Press release

Travel Insurance Market Forecast to 2032: Impact of Online Platforms, Insurtech Innovation, and Rising Business & Leisure Travel

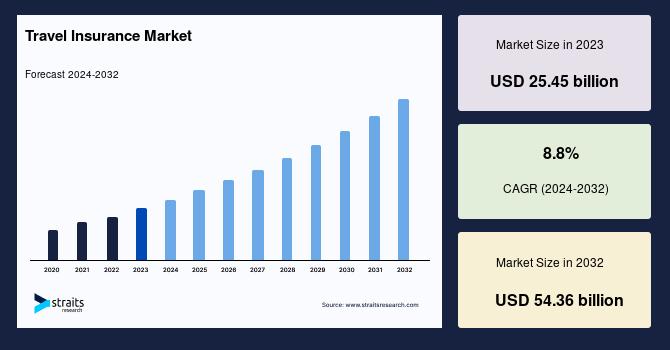

According to a new report by Straits Research, the global travel insurance market is projected to reach USD 54.36 billion by 2032, growing at a compound annual growth rate (CAGR) of 8.8 % during the forecast period (2024-2032).Travel insurance, a specialized form of coverage designed to protect travelers against unpredictable events during journeys such as trip cancellation, medical emergencies, lost baggage, delays, and personal liability has become increasingly essential in an era of global mobility. As more people travel for leisure, business, study, or family purposes, the demand for robust and flexible travel protection solutions is rising.

View the full report for complete insights and forecasts: https://straitsresearch.com/report/travel-insurance-market

Market Dynamics & Growth Drivers:

Surging Global Tourism and Travel Demand

The resurgence of tourism driven by improving economic conditions, growing disposable incomes, and cheaper travel options is a major catalyst for the travel insurance market. More people are venturing abroad or undertaking multi-stop journeys, increasing exposure to travel risks and driving the uptake of insurance policies.

Digital Channels & Comparison Platforms

The rise of online booking and aggregator platforms enables travelers to compare and purchase travel insurance seamlessly. Airline websites, OTAs, travel aggregators, and insurer apps now present travel insurance options at the point of booking driving penetration and conversion. As consumers favour convenience and transparency, online channels are becoming key revenue drivers.

Regulatory & Industry Frameworks

Industry bodies and regulatory authorities are standardizing travel insurance regulations and best practices. For instance, in the U.S., the National Association of Insurance Commissioners (NAIC) has considered model acts to promote consumer protection and uniform policy frameworks. These legislative developments help instill trust and encourage broader market adoption.

Technology & Data Innovation

Insurers are harnessing AI, big data analytics, geolocation, APIs, blockchain, and risk modeling to design more tailored policies, perform real-time risk assessment, and detect fraud. These innovations enable dynamic pricing, automated claims processing, and embedded coverage, further expanding market opportunities.

Market Restraints & Challenges:

Consumer Awareness & Education Gaps

A significant barrier remains low awareness and understanding of travel insurance benefits and coverage limits. Surveys suggest that many travelers are either unaware of what travel insurance covers or distrust it due to opaque terms. This lack of clarity constrains broader adoption.

Price Sensitivity & Perceived Value

Many consumers view travel insurance as a discretionary add‐on, particularly for shorter trips. When premiums seem high relative to perceived risk, some travelers opt to forgo coverage especially in mature markets with lower incidence of claims.

Interoperability & Cross‐Border Issues

Operating across multiple jurisdictions introduces regulatory, coverage, and cross-border claims complexity. Insurers must navigate local laws, licensing, currency differences, and coordination with international assistance services.

Download a free sample to explore key drivers and segment data: https://straitsresearch.com/report/travel-insurance-market/request-sample

Regional Outlook:

Asia-Pacific: Fastest-Growing Region

Asia-Pacific leads in growth and revenue share. With economies such as China, India, Indonesia, Japan, Australia, and Southeast Asian nations recording strong tourism rebound, insurance penetration is climbing rapidly. The region is expected to grow at a CAGR of around 11.3 %, supported by rising middle-class travel, increasing digital adoption, and proactive distribution via travel agencies and online platforms.

Europe

Europe is a mature and significant region. Aging populations, multigenerational travel trends, and robust outbound/inbound travel drive stable growth. Single-trip policies dominate, while annual and long-stay policies gain from business and long-term travel segments.

North America

In North America, trip cancellation/interruption and medical/evacuation coverages remain the dominant policy types. Growth is steady, supported by outbound tourism, increasing travel for remote work ("bleisure"), and a preference for premium, comprehensive plans.

Segment Analysis:

By Insurance Cover:

• Single‐trip travel insurance is the largest segment, widely adopted for discrete journeys.

• Annual multi-trip travel insurance is expanding rapidly, especially for frequent business or leisure travelers.

• Long-stay travel insurance caters to extended trips, expatriates, students, and work assignments abroad.

By Distribution Channel:

• Insurance intermediaries (travel agents, brokers) remain dominant, especially in regions where travelers rely on guidance.

• Insurance aggregators are the fastest-growing channel, enabling consumers to compare across multiple insurers online.

By End User:

• Family travelers account for the largest share, reflecting growth in multigenerational tourism.

• Business travelers are the fastest-growth segment, fuelled by corporate travel and "bleisure" demands.

Get the full report to access detailed datasets and strategies: https://straitsresearch.com/buy-now/travel-insurance-market

Competitive Landscape & Key Players:

Notable players operating in the travel insurance market include:

Allianz Group

American International Group, Inc. (AIG)

Assicurazioni Generali S.p.A.

AXA

Insure and Go Insurance Services Limited

Seven Corners, Inc.

Travel Insured International

TravelSafe Insurance

S.I. Insurance Services

Zurich Insurance Co. Limited

These companies compete across product features, distribution reach, pricing models, digital interfaces, and assistance networks.

Recent Developments & Trends:

AXA & HK Express Partnership (June 2024): A collaboration in Hong Kong and Macau to embed travel insurance into flight booking experiences, offering streamlined protection for travelers.

TATA AIG Travel Guard Plus Launch (March 2024): In India, the insurer introduced a comprehensive policy covering multiple trips up to a year, with additional services such as lost passport monitoring, baggage tracking, and home-based care.

Aggregator Adoption Surge: Insurers in markets like the U.K. and U.S. are increasingly launching or integrating with aggregator platforms, responding to consumer demand for comparison shopping.

Analyst Perspective & Outlook:

Analysts believe the travel insurance market is poised for sustained double-digit expansion in many regions. The combination of digital distribution, product innovation, and travel demand forms a resilient growth foundation. While challenges like education, price sensitivity, and regulatory complexity endure, the adoption curve is expected to accelerate especially among younger, tech-savvy travelers. Insurers that invest in embedded insurance, personalization, and omnichannel presence are likely to lead the next growth wave.

Contact Us :

+1 646 905 0080 (U.S.)

+91 8087085354 (India)

+44 203 695 0070 (U.K.)

sales@straitsresearch.com

About Us :

Straits Research is a market intelligence company providing global business information reports and services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insight for thousands of decision-makers. Straits Research Pvt. Ltd. provides actionable market research data, especially designed and presented for decision making and ROI.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Travel Insurance Market Forecast to 2032: Impact of Online Platforms, Insurtech Innovation, and Rising Business & Leisure Travel here

News-ID: 4252364 • Views: …

More Releases from Straits Research

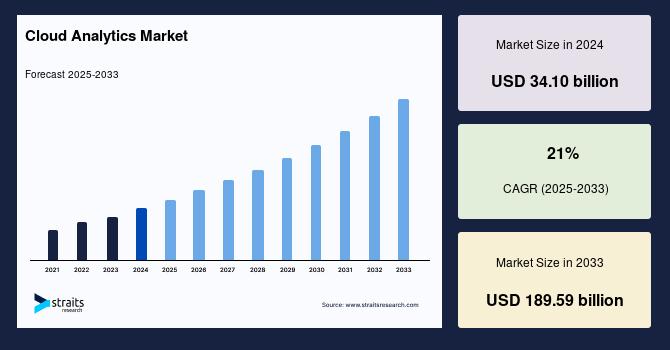

Cloud Analytics Market Size Set to Surge to USD 189.59 Billion by 2033 | Massive …

The global cloud analytics market is poised for exceptional growth as organisations leverage the power of the cloud to collect, analyse and visualise large volumes of data for actionable business insights. According to recent research, The global cloud analytics market size was worth USD 34.10 billion in 2024 and is estimated to reach an expected value of USD 189.59 billion by 2033, growing at a CAGR of 21% during the…

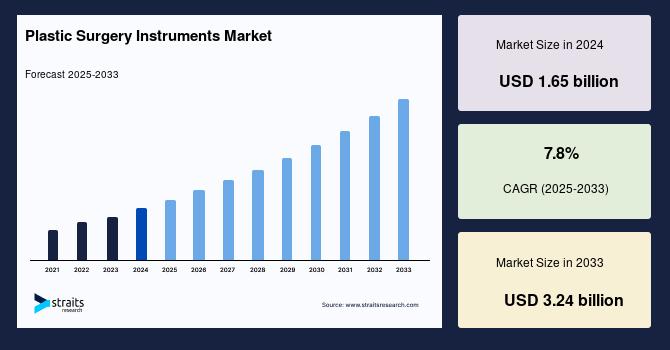

Plastic Surgery Instruments Market Size to Reach USD 3.24 Billion by 2033 | Glob …

The global plastic surgery instruments market is witnessing robust expansion, driven by the rising demand for cosmetic and reconstructive surgeries worldwide. According to a new study by Straits Research, the market size is estimated at USD 1.78 billion in 2025 and is projected to reach USD 3.24 billion by 2033, reflecting a compound annual growth rate (CAGR) of 7.8% during the forecast period (2025-2033).

The rising popularity of aesthetic enhancement procedures…

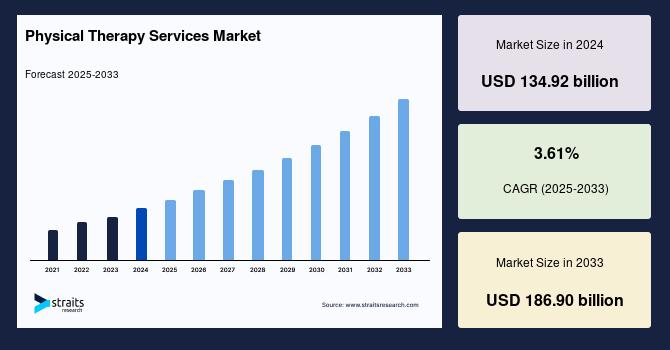

Physical Therapy Services Market Outlook 2025-2033: Rise of Home-Based Care and …

The global physical therapy services market is witnessing significant expansion, fueled by the growing prevalence of chronic diseases, increasing sports-related injuries, and technological innovations such as tele-rehabilitation and AI-based therapy platforms. According to Straits Research, the global market size is estimated at USD 140.69 billion in 2025 and is projected to reach USD 186.90 billion by 2033, exhibiting a steady CAGR of 3.61% during the forecast period.

Read the full report…

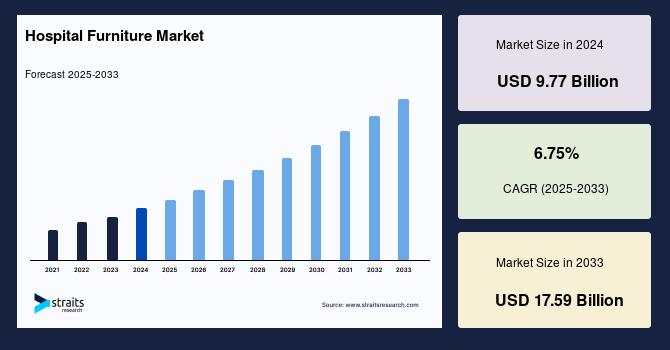

Global Hospital Furniture Market Size Expected to Reach USD 17.59 Billion by 203 …

The global hospital furniture market size is estimated at USD 10.43 billion in 2025, and is projected to reach USD 17.59 billion by 2033, representing a CAGR of 6.75% from 2025-2033.

Hospital furniture encompasses specialized furnishings and equipment designed for healthcare settings such as hospital beds, examination tables, patient chairs, over-bed tables, stretchers and bedside lockers. These products are engineered not only for safety and hygiene but also for patient comfort,…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…