Press release

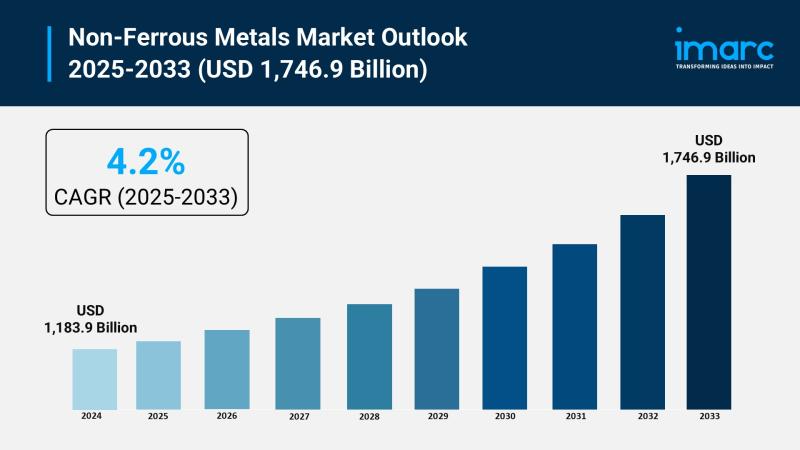

Non-Ferrous Metals Market Size To Worth USD 1,746.9 Billion in 2033 | Grow CAGR by 4.2%

Market Overview:The non-ferrous metals market is experiencing rapid growth, driven by accelerated electric vehicle adoption, renewable energy infrastructure expansion, and surging construction and industrial investment. According to IMARC Group's latest research publication, "Non-Ferrous Metals Market Report by Type (Aluminum, Copper, Lead, Tin, Nickel, Titanium, Zinc, and Others), Application (Automobile Industry, Electronic Power Industry, Construction Industry, and Others), and Region 2025-2033", the global non-ferrous metals market size reached USD 1,183.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1,746.9 Billion by 2033, exhibiting a growth rate (CAGR) of 4.2% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/non-ferrous-metals-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Non-Ferrous Metals Market

● Accelerated Electric Vehicle Adoption

The worldwide surge in Electric Vehicle (EV) production is a profound driver for non-ferrous metal consumption, particularly for copper and aluminum. A single battery electric vehicle requires substantially more copper-upwards of 80 kilograms-compared to approximately 25 kilograms in a traditional internal combustion engine vehicle, primarily for its battery, motor windings, and charging infrastructure. Global EV sales recently surpassed 14 million units, marking a significant year-on-year increase. Furthermore, the massive battery production capacity of companies, such as the prominent Chinese battery manufacturer CATL, requires substantial amounts of non-ferrous metals, with one company alone reporting the use of 45,000 tons of aluminum in a recent period for battery housing. Government mandates, like the European Union's regulation for public charging points, will mandate the deployment of millions of new chargers, translating into hundreds of thousands of tons of additional copper demand for the supporting electrical infrastructure.

● Renewable Energy Infrastructure Expansion

The global shift toward clean energy generation is significantly increasing the demand for non-ferrous metals in renewable energy projects. Copper and aluminum are essential components in solar photovoltaic (PV) systems, wind turbines, and energy storage. Offshore wind turbines can contain between 8 and 15 tons of copper per megawatt of capacity, while onshore installations require 4 to 6 tons per megawatt. Recent global wind capacity additions exceeded 70 gigawatts, consuming hundreds of thousands of tons of copper. Similarly, solar power installations, which recently surpassed 190 gigawatts globally, require approximately 4 to 5 tons of copper for wiring and inverters, alongside 35 to 40 tons of aluminum for structural mounting per megawatt. Government initiatives, such as India's National Solar Mission aiming for a colossal solar capacity target, will require millions of tons of non-ferrous metals to meet the massive infrastructure development goals.

● Surging Construction and Industrial Investment

Rapid urbanization and vast infrastructure development in emerging and established economies are sustaining robust demand across the non-ferrous metals market. Non-ferrous metals like aluminum and zinc are crucial for construction applications, including structural elements, roofing, piping, and coatings for steel. Recent industry data from a major economy indicated an impressive 7.0% year-on-year growth in the added value of its non-ferrous metals industry, significantly outpacing the general industrial average. This growth is directly linked to substantial capital deployment, with fixed asset investment in the sector showing a striking 19.9% growth, which is considerably higher than the national industrial investment average. Furthermore, a single metal-primary aluminum-accounted for almost 80% of the production increase across ten major non-ferrous metals, underscoring its role in large-scale building and construction projects globally.

Key Trends in the Non-Ferrous Metals Market

● The Dominance of Advanced Recycling and Circular Economy

A major shift in the non-ferrous metals market is the growing dominance of advanced recycling and the circular economy model. Non-ferrous metals like aluminum and copper are highly recyclable without loss of quality, leading to the deployment of sophisticated sorting technologies like X-ray fluorescence (XRF) and laser-induced breakdown spectroscopy (LIBS). These technologies enable recyclers to achieve cleaner batches and higher purity from mixed refuse, which is critical for high-specification end-use products. Globally, over 30 million tons of aluminum refuse is recycled, and a significant fraction of the world's aluminum supply now comes from secondary, recycled sources. Recycling is a core focus for companies like Novelis and Aurubis, reducing the energy consumption required for primary production by up to 95% for aluminum and approximately 85% for copper.

● Focus on High-Performance, Lightweight Alloys

There is an unmistakable trend toward the development and adoption of high-performance, lightweight non-ferrous alloys, driven by the automotive and aerospace sectors' need for fuel efficiency and enhanced performance. Alloys based on aluminum, titanium, and magnesium are increasingly replacing traditional materials due to their superior strength-to-weight ratio. For instance, the use of specialized aluminum alloys in the construction of electric vehicle battery enclosures and chassis components drastically reduces the overall vehicle weight, directly translating to increased battery range. In the aerospace industry, the continued use of titanium alloys in airframes and engines is critical for meeting stringent fuel efficiency targets and reducing operational costs for new commercial aircraft. This demand has spurred significant research and development investment in materials science.

● Digital Integration and Smart Manufacturing

The integration of digital technologies and smart manufacturing is rapidly emerging as a transformative trend across the non-ferrous metals value chain, from mining to processing. This includes implementing the Industrial Internet of Things (IIoT) for real-time monitoring and process optimization in smelting and refining operations. Specialized software and automated systems are now used to manage material inventories, evaluate refuse value, and optimize logistics, significantly improving operational efficiency. Companies are using data analytics to fine-tune production processes, leading to higher metal recovery rates and reduced energy consumption. Furthermore, technologies like Blockchain are being explored to enhance supply chain transparency and traceability, particularly for ethically sourced and recycled critical non-ferrous metals, ensuring compliance and building consumer trust in metal origins.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=7871&flag=E

Leading Companies Operating in the Global Non-Ferrous Metals Industry:

● Aditya Birla Group

● Alcoa Corporation

● Aluminum Corporation of China Limited

● Anglo American plc

● BHP

● RUSAL (En+ Group MKPAO)

● Glencore Plc

● Norilsk Nickel

● Rio Tinto Group

● Sumitomo Metal Mining Co. Ltd.

● Vale S.A

Non-Ferrous Metals Market Report Segmentation:

By Type:

● Aluminum

● Copper

● Lead

● Tin

● Nickel

● Titanium

● Zinc

● Others

The non-ferrous metals market is segmented by type into aluminum, copper, lead, tin, nickel, titanium, zinc, and others, with aluminum being the largest segment.

By Application:

● Automobile Industry

● Electronic Power Industry

● Construction Industry

● Others

The market is analyzed by application, including the automobile industry, electronic power industry, construction industry, and others, with the automobile industry holding the largest market share.

By Region:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

The non-ferrous metals market is divided by region into North America (U.S. and Canada), Europe (Germany, France, U.K., Italy, Spain, Russia, and others), Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, and others), Latin America (Brazil, Mexico, and others), and the Middle East and Africa, with Asia Pacific being the largest regional market due to rapid industrialization and technological advancements.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Non-Ferrous Metals Market Size To Worth USD 1,746.9 Billion in 2033 | Grow CAGR by 4.2% here

News-ID: 4254133 • Views: …

More Releases from IMARC Group

Hydrogen Fluoride Manufacturing Plant DPR 2026: Investment Cost, Market Growth & …

Setting up a hydrogen fluoride manufacturing plant positions investors within a strategically important segment of the global specialty chemicals and fluorochemicals industry, driven by increasing demand for semiconductor manufacturing, refrigerant production, and pharmaceutical intermediates. As modern industrial processes advance, electronics manufacturing expands, and the need for high-purity fluorine compounds grows, hydrogen fluoride continues to gain traction across semiconductor fabrication, aluminum production, and petroleum refining worldwide. Rising demand from high-tech industries,…

Vinyl Acetate Ethylene Production Plant Cost 2026: Industry Overview and Profita …

Setting up a Vinyl Acetate Ethylene Production Plant positions investors in one of the most stable and essential segments of the specialty chemicals and polymer value chain, backed by sustained global growth driven by growing construction activity, rising demand for high-performance dry-mix mortars, increasing use in paints and coatings, and the dual-benefit advantages of delivering flexible, low-VOC polymer binder solutions that meet both industrial performance standards and evolving environmental compliance…

Fluff Pulp Manufacturing Plant DPR & Unit Setup - 2026: Machinery Cost, CapEx/Op …

Setting up a fluff pulp manufacturing plant positions investors within a strategically important segment of the global hygiene products and absorbent materials industry, driven by increasing demand for disposable hygiene products, absorbent personal care items, and medical applications. As consumer hygiene standards advance, disposable product adoption expands, and the need for high-quality absorbent materials grows, fluff pulp continues to gain traction across baby diapers, adult incontinence products, feminine hygiene items,…

Fire Alarms Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Pro …

Setting up a fire alarms manufacturing plant positions investors within a strategically important segment of the global safety and security equipment industry, driven by increasing demand for fire detection and safety systems, stringent building safety regulations, and growing awareness of fire protection measures. As modern construction practices advance, smart building integration expands, and the need for advanced fire safety infrastructure grows, fire alarms continue to gain traction across commercial buildings,…

More Releases for Metal

Metal Roofing Companies Revolutionizing the Industry: Classic Metal Roofs Leads …

Classic Metal Roofs has established itself as a leading provider of durable and energy-efficient roofing systems in Southern New England. With over 20 years of experience, the company is known for high-quality installations, customer satisfaction, and sustainable metal roofing solutions.

As homeowners increasingly seek durable and energy-efficient solutions, metal roofing companies continue to provide top-tier roofing systems. Among the industry leaders, Classic Metal Roofs [http://business.bigspringherald.com/bigspringherald/markets/article/abnewswire-2025-2-15-classic-metal-roofs-expert-aluminum-shingle-metal-roof-installation-and-services/] stands out for its commitment to…

Rare Metal Raw Materials - Boron(B) Metal

Boron Powder [https://www.urbanmines.com/boron-powder-product/]

Short Description:

Boron [,%20a%20chemical%20element%20with%20the%20symbol%20B%20and%20atomic%20number%205,%20is%20a%20black/brown%20hard%20solid%20amorphous%20powder.%20It%20], a chemical element with the symbol B and atomic number 5, is a black/brown hard solid amorphous powder. It is highly reactiveand soluble in concentrated nitric and sulfuric acids but insoluble in water, alcohol and ether. It has a high neutro absorption capacity. UrbanMines specializes in producing high purity Boron Powder with the smallest possible average grain sizes. Our standard powderparticle sizes average in the…

Metal Polishing Services Market Trends and Leading Players 2023-2030 | Metal Pol …

With a CAGR of 6.1%, the Metal Polishing Services Market is expected to grow from USD 1.5 billion in 2023 to USD 2.3 billion by 2030, offering a gleaming finish to metal surfaces for aesthetic and functional purposes.

Market Overview:

The Metal Polishing Services market is poised for rapid growth, driven by several pivotal drivers. There is a continuous demand for metal finishing and polishing services that improve the appearance and…

Metal-to-metal Seal Market 2021 | Detailed Report

Metal-to-metal Seal Market Forecasts report provided to identify significant trends, drivers, influence factors in global and regions, agreements, new product launches and acquisitions, Analysis, market drivers, opportunities and challenges, risks in the market, cost and forecasts to 2027.

Get Free Sample PDF (including full TOC, Tables and Figures) of Metal-to-metal Seal Market @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=5089735

The report provides a comprehensive analysis of company profiles listed below:

- Parker

- CPI

- HTMS

- American Seal &…

Metal Polishing Services Market Research Report 2020 Analysis: Enhanced Growth a …

Metal Polishing Services Market

Global Metal Polishing Services Market is providing the summarized study of several factors encouraging the growth of the market such as manufacturers, market size, type, regions and numerous applications. By using the report consumer can recognize the several dynamics that impact and govern the market. For any product, there are several companies playing their role in the market, some new, some established and some are planning to…

Worldwide Recycled Metal Market By Metal 2024 | Nucor, Steel Dynamics, Schnitzer …

The 2018-2024 report on global Recycled Metal market explores the essential factors of Recycled Metal industry covering current scenario, market demand information, coverage of active companies and segmentation forecasts.

North America recycled metal market was estimated close to USD 8.5 billion in 2017. This is mainly attributed to strong presence of transportation, electrical & electronics and defense industry which majorly constitute to the overall product demand. Moreover, strict laws formulated…