Press release

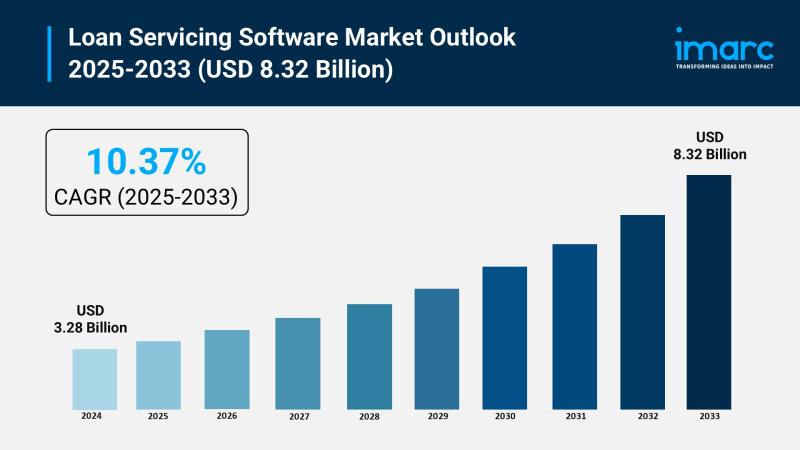

Loan Servicing Software Market Size to Reach USD 8.32 Billion by 2033 | With a 10.37% CAGR

Market Overview:The loan servicing software market is experiencing rapid growth, driven by demand for operational automation and efficiency, stringent regulatory compliance and risk management, and shift to cloud-based deployment for scalability. According to IMARC Group's latest research publication, "Loan Servicing Software Market Size, Share, Trends and Forecast by Component, Deployment Mode, Enterprise Size, End User, and Region, 2025-2033", The global loan servicing software market size was valued at USD 3.28 Billion in 2024. Looking forward, IMARC Group estimates the market to reach USD 8.32 Billion by 2033, exhibiting a CAGR of 10.37% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Download a sample PDF of this report: https://www.imarcgroup.com/loan-servicing-software-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the Loan Servicing Software Market

● Demand for Operational Automation and Efficiency

Financial institutions are prioritizing automation to streamline traditionally labor-intensive and error-prone loan servicing processes, a major factor propelling the market. Software solutions automate critical tasks such as payment processing, escrow management, and statement generation, significantly reducing the turnaround time for key workflows. This focus on efficiency allows lenders to handle larger loan volumes without a proportional increase in personnel costs. For instance, the software component segment of the market accounts for a commanding majority of the total revenue, indicating a clear preference for automated systems over manual methods. The rise of digital services in key markets like North America further underscores the adoption of this technology to serve customers efficiently and reduce administrative errors.

● Stringent Regulatory Compliance and Risk Management

The ever-increasing complexity and stringency of financial regulations globally necessitate the adoption of sophisticated loan servicing software with built-in compliance features. This is a crucial driver, as non-compliance can result in severe penalties and reputational damage. Modern platforms are designed to automatically track and adhere to mandates like the Truth in Lending Act (TILA) and the Fair Credit Reporting Act (FCRA), and generate audit-ready reporting. Furthermore, in environments with rising non-performing loan (NPL) ratios, such as the one recently seen in the United States at over one percent of total loans, servicing software becomes essential. It automates monitoring and enhances collection efforts, providing better data analysis to mitigate financial impact and reduce risk.

● Shift to Cloud-Based Deployment for Scalability

The preference for cloud-based loan servicing solutions is significantly driving growth, offering flexibility, lower capital expenditure, and enhanced scalability compared to traditional on-premises systems. This model is particularly appealing as it allows financial institutions to handle seasonal spikes in loan origination or rapid portfolio expansion on demand. The cloud deployment segment of the market is witnessing the fastest growth, demonstrating a clear industry-wide trend. The adoption of these scalable platforms is often paired with an integrated approach to data security, utilizing advanced encryption and multi-factor authentication. This provides a crucial balance, enabling remote accessibility and system updates while maintaining high levels of data protection for sensitive financial information.

Key Trends in the Loan Servicing Software Market

● Integration of AI for Predictive Analytics

A major emerging trend is the deep integration of Artificial Intelligence (AI) and Machine Learning (ML) to move loan servicing from reactive collections to proactive risk management. AI-powered platforms analyze vast datasets, including payment histories and economic indicators, to predict borrower behavior with high accuracy. This allows servicers to identify accounts at risk of delinquency weeks or months in advance, prompting early, targeted interventions like customized repayment plans. For example, recent reports from North America indicate that the use of AI-driven analytics has contributed to significant reductions in loan defaults, saving lenders substantial sums in potential losses. This is achieved by the system continuously refining its models, providing loan officers with automated alerts and recommended courses of action.

● Self-Service and Mobile-First Borrower Experience

The market is rapidly shifting toward providing borrowers with comprehensive self-service capabilities through mobile applications and intuitive online portals. This trend is a direct response to rising consumer expectations for digital convenience, mirroring their experiences with other online services. A core application of this is empowering borrowers to manage their entire loan lifecycle-from viewing balances and downloading statements to scheduling or making payments-directly from their smartphones. This mobile-first strategy reduces the burden on customer support centers while enhancing customer satisfaction. Leading providers are offering highly customizable portals that simplify interactions and include features like integrated e-signature and automated document verification, minimizing the need for any in-person or paper-based interactions.

● Adoption of Blockchain for Transparency and Security

Blockchain technology is emerging as a powerful tool to revolutionize the security and transparency of loan transactions and documentation. The immutable, distributed ledger nature of blockchain creates a tamper-proof audit trail for every single event in the loan lifecycle, from the initial disbursement to the final payment and any subsequent modifications. A notable real-world application is the enhancement of trust between borrowers, servicers, and investors, as payment histories and contract changes are cryptographically guaranteed and visible to all authorized parties. Furthermore, the use of smart contracts is gaining traction, automatically executing payment distributions and other servicing rules based on predetermined conditions, ultimately simplifying complex processes and mitigating potential disputes over documentation accuracy.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=6773&flag=E

Leading Companies Operating in the Loan Servicing Software Industry:

● Altisource

● Applied Business Software

● Bryt Software LCC

● C-Loans Inc.

● Emphasys Software (Constellation Software)

● Financial Industry Computer Systems Inc.

● Fiserv Inc.

● GOLDPoint Systems Inc.

● Graveco Software Inc.

● LoanPro

● Nortridge Software LLC

● Q2 Software Inc. (Q2 Holdings Inc.)

● Shaw Systems Associates LLC.

Loan Servicing Software Market Report Segmentation:

By Component :

● Software

● Services

The loan servicing software market is primarily composed of software and services, with software being the largest segment.

By Deployment Mode:

● On-premises

● Cloud-based

The market analysis reveals that cloud-based deployment holds the largest market share compared to on-premises solutions.

By Enterprise Size:

● Large Enterprises

● Small and Medium-sized Enterprises

Large enterprises dominate the loan servicing software market, as highlighted in the analysis of enterprise size.

By End User:

● Banks

● Credit Unions

● Mortgage Lenders and Brokers

● Others

Banks represent the largest segment among end users in the loan servicing software market, followed by credit unions and mortgage lenders.

Regional Insights:

● North America (United States, Canada)

● Asia Pacific (China, Japan, India, South Korea, Australia, Indonesia, Others)

● Europe (Germany, France, United Kingdom, Italy, Spain, Russia, Others)

● Latin America (Brazil, Mexico, Others)

● Middle East and Africa

North America, driven by growth in the BFSI sector and technology integration, is the largest market for loan servicing software, encompassing the United States and Canada, along with other global regions.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Loan Servicing Software Market Size to Reach USD 8.32 Billion by 2033 | With a 10.37% CAGR here

News-ID: 4253000 • Views: …

More Releases from IMARC Group

Charcoal Production Plant DPR & Unit Setup 2026: Demand Analysis and Project Cos …

Setting up a charcoal production plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential biomass fuel serves cooking, heating, metallurgical, and industrial applications. Success requires careful site selection, efficient carbonization processes, proper kiln systems, reliable wood and biomass sourcing, and compliance with environmental and forestry regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Charcoal Production Plant Project Report 2026: Industry Trends, Plant Setup,…

Grease Manufacturing Plant DPR 2026: CapEx/OpEx Analysis with Profitability Fore …

Setting up a grease manufacturing plant involves strategic planning, substantial capital investment, and comprehensive understanding of production technologies. This essential lubricant serves automotive, industrial machinery, and heavy equipment applications. Success requires careful site selection, efficient blending and mixing processes, quality control systems, reliable raw material sourcing from base oil and thickener suppliers, and compliance with environmental and safety regulations to ensure profitable and sustainable operations.

IMARC Group's report, "Grease Production Plant…

Tequila Manufacturing Plant Cost 2026: CapEx, OpEx & ROI Analysis

Setting up a Tequila Manufacturing Plant positions investors in one of the most stable and essential segments of the premium spirits and alcoholic beverages value chain, backed by sustained global growth driven by rising international demand for authentic agave-based spirits, increasing consumer preference for premium and super-premium heritage-driven beverages, expanding consumption across hospitality, retail, and export channels, and the dual-benefit advantages of strong brand loyalty combined with high-margin product differentiation.…

Prefabricated Building and Structural Steel Manufacturing Plant Cost Analysis Re …

Setting up a prefabricated building and structural steel manufacturing plant positions investors within one of the most dynamic and infrastructure-driven segments of the global construction and industrial manufacturing sector, supported by accelerating urbanization, expanding industrial corridors, and rising demand for fast-track, cost-efficient building solutions across residential, commercial, and industrial projects.

Prefabricated structures and structural steel components play a critical role in modern construction by enabling reduced project timelines, improved quality…

More Releases for Software

Takeoff Software Market May See a Big Move | Sage Software, Bluebeam Software, Q …

Latest Study on Industrial Growth of Takeoff Software Market 2023-2028. A detailed study accumulated to offer Latest insights about acute features of the Takeoff Software market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market, the report also offers a complete study of the future trends and developments…

Robot Software Market Analysis by Software Types: Recognition Software, Simulati …

The Insight Partners provides you global research analysis on “Robot Software Market” and forecast to 2028. The research report provides deep insights into the global market revenue, parent market trends, macro-economic indicators, and governing factors, along with market attractiveness per market segment. The report provides an overview of the growth rate of the Robot Software market during the forecast period, i.e., 2021–2028.

Download Sample Pages of this research study at: https://www.theinsightpartners.com/sample/TIPRE00007689/?utm_source=OpenPR&utm_medium=10452…

HR Software Market Analysis by Top Key Players Zenefits Software, Kronos Softwar …

HR software automates how companies conduct business with relation to employee management, training and e-learning, performance management, and recruiting and on-boarding. HR professionals benefit from HR software systems by providing a more structured and process oriented approach to completing administrative tasks in a repeatable and scalable manner. Every employee that is added to an organization requires management of information, analysis of data, and ongoing updates as progression throughout the company…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market by Top Manufacturers – Zenefits Software, Kronos Software, …

Global HR Software market could be classified into different regions and countries for a clear understanding of business prospects available across the globe. This intelligence research study presents a wide-ranging study of the global market by evaluating the growth drivers and detaining factors at length. This detailed study of significant factors supports the market participants in understanding the issues they will be facing while operative in this market over a…

HR Software Market Analysis by Top Key Players – Zenefits Software, Kronos Sof …

HR software helps HR personnel automate many necessary tasks, such as maintaining employee records, time tracking, and benefits, which allows HR professionals to focus on recruiting efforts, employee performance and engagement, corporate wellness, company culture, and so on. These human management tools can be purchased and implemented as on premise or cloud-based software.

This market studies report on the Global HR Software Market is an all-inclusive study of the enterprise sectors…