Press release

Real Estate Loan Market Current Impact to Make Big Changes| Wells Fargo, Barclays, DBS Bank

The latest study released on the Global Real Estate Loan Market by HTF MI evaluates market size, trend, and forecast to 2033. The Real Estate Loan market study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analyzed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.Key Players in This Report Include: Wells Fargo (United States), JPMorgan Chase (United States), Bank of America (United States), Citigroup / CitiMortgage (United States), U.S. Bancorp (United States), HSBC (United Kingdom), Barclays (United Kingdom), Lloyds Banking Group (United Kingdom), BNP Paribas (France), Société Générale (France), Deutsche Bank (Germany), CaixaBank (Spain), Santander (Spain), BBVA (Spain), Mitsubishi UFJ Financial Group (Japan), Sumitomo Mitsui Banking Corporation (Japan), Mizuho Financial Group (Japan), State Bank of India (India), Housing Development Finance Corporation (India), ICICI Bank (India), DBS Bank (Singapore), OCBC Bank (Singapore).

According to HTF Market Intelligence, the global Real Estate Loan market is valued at USD 8781 Billion in 2024 and estimated to reach a revenue of USD 22121 Billion by 2033, with a CAGR of 14.11% from 2024 to 2033.

Get inside Scoop of Real Estate Loan Market: https://www.htfmarketintelligence.com/sample-report/global-real-estate-loan-market?utm_source=Krati_OpenPR&utm_id=Krati

Definition:

The Real Estate Loan Market involves financial products designed to fund the purchase, development, or renovation of residential and commercial properties. Loans can include mortgages, construction loans, and refinancing options provided by banks, credit unions, and private lenders. The market encompasses diverse lending mechanisms, interest rate models, and risk management frameworks, serving individuals, investors, and developers across global economies.

Market Trends:

Digital transformation and AI-driven credit assessment tools are reshaping how real estate loans are processed. Fintech integration, blockchain for secure transactions, and online mortgage marketplaces are among the major trends influencing the sector globally.

Market Drivers:

Rising urbanization, growing middle-class income, and increasing infrastructure development are driving strong demand for real estate loans. Governments and financial institutions are also introducing favorable mortgage schemes and digital lending platforms to make property financing more accessible.

Market Opportunities:

Emerging markets in Asia and Africa present large-scale opportunities due to rapid urban growth and government housing initiatives. Green financing and sustainable real estate lending are new growth areas for global lenders.

Fastest-Growing Region:

Asia-Pacific

Dominating Region:

North America

Have Any Query? Ask Our Expert @: https://www.htfmarketintelligence.com/enquiry-before-buy/global-real-estate-loan-market?utm_source=Krati_OpenPR&utm_id=Krati

The Global Real Estate Loan Market segments and Market Data Break Down are illuminated below:

Real Estate Loan Market is Segmented by Application (Home Purchase and Home Equity, Rental Property Financing, Office and Retail Property Loans, Industrial and Warehouse Financing, Hospitality and Leisure Property Loans, Mixed Use Development Financing) by Type (Residential Mortgage Loans, Commercial Real Estate Loans, Construction & Development Loans, Bridge Loans, Refinance Loans, Land Acquisition Loans)

Global Real Estate Loan market report highlights information regarding the current and future industry trends, growth patterns, as well as it offers business strategies to helps the stakeholders in making sound decisions that may help to ensure the profit trajectory over the forecast years.

Geographically, the detailed analysis of consumption, revenue, market share, and growth rate of the following regions:

• The Middle East and Africa (South Africa, Saudi Arabia, UAE, Israel, Egypt, etc.)

• North America (United States, Mexico & Canada)

• South America (Brazil, Venezuela, Argentina, Ecuador, Peru, Colombia, etc.)

• Europe (Turkey, Spain, Turkey, Netherlands Denmark, Belgium, Switzerland, Germany, Russia UK, Italy, France, etc.)

• Asia-Pacific (Taiwan, Hong Kong, Singapore, Vietnam, China, Malaysia, Japan, Philippines, Korea, Thailand, India, Indonesia, and Australia).

Objectives of the Report

• -To carefully analyze and forecast the size of the Real Estate Loan market by value and volume.

• -To estimate the market shares of major segments of the Real Estate Loan

• -To showcase the development of the Real Estate Loan market in different parts of the world.

• -To analyze and study micro-markets in terms of their contributions to the Real Estate Loan market, their prospects, and individual growth trends.

• -To offer precise and useful details about factors affecting the growth of the Real Estate Loan

• -To provide a meticulous assessment of crucial business strategies used by leading companies operating in the Real Estate Loan market, which include research and development, collaborations, agreements, partnerships, acquisitions, mergers, new developments, and product launches.

Read Detailed Index of full Research Study: https://www.htfmarketintelligence.com/report/global-real-estate-loan-market

Major highlights from Table of Contents:

Real Estate Loan Market Study Coverages:

• It includes major manufacturers, emerging player's growth story, and major business segments of Real Estate Loan market, years considered, and research objectives. Additionally, segmentation on the basis of the type of product, application, and technology.

• Real Estate Loan Market Executive Summary: It gives a summary of overall studies, growth rate, available market, competitive landscape, market drivers, trends, and issues, and macroscopic indicators.

• Real Estate Loan Market Production by Region Real Estate Loan Market Profile of Manufacturers-players are studied on the basis of SWOT, their products, production, value, financials, and other vital factors.

Key Points Covered in Real Estate Loan Market Report:

• Real Estate Loan Overview, Definition and Classification Market drivers and barriers

• Real Estate Loan Market Competition by Manufacturers

• Impact Analysis of COVID-19 on Real Estate Loan Market

• Real Estate Loan Capacity, Production, Revenue (Value) by Region (2024-2033)

• Real Estate Loan Supply (Production), Consumption, Export, Import by Region (2024-2033)

• Real Estate Loan Production, Revenue (Value), Price Trend by Type {Residential Mortgage Loans, Commercial Real Estate Loans, Construction & Development Loans, Bridge Loans, Refinance Loans, Land Acquisition Loans}

• Real Estate Loan Manufacturers Profiles/Analysis Real Estate Loan Manufacturing Cost Analysis, Industrial/Supply Chain Analysis, Sourcing Strategy and Downstream Buyers, Marketing

• Strategy by Key Manufacturers/Players, Connected Distributors/Traders Standardization, Regulatory and collaborative initiatives, Industry road map and value chain Market Effect Factors Analysis.

Check for Best Quote: https://www.htfmarketintelligence.com/buy-now?format=1&report=16164?utm_source=Krati_OpenPR&utm_id=Krati

Key questions answered

• How feasible is Real Estate Loan market for long-term investment?

• What are influencing factors driving the demand for Real Estate Loan near future?

• What is the impact analysis of various factors in the Global Real Estate Loan market growth?

• What are the recent trends in the regional market and how successful they are?

Thanks for reading this article; you can also get individual chapter wise section or region wise report version like North America, Middle East, Africa, Europe or LATAM, Southeast Asia.

Nidhi Bhawsar (PR & Marketing Manager)

HTF Market Intelligence Consulting Private Limited

Phone: +15075562445

sales@htfmarketreport.com

About Author:

HTF Market Intelligence Consulting is uniquely positioned to empower and inspire with research and consulting services to enable businesses with growth strategies, by offering services with extraordinary depth and breadth of thought leadership, research, tools, events, and experience that assist in decision-making.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Real Estate Loan Market Current Impact to Make Big Changes| Wells Fargo, Barclays, DBS Bank here

News-ID: 4247029 • Views: …

More Releases from HTF Market Intelligence Consulting Pvt. Ltd.

Precision Medicine Certification Market Hits New High | Major Giants Harvard Med …

The latest study released on the Global Precision Medicine Certification Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Precision Medicine Certification study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major…

Satellite-powered Classrooms Market May See a Big Move | Major Giants OneWeb, Hu …

The latest study released on the Global Satellite-powered Classrooms Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Satellite-powered Classrooms study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major companies profiled…

Floating Schools Innovation Market to Expand Rapidly Over Next Decade| Shidhulai …

The latest study released on the Global Floating Schools Innovation Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Floating Schools Innovation study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major…

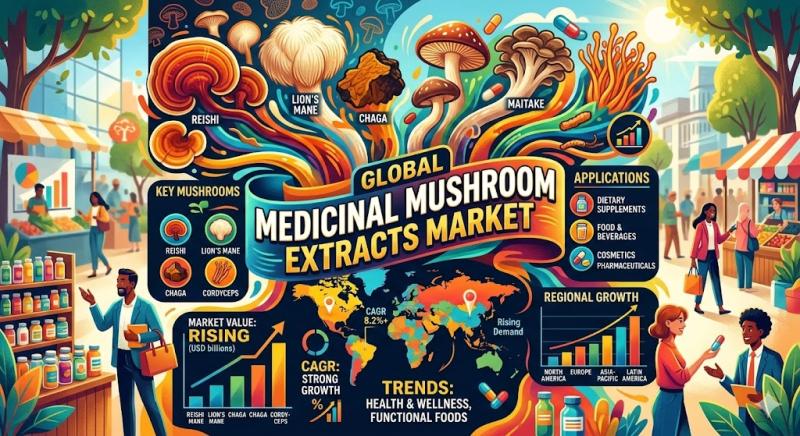

Medicinal Mushroom Extracts Market to Expand Rapidly Over Next Decade| Swanson, …

The latest study released on the Global Medicinal Mushroom Market by HTF MI Research evaluates market size, trend, and forecast to 2033. The Medicinal Mushroom study covers significant research data and proofs to be a handy resource document for managers, analysts, industry experts and other key people to have ready-to-access and self-analysed study to help understand market trends, growth drivers, opportunities and upcoming challenges and about the competitors.

Major companies profiled…

More Releases for Loan

Travel Loan Personal Loan Guide To Finance Domestic And International Trips Easi …

Image: https://www.abnewswire.com/upload/2026/02/71bfa2bd36a80322c40217cb0777143c.jpg

Travel opens up new worlds, fresh perspectives, and unforgettable memories. Whether it is a peaceful beach escape, a mountain adventure, or an international holiday, planning the perfect trip often requires careful budgeting. This is where a travel loan can help you turn your plans into reality without financial stress. As a type of personal loan, it offers flexible funding, easy repayment, and quick access to money, making travel planning…

Navigating the Loan Landscape with Retail Loan Origination Systems

In the world of finance, obtaining a loan is a common practice for individuals looking to buy a home, start a business, or meet various financial needs. Behind the scenes, a crucial player in this process is the Retail Loan Origination System (RLOS). In simple terms, an RLOS is the engine that powers the loan application journey, making it smoother and more efficient for both borrowers and lenders.

Click Here for…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Loan Brokers Market Report 2024 - Loan Brokers Market Trends And Growth

"The Business Research Company recently released a comprehensive report on the Global Loan Brokers Market Size and Trends Analysis with Forecast 2024-2033. This latest market research report offers a wealth of valuable insights and data, including global market size, regional shares, and competitor market share. Additionally, it covers current trends, future opportunities, and essential data for success in the industry.

Ready to Dive into Something Exciting? Get Your Free Exclusive Sample…

Business Loan - What is a Business Loan?

Business Loans are funds available to all types of businesses from banks, non-banking financial companies (NBFCs), or other financial institutions. Business Loans can be tailor-made to meet the specific needs of growing small and large businesses. These loans offer your business the opportunity to scale up and give it the cutting-edge necessary for success in today's competitive world.

Business Loans for the micro-small-medium enterprise (MSME) sector in India are particularly…

Business Loan - Apply Business Loan With Lowest EMI–loanbaba.com

Business loan is the perfect loan option for established entrepreneurs. Typically, it helps in expanding the business. Any idea or plans the business owner may have for the business, he or she can apply business loan with lowest EMI to execute them. But before getting the loan, there are few important steps that need to be followed by the borrower. Step one involves putting together the necessary paperwork. Submission of…