Press release

Compostable Laminating Packaging Films Market to Reach CAGR 9,4% by 2031 Top 10 Company Globally

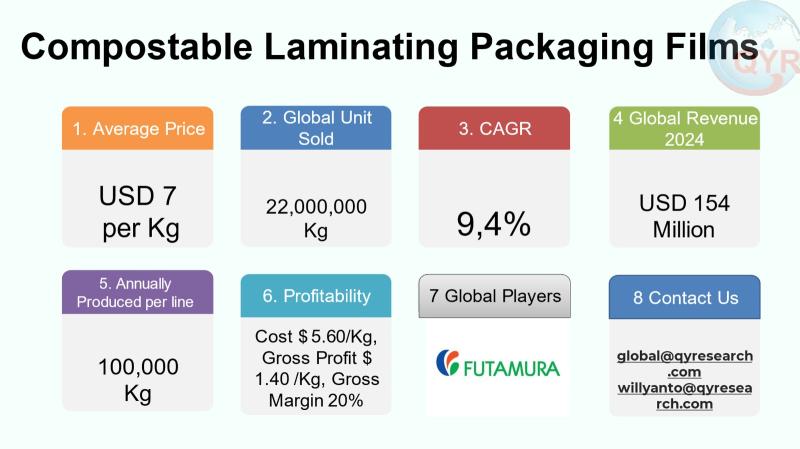

Compostable laminating packaging films are specialty multilayer films and coatings designed to provide the protective, heat-seal and aesthetic functions of traditional laminates while being industrially (and in some grades home-) compostable at end of life. They are typically based on bio-derived polymers and cellulose-based films and may include compostable adhesive and barrier coatings that allow brands to maintain shelf life and product protection while reducing plastic waste. These films are used as lamination layers, top films, shrink wraps and thermo-lamination materials across food, personal care, retail and some industrial applications, and they bridge performance demands with regulatory and consumer-driven sustainability goals.The market size for compostable laminating packaging films in 2024 as USD 154 million and a compound annual growth rate of 9.4% through 2031, reaching market size USD 287 million by 2031. With an average selling price of USD 7 per kilogram, the industry sold approximately 22,000,000 kg of compostable laminating film globally in 2024. Manufacturers operate with a factory gross margin of roughly 20%, which implies an average cost of goods sold of about USD 5.60 per kilogram and an average factory gross profit of roughly USD 1.40 per kilogram. COGS breakdown is raw materials, coating/adhesives & barrier treatments, energy, labor, maintenance & quality control, packaging & logistics. Typical full-line production capacity for modern specialty film lines varies by technology and scale, and a representative range for established lines runs from around 100,000 kg per year per line. Downstream demand is concentrated in food packaging (majority share), followed by consumer goods/retail and personal care, e-commerce protective wraps and a smaller industrial/technical segment.

Price, Units and Cost Breakdown (industry level)

Average industry selling price: USD 7.00 / kg.

Total units sold globally (2024): ~20,714,286 kg (≈20,714 tonnes).

COGS (industry average): USD 5.60 / kg.

Factory gross profit: USD 1.40 / kg.

Factory gross margin: 20% (industry target/typical for this niche).

Typical COGS breakdown (percentage of COGS): raw materials 65%, coating/adhesives & barrier treatments 12%, energy 7%, labor 6%, maintenance & quality control 6%, packaging & logistics 4% (these percentages represent an industry-level typical split to explain cost drivers and sum to 100%). Downstream industry demand by end use (illustrative split): food packaging ~5570%, personal care & cosmetics ~812%, consumer retail & e-commerce ~1015%, industrial/technical ~58%, other/innovation niches ~35%.

Latest Trends and Technological Developments

The industry has seen several product launches and line expansions in the last 18 months focused on higher-barrier compostable laminates and thermo-lamination films suitable for tray applications, along with improved sealant chemistry for liquid and sauce sachets. Notable recent items include Futamuras launch of compostable liquid-sachet laminate applications (May 2025) and Asplas introduction of a 100% compostable tray thermo-lamination film (January 2025). Smaller innovators and startups continue to push bio-based laminating films and shrink films to provide the same processing speeds as conventional films while meeting industrial compostability certifications. Advances in multi-layer compostable solutions, barrier coatings that are compostable, and cellulosic film grades certified for home and industrial composting are the key technological developments shaping adoption. These product and capacity announcements underline both technical progress and market validation from brand customers.

Nature's Best Organics, a leading producer of certified organic snack bars, has committed to transitioning its entire product line to fully compostable packaging by 2025. To meet this goal, their procurement department has initiated a bulk purchase of compostable laminating films. They have recently signed an annual supply contract with TIPA Corp., a pioneer in compostable packaging solutions, for the procurement of 50 metric tons of their proprietary high-barrier compostable laminate film. The agreed-upon price is $8,500 per metric ton, representing a total investment of $425,000 to package their new line of "Eco-Crunch" bars, ensuring that the packaging can be composted in industrial facilities alongside the food waste.

The product is successfully applied by FreshLeaf Salads, a premium ready-to-eat salad company, for their new "Zero-Waste" salad bowl range. The company uses the compostable laminating film to create a durable, yet entirely compostable, sealed lid for their plastic-free bowl containers. This application ensures product freshness and a high-quality seal while aligning with their sustainability branding. For the initial launch, FreshLeaf Salads utilized approximately 2.5 tons of the film, supplied by Kuraray's Plantic division, at a cost of $9,200 per ton. This application, amounting to a $23,000 material investment, allows consumers to dispose of the entire packaging in a commercial compost bin, where it breaks down within weeks.

Asia is an accelerating market for compostable laminating films driven by a combination of large packaging demand, tightening single-use plastic regulations in some markets, and strong manufacturing supply chains for film and coating technologies. Japan and parts of East Asia are home to cellulose and specialty film producers investing in compostable grades (cellulose-based films have a long history in Japan and Europe). Larger Asian converters and film producers are increasingly offering compostable laminating grades to multinational food and consumer brands that source locally. Cost sensitivity in many Asian markets means adoption is strongest where brands can command sustainability premiums or where regulations/retailer requirements make compostable options mandatory or highly preferred. On the supply side, localized production in Asia helps lower lead times for regional brand customers and supports growth in Southeast Asian markets that are rapidly adopting compostable packaging for food and small goods.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5291481

Compostable Laminating Packaging Films by Type:

High Barrier

Low Barrier

Compostable Laminating Packaging Films by Product:

PLA

PHA

Others

Compostable Laminating Packaging Films by Shape:

Single Layer Compostable Films

Multi Layer Laminates

Shrink and Stretch Film Structures

Thermoforming Sheet Structures

Others

Compostable Laminating Packaging Films by Features:

Industrial Compostable Certified Grades

Thermo Lamination Films

Transparent and Printables Finishes

Others

Compostable Laminating Packaging Films by Size:

Thin Gauge (≤25 microns)

Medium Gauge (26-50 microns

Thick Gauge (>50 microns)

Die-Cut Formats

Others

Compostable Laminating Packaging Films by Application:

Food Packaging

Non Food Packaging

Global Top 10 Key Companies in the Compostable Laminating Packaging Films Market

Futamura

Novamont

Grounded Packaging

TIPA Compostable Packaging

Taghleef Industries

Walki Group

Billerud

Ticinoplast

Polycart

Earthfirst (Aluf Plastics)

Regional Insights

Within ASEAN, demand is concentrated in countries with large packaged food markets and active sustainability agendas. Indonesia a top consumer market in the region shows growing interest from food brands, snack producers and personal-care manufacturers seeking compostable laminating solutions for tray lamination, sachets and secondary packaging. Adoption in ASEAN is enabled by regional converters and some China-based film plants exporting to Southeast Asia; however, variability in industrial composting infrastructure across ASEAN nations means brands must consider local end-of-life pathways when specifying compostable laminates. Where industrial composting or organic waste collection is limited, labels and supply chain communication become critical to avoid consumer confusion. Local capacity additions and technology partnerships (between European/Asian specialty film makers and ASEAN converters) are the likely near-term route to scaling supply.

Key challenges include the higher raw-material cost of compostable chemistries versus conventional polyolefins, maintaining barrier and mechanical performance at competitive processing speeds, and the fragmentation of composting infrastructure (industrial vs home composting) which can limit lifecycle benefits in some markets. Regulatory complexity and differing certification standards across regions create compliance and labeling complexity for exporters. Supply-chain scale is also a constraint: while some lines can produce tens of thousands of tonnes per year, the number of lines dedicated to compostable laminates is still small compared with conventional film capacity, creating potential bottlenecks during rapid demand surges. Finally, cost parity with conventional laminates remains a medium-term objective for many buyers price premia and brand willingness to pay will govern adoption speed in price-sensitive markets.

Producers should prioritize R&D into barrier coatings that are compostable, build partnerships with converters and tray manufacturers to qualify materials for existing lines, and secure certification (EN 13432, ASTM D6400, TÜV/OK Compost) to reassure buyers. Brands and converters should map local organic waste infrastructure and tailor claims (industrial vs home compostability) to avoid greenwashing risk. Investors and managers should evaluate modular capacity expansion (add-on coating/lamination modules rather than greenfield full plants) to meet intermittently rising demand while limiting capital intensity. Lastly, close collaboration with downstream food and personal-care brands to co-develop specifications (especially for heat seal and liquid-tight laminates) will shorten qualification cycles and accelerate adoption.

Product Models

Compostable laminating packaging films are multi-layered biodegradable films made from renewable materials such as PLA (polylactic acid), PBAT (polybutylene adipate terephthalate), and cellulose-based polymers.

High Barrier compostable films are designed for products that require extended shelf life and protection from oxygen and moisture. Notable products include:

NatureFlex NK (barrier grades) - Futamura Group: cellulose-based barrier film family for coffee, tea and dry foods offering strong aroma and oxygen protection when laminated.

MATER-BI barrier films (for trays & capsules) - Novamont: Mater-Bi bioplastic films designed for food trays/capsules with certified compostability and improved barrier performance for moist or fat-rich foods.

Plantcell High Barrier laminate - Grounded Packaging: compostable laminated structures (Plantcell) offered in high-barrier versions for snacks and sensitive dry foods.

TIPA Barrier Laminate (food-grade laminate solutions) - TIPA Compostable Packaging: compostable laminates and barrier film solutions engineered to extend shelf life for fresh and packaged foods.

Biobased / Biodegradable barrier films - Taghleef Industries (biobased portfolio): Taghleefs biodegradable/biobased film line tailored to offer enhanced barrier and printing performance in flexible packaging.

Low Barrier compostable films are used for short-shelf-life products where breathability and flexibility are more important than barrier strength. Examples include:

TIPA standard compostable film (flow-pack / pouch grades) - TIPA Compostable Packaging: flexible, breathable compostable film grades for flow packs, bags and pouches where short shelf life is acceptable.

Walki®Bioska 302 / 402 (low barrier & home-compostable options) - Walki Group: compostable films available in industrial (302) and home-compostable (402) grades suited for magazine wrap, bakery and single-use applications.

Nextfilm low-sealing compostable films - Ticinoplast (Nextfilm): low sealing and paper-coupling compostable films for bakery and produce packaging to enable easy composting.

Taghleef biodegradable film (flexible low barrier grades) - Taghleef Industries: biobased/biodegradable film grades designed for soft, printable low-barrier packaging formats.

Aspla BioTerm® thermo-lamination film (tray lamination low-to-mid barrier) - Aspla / Armando Álvarez group: 100% compostable thermo-lamination film optimized for tray lamination and light barrier needs.

Compostable laminating packaging films are a technically mature and fast-growing niche within broader compostable packaging, driven principally by food industry demand, brand sustainability programs, and regulatory shifts. While cost and end-of-life infrastructure remain adoption constraints in some markets, clear technological progress in barrier coatings and thermo-lamination compatibility has lowered technical barriers. Asia and Southeast Asia present particularly strong commercial potential due to large packaged goods demand and expanding local conversion capacity, but success depends on aligning product claims with local composting capabilities and managing price premia through scale and process innovation.

Investor Analysis

What investors need to know: this report highlights a well-defined product niche with attractive growth (9.4% CAGR to 2031 on the user baseline), constrained supply relative to conventional films, and clear downstream demand concentration in food packaging. How to act: investors should prioritize opportunities that combine proprietary compostable barrier technologies or strong certification credentials with scalable production footprints (modular capacity additions or partnerships with established film lines). Strategic M&A or minority investments into converters that can rapidly qualify compostable laminates for major food brands may yield faster revenue capture than greenfield plants. Why it matters: the combination of brand demand for sustainability, tightening regulations on single-use plastics in many markets, and measurable price premia for certified compostable solutions creates a Path-to-Profit for early entrants who can secure supply, demonstrate validated performance and manage cost curves. Regions such as ASEAN (including Indonesia) offer demand growth plus cost arbitrage if capacity is located near customers. Finally, line-level capacity constraints and the premium per kg create margin tailwinds for efficient producers while presenting entry barriers for low-capability manufacturers.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5291481

5 Reasons to Buy This Report

Market sizing and growth: precise 2024 baseline and CAGR outlook to 2031 for strategic planning.

Cost and margin transparency: per-kg price, COGS, gross profit and a practical COGS breakdown useful for unit-economics modeling.

Regional focus: actionable insights specific to Asia and ASEAN where demand/production dynamics differ from Europe/North America.

Technology & capacity intelligence: recent product launches, representative per-line capacity ranges and supplier profiles to guide investment or sourcing decisions.

Competitive map: top industry players and product directions to support partnership, M&A or supplier selection decisions.

5 Key Questions Answered

What was the market size for compostable laminating films in 2024 and what is the forecast CAGR to 2031?

How many kilograms/tonnes of compostable laminating film were sold globally in 2024 at the stated average price?

What are the industry-level unit economics (price/kg, COGS/kg, gross profit/kg, gross margin)?

Which end-uses and regions (Asia, ASEAN, Indonesia) will drive near-term demand and what supply constraints exist?

Who are the leading suppliers and what recent product or capacity developments should buyers and investors know about?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Compostable Laminating Packaging Films Market Research Report 2025

https://www.qyresearch.com/reports/5291481/compostable-laminating-packaging-films

Compostable Laminating Packaging Films - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5291480/compostable-laminating-packaging-films

Global Compostable Laminating Packaging Films Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5291479/compostable-laminating-packaging-films

Global Compostable Laminating Packaging Films Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5291478/compostable-laminating-packaging-films

Global Tinplate and Film Laminated Steel for Metal Packaging Market Research Report 2025

https://www.qyresearch.com/reports/3801825/tinplate-and-film-laminated-steel-for-metal-packaging

Global PVC/PE/PVDC Laminated Film for Pharmaceutical Packaging Market Research Report 2025

https://www.qyresearch.com/reports/4505632/pvc-pe-pvdc-laminated-film-for-pharmaceutical-packaging

Global Compostable Packaging Films Market Research Report 2025

https://www.qyresearch.com/reports/3796373/compostable-packaging-films

Global PLA Compostable Packaging Film Market Research Report 2025

https://www.qyresearch.com/reports/4431330/pla-compostable-packaging-film

Global Bioplastic Multi-Layer Films for Compostable Food Service Packaging Market Research Report 2025

https://www.qyresearch.com/reports/4513155/bioplastic-multi-layer-films-for-compostable-food-service-packaging

Global Compostable Films Market Research Report 2025

https://www.qyresearch.com/reports/4157410/compostable-films

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Compostable Laminating Packaging Films Market to Reach CAGR 9,4% by 2031 Top 10 Company Globally here

News-ID: 4248634 • Views: …

More Releases from QY Research

Top 30 Indonesian Sugar Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Aman Agrindo Tbk sugarcane & sugar products (IDX:GULA)

PT Sugar Group Companies largest private sugar producer (not publicly listed)

PT Prima Alam Gemilang (PAG) major sugar mill operator (private)

PT Sinergi Gula Nusantara sugar mill operator (private)

PT Indofood Sukses Makmur Tbk (IDX:INDF) major food company using sugar inputs

PT Mayora Indah Tbk (IDX:MYOR) food & beverage…

Smart Factories, Smart Sensors: Investment Opportunities in Pressure Monitoring …

Pressure level sensors are electro-mechanical or MEMS-based devices that measure liquid or gas pressure and convert it into electrical signals for level monitoring, process control, and safety automation.

Widely deployed across industrial automation, water management, automotive systems, oil & gas, HVAC, chemical processing, and medical devices.

Growing demand for real-time monitoring, smart factories, and predictive maintenance is accelerating sensor integration in both legacy and new equipment.

Miniaturization, digital connectivity, and ruggedization enable deployment…

Inside the USD 14.5B Cookie Dough Boom: Asia & ASEAN Drive the Next Growth Wave

Cookie dough refers to ready-to-bake, ready-to-eat (heat-treated flour), frozen, chilled, or shelf-stable dough products used by households, foodservice, bakeries, cafés, QSR chains, and industrial bakery processors.

The industry sits at the intersection of frozen desserts, bakery ingredients, and convenience foods, driven by home baking trends, quick-service restaurants, and private label retail expansion.

Growth is supported by:

rising demand for convenience snacks

growth of frozen retail chains

increasing foodservice pre-mix adoption

premium flavors and indulgence culture

Asia &…

Inside the USD 440M Ceramic RF Filter Industry: ASEAN Expansion & IoT Demand

Inside the USD 440M Ceramic RF Filter Industry: ASEAN Expansion & IoT Demand

Ceramic band pass filters are compact radio-frequency (RF) components that allow a defined frequency band to pass while attenuating signals outside the range, enabling stable signal integrity in wireless, automotive, IoT, and industrial communication systems.

Built using piezoelectric ceramic resonators, they offer low insertion loss, small footprint, high selectivity, and strong thermal stability, making them widely adopted in smartphones,…

More Releases for Compost

Increasing Demand For Organic Farm Products Drives Demand For Compost: An Emergi …

The Compost Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

What Is the Compost Market Size and Projected Growth Rate?

In recent times, the compost market has witnessed significant growth. It's projected to increase from $8.15 billion in 2024 to $8.86 billion in 2025, reflecting a…

Leading Growth Driver in the Compost Market in 2025: Increasing Demand For Organ …

What market dynamics are playing a key role in accelerating the growth of the compost market?

The expanding requirement for organic agricultural products is fostering the compost market's expansion. Harvested without the use of synthetic insecticides, growth hormones, antibiotics, or synthetic pesticides, these are considered high-grade products which are healthier and eco-friendly. Amid the COVID-19 pandemic, consumers leaned towards more nutritious food options leading to an increase in the demand for…

Compost Service Market 2023 Size Predicted to Increase at a Positive CAGR | Enva …

The qualitative report published by market intelligence data research on the Compost Service Market offers an in-depth examination of the current trends, latest expansions, conditions, market size, various drivers, limitations, and key players along with their profile details. The Compost Service market report offers the historical data for 2017 to 2022 and also makes available the forecast data from the year 2023 to 2029 which is based on revenue. With…

Europe Compost Market To Cross Valuation Of USD 52.14 million by 2029| Top Playe …

Market Definition

Compost is a product that is manufactured through the controlled aerobic and biological decomposition of biodegradable materials. Compost is the result of a compost pile. People often opt to make their compost by using pet waste, plant clippings, viable food scraps, and weeds, among others. Compost is economical and environmentally friendly and is a good source of nutrition for vegetables and fruits bearing plants.

Data Bridge Market Research analyses that…

Europe Compost Market Will Reach USD 52.14 million by 2029| COMPO, Compost Direc …

Market Definition

Compost is a product that is manufactured through the controlled aerobic and biological decomposition of biodegradable materials. Compost is the result of a compost pile. People often opt to make their compost by using pet waste, plant clippings, viable food scraps, and weeds, among others. Compost is economical and environmentally friendly and is a good source of nutrition for vegetables and fruits bearing plants.

Data Bridge Market Research analyses that…

Residential Organic Compost Market Report Contains Product Specifications and An …

LOS ANGELES, United States: The report is an all-inclusive research study of the global Residential Organic Compost market taking into account the growth factors, recent trends, developments, opportunities, and competitive landscape. The market analysts and researchers have done extensive analysis of the global Residential Organic Compost market with the help of research methodologies such as PESTLE and Porter's Five Forces analysis. They have provided accurate and reliable market data and…