Press release

Multi-Core Processor Market Size: Strong Growth Projected Through 2035 | Key Participants Intel Corporation, Advanced Micro Devices, Inc., NVIDIA Corporation, Arm Holdings plc

The multi-core processor market is entering a transformative phase, driven by the convergence of AI workloads, edge computing, and energy-efficient architectures. As industries shift toward data-centric computing and cloud-to-edge integration, multi-core processors are becoming indispensable for powering modern applications across servers, mobile devices, automotive systems, and embedded platforms. This article explores the top companies defining competitive dynamics, analyzes their strategic positioning, and highlights the investment themes shaping the next wave of capital in the global semiconductor and processor industry.➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7081

Top Companies & Their Strategies

1. Intel Corporation

Intel remains a cornerstone in the multi-core processor landscape, with its Core, Xeon, and Atom families spanning client computing to data centers. The company's strategy focuses on reclaiming performance leadership through process node advancements, AI-integrated cores, and heterogeneous chip designs under its IDM 2.0 model. Intel is heavily investing in foundry services, new fabs in the U.S. and Europe, and cross-sector collaborations to strengthen resilience across its supply chain. Its integration of CPUs, GPUs, and FPGAs reinforces its competitive edge in enterprise and AI workloads.

2. Advanced Micro Devices, Inc. (AMD)

AMD has redefined market competition with its Ryzen, EPYC, and Threadripper processor lines, leveraging high core counts, energy efficiency, and strong price-performance ratios. Built on advanced 5nm and 3nm processes through its partnership with TSMC, AMD's "Zen" architecture continues to challenge Intel's dominance in both consumer and enterprise markets. The company's strategy centers on scalability, modular design (chiplets), and expanding into data center AI acceleration through the integration of its Xilinx acquisition.

3. NVIDIA Corporation

Traditionally known for GPUs, NVIDIA's strategic expansion into multi-core CPU architectures through its ARM-based Grace CPU and Grace Hopper Superchip platforms marks a major inflection point. By merging AI acceleration, HPC (high-performance computing), and data center optimization, NVIDIA is positioning itself as a holistic compute platform provider. Its acquisition of Mellanox and ecosystem partnerships with hyperscalers have fortified its presence in AI-driven cloud computing.

4. Qualcomm Technologies, Inc.

Qualcomm continues to dominate the mobile and embedded multi-core processor segment with its Snapdragon platform. The company's innovation centers on integrating CPU, GPU, and AI engines for seamless performance and low power consumption. Its entry into PC and automotive markets with the Snapdragon X Elite and Snapdragon Ride platforms showcases its ambition to expand beyond smartphones. Qualcomm's competitive edge lies in its power efficiency and advanced connectivity features such as 5G and Wi-Fi 7.

➤ Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-7081

5. Apple Inc.

Apple's vertically integrated strategy with its Apple Silicon (M-series) processors represents a paradigm shift in consumer and professional computing. The company's unified architecture across Macs, iPads, and iPhones maximizes software-hardware optimization and performance-per-watt efficiency. With multi-core architectures tailored for AI, graphics, and neural processing, Apple's in-house design approach reduces reliance on external chip suppliers and reinforces its ecosystem moat.

6. Arm Holdings plc

Arm remains the foundation of most mobile and embedded multi-core processors worldwide. Its licensing model empowers ecosystem partners-from Qualcomm and Samsung to MediaTek-to innovate atop its energy-efficient architectures. Arm's focus on AI-ready cores, chiplet compatibility, and RISC-based customization ensures continued dominance in edge computing, IoT, and automotive applications. Its recent IPO has renewed investor confidence in its long-term growth trajectory.

7. Taiwan Semiconductor Manufacturing Company (TSMC)

As the world's largest contract foundry, TSMC plays a pivotal role in the multi-core processor value chain. Its advanced nodes (3nm, 2nm) power the products of nearly every leading semiconductor company. TSMC's technological leadership and production scalability position it as a strategic partner in the global semiconductor supply chain. Recent investments in U.S., Japan, and Europe fabs further strengthen its geographic diversification and resilience.

8. MediaTek Inc.

MediaTek is emerging as a formidable competitor in the mobile and IoT processor market with its Dimensity series. The company combines high-performance multi-core designs with cost-efficient production, making it a preferred choice for mid-range smartphones and smart devices. MediaTek's integration of AI, 5G, and edge computing capabilities into affordable chipsets enhances its reach in Asia-Pacific and emerging markets.

➤ View our Multi-core Processor Market Report Overview here: https://www.researchnester.com/reports/multi-core-processor-market/7081

SWOT Analysis

Strengths - Leading companies in the multi-core processor market benefit from deep R&D pipelines, advanced fabrication partnerships, and vertically integrated ecosystems. Their architectures support diverse workloads across AI, gaming, data centers, and automotive systems. Multi-core innovation enables parallel processing efficiency, performance scaling, and energy savings. Strategic alliances between chip designers and foundries (e.g., AMD-TSMC, Apple-TSMC) amplify production agility. Established brands like Intel, NVIDIA, and Apple maintain strong developer ecosystems and IP portfolios, ensuring sustained technological leadership.

Weaknesses - Despite rapid innovation, the industry faces challenges tied to manufacturing complexity, high capital expenditure, and supply chain dependencies. Lead times for next-generation node transitions can slow time-to-market. Additionally, the growing reliance on a few advanced foundries-particularly TSMC and Samsung-creates vulnerability in global logistics. Fragmentation in instruction sets (x86, ARM, RISC-V) and software optimization overheads can hinder interoperability. For some players, heavy reliance on cyclical end markets like smartphones or PCs remains a structural weakness.

Opportunities - The expansion of AI workloads, autonomous vehicles, and edge computing represents the most promising frontier for multi-core processors. Hybrid CPU-GPU-NPU integration offers new revenue channels across datacenter and embedded computing. Startups are leveraging RISC-V and open-source architectures to innovate in low-cost, customizable processors. Growth in regional semiconductor ecosystems-driven by government incentives in the U.S., Europe, and India-is attracting capital for design and manufacturing. Furthermore, sustainability-focused designs and chiplet-based modular architectures are unlocking new efficiencies and design flexibility.

Threats - The multi-core processor industry faces intense competition, cyclical demand, and geopolitical risks that could disrupt semiconductor supply chains. Export restrictions, fluctuating energy prices, and global chip shortages continue to pressure margins. Rapid technological convergence may also erode differentiation, especially as open-source designs and fabless startups enter the market. Emerging computing paradigms such as quantum processors, neuromorphic chips, and photonic computing could potentially challenge traditional multi-core architectures over the long term.

➤ Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-7081

Investment Opportunities & Trends

1. M&A Activity and Consolidation

The semiconductor sector continues to see consolidation as companies seek vertical integration and IP synergy. Major deals-such as AMD's acquisition of Xilinx and Intel's push into foundry services-reflect a shift toward end-to-end compute ecosystems. Investors are backing firms with advanced design automation, chiplet integration, and AI-enhanced architectures that address diverse workloads. Private equity activity is also accelerating in packaging, testing, and mid-tier design firms.

2. Technology Integration and AI Acceleration

Capital is flowing into multi-core designs optimized for AI, machine learning, and high-performance computing (HPC). Hybrid architectures that integrate neural processing units (NPUs) and specialized accelerators are becoming investor favorites. Companies focusing on scalable, low-power multi-core chips for edge and IoT applications are attracting strategic partnerships with hyperscalers and cloud service providers.

3. Regional Expansion and Policy Incentives

Geopolitical realignment of semiconductor manufacturing is driving significant investment into new fabrication hubs. The U.S. CHIPS and Science Act, EU Chips Act, and similar initiatives in India and Japan have accelerated local capacity building. Asia-Pacific remains a key manufacturing stronghold, while North America and Europe are gaining momentum as design and R&D centers. Investors are targeting firms that can balance local production with global supply chain resilience.

Notable Developments in the Last 12 Months

• Intel and TSMC expanded joint manufacturing programs for next-gen 2nm and hybrid bonding technologies.

• NVIDIA unveiled the Grace Hopper Superchip, integrating CPU and GPU capabilities for data-intensive workloads.

• AMD launched the EPYC 9004 "Genoa" series, marking a leap in server-grade multi-core performance.

• Apple introduced its M4 series processors with enhanced AI co-processors, advancing on-device intelligence.

• Qualcomm announced expanded partnerships with automakers for Snapdragon Ride platforms, targeting the autonomous driving segment.

• Multiple RISC-V startups secured venture funding for open-source multi-core designs focused on embedded and industrial IoT applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-7081

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Multi-Core Processor Market Size: Strong Growth Projected Through 2035 | Key Participants Intel Corporation, Advanced Micro Devices, Inc., NVIDIA Corporation, Arm Holdings plc here

News-ID: 4255403 • Views: …

More Releases from Research Nester Pvt Ltd

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

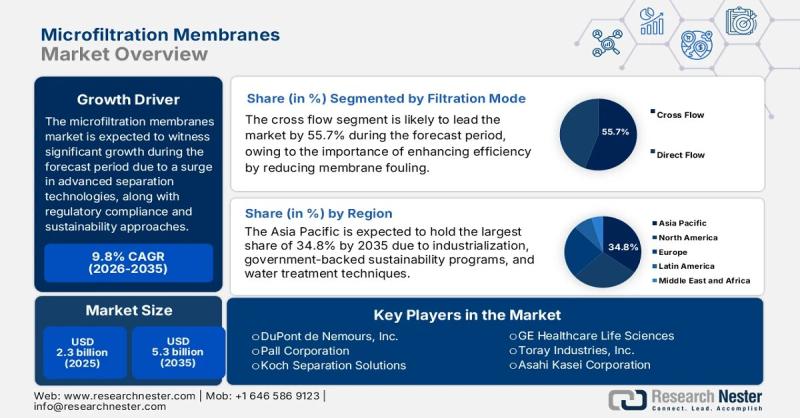

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for TSMC

Semiconductor Foundry Market is Booming Worldwide | • TSMC • Samsung Electro …

Worldwide Market Reports has added a new research study on "Semiconductor Foundry Market" is projected to experience substantial growth in the coming years. This report provides a comprehensive analysis of the market landscape using an integrated approach that includes research methodology, market size evaluation, data compilation, and insights gathered from multiple credible sources.

The study covers critical market elements such as market dynamics, drivers, restraints, challenges, threats, growth opportunities, development trends,…

Chiplet Technology Market Revenue Facts Statastics By 2028 |AMD, Intel, TSMC

The report named, *Global Chiplet Technology Market Insights, Forecast to 2028* has been added to the archive of market research studies by QY Research. The industry experts and researchers have offered a reliable and precise analysis of the global Chiplet Technology market in view of numerous aspects such as growth factors, challenges, limitations, developments, trends, growth opportunities, geographical expansion, market segments, competitive landscape, manufacturing, and pricing and cost structures. . This…

FinFET Technology Market Outlook and Forecast 2022-2028 | TSMC, Samsung, GlobalF …

Latest survey on FinFET Technology Market is conducted to provide hidden gems performance analysis of FinFET Technology to better demonstrate competitive environment . The study is a mix of quantitative market stats and qualitative analytical information to uncover market size revenue breakdown by key business segments and end use applications. The report bridges the historical data from 2016 to 2021 and forecasted till 2028*, the outbreak of latest scenario in…

FinFET Technology Market Overview 2020-26, TSMC, Samsung, Intel, GlobalFoundries

The latest study on the Global FinFET Technology market report represents a deep appraisal of the international industry. The research report on the worldwide FinFET Technology market 2020-2026 sheds light on qualitative as well as quantitative insights, historical FinFET Technology industry status and authorized projection related to the FinFET Technology market size. Each and every segment exhibited in this report are discovered through verifiable research methods and techniques. It also…

Global Solar Battery Market 2018 - Panasonic, Sanyo Solar, TSMC, Yingli

Apex Market Research, recently published a detailed market research study focused on the “Solar Battery Market” across the global, regional and country level. The report provides 360° analysis of “Solar Battery Market” from view of manufacturers, regions, product types and end industries. The research report analyses and provides the historical data along with current performance of the global PP Pipe industry, and estimates the future trend of Solar Battery on…

FinFET Technology Market: TSMC, Samsung, Intel, GlobalFoundries

MarketResearchReports.Biz has recently announced the Latest industry research report on: "Global FinFET Technology Market" : Industry Size, Share, Research, Reviews, Analysis, Strategies, Demand, Growth, Segmentation, Parameters, Forecasts.

This report studies the global FinFET Technology market status and forecast, categorizes the global FinFET Technology market size (value & volume) by manufacturers, type, application, and region. This report focuses on the top manufacturers in North America, Europe, Japan, China, India, Southeast Asia and…