Press release

Unlocking the U.S. Oil Storage Terminal Market: SWOT Review & Where Investors Are Betting Next

The U.S. oil storage terminal market serves as a critical link in the country's energy logistics chain, ensuring supply stability and enabling traders, refiners, and energy companies to optimize operations amid fluctuating oil demand. These terminals are essential for crude oil, refined products, and natural gas liquids (NGLs), forming a backbone for U.S. energy infrastructure and exports. With the ongoing energy transition, modernization of assets, and strategic mergers, the market is experiencing a period of active restructuring and investment.Explore detailed profiles of top players and new entrants in this space - access your free sample report →https://www.researchnester.com/sample-request-7589

Top Companies & Their Strategies

1. Kinder Morgan Inc.

Kinder Morgan operates one of the largest independent terminal networks in North America, offering crude oil, petroleum products, and chemical storage. The company's strength lies in its extensive pipeline integration, enabling seamless product flow across terminals. Strategic investments in automation and sustainability-such as expanding renewable fuel storage-reinforce its competitive position in the evolving U.S. energy landscape.

2. Magellan Midstream Partners L.P. (Now part of ONEOK Inc.)

Magellan Midstream, acquired by ONEOK in 2023, is known for its refined products storage and distribution network, spanning major U.S. refining centers and demand markets. The merger strengthens its presence in the liquids storage sector, allowing integrated midstream operations. The combined entity benefits from cost efficiencies, enhanced pipeline connectivity, and access to Gulf Coast export facilities, boosting competitiveness against independent storage operators.

3. Buckeye Partners L.P. (Owned by IFM Investors)

Buckeye Partners operates a vast network of marine and inland terminals, with strong Gulf Coast exposure supporting U.S. export growth. Under IFM Investors' ownership, the company focuses on strategic modernization projects and sustainability initiatives, such as low-emission terminal upgrades. Its global reach and capital backing position Buckeye as a formidable player in the midstream storage landscape.

4. Enterprise Products Partners L.P.

Enterprise Products Partners combines integrated logistics, fractionation, and terminal operations, giving it a strong edge in vertical integration. The company's Gulf Coast terminals handle large volumes of crude oil and NGLs for both domestic and export markets. Enterprise's strategy emphasizes long-term customer contracts, advanced automation, and diversification into petrochemical storage, enhancing operational resilience and profitability.

5. NuStar Energy L.P.

NuStar Energy operates across multiple U.S. regions, including the Gulf Coast, Midwest, and West Coast. Its core strength lies in flexibility and regional diversity, which supports refined products, crude, and ammonia storage. NuStar is actively investing in renewable fuel storage and hydrogen-ready infrastructure, aligning its assets with the clean energy transition while maintaining a reliable revenue base from traditional fuels.

Get deeper insights into competitive positioning and strategic benchmarking: Download our sample U.S. Oil Storage Terminal Market report here → https://www.researchnester.com/sample-request-7589

6. Plains All American Pipeline L.P.

Plains All American operates extensive crude oil storage and transportation assets across the U.S., with a strong focus on the Permian Basin and Cushing hub. Its strategy revolves around operational efficiency, asset optimization, and joint ventures with refiners and producers. Plains' cost-effective network and strategic locations allow it to benefit from rising crude export volumes and inventory management needs.

7. Marathon Petroleum Corporation (MPLX)

Through MPLX, Marathon Petroleum operates one of the largest integrated storage networks connected to its refining assets. The company's vertical integration allows it to balance storage demand between upstream supply and downstream refining. MPLX continues to expand its terminal network with digital monitoring systems and automation technologies to enhance safety and efficiency.

8. Enbridge Inc.

Enbridge, though Canadian-based, has significant U.S. terminal operations, particularly along the Gulf Coast and Midwest. Its assets are strategically located near major refineries and export terminals. Enbridge's strength lies in scale, diversified asset portfolio, and stable long-term contracts. The company is investing in digital technologies and decarbonization initiatives to future-proof its storage assets.

View our Oil Storage Terminal Market Report Overview here: https://www.researchnester.com/reports/oil-storage-terminal-market/7589

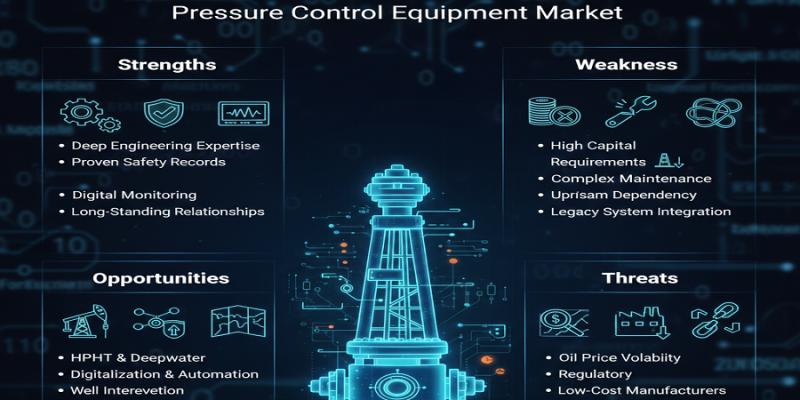

SWOT Analysis of Leading U.S. Oil Storage Terminal Operators

Strengths:

Leading U.S. terminal operators possess extensive logistics networks, geographic diversification, and integration with pipeline systems. These strengths provide operational efficiency, lower transport costs, and stable throughput volumes. Long-term take-or-pay contracts and partnerships with refiners and traders ensure predictable revenue streams. Moreover, the ability to adapt assets for renewable fuels and low-carbon storage further strengthens long-term competitiveness.

Weaknesses:

Despite their scale, several operators face high maintenance costs and limited asset flexibility for non-petroleum storage. Dependence on fossil fuel demand creates exposure to long-term energy transition risks. Regulatory hurdles and environmental compliance costs, particularly at aging terminals, can constrain profitability. Smaller players often struggle with capital intensity and technological modernization compared to integrated majors.

Opportunities:

The ongoing shift toward renewable fuels, carbon capture, and hydrogen infrastructure presents major growth opportunities. Investments in automation, predictive maintenance, and IoT-enabled monitoring enhance operational efficiency and safety. The U.S. Gulf Coast's rising export demand for crude and refined products continues to attract private and institutional investment. Furthermore, strategic M&A and terminal repurposing for sustainable energy logistics are emerging as attractive opportunities for investors and operators alike.

Threats:

Operators face increasing regulatory pressure regarding emissions, water usage, and storage safety. Fluctuating oil prices and geopolitical uncertainties can reduce throughput and storage utilization rates. Competition from new independent terminals and energy hubs may challenge established operators. Additionally, the accelerating shift toward electric mobility and clean fuels could eventually reduce demand for petroleum product storage.

Interested in a customized SWOT for your target competitor? Request your tailored assessment →https://www.researchnester.com/sample-request-7589

Investment Opportunities & Trends

The U.S. oil storage terminal market is undergoing a transformation driven by sustainability goals, digitalization, and infrastructure consolidation. Investors are showing growing interest in modern, strategically located terminals with export connectivity and renewable compatibility.

M&A Activity:

Recent years have seen heightened merger and acquisition activity, signaling industry consolidation. The ONEOK-Magellan merger in 2023 created a vertically integrated energy logistics giant, while private equity firms like IFM Investors and Global Infrastructure Partners continue to acquire midstream assets for long-term yield. These moves reflect a shift toward portfolio optimization and asset integration to withstand market volatility.

Technology Integration:

Digital technologies such as IoT sensors, AI-based monitoring, and automated safety systems are reshaping terminal operations. Companies like Enterprise and Kinder Morgan are investing in digital twins and smart terminal systems to enhance real-time monitoring and reduce downtime. Such innovations are becoming essential for ensuring safety, efficiency, and regulatory compliance.

Sustainability and Renewable Fuels:

A growing share of capital is being directed toward biofuel and hydrogen-ready terminals. NuStar, Buckeye, and Enbridge are actively repurposing existing storage tanks for renewable diesel, ethanol, and ammonia. These initiatives align with federal incentives under the Inflation Reduction Act, which supports energy infrastructure modernization and emissions reduction.

Regional Expansion:

The Gulf Coast remains the epicenter of new investments, driven by its proximity to export markets and refinery hubs. Terminals in Houston, Corpus Christi, and Louisiana are expanding capacity to handle increasing export flows of crude and refined products. Meanwhile, the Midwest and West Coast regions are witnessing targeted investments in renewable storage infrastructure, catering to evolving state-level clean fuel mandates.

Policy and Regulation:

Federal and state energy policies continue to influence market direction. Environmental permitting, decarbonization incentives, and carbon capture funding are shaping the next generation of storage infrastructure. Companies aligning with these policy frameworks are expected to attract stronger institutional backing and long-term contracts.

Stay ahead of investment moves in the U.S. Oil Storage Terminal Market - view our analyst-verified insights→ https://www.researchnester.com/sample-request-7589

Related News:

https://www.linkedin.com/pulse/what-future-solid-state-battery-market-consumers-pathways-0wa9f

https://www.linkedin.com/pulse/how-permanent-magnet-motors-powering-future-smart-industries-umfsf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Unlocking the U.S. Oil Storage Terminal Market: SWOT Review & Where Investors Are Betting Next here

News-ID: 4247130 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

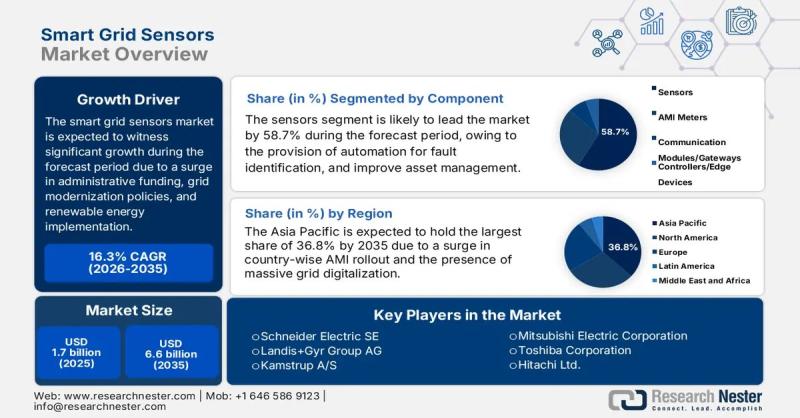

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Terminal

Terminal Tractor Market Trends That Will Shape the Next Decade: Insights from Ad …

Use code ONLINE30 to get 30% off on global market reports and stay ahead of tariff changes, macro trends, and global economic shifts.

How Large Will the Terminal Tractor Market Size By 2025?

The growth of the terminal tractor market has been robust in recent times. It is forecasted to expand from $0.95 billion in 2024 to $1.01 billion in 2025, reflecting a compound annual growth rate (CAGR) of 6.0%. Factors contributing…

Emerging Trends Influencing The Growth Of The Terminal Tractor Market: Advanceme …

The Terminal Tractor Market Report by The Business Research Company delivers a detailed market assessment, covering size projections from 2025 to 2034. This report explores crucial market trends, major drivers and market segmentation by [key segment categories].

How Big Is the Terminal Tractor Market Size Expected to Be by 2034?

The terminal tractor market will grow from $0.95 billion in 2024 to $1.01 billion in 2025 at a CAGR of 6.0%. The…

Advancements In Electric Terminal Tractors Enhanced Terminal Tractors Market Tre …

"What Is the Expected Size and Growth Rate of the Terminal Tractor Market?

In recent times, the market size of terminal tractors has seen solid growth. It's expected to expand from $0.95 billion in 2024 to $1.01 billion in 2025, with a compound annual growth rate (CAGR) of 6.0%. This growth during the historical period can be credited to the heightened demand for effective logistics and supply chain solutions, a…

Terminal Security Protection Platform Market Growing concerns over terminal secu …

Global Terminal Security Protection Platform Market Overview:

The Terminal Security Protection Platform market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that operate in areas such as consumer goods, technology, healthcare, and finance, among others.

In recent years, the Terminal Security Protection Platform market has experienced significant growth, driven by factors such as increasing consumer demand, technological advancements, and…

Research Insights: Paperless Office System ( By type -"Mobile Terminal,Computer …

"

The paperless office system refers to the use of modern network technology for office work, which can conduct meetings, communication, files, process approval, etc. online. The main media tool is the computer, or the system software developed. For example: Internet fax, fax server and other modern office tools can realize various business and transaction processing without paper and pen.

Report Overview

Due to the COVID-19 pandemic and Russia-Ukraine War Influence, the global…

Bedside Terminal Service Market

#Download Sample Pages of Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=1907052

The global Bedside Terminal Service market 2019 research is a professional and in-depth study on the current state of the industry and provides a basic overview of the industry including definitions, classifications, applications and industry chain structure.

Global Bedside Terminal Service Market Report including definitions, classifications, applications and industry chain structure. Global Bedside Terminal Service market status, size, outlook of global and major…