Press release

Supply Chain Finance Market Size is Expected to Witness Accelerated Expansion by 2035 | Leading Firms Such as Citi Group Inc, Standard Chartered Bank, HSBC Holdings plc, SAP SE

The supply chain finance market is evolving rapidly as global trade networks become more complex and businesses seek to improve liquidity, reduce risk, and strengthen supplier relationships. Once limited to large corporations and banks, supply chain finance (SCF) is now being reshaped by fintech innovation, digital platforms, and blockchain-based transparency. Companies are turning to SCF solutions to stabilize working capital, enhance cash flow predictability, and support small and medium-sized enterprises (SMEs) in volatile markets. This article examines the leading players shaping the market, outlines a combined SWOT analysis of key competitors, and identifies the major investment themes transforming the global supply chain finance ecosystem.➤ Request Free Sample PDF Report @https://www.researchnester.com/sample-request-8035

Top Companies & Their Strategies

Citi Group Inc.

Citigroup remains a global leader in supply chain finance, leveraging its extensive international banking network and digital infrastructure. The company's Citi Supplier Finance platform offers automated onboarding, real-time data visibility, and integration with enterprise resource planning (ERP) systems. Citi's strength lies in its deep corporate relationships, robust liquidity management capabilities, and commitment to sustainable finance. Its recent initiatives have focused on green supply chain finance programs, aligning working capital solutions with ESG (Environmental, Social, and Governance) goals.

Standard Chartered Bank

Standard Chartered is a key player in emerging markets, offering supply chain finance solutions that bridge global corporations with suppliers across Asia, Africa, and the Middle East. The bank's digital trade ecosystem and collaboration with fintech firms such as Linklogis highlight its strategy of combining innovation with regional expertise. Its competitive edge comes from its ability to deliver customized financing programs to underserved markets while ensuring compliance with global trade standards.

HSBC Holdings plc

HSBC has developed a comprehensive suite of supply chain finance and receivables solutions supported by advanced analytics and blockchain technology. The bank's "HSBCnet" platform provides enhanced transparency, enabling clients to monitor payment cycles and improve liquidity management. HSBC's strategy emphasizes cross-border transaction efficiency and sustainable supply chain finance, with initiatives aimed at financing suppliers that meet sustainability benchmarks.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-8035

SAP SE (SAP Ariba Network)

SAP has revolutionized supply chain finance through its Ariba Network, connecting buyers, suppliers, and financial institutions on a single digital platform. By integrating procurement and financing functions, SAP enables real-time invoice approval and payment visibility. Its strategic focus on end-to-end digitization and API-based integrations makes it a technology enabler for enterprises adopting finance automation. SAP's strong global ecosystem of partners further enhances its reach in manufacturing, retail, and logistics sectors.

Taulia (A SAP Company)

Taulia has emerged as one of the most innovative fintech firms in the supply chain finance market. Acquired by SAP in 2022, Taulia's AI-driven platform optimizes working capital for both buyers and suppliers. Its dynamic discounting and early payment solutions have gained traction among Fortune 500 companies. Taulia's strength lies in its data analytics capability and seamless integration with ERP systems, providing actionable financial insights that enhance liquidity management.

Oracle Corporation

Oracle has positioned itself as a strong competitor with its integrated finance and supply chain management solutions. Its Oracle Cloud SCM suite leverages AI and machine learning to predict cash flow risks, assess supplier reliability, and optimize payment schedules. Oracle's competitive advantage is its deep technology stack and modular platform, allowing businesses to implement supply chain finance capabilities as part of broader digital transformation initiatives.

Demica Ltd.

Demica specializes in working capital solutions for multinational corporations and financial institutions. Its technology-driven platform enables the securitization of receivables and payables, providing flexible financing structures. Demica's strength lies in its focus on scalability, risk analytics, and strong relationships with major global banks. The company's collaborative approach with both buyers and suppliers makes it a trusted partner in complex, multi-tier supply chains.

PrimeRevenue Inc.

PrimeRevenue is a global leader in multibank supply chain finance platforms. It enables buyers and suppliers to access financing through a network of funding partners, offering flexibility and liquidity diversity. PrimeRevenue's cloud-based "OpenSCi" platform delivers real-time payment visibility, risk management tools, and integration with various ERP systems. The company's cost-effective and modular approach appeals to both large enterprises and mid-market firms.

➤ View our Supply Chain Finance Market Report Overview here: https://www.researchnester.com/reports/supply-chain-finance-market/8035

SWOT Analysis

Strengths

Top players in the supply chain finance market possess strong digital infrastructures, deep banking relationships, and robust global footprints. Their solutions deliver real-time visibility, automation, and liquidity optimization-key priorities for corporates managing complex global operations. Partnerships between financial institutions and fintech innovators have enhanced agility and customer experience. Moreover, the increasing integration of ESG-linked financing has positioned leading firms as responsible financial partners supporting sustainable business growth.

Weaknesses

Despite strong growth, the market faces challenges related to integration complexity and data interoperability. Many companies struggle to align legacy systems with modern digital platforms, slowing adoption. Dependence on regulatory approval and risk assessment frameworks also creates operational friction, especially in emerging markets. Additionally, high setup costs for SCF programs can deter small businesses from adopting these solutions, leaving a significant untapped segment in global supply chains.

Opportunities

The ongoing digital transformation of trade finance presents vast opportunities for innovation in the supply chain finance market. The adoption of blockchain, AI, and API-based integration is enabling real-time risk management and financing automation. SMEs in Asia-Pacific, Africa, and Latin America represent major growth areas as banks and fintechs expand access to short-term liquidity. The growing focus on green and sustainable supply chain finance provides another opportunity-linking financing terms with environmental performance and ethical sourcing practices. Moreover, new government and development bank initiatives supporting digital trade are expected to further expand financing inclusion across global supply chains.

Threats

Cybersecurity risks and regulatory uncertainties remain key threats to the supply chain finance industry. The increasing digitalization of financial transactions exposes systems to data breaches and fraud risks. In addition, global trade tensions and geopolitical disruptions may impact liquidity and cross-border transaction flows. The entry of new fintech competitors with aggressive pricing and innovation cycles could also pressure traditional banks to accelerate their digital transformation. Lastly, inconsistent ESG reporting standards could complicate the integration of sustainability-linked finance products.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-8035

Investment Opportunities & Trends

Fintech Collaboration and Ecosystem Expansion

Collaboration between banks and fintechs is one of the most defining trends in the supply chain finance market. Partnerships like Standard Chartered and Linklogis, or HSBC and Tradeshift, exemplify how traditional banks are leveraging fintech agility to enhance customer experience and digital reach. Investors are particularly drawn to platforms that provide end-to-end automation, AI-driven credit assessment, and real-time analytics, as these capabilities increase scalability and transparency.

Technology Integration and Blockchain Adoption

Technology integration is transforming supply chain finance into a data-driven ecosystem. Blockchain adoption is enabling greater transaction security and transparency, reducing fraud and operational delays. Companies like Citi and HSBC are piloting blockchain-based platforms to streamline trade documentation and reduce settlement times. Meanwhile, API-driven architectures by firms such as SAP Ariba and Oracle are allowing seamless integration between procurement, logistics, and financing systems-enhancing efficiency across the value chain.

ESG-Linked Supply Chain Finance

Sustainability has emerged as a key investment theme. Financial institutions are increasingly offering supply chain finance programs that incentivize suppliers meeting ESG performance targets. For instance, Citi and HSBC have launched sustainability-linked financing solutions that reward suppliers for reducing carbon emissions or improving labor standards. This trend aligns with the growing demand for responsible sourcing and compliance with green financing frameworks.

Mergers, Acquisitions, and Venture Funding

M&A activity in the supply chain finance space continues to accelerate. The acquisition of Taulia by SAP is a prime example of how technology providers are consolidating capabilities to offer holistic, AI-powered working capital platforms. Venture funding in SCF-focused startups like Demica and PrimeRevenue has surged, signaling investor confidence in the scalability of digital liquidity solutions. Fintech-focused venture capital funds are targeting firms developing modular, API-enabled platforms capable of integrating with both banks and corporates.

Regional Growth and Emerging Markets

Emerging economies, particularly in Asia-Pacific, Africa, and Latin America, are witnessing increased investment in supply chain finance infrastructure. Governments and development institutions are promoting financial inclusion for SMEs through digital financing platforms. For instance, India's TReDS platform and China's fintech-driven SCF networks have expanded access to working capital for small suppliers. This regional focus not only boosts local economic resilience but also offers investors access to high-potential markets with growing trade volumes.

Policy and Regulatory Developments

The past year has seen a surge in policy initiatives aimed at strengthening transparency and access to supply chain finance. Regulatory bodies in Europe and Asia are emphasizing standardized reporting and disclosure for SCF transactions, particularly after concerns over accounting transparency in reverse factoring. Meanwhile, governments are encouraging financial institutions to use digital tools to support SMEs-a trend that is likely to drive technology adoption and investor participation.

➤ Request Free Sample PDF Report @https://www.researchnester.com/sample-request-8035

Related News -

https://www.linkedin.com/pulse/what-future-commercial-printing-outsourcing-market-digital-ulq4f

https://www.linkedin.com/pulse/how-5g-infrastructure-market-powering-next-wave-digital-7iwlf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Supply Chain Finance Market Size is Expected to Witness Accelerated Expansion by 2035 | Leading Firms Such as Citi Group Inc, Standard Chartered Bank, HSBC Holdings plc, SAP SE here

News-ID: 4255404 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

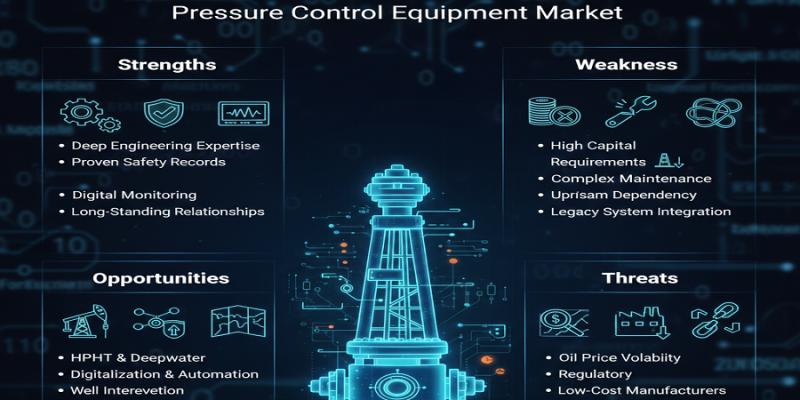

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

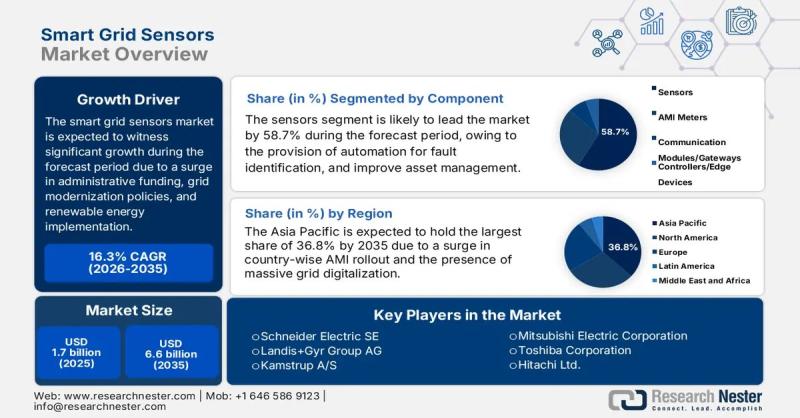

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for SAP

SAP Extended Warehouse Management (SAP EWM) - Epic Guide for U.S. Enterprises

What Is SAP Extended Warehouse Management?

SAP Extended Warehouse Management (SAP EWM) is a powerful, flexible warehouse management system developed by SAP SE. It allows organizations to efficiently manage and optimize their warehouse operations, from inbound and outbound logistics to inventory tracking and resource management.

Related terms: SAP EWM software, warehouse automation with SAP, extended warehouse logistics.

In the U.S. market, where logistics, fulfillment speed, and cost efficiency are crucial due to high…

atkrypto.io Enterprise Blockchain Platform for SAP joins SAP PartnerEdge Open Ec …

atkrypto.io, the Enteprise Blockchain Platform leader, announced today that it has signed an SAP® PartnerEdge® program agreement. The program provides access to resources, services and benefits that will help atkrypto.io build and maintain a successful partnership with SAP.

By partnering with the SAP PartnerEdge Program, atkrypto.io intends to help SAP Customers with enabling their Web3 and Blockchain visions to come to life.

atkrypto is an Enterprise Private Blockchain Platform taking blockchain to…

SAP Application Services Market Services for SAP Applications 2024 to 2030 | SAP …

The Report on "SAP Application Services Market" provides Key Benefits, Market Overview, Regional Analysis, Market Segmentation, Future Trends Upto 2030 by Infinitybusinessinsights.com. The report will assist reader with better understanding and decision making.

Market Overview of SAP Application Services Market: The SAP Application Services market is witnessing substantial growth due to the widespread adoption of SAP (Systems, Applications, and Products) solutions by businesses for enterprise resource planning (ERP) and business process…

Unlocking the Full Potential of SAP ERP: Understanding SAP AMS

Every organization invests significantly in enterprise software solutions like SAP ERP. However, reaping the full benefits and realizing the true value of this software requires effective maintenance and management, which is where SAP AMS comes into play.

So, what exactly is SAP AMS? It's a crucial service that steps in after the implementation phase. It assists the IT department in handling complexities by maintaining the existing SAP technology. Essentially, SAP AMS…

Investigation announced for Investors in shares of SAP SE (NYSE: SAP)

An investigation was announced over possible violations of securities laws by SAP SE in connection with certain financial statements.

Investors who purchased shares of SAP SE (NYSE: SAP), have certain options and should contact the Shareholders Foundation at mail@shareholdersfoundation.com or call +1(858) 779 - 1554.

The investigation by a law firm focuses on whether a series of statements by SAP SE regarding its business, its prospects and its operations were materially false…

SAP Business One Partner adopts TaskCentre for SAP Business One

Orbis Software today announced that Infinium Technologies has joined its TaskCentre for SAP Business One channel partner program. The partnership will enable Infinium Technologies to address complex SAP Business One Integration, Workflow and process automation requirements through the TaskCentre Business Process Management (BPM) Suite.

Manian Shankhar, Managing Director for Infinium Technologies highlighted the rationale for partnering with Orbis Software, “One of the primary drivers for joining the Orbis Software partner was…