Press release

AI in the Credit-Scoring Market Growth Accelerated by Advanced Algorithms and Real-Time Risk Assessment Capabilities

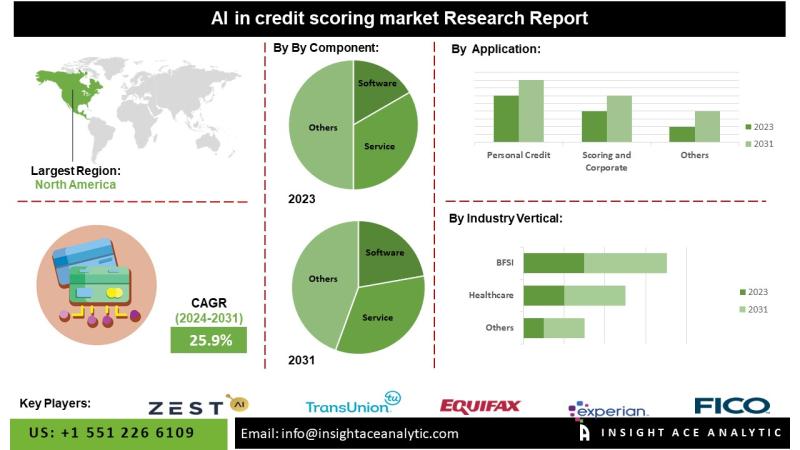

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global AI In The Credit-Scoring Market - (By Component (Software and Service), By Application (Personal Credit Scoring and Corporate Credit Scoring), By Industry Vertical (BFSI (Banking, Financial Services, Insurance), Retail, Healthcare, Telecommunications, Utilities, and Real Estate)), Trends, Industry Competition Analysis, Revenue and Forecast To 2031."According to the latest research by InsightAce Analytic, the Global AI In The Credit-Scoring Market is expected to grow with a CAGR of 25.9% during the forecast period of 2024-2031.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2578

The integration of artificial intelligence (AI) and machine learning (ML) in credit scoring is advancing steadily, though its alignment with national economic development objectives is still at an early stage. Financial institutions and fintech innovators are increasingly deploying these technologies to enhance financial inclusion and foster sustainable economic growth.

A key component of this evolution is the adoption of alternative data sources, sophisticated AI and ML algorithms, and cloud-based infrastructures to create dynamic credit scoring systems designed for underserved and underbanked segments. This data-driven framework enables financial service providers to develop more inclusive lending models and extend credit access to individuals and communities historically excluded from the formal financial sector.

The global AI-based credit scoring market is witnessing strong growth, supported by ongoing advancements in machine learning methodologies and the exponential expansion of big data. AI-powered credit models leverage a broad spectrum of data inputs-such as social media activity, digital behavioral patterns, and transaction histories-to deliver more accurate and holistic credit assessments than traditional evaluation methods.

This technological innovation enhances the precision of credit risk analysis and enables lenders to expand their customer reach responsibly, particularly to individuals with limited or no conventional credit records. Nonetheless, effective implementation requires addressing challenges related to data quality, ethical use of AI, and regulatory compliance to ensure transparent and equitable credit decisioning.

List of Prominent Market Players in the AI credit scoring market:

• FICO (Fair Isaac Corporation)

• Experian

• Equifax

• TransUnion

• Zest AI

• LenddoEFL

• Kreditech

• CreditVidya

• CreditXpert

• Upstart

• Pagaya

• Underwrite.ai

• Kensho Technologies

• Scienaptic

• DataRobot

• Deserve

• ClearScore

• ScoreData

• CredoLab

• Trust Science

• Other Prominent Players

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-04

Market Dynamics

Drivers:

The global market for artificial intelligence (AI) in credit scoring is experiencing strong growth, driven by multiple influential factors. AI-powered credit models exhibit superior analytical capabilities, enabling the processing and interpretation of extensive datasets with high precision. These systems identify complex patterns and correlations that traditional credit assessment methods often overlook, resulting in more accurate and reliable credit evaluations. Furthermore, AI facilitates real-time data processing, allowing for swift and informed decision-making, which is critical in today's fast-paced financial landscape.

Automation through AI also minimizes manual intervention, thereby reducing operational costs and improving process efficiency for financial institutions. The integration of alternative data sources-such as digital transaction histories and behavioral data-has further expanded access to credit for individuals with limited or non-existent traditional credit histories, enhancing financial inclusion. In addition, AI-driven credit scoring models contribute to improved risk management by providing advanced predictive insights into potential defaults and strengthening overall regulatory compliance through standardized and objective credit assessments.

Challenges:

Despite its advantages, the AI-based credit scoring market faces several notable challenges. One of the primary concerns is the potential for algorithmic bias, which may lead to unfair or discriminatory lending outcomes. The performance of AI models is also heavily reliant on the quality and consistency of the data used for training, making data integrity a fundamental prerequisite for success.

Data privacy and cybersecurity remain pressing issues due to the sensitive nature of personal and financial information processed by these systems. Moreover, the complexity and opacity of certain AI algorithms can reduce transparency and erode stakeholder confidence, particularly among regulators and consumers. This has intensified the need for explainable AI frameworks that promote accountability, interpretability, and trust in automated decision-making processes.

Regional Trends:

North America is expected to maintain its leading position in the AI-based credit scoring market throughout the forecast period. This dominance is supported by a mature technological infrastructure, significant investment in AI and analytics, and the strong presence of established financial institutions and fintech innovators. In the United States, in particular, widespread adoption of AI-driven scoring models has enhanced accuracy, reduced default risks, and enabled the delivery of personalized financial services.

Meanwhile, Europe continues to hold a substantial market share, driven by rapid digital transformation across the financial sector, the growing adoption of AI solutions by banks and credit agencies, and the increasing emphasis on inclusive lending practices. Additionally, emerging economies within the region are leveraging AI technologies to extend credit accessibility and strengthen financial ecosystems.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2578

Recent Developments:

• In Jan 2024, Intuit Inc., the worldwide financial technology platform responsible for Intuit TurboTax, Credit Karma, and Mailchimp, has declared that Credit Karma members Online customers now have the ability to complete and submit their 2023 tax returns using TurboTax directly within the Credit Karma Online product interfaces.

Segmentation of AI in credit scoring market-

By Component

• Software

• Service

By Application

• Personal Credit Scoring

• Corporate Credit Scoring

By Industry Vertical

• BFSI

o Banking,

o Financial Services,

o Insurance

• Retail,

• Healthcare,

• Telecommunications,

• Utilities,

• Real Estate

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/ai-in-the-credit-scoring-market/2578

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: https://www.insightaceanalytic.com/

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release AI in the Credit-Scoring Market Growth Accelerated by Advanced Algorithms and Real-Time Risk Assessment Capabilities here

News-ID: 4250322 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

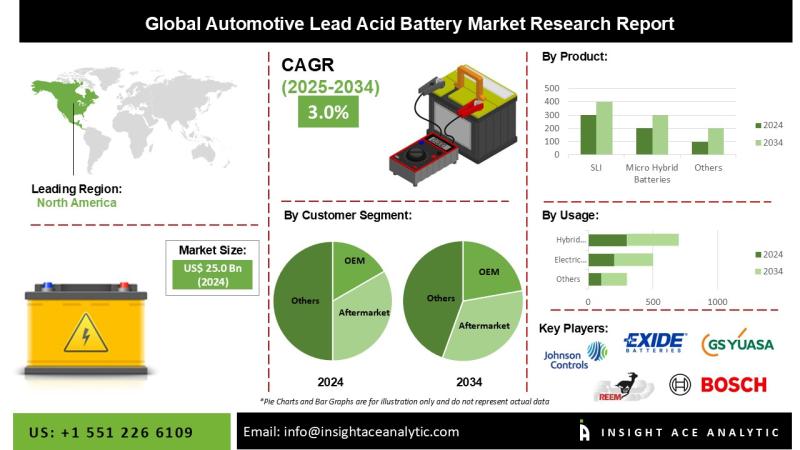

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

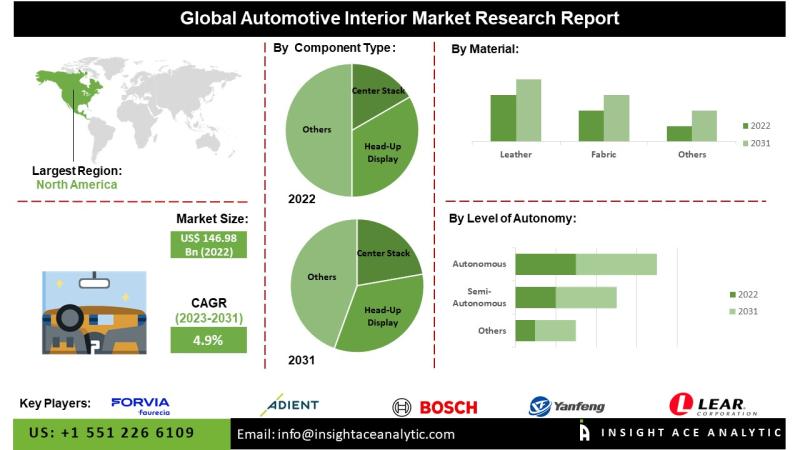

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

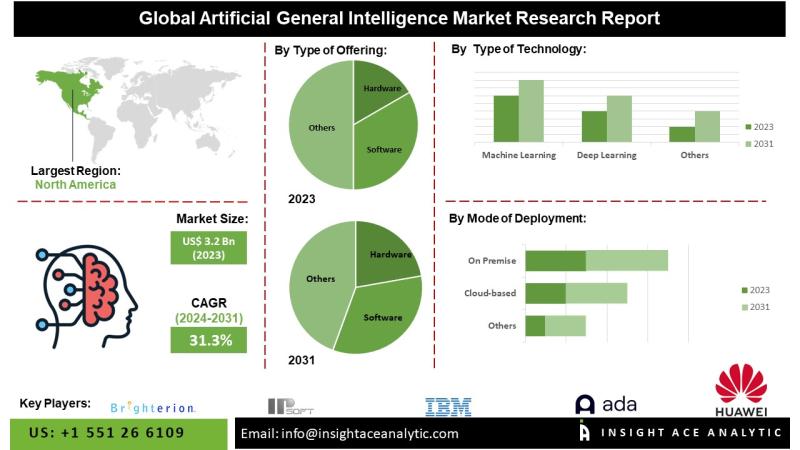

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Credit

Credit Scores, Credit Reports & Credit Check Services Market Set for Explosive G …

Global Credit Scores, Credit Reports & Credit Check Services Market Report from AMA Research highlights deep analysis on market characteristics, sizing, estimates and growth by segmentation, regional breakdowns & country along with competitive landscape, player's market shares, and strategies that are key in the market. The exploration provides a 360° view and insights, highlighting major outcomes of the industry. These insights help the business decision-makers to formulate better business plans…

Credit Repair Service Market Size in 2023 To 2029 | AMB Credit Consultants, Cred …

The Credit Repair Service market report provides a comprehensive analysis of the market-driving factors, major obstacles, and restraining factors that can impede market growth during the forecast period. This information can be particularly useful for existing manufacturers and start-ups as they develop strategies to overcome challenges and capitalize on lucrative opportunities. The report also offers detailed information about prime end-users and annual forecasts during the estimated period. This can help…

Credit Scores, Credit Reports & Credit Check Services Market is Going to Boom | …

Latest Study on Industrial Growth of Global Credit Scores, Credit Reports & Credit Check Services Market 2022-2028. A detailed study accumulated to offer Latest insights about acute features of the Credit Scores, Credit Reports & Credit Check Services market. The report contains different market predictions related to revenue size, production, CAGR, Consumption, gross margin, price, and other substantial factors. While emphasizing the key driving and restraining forces for this market,…

Credit Scores, Credit Reports and Credit Check Services Market is Booming Worldw …

Credit Scores, Credit Reports and Credit Check Services Market - Global Outlook and Forecast 2022-2028 is the latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities, and leveraging with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure of the Credit Scores, Credit Reports and Credit Check Services Market. Some of…

Credit Scores, Credit Reports & Credit Check Services Market is Booming With Str …

The latest study released on the Global Credit Scores, Credit Reports & Credit Check Services Market by AMA Research evaluates market size, trend, and forecast to 2027. The Credit Scores, Credit Reports & Credit Check Services market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends,…

Credit Scores, Credit Reports & Credit Check Services Market May See Big Move | …

Global Credit Scores, Credit Reports & Credit Check Services Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market risk side analysis, highlighting opportunities and leveraged with strategic and tactical decision-making support. The report provides information on market trends and development, growth drivers, technologies, and the changing investment structure…