Press release

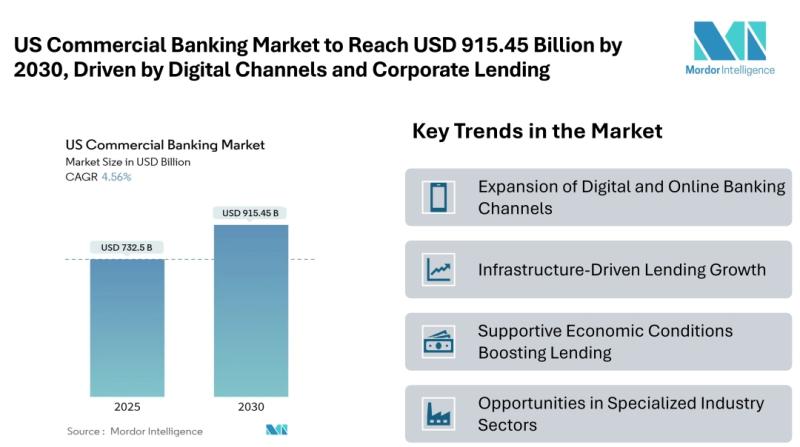

US Commercial Banking Market to Reach USD 915.45 Billion by 2030, Driven by Digital Channels and Corporate Lending

Mordor Intelligence has published a new report on the US Commercial Banking Market, offering a comprehensive analysis of trends, growth drivers, and future projections.US Commercial Banking Market Outlook

According to Mordor Intelligence, the US commercial banking market size [https://www.mordorintelligence.com/industry-reports/us-commercial-banking-market?utm_source=abnewswire] stands at USD 732.5 billion in 2025 and is forecasted to reach USD 915.45 billion by 2030, reflecting a 4.56% CAGR. The expanding role of digital channels alongside traditional services is also contributing to the overall US commercial banking market size. In terms of market distribution, the United States commercial banking market share is spread across both large enterprises and SMEs, with digital banking gradually gaining prominence alongside offline operations.

Key Trends in the US Commercial Banking Market

1. Expansion of Digital and Online Banking Channels

Digital and online banking adoption is increasing rapidly, with banks leveraging APIs and automated treasury solutions. Even smaller community banks are using these tools to compete effectively with larger institutions.

2. Infrastructure-Driven Lending Growth

Federal and state infrastructure programs are creating steady demand for construction loans, equipment financing, and working-capital facilities, helping banks secure long-term revenue streams.

3. Supportive Economic Conditions Boosting Lending

A stable economy with steady GDP growth and strong corporate cash flows is enabling businesses to access credit more easily, supporting commercial lending and treasury management services.

4. Opportunities in Specialized Industry Sectors

Emerging sectors, including renewable energy and cannabis-related businesses, are opening new fee-based services. Regulatory changes in these areas provide banks opportunities to expand offerings and strengthen their market position.

Segmentation of the US Commercial Banking Market

By Product:

*

Commercial Lending

*

Treasury Management

*

Syndicated Loans

*

Capital Markets

*

Other Products

By Client Size:

*

Large Enterprises

*

Small & Medium Enterprises (SME)

By Channel:

*

Online Banking

*

Offline Banking

By End-User Industry Vertical:

*

IT & Telecommunication

*

Manufacturing

*

Retail and E-Commerce

*

Public Sector

*

Healthcare and Pharmaceuticals

*

Other Industry Verticals

Key Players in the US Commercial Banking Market

*

JPMorgan Chase & Co. - A leading US bank offering commercial lending, treasury management, and investment banking services.

*

Bank of America Corp. - Provides a wide range of banking solutions, including corporate finance, cash management, and digital banking.

*

Wells Fargo & Co. - Focuses on commercial banking, lending, and payment services for businesses of all sizes.

*

Citigroup Inc. - Offers global banking and treasury services, serving both large enterprises and SMEs.

*

U.S. Bancorp - Provides commercial banking and financial services with a focus on regional business clients.

Conclusion

The US Commercial Banking Market is expected to grow steadily, supported by strong economic conditions, rising digital banking adoption, and increased lending opportunities. Banks that combine digital and traditional services while focusing on high-growth client segments are likely to gain a competitive edge.

Get the latest industry insights on the US Commercial Banking Market: https://www.mordorintelligence.com/industry-reports/us-commercial-banking-market?utm_source=abnewswire

Industry Related Reports:

US Retail Banking Market

The United States retail banking market stands at USD 0.87 trillion in 2025 and is projected to reach USD 1.08 trillion by 2030, growing at a CAGR of 4.22% during the forecast period. Growth is driven by increasing adoption of digital banking services and expanding consumer demand for personalized financial products, enhancing accessibility and convenience across the retail banking sector.

Get more insights: https://www.mordorintelligence.com/industry-reports/us-retail-banking-market?utm_source=abnewswire

United States Private Banking Market

The United States private banking market is valued at USD 59.54 billion in 2025 and is expected to reach USD 94.89 billion by 2030, growing at a CAGR of 9.77% during the forecast period. Growth is supported by rising high-net-worth individuals, increasing demand for wealth management solutions, and a focus on personalized financial advisory and investment services.

Get more insights: https://www.mordorintelligence.com/industry-reports/united-states-private-banking-market?utm_source=abnewswire

US Investment Banking Market

The US investment banking market stands at USD 54.74 billion in 2025 and is projected to reach USD 66.15 billion by 2030, growing at a CAGR of 3.86%. Market growth is driven by increased corporate financing activities, mergers and acquisitions, and rising demand for advisory services in capital markets and structured financial solutions.

Get more insights: https://www.mordorintelligence.com/industry-reports/us-investment-banking-market?utm_source=abnewswire

About Mordor Intelligence:

Mordor Intelligence is a trusted partner for businesses seeking comprehensive and actionable market intelligence. Our global reach, expert team, and tailored solutions empower organizations and individuals to make informed decisions, navigate complex markets, and achieve their strategic goals.

With a team of over 550 domain experts and on-ground specialists spanning 150+ countries, Mordor Intelligence possesses a unique understanding of the global business landscape. This expertise translates into comprehensive syndicated and custom research reports covering a wide spectrum of industries, including aerospace & defense, agriculture, animal nutrition and wellness, automation, automotive, chemicals & materials, consumer goods & services, electronics, energy & power, financial services, food & beverages, healthcare, hospitality & tourism, information & communications technology, investment opportunities, and logistics.

For any inquiries or to access the full report, please contact:

media@mordorintelligence.com https://www.mordorintelligence.com/

Mordor Intelligence, 11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli, Hyderabad, Telangana - 500032, India.

Media Contact

Company Name: Mordor Intelligence Private Limited

Contact Person: Jignesh Thakkar

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=us-commercial-banking-market-to-reach-usd-91545-billion-by-2030-driven-by-digital-channels-and-corporate-lending]

Phone: +1 617-765-2493

Address:11th Floor, Rajapushpa Summit, Nanakramguda Rd, Financial District, Gachibowli

City: Hyderabad

State: Telangana 500008

Country: India

Website: https://www.mordorintelligence.com/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release US Commercial Banking Market to Reach USD 915.45 Billion by 2030, Driven by Digital Channels and Corporate Lending here

News-ID: 4253850 • Views: …

More Releases from ABNewswire

CharmDate Identifies Financial Transparency as the New Standard in Modern Online …

As modern singles seek deeper compatibility and long-term stability in their relationships, Charmdate recognizes the importance of financial compatibility and encourages open communication about financial attitudes, habits, and expectations.

As modern singles seek deeper compatibility and long-term stability in their relationships, CharmDate, a leading platform for international matchmaking, is shedding light on an emerging trend that is reshaping dating norms: the growing importance of financial transparency. With millennials and Gen Z…

Healthcare Interoperability Solutions Market: Growth Outlook, Trends, and Strate …

Browse 160 market data Tables and 37 Figures spread through 223 Pages and in-depth TOC on "Healthcare Interoperability Solutions Market by Type (Software (EHR, Lab System, Imaging, Health Information Exchange, Enterprises), and Services), Interoperability Level (Foundational, Structural, Semantic), End User, and Region - Global Forecast to 2027

The global healthcare interoperability solutions market is experiencing a rapid transformation driven by digitization, regulatory pressure, and the emergence of advanced data-sharing technologies. Valued…

NGS Sample Preparation Market: Growth Outlook, Competitive Landscape & Future Bu …

Browse 299 market data Tables and 47 Figures spread through 301 Pages and in-depth TOC on "NGS Sample Preparation Market by Product (Reagents & Consumables, Workstations), Workflow (Library Prep, Target Enrichment), Sample Type (DNA), Application (Diagnostics, Drug Discovery), Method (Microfluidic, Automated), End User- Global Forecast to 2028

The global Next-Generation Sequencing (NGS) sample preparation market continues to experience robust growth, driven by efficiency gains in sequencing workflows, rising adoption in clinical…

Surgical Robots Market Set to Reach USD 23.7 Billion by 2029, Growing at a 16.5% …

Browse 355 market data Tables and 59 Figures spread through 319 Pages and in-depth TOC on "Surgical Robots Market by Product (Instruments & Accessories, Systems, Services), Application (Urological Surgery, Gynecological Surgery, Orthopedic Surgery, Neurosurgery), End user (Hospitals, Ambulatory Surgery Centers)- Global Forecast to 2029

Introduction: The Rapid Rise of Surgical Robotics

The surgical robots market is experiencing strong momentum as healthcare systems worldwide shift toward minimally invasive procedures. Valued at USD 11.1…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…