Press release

Business Travel Insurance Market Growth Worldwide Firms Prioritize Employee Safety Abroad | Top 5 Companies - Tokio Marine Holdings, Inc., Nationwide Mutual Insurance Company, Starr International Company Inc., Assicurazioni Generali S.P.A., Tata AIG Gener

DataM Intelligence unveils its latest report on the "Business Travel Accident Insurance Market Size 2025," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies aiming to stay ahead in the competitive Market.Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://datamintelligence.com/download-sample/business-travel-accident-insurance-market?kb

List of Top Key Player:

Zurich Insurance Group, American International Group, Inc., Tokio Marine Holdings, Inc., Nationwide Mutual Insurance Company, Starr International Company Inc., Assicurazioni Generali S.P.A., Tata AIG General Insurance Company Limited, AWP Australia Pty Ltd., AXA, MetLife Services and Solutions Inc

Latest M&A in Business Travel Accident Insurance

The global business travel accident insurance market is concentrated among major multinational insurers such as Assicurazioni Generali, MetLife, Zurich, AIG, Chubb, and Tokio Marine Holdings.

M&A activity in 2022-2023 included deals to expand geographic reach, deepen product portfolios, and invest in AI-driven risk assessment and claims processing technologies.

The market sees moderate M&A focused on digitalization and integration with corporate travel risk management solutions to enhance service offerings.

Forecast Projection:

The Global Business Travel Accident Insurance Market is poised for significant growth between 2025 and 2032. In 2024, the market maintained a steady upward trajectory, and with strategic initiatives by leading players accelerating adoption, the market is expected to soar throughout the forecast period. Companies leveraging these trends are well-positioned to capture emerging opportunities and maximize revenue potential.

Market Intelligence Research Process:

The Business Travel Accident Insurance Market research report by DataM Intelligence combines primary and secondary data to deliver deep, actionable insights. It examines the full spectrum of factors shaping the industry, from government regulations and market conditions to competitive dynamics, historical trends, technological breakthroughs, upcoming innovations, and potential challenges. This comprehensive analysis not only highlights growth prospects but also identifies barriers, equipping businesses to navigate market volatility and capitalize on emerging opportunities.

Buy Now & Get 30% OFF - (Grab 50% OFF on 2+ reports) @ https://www.datamintelligence.com/buy-now-page?report=business-travel-accident-insurance-market?kb

Key Segmentation:

By Policy Type: (Local Policies Only, One Global Policy, Controlled Master Program (CMP), Others)

By Coverage Type: (Single-Trip Travel Insurance, Multi-Trip Travel Insurance)

By Distribution Channels: (Insurance Company, Banks Insurance Aggregators, Others)

By End-User: (Corporations, Government Bodies, International Travelers, Others)

Global Growth Regional Analysis:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Latest News & Market Trends

The business travel accident insurance market was valued around $15 billion in 2025 and is forecasted to reach nearly $25 billion by 2033 with a CAGR above 7%.

Growth drivers include rising international business travel, heightened risk awareness, stronger corporate duty-of-care policies, and innovations like AI-powered personalized insurance.

Recent launches focus on digital distribution, risk monitoring with wearables and telematics, and bundled solutions combining travel, accident, and health protections.

COVID-19 impacted demand historically, but recovery and increasing travel frequency support strong growth projections.

Notable recent launches: BHSI (Berkshire Hathaway Specialty Insurance) introduced Group Personal Accident and Business Travel Insurance in the UK, offering real-time risk alerts and virtual medical services.

AIG launched an enhanced business travel accident insurance plan in New York providing broad medical, evacuation, and trip interruption cover for corporate clients.

Chubb launched Travel Pro in 2025, a digital-first, parametric insurance product integrated into booking platforms offering automatic claims and coverage for delays, baggage, weather, and medical emergencies.

Benefits of the Report:

Chapter 1 - Market Overview: Kickstarts the report with a comprehensive snapshot of the Business Travel Accident Insurance Market, summarizing key segments by region, product type, and application. Highlights include market size, segment growth potential, and short- & long-term industry outlook.

Chapter 2 - Emerging Trends: Uncovers the game-changing trends and high-impact innovations shaping the future of the industry.

Chapter 3 - Competitive Landscape: Offers a deep dive into market competition, detailing revenue shares, strategic initiatives, and recent mergers & acquisitions.

Chapter 4 - Top Player Profiles: Features detailed company profiles, covering revenue, profit margins, product lines, and major milestones for leading market players.

Chapters 5 & 6 - Regional & Country Analysis: Breaks down revenue performance across global regions, providing insights on market sizes, opportunities, and growth prospects worldwide.

Chapter 7 - Segmentation Analysis: Explores market segmentation by type, revealing high-potential categories and guiding businesses towards lucrative areas.

Chapter 8 - Application Insights: Examines downstream markets and identifies promising sectors for expansion, showing how different applications are driving growth.

Chapter 9 - Supply Chain Mapping: Maps the entire industry supply chain, highlighting upstream and downstream activities for a holistic market perspective.

Chapter 10 - Key Takeaways: Concludes with critical insights and actionable strategies, equipping stakeholders to make informed decisions and stay ahead in the market.

Get Customization in the report as per your requirements: https://datamintelligence.com/customize/business-travel-accident-insurance-market?kb

Recent Product Launches and Innovations

BHSI's Group Personal Accident and Business Travel Insurance product launched in 2025 for the UK, focusing on comprehensive coverage combined with digital risk management services.

AIG's new plan provides global medical emergency coverage, trip interruption, and evacuation services tailored for business travelers.

Chubb's Travel Pro offers embedded insurance with digital claims automation and personalized coverage options including weather-related travel disruptions.

Use of AI and telematics for real-time traveler risk assessment and personalized pricing is becoming mainstream.

Insurers focus on multi-trip annual policies to provide flexible, cost-effective solutions for frequent travelers.

Have any Query We Will Provide in Detailed @ https://www.datamintelligence.com/enquiry/business-travel-accident-insurance-market?kb

Get 2-Day Free Trial + 50% OFF DataM Subscription@ https://www.datamintelligence.com/reports-subscription?kb

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Business Travel Insurance Market Growth Worldwide Firms Prioritize Employee Safety Abroad | Top 5 Companies - Tokio Marine Holdings, Inc., Nationwide Mutual Insurance Company, Starr International Company Inc., Assicurazioni Generali S.P.A., Tata AIG Gener here

News-ID: 4252493 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

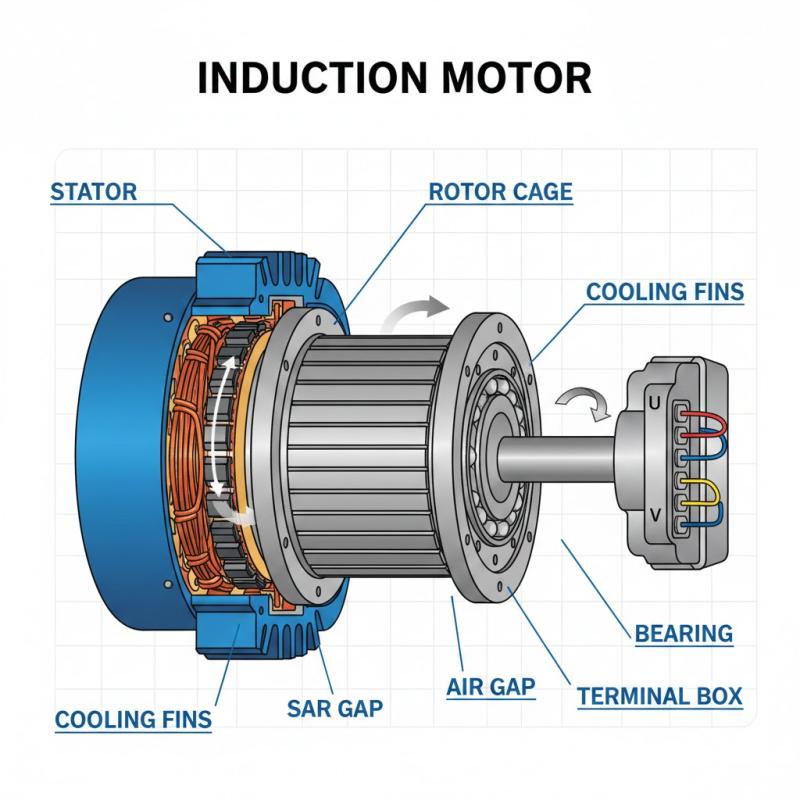

United States Induction Motor Market 2031 | Growth Drivers, Trends & Market Fore …

Induction Motor Market size was worth US$ 20.36 billion in 2023 and is estimated to reach US$ 33.66 billion by 2031, growing at a CAGR of 6.49% during the forecast period (2024-2031).

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/induction-motor-market?kb

List of Top Key Player:

ABB Ltd., Ametek, Emerson Electric, Siemens AG, Brook Crompton, Danaher Corporation, Johnson Electric Holdings, Regal Beloit, WEG Electric Corp.…

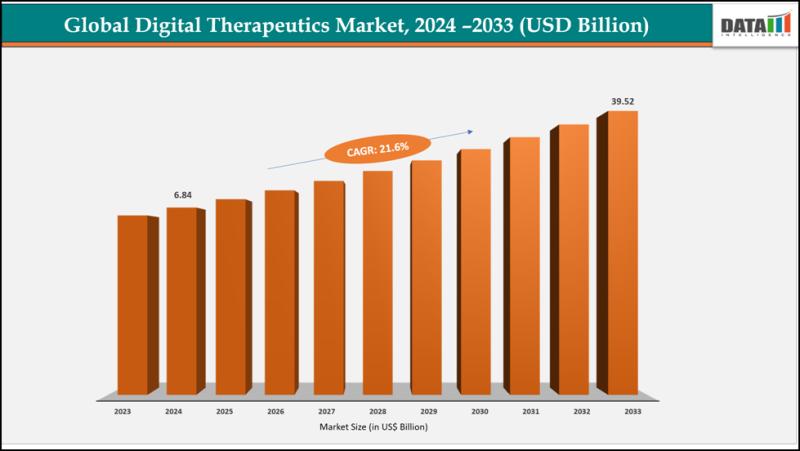

Digital Therapeutics Market Set for Explosive Growth to USD 39.52 Billion by 203 …

The Global Digital Therapeutics Market size reached USD 6.84 billion in 2024 and is expected to reach USD 39.52 billion by 2033, growing at a CAGR of 21.6% during the forecast period 2025-2033.

Market growth is driven by the rising prevalence of chronic diseases like diabetes and mental health disorders, increasing smartphone penetration, and growing patient demand for personalized, app-based interventions. Advancements in AI and machine learning for behavior change, expanding…

United States Contrast Media Injectors Market: Real-Time Market Trends & Competi …

DataM Intelligence unveils its latest report on the "Contrast Media Injectors Market Size 2025," offering an in-depth analysis of market trends, growth drivers, competitive landscape, and regional dynamics. The study covers market size in value and volume, CAGR forecasts, and emerging opportunities that can guide businesses in seizing growth potential and crafting winning strategies. Packed with data-driven insights on current developments and future trends, this report is essential for companies…

United States Real Time Location System (RTLS) Market Analysis 2026: Growth Driv …

Real Time Location System (RTLS) Market is expected to grow at a CAGR of 18% during the forecasting period (2022-2029).

Request a Premium Sample PDF of This Report (Corporate Email IDs Receive Priority Service): https://www.datamintelligence.com/download-sample/real-time-location-system-market?kb

United States: Recent Industry Developments

✅ December 2025: Major healthcare systems expanded RTLS deployments to enhance patient tracking, asset utilization, and workflow efficiency.

✅ November 2025: Leading tech providers integrated AI‐driven analytics into RTLS platforms to deliver predictive…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…