Press release

Saudi Arabia Environmental Consulting Services Market Size Worth USD 834.53 Million in 2033 | IMARC Group

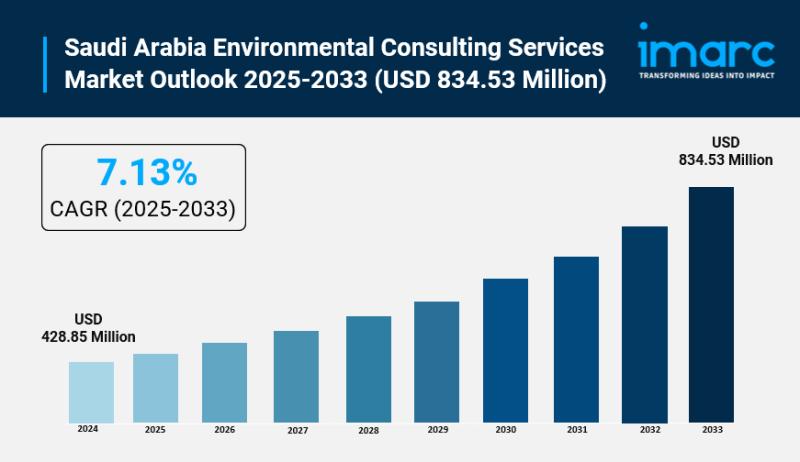

Saudi Arabia Environmental Consulting Services Market OverviewMarket Size in 2024: USD 428.85 Million

Market Size in 2033: USD 834.53 Million

Market Growth Rate 2025-2033: 7.13%

According to IMARC Group's latest research publication, "Saudi Arabia Environmental Consulting Services Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia environmental consulting services market size reached USD 428.85 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 834.53 Million by 2033, exhibiting a CAGR of 7.13% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Environmental Consulting Services Market

● Advanced Environmental Monitoring and Data Analytics: AI-powered remote sensing technologies integrated with satellite imagery, IoT sensors, and drone surveillance are revolutionizing environmental monitoring across Saudi Arabia's diverse ecosystems, enabling real-time tracking of air quality, water pollution, soil degradation, and biodiversity changes with 85% improved accuracy, while machine learning algorithms process vast environmental datasets to identify pollution hotspots, predict ecological risks, and generate actionable insights for consultants working on Vision 2030 sustainability projects across industrial zones, nature reserves, and urban development areas.

● Intelligent Environmental Impact Assessment: AI-driven predictive modeling systems are transforming Environmental Impact Assessment (EIA) processes by analyzing historical project data, geographical information, climate patterns, and regulatory frameworks to forecast potential environmental consequences of proposed developments with unprecedented precision, reducing assessment timelines by 40% while improving recommendation quality for mega-projects including NEOM, The Line, and renewable energy installations, enabling environmental consultants to deliver comprehensive impact studies that address Saudi Arabia's stringent National Center for Environmental Compliance (NCEC) requirements.

● Automated Compliance Monitoring and Reporting: Machine learning algorithms integrated with digital compliance management platforms are automating environmental regulatory monitoring for industries across Saudi Arabia's energy, petrochemical, and manufacturing sectors, continuously tracking emissions data, waste management practices, and environmental permits against NCEC standards, generating automated compliance reports, and providing early warning alerts for potential violations, reducing consultancy workload by 50% while ensuring clients maintain Environmental License Class A certification and adhere to Saudi Green Initiative targets for carbon emission reduction of 278 million tons per annum by 2030.

● AI-Enhanced Climate Risk Assessment and Adaptation Planning: Advanced climate modeling powered by artificial intelligence is enabling environmental consultants to conduct sophisticated climate change vulnerability assessments for Saudi infrastructure projects, urban developments, and industrial facilities, analyzing multiple climate scenarios including temperature increases, water scarcity projections, and extreme weather patterns to develop robust adaptation strategies, helping organizations align with the Kingdom's commitment to protecting 30% of land and marine areas under the Saudi Green Initiative while supporting the Circular Carbon Economy framework endorsed during Saudi Arabia's G20 Presidency.

● Smart Waste Management and Circular Economy Solutions: AI-powered waste characterization systems utilizing computer vision and predictive analytics are transforming waste management consulting services across Saudi Arabia by automatically identifying waste composition, optimizing collection routes, forecasting waste generation patterns, and recommending circular economy strategies including waste-to-energy conversion, material recovery, and recycling optimization, supporting the Kingdom's ambitious goal of reducing food waste by 50% by 2030 and enabling consultants to design integrated waste management solutions for municipalities, industrial facilities, and mega-developments that achieve zero-waste-to-landfill targets aligned with Vision 2030 sustainability objectives.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-environmental-consulting-services-market/requestsample

Saudi Arabia Environmental Consulting Services Market Trends & Drivers:

Saudi Arabia's environmental consulting services market is experiencing robust growth driven by the Kingdom's transformative Vision 2030 initiative and the landmark Saudi Green Initiative (SGI), which has mobilized investments exceeding SAR 705 billion across 86 environmental programs since its 2021 launch. The government's ambitious climate action targets, including reducing carbon emissions by 278 million tons per annum by 2030 and achieving net-zero emissions by 2060, are creating unprecedented demand for specialized environmental consulting expertise. The National Center for Environmental Compliance (NCEC) has significantly strengthened regulatory enforcement by introducing the prestigious Environmental License Class A certification system, compelling businesses across energy, petrochemical, manufacturing, and construction sectors to engage environmental consultants for comprehensive compliance assessments, emissions inventories, carbon management strategies, and sustainability roadmaps. The integration of 6.6 gigawatts of renewable energy into the national grid, with ongoing projects totaling 44.2 gigawatts capacity and ambitious targets to achieve 130 gigawatts by 2030, is driving substantial consulting demand for environmental impact assessments, biodiversity protection strategies, and ecosystem restoration planning for large-scale solar and wind energy installations across the Kingdom's diverse landscapes.

The explosive growth of mega-development projects including NEOM, The Line (a revolutionary 170-kilometer linear city powered by 100% renewable energy), Red Sea Project, Qiddiya, and Diriyah Gate is creating massive opportunities for environmental consulting services, with each project requiring comprehensive environmental assessments, ecological baseline studies, marine and terrestrial biodiversity monitoring, water resource management strategies, waste management solutions, and long-term environmental management plans. Corporate social responsibility (CSR) initiatives are gaining significant momentum, exemplified by NEOM's social responsibility programs benefiting 50,000 people with investments generating over USD 10.67 million in social returns, compelling organizations to integrate environmental considerations into their business models and seek expert consulting guidance on sustainability practices, ESG reporting frameworks, and green certification standards. The Kingdom's commitment to protecting 30% of land and marine areas, coupled with ambitious afforestation targets including planting 10 billion trees and implementing extensive greening programs across Riyadh and urban centers, is creating sustained demand for specialized consulting services in habitat restoration, species conservation, rangeland management, coastal protection, and biodiversity assessment supporting the establishment of 15 wildlife sanctuaries managed by the National Center for Wildlife.

The rapid expansion of Saudi Arabia's oil and gas sector, with new oilfield developments, refinery capacities, and petrochemical complexes including major projects by Saudi Aramco and international partners, necessitates comprehensive environmental consulting for impact assessments, emissions monitoring, air quality management, water contamination prevention, land rehabilitation, and adoption of cleaner technologies aligned with the Circular Carbon Economy framework that promotes reducing, reusing, recycling, and removing carbon. Rising waste management challenges across industrial, municipal, and hazardous waste streams are driving consulting demand for integrated waste management system design, waste-to-energy solutions, circular economy strategies, and compliance with Vision 2030's ambitious target of achieving 100% wastewater recycling and reuse in urban centers. The technological revolution in environmental monitoring, incorporating advanced tools including remote sensing, IoT sensors, drones, AI analytics, and carbon capture systems demonstrated by Saudi Arabia's first Direct Air Capture unit launched in Riyadh, is transforming consulting service delivery while attracting global environmental consulting firms to establish operations in the Kingdom, creating a highly competitive market where expertise in cutting-edge technologies, stringent NCEC regulatory frameworks, and Vision 2030 sustainability objectives determines success in securing contracts from government entities, private sector corporations, and international investors seeking credible environmental strategies for their Saudi operations.

Saudi Arabia Environmental Consulting Services Industry Segmentation:

The report has segmented the market into the following categories:

Service Insights:

● Investment Assessment and Auditing

● Permitting and Compliance

● Project and Information Management

● Monitoring and Testing

● Others

Medium Insights:

● Water Management

● Waste Management

Vertical Insights:

● Energy and Utilities

● Chemical and Petroleum

● Manufacturing and Process Industry

● Transportation and Construction Industries

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=29005&flag=E

Recent News and Developments in Saudi Arabia Environmental Consulting Services Market

● February 2025: The Saudi Green Initiative celebrated its anniversary on SGI Day, marking remarkable progress with several initiatives backed by major investments, achieving integration of renewable energy into the national grid and advancing toward ambitious targets including carbon emission reduction and protection of land and marine areas, significantly expanding opportunities for environmental consulting firms supporting climate action implementation, biodiversity conservation programs, and sustainability assessments across the Kingdom's diverse sectors.

● March 2025: Saudi Arabia inaugurated the country's first Direct Air Capture (DAC) demonstration unit at the King Abdullah Petroleum Studies and Research Center in Riyadh, developed through collaboration between Aramco, Siemens Energy, and Climeworks, representing a groundbreaking advancement in carbon capture technology and creating new consulting opportunities for environmental firms specializing in carbon removal strategies, climate technology assessments, and innovative sustainability solutions aligned with the Kingdom's Circular Carbon Economy framework and net-zero emissions targets.

● April 2025: Ergis received the prestigious Environmental License Class A from the National Center for Environmental Compliance (NCEC), demonstrating the growing emphasis on stringent environmental standards and regulatory compliance in Saudi Arabia, while several leading companies registered for the Sustainability Champions Program during the World Economic Forum to advance the sustainability revolution, with PwC's CEO Survey revealing that many Saudi business leaders are prioritizing energy efficiency improvements and innovating climate-friendly products, driving accelerated demand for environmental consulting services across permitting, compliance auditing, sustainability strategy development, and ESG reporting frameworks supporting Vision 2030 objectives.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Environmental Consulting Services Market Size Worth USD 834.53 Million in 2033 | IMARC Group here

News-ID: 4250613 • Views: …

More Releases from IMARC Group

Industrial Enzymes Manufacturing Plant DPR 2026: Cost Structure, Production Proc …

Setting up an industrial enzymes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of fermentation-based production technologies. These biological catalysts serve critical roles in detergents, food and beverages, animal feed, biofuels, pulp and paper, textiles, and wastewater treatment. Success requires careful site selection, efficient microbial fermentation processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial and environmental regulations to ensure profitable and…

Fly Ash Bricks Manufacturing Plant DPR & Unit Setup Report 2026

Setting up a fly ash bricks manufacturing plant positions investors in one of the fastest-growing and most environmentally progressive segments of the construction materials value chain, backed by sustained global growth driven by the increased demand for environmentally friendly construction materials, the growing trend of sustainable construction, and increasing government support towards waste utilisation and green construction methods. As urbanization accelerates, infrastructure development intensifies, and regulatory frameworks increasingly mandate the…

ERW Steel Pipes Manufacturing Plant DPR 2026: Investment Cost, Demand Analysis & …

Setting up an ERW steel pipes manufacturing plant involves strategic planning, substantial capital investment, and a comprehensive understanding of production technologies. These high-strength, cost-effective pipes serve the oil and gas, construction, automotive, water transportation, and energy infrastructure sectors. Success requires careful site selection, advanced welding and precision manufacturing processes, stringent quality assurance protocols, reliable raw material sourcing, and compliance with industrial safety and environmental regulations to ensure profitable and sustainable…

Waste-to-Energy Plant DPR & Unit Setup - 2026: Demand Analysis and Project Cost

Setting up a Waste-to-Energy Plant positions investors in one of the most stable and essential segments of the renewable energy and waste management value chain, backed by sustained global growth driven by rising municipal solid waste generation, sustainable waste management requirements, increasing demand for renewable energy sources, and the dual-benefit advantages of waste reduction with energy production. As urbanization accelerates, waste volumes escalate toward 3.40 billion tons globally by 2050,…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…