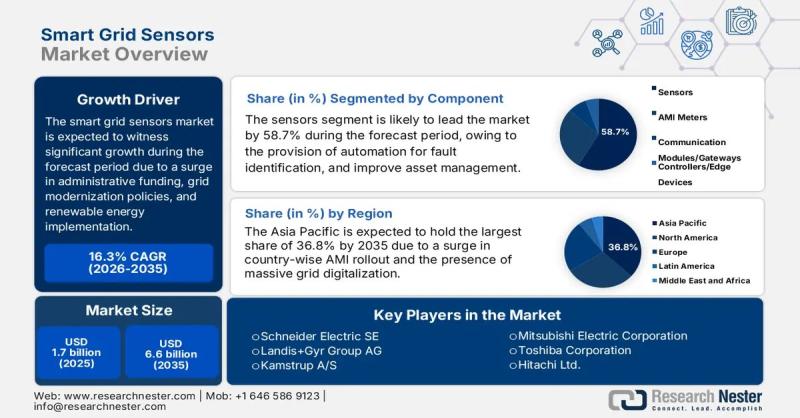

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…