Press release

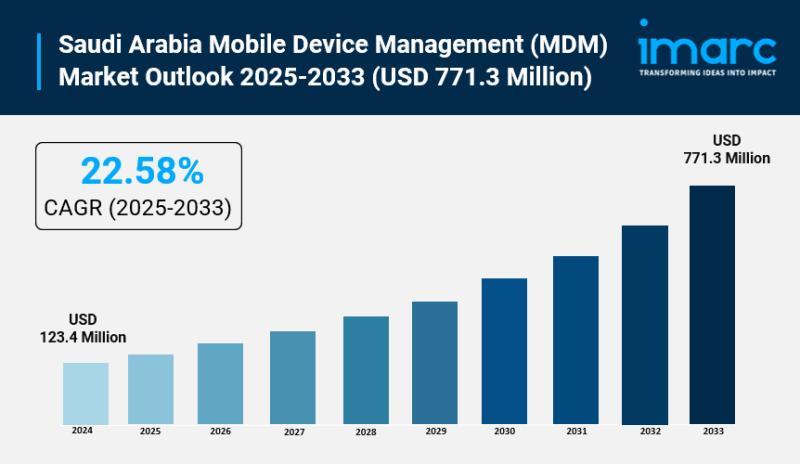

Saudi Arabia Mobile Device Management (MDM) Market Size To Worth USD 771.3 Million By 2033 | CAGR of 22.58%

Saudi Arabia Mobile Device Management (MDM) Market OverviewMarket Size in 2024: USD 123.4 Million

Market Size in 2033: USD 771.3 Million

Market Growth Rate 2025-2033: 22.58%

According to IMARC Group's latest research publication, "Saudi Arabia Mobile Device Management (MDM) Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia mobile device management (MDM) market size reached USD 123.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 771.3 Million by 2033, exhibiting a CAGR of 22.58% during 2025-2033.

How AI is Reshaping the Future of Saudi Arabia Mobile Device Management (MDM) Market

● Intelligent Threat Detection and Prevention: AI-powered MDM solutions are revolutionizing mobile security across Saudi Arabia by employing machine learning algorithms that analyze device behavior patterns in real-time, automatically detecting anomalies, identifying zero-day threats, and preventing sophisticated cyberattacks with 90% greater accuracy than traditional signature-based detection methods, significantly reducing response times from hours to milliseconds for enterprises managing thousands of mobile endpoints.

● Automated Policy Enforcement and Compliance: AI-driven automation is transforming how Saudi organizations implement and manage security policies across diverse mobile device fleets, with intelligent systems automatically adjusting configurations based on risk assessments, regulatory requirements, and user behavior patterns, reducing administrative overhead by 60% while ensuring continuous compliance with National Cybersecurity Authority (NCA) guidelines and Personal Data Protection Law (PDPL) requirements across government, healthcare, and BFSI sectors.

● Predictive Risk Analytics and Vulnerability Management: Machine learning models integrated within MDM platforms are enabling Saudi enterprises to proactively identify security vulnerabilities and predict potential breach scenarios before they occur, analyzing device health metrics, application behaviors, and network traffic patterns to forecast risks with 85% accuracy, allowing IT teams to implement preventive measures and patch vulnerabilities across mobile infrastructure serving over 52.5 million mobile subscribers nationwide.

● Context-Aware Access Control and Authentication: AI-enhanced MDM solutions are implementing intelligent, context-based authentication mechanisms that evaluate multiple factors including device location, network environment, time of access, and user behavior patterns to dynamically adjust security protocols, reducing false positives by 70% while strengthening zero-trust architecture implementations across Saudi Arabia's rapidly expanding remote workforce and BYOD (Bring Your Own Device) environments in alignment with Vision 2030 digital transformation goals.

● Advanced Data Loss Prevention and Encryption: AI-powered data protection capabilities embedded in MDM platforms are revolutionizing how Saudi organizations safeguard sensitive information on mobile devices through intelligent classification systems that automatically identify, categorize, and encrypt confidential data in real-time, implementing dynamic security controls that adapt to threat levels, user privileges, and data sensitivity, reducing data breach incidents by 55% while supporting secure mobile operations for digital payment systems, e-commerce platforms, and government services processing billions of transactions across the Kingdom.

Grab a sample PDF of this report: https://www.imarcgroup.com/saudi-arabia-mobile-device-management-market/requestsample

Saudi Arabia Mobile Device Management (MDM) Market Trends & Drivers:

Saudi Arabia's mobile device management market is experiencing explosive growth driven by the Kingdom's ambitious Vision 2030 digital transformation initiatives and the rapid expansion of 5G telecommunications infrastructure. In 2025, Saudi Telecom Company (STC) secured a landmark $9 billion deal with government entities to build and operate advanced telecom infrastructure over an 18-month setup and 15-year operational period, positioning 5G as a catalyst for unprecedented mobile device proliferation across public and private sectors. This infrastructure revolution is enabling faster, more reliable, and higher-capacity mobile connectivity that facilitates enhanced mobile operations and seamless real-time collaboration, while simultaneously intensifying concerns regarding security, data protection, and centralized device management. As businesses progressively rely on mobile devices for critical operations including data transmission, cloud access, real-time communications, and IoT connectivity, the demand for sophisticated MDM solutions that can oversee device health, implement robust security measures, enforce compliance policies, and guarantee that only authorized devices access critical networks and corporate assets has intensified dramatically across Saudi Arabia's 97% smartphone-penetrated population.

The explosive growth of Saudi Arabia's digital economy, with the e-commerce sector reaching USD 222.9 Billion in 2024 and digital payment platforms processing cashless transactions totaling SR550 Billion (USD 146.8 Billion) representing 79% of all retail transactions, is fundamentally transforming mobile security requirements and driving unprecedented MDM adoption. Mastercard's introduction of a localized e-commerce payment processing framework backed by the Saudi Central Bank (SAMA), which launched the Mastercard Gateway enabling more than 30 payment options with enhanced fraud prevention functionalities, exemplifies the critical importance of strong mobile endpoint security in Saudi Arabia's digital-first economy. Mobile devices have become pivotal instruments for conducting financial transactions, online shopping, digital banking services, and accessing government platforms like Absher which processed 430 million e-transactions in 2024, creating heightened vulnerabilities that MDM solutions must address through comprehensive security features including encryption, secure access controls, application whitelisting, remote wiping capabilities, and continuous compliance monitoring to safeguard sensitive information against fraud, data breaches, and sophisticated cyber threats targeting the Kingdom's increasingly mobile-dependent business ecosystem.

The stringent regulatory landscape established by the National Cybersecurity Authority (NCA) and the comprehensive Personal Data Protection Law (PDPL) is mandating unprecedented investments in MDM infrastructure across Saudi Arabia's enterprise sector. Government regulations requiring strict data localization, Arabic language support obligations, integration with national cybersecurity infrastructure, and adherence to Essential Cybersecurity Controls (ECC) frameworks are compelling organizations across BFSI, healthcare, government, manufacturing, and telecommunications sectors to implement sophisticated MDM platforms that ensure regulatory compliance while protecting sensitive data. The rapid evolution of workplace models including remote work, hybrid arrangements, field service teams, and cross-regional operations, combined with the increasing adoption of BYOD (Bring Your Own Device) policies that balance operational flexibility with security requirements, is expanding the attack surface for cyber threats while creating demand for comprehensive MDM solutions offering centralized control, real-time monitoring, secure app deployment, strong access enforcement, automated policy management, and incident response capabilities. With over 110 million cyberattacks witnessed across Saudi industries in recent years and the NCA's target of licensing 525 fintechs by 2030, MDM has transformed from a technological upgrade into a strategic necessity for organizations operating in Saudi Arabia's increasingly connected, digital-first economy where mobile security is paramount to business continuity, regulatory compliance, and data sovereignty.

Saudi Arabia Mobile Device Management (MDM) Industry Segmentation:

The report has segmented the market into the following categories:

Type Insights:

● Solutions

● Services

Deployment Type Insights:

● On-premises

● Cloud-based

Organization Size Insights:

● Large Enterprises

● Small and Medium-Sized Enterprises

Vertical Insights:

● BFSI

● Manufacturing

● Healthcare

● Communication

● Others

Breakup by Region:

● Northern and Central Region

● Western Region

● Eastern Region

● Southern Region

Competitive Landscape:

The competitive landscape of the industry has also been examined along with the profiles of the key players.

Ask analyst of customized report: https://www.imarcgroup.com/request?type=report&id=33007&flag=E

Recent News and Developments in Saudi Arabia Mobile Device Management (MDM) Market

● February 2025: Saudi Telecom Company (STC) announced the signing of a transformational $9 billion infrastructure agreement with government entities to build and operate advanced telecommunications infrastructure over an 18-month setup period and 15-year operational phase, directly supporting Vision 2030 digital transformation goals and creating unprecedented demand for enterprise-grade MDM solutions to secure and manage the exponential growth of mobile endpoints across government, healthcare, and private sector networks throughout the Kingdom.

● March 2025: Middle East Cyber Security (MECS), a leading cybersecurity provider in Saudi Arabia, expanded its advanced Mobile Device Management services portfolio with enhanced features including AI-powered encryption, real-time threat detection, remote device wiping capabilities, 24/7 security monitoring, and automated compliance enforcement aligned with National Cybersecurity Authority (NCA) guidelines and Personal Data Protection Law (PDPL) requirements, helping enterprises across BFSI, healthcare, and government sectors protect sensitive data while supporting Vision 2030 digital economy initiatives.

● April 2025: The National Cybersecurity Authority reported that Saudi Arabia maintained its leadership position in the Global Cybersecurity Index 2025 rankings, while the National Cybersecurity Academy empowered over 9,600 cybersecurity professionals in the first half of 2025 through specialized training programs covering MDM implementation, zero-trust architecture, endpoint security, and regulatory compliance, strengthening the Kingdom's cybersecurity workforce capabilities and accelerating enterprise adoption of sophisticated mobile device management platforms across all economic sectors in support of the nation's digital transformation roadmap.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provide a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: +1-201971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Saudi Arabia Mobile Device Management (MDM) Market Size To Worth USD 771.3 Million By 2033 | CAGR of 22.58% here

News-ID: 4250422 • Views: …

More Releases from IMARC Group

Green Tea Bags Manufacturing Plant DPR 2026: Investment Cost, Market Growth & RO …

Setting up a green tea bags manufacturing plant positions investors within one of the steadily expanding and health-oriented segments of the global beverage industry, driven by increasing consumer awareness of wellness, rising preference for natural antioxidants, and growing demand for convenient herbal drink options. Green tea is widely valued for its perceived health benefits, including metabolism support and antioxidant properties, making it popular among health-conscious urban populations.

The shift toward…

Calcium Acetate Prices Q4 2025: USA Reaches USD 1,165/MT While China Trades at U …

North America Calcium Acetate Price Outlook Q4 2025:

United States Calcium Acetate Price Overview:

In Q4 2025, calcium acetate prices in the United States reached USD 1165 per metric ton. The market remained firm due to steady demand from food processing, pharmaceuticals, and wastewater treatment sectors. Stable consumption patterns and moderate production costs supported pricing levels. Supply chain efficiency and consistent raw material availability helped prevent sharp fluctuations during the quarter.

Get the…

Automotive Radiator Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis …

Setting up an Automotive Radiator manufacturing plant positions investors in one of the most critical and high-demand segments of the global automotive components and thermal management industry, backed by sustained global growth driven by rising vehicle production, increasing regulatory focus on engine efficiency and emission reduction, and the growing adoption of electric and hybrid vehicles requiring advanced cooling solutions. As global automotive production expands across emerging economies, regulatory frameworks continue…

Watch Manufacturing Plant DPR & Unit Setup - 2026: Machinery, CapEx/OpEx, ROI an …

Setting up a watch manufacturing plant positions investors at the convergence of precision engineering, consumer lifestyle, luxury goods, and wearable technology - one of the most dynamic and diversified segments of the global consumer goods industry - driven by rising demand for luxury and premium accessories, increasing adoption of smart and hybrid watches, growing disposable incomes across emerging markets, and expanding e-commerce and organized retail channels enabling access to global…

More Releases for Saudi

Saudi Wakala Offers Efficient and Reliable Saudi Visa Stamping Services

Saudi Wakala, a renowned agency specializing in Saudi visa stamping services, is proud to announce its commitment to providing swift and reliable visa processing for travelers to Saudi Arabia. Located in New Delhi, Saudi Wakala has established itself as a trusted partner for individuals and businesses requiring efficient visa stamping services.

Efficient Visa Processing

Understanding the complexities and time-sensitivity associated with visa stamping, Saudi Wakala offers a streamlined process managed by an…

saudi construction company,TOP saudi arabia construction companies list,civil co …

Abdul Ali Al-Ajmi Company

Advanced Support Company

Al Ashbelya Engineering

Al-Dour Engineering Contracting Est.

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Alfanar

Arabian Tile Co. Ltd. (ARTIC)

Assad Said for Contracting Co Ltd

Automated Buildings Company

Bazy Trading and Contracting

Bin Dayel Contracting

Cercon

City Cement Company

Dar Al Majd

EG & G Middle East

East Consulting Engineering Center

El Seif Engineering Contracting Company

El Seif Engineering Contracting Company

Engineering Development Co for Contracting

FCC Company

https://www.gdwatches.cn/

Free engineering construction consultation

Email:nolan@wholsale9.com

Jones Engineering Group

Masar Consulting Engineer

Meinhardt Arabia

Mohammed M. Al Rashid Co. (MARCO)

Qureshi Telecom Contracting &…

Saudi Arabia Agriculture Market, Saudi Arabia Agriculture Industry, Saudi Arabia …

Saudi Arabia Agriculture is focussed on the spread of dates, dairy farm merchandise, eggs, fish, poultry, vegetables, and flowers to markets round the creation because it has attained its own potency within the production of such merchandise. The private sector additionally plays a role within the nation's agriculture, because the government offers long-term interest-free loans and inexpensive water, fuel, electricity, and duty-free imports of raw materials and machinery. Over the past…

Saudi Arabia Pharmaceutical Market | pharmaceutical companies in saudi arabia, p …

In order to study the various trends and patterns prevailing in the concerned market, Market Research Reports Search Engine (MRRSE) has included a new report titled “Saudi Arabia Pharmaceutical Market” to its wide online database. This research assessment offers a clear insight about the influential factors that are expected to transform the global market in the near future.

The report examines Saudi Arabia pharmaceutical market for the period 2016–2026. The primary…

Saudi Arabia Airport Privatization Sector Saudi Arabia Airport Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

Saudi Arabia Aviation Industry Overview

Privatization in Saudi Arabia

Saudi Arabia Civil Aviation Regulatory Authority

3.1 General Authority of Civil Aviation (GACA)

3.2 International Air Transport Association

Saudi…

Saudi Arabia Mutual Fund Sector Saudi Arabia Mutual Fund Sales Report 2022

For Report Sample Contact: neeraj@kuickresearch.com or +91-11-47067990

Report Table of Contents

1. Saudi Arabia Financial Sector Overview

2. Saudi Arabia Stock Market and Exchange Overview

3. Saudi Arabia Mutual Fund Market Overview

4. Saudi Arabia Mutual Fund Program and Managers

4.1 Fund Managers and Companies

4.2 Types of Mutual Funds

5. Saudi Arabia Mutual Fund Asset Allocation

5.1 Market Overview

5.2 Mutual Fund Market Indicators

…