Press release

Philippines Private Equity Market 2025 | Worth USD 33,292.88 Million by 2033

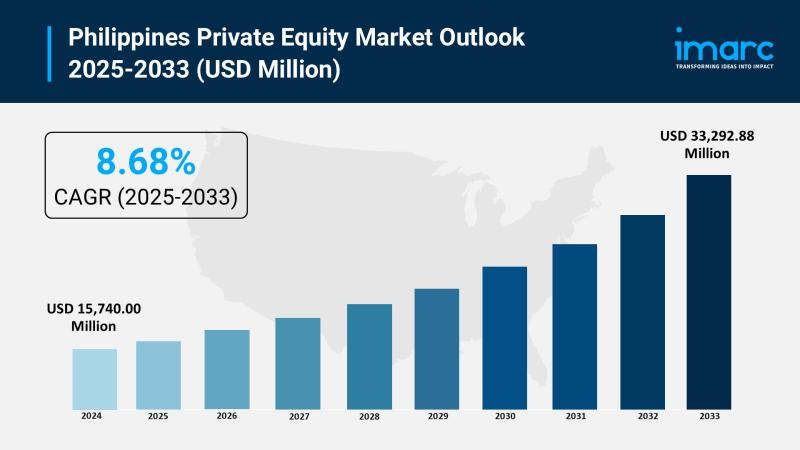

The latest report by IMARC Group, "Philippines Private Equity Market Size, Share, Trends and Forecast by Fund Type and Region, 2025-2033," provides an in-depth analysis of the Philippines private equity market. The report also includes competitor and regional analysis, along with a breakdown of segments within the industry. The Philippines private equity market size reached USD 15,740.00 Million in 2024 and is projected to grow to USD 33,292.88 Million by 2033, exhibiting a growth rate of 8.68% during the forecast period.Report Attributes and Key Statistics:

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 15,740.00 Million

Market Forecast in 2033: USD 33,292.88 Million

Growth Rate (2025-2033): 8.68%

Philippines Private Equity Market Overview:

The Philippines private equity market is gaining momentum propelled by rising investor interest and supportive policy reforms including foreign ownership liberalization and tax incentives. The Philippines ranks close second to Indonesia in Southeast Asia's deal value climbing from 2 percent in 2020 to 19 percent in 2024. Investment surged from USD 220 million in 2014 to over USD 1.3 billion in 2024 representing remarkable 491 percent increase. December 2024 Government Service Insurance System signaled institutional engagement following infrastructure divestment payout. Philippines requires cumulative investment over USD 300 billion through 2040 meeting renewable energy targets. Government removed foreign direct investment restrictions in renewable energy expanding capital pool. Emphasis on innovation digital services sustainability and fintech reshaping investment activity across regions.

Request For Sample Report: https://www.imarcgroup.com/philippines-private-equity-market/requestsample

Philippines Private Equity Market Trends:

Philippines private equity market trends indicate deepening institutional participation and mid-market focus. December 2024 Government Service Insurance System announced infrastructure divestment payout via Macquarie's regional fund highlighting domestic pension funds deploying capital into private equity vehicles. January 2025 Creador expected to close sixth flagship fund at USD 930 million. March 2025 Boston Consulting Group released Philippine Venture Capital Report 2025. July 2025 Macquarie CEO named Australian Government Business Champion leading delegation representing USD 1.1 trillion funds. Private equity firms targeting mid-sized companies in consumer fintech healthcare logistics. Deal volume reached hundreds of transactions in 2024 across energy financial services technology. Technology sector attracting spotlight with fintech online retail healthcare education technology addressing local issues.

Philippines Private Equity Market Drivers:

Drivers include robust economic growth with Philippines second-fastest growing economy in Southeast Asia enjoying 5 to 7 percent annual GDP growth forecast continuing 6 percent annually. Foreign investments surged 127.2 percent in fourth quarter 2023 reaching PHP 394.45 billion. Philippine Economic Zone Authority investment approvals reached over PHP 170 billion January to October 2025 targeting PHP 250 billion goal. Transportation sector 186 awarded public-private partnership projects and 117 pipeline totaling PHP 2.5 trillion. Government liberalizing foreign investment laws lowering corporate income tax to 20 percent from 25 percent granting fiscal incentives. Consumer spending top contributor to GDP. Young digitally native population increasing urbanization and growing demand for renewable energy creating sustained opportunities.

Market Challenges:

• Infrastructure Deficit marked disparities across regions from Metro Manila to rural areas requiring productive infrastructure investment

• Regulatory Complexity navigating regulatory frameworks despite reforms requiring specialized expertise and resources

• Exit Limitations limited secondary market for well-performing assets constraining liquidity options for investors

• Talent Shortage limited availability of experienced private equity professionals and investment teams domestically

• Economic Volatility currency fluctuations peso pressure from current account deficit affecting investment returns

• Political Uncertainty geopolitical tensions and policy changes creating investment risk considerations

• Competition Intensity increasing number of funds competing for quality mid-market investment opportunities

• Operational Challenges varying business practices and governance standards across portfolio companies requiring intensive support

Market Opportunities:

• Infrastructure Investment capitalizing on USD 300 billion renewable energy investment requirements through 2040

• Mid-Market Focus targeting domestic companies in consumer fintech healthcare logistics with high scalability potential

• Institutional Capital leveraging increased pension fund and institutional investor participation in private equity vehicles

• Digital Transformation investing in fintech online retail healthcare technology education technology addressing local needs

• Public-Private Partnerships supporting 186 awarded projects and 117 pipeline projects totaling PHP 2.5 trillion

• Regional Expansion targeting growth opportunities across Luzon Visayas and Mindanao with varying development levels

• Sustainability Focus addressing renewable energy targets with government removing foreign direct investment restrictions

• Export Growth supporting businesses benefiting from trade relationships with top destination United States

Browse the full report with TOC and List of Figures: https://www.imarcgroup.com/philippines-private-equity-market

Philippines Private Equity Market Segmentation:

Fund Type Insights:

• Buyout

• Venture Capital (VCs)

• Real Estate

• Infrastructure

• Others

Regional Insights:

• Luzon

• Visayas

• Mindanao

Philippines Private Equity Market News:

July 2025: Macquarie Group CEO Shemara Wikramanayake named Australian Government's Business Champion for Philippines leading delegation of prominent institutional investors to Philippines representing USD 1.1 trillion of funds and assets under management and companies with USD 78 billion market capitalization. Macquarie teams deployed USD 2 billion capital into eight investments across country with sizeable presence in renewables space including significant stake in Energy Development Corporation largest producer of geothermal energy.

March 2025: Boston Consulting Group and Foxmont Capital Partners released Philippine Venture Capital Report 2025 providing key insights on country's evolving investment landscape. Report highlighting investment pours in challenges in infrastructure and policy remain with Philippines positioning to fully capitalize on growth opportunities demonstrating maturation of private equity venture capital ecosystem.

January 2025: Creador expected to close sixth flagship fund at USD 930 million by mid-January 2025 further strengthening capacity to invest in high-potential markets including Philippines. Firm specializing in identifying opportunities in sectors with high scalability strong management teams potential for long-term value creation with focus on financial services healthcare and business services optimistic activity continuing through 2025.

Key Highlights of the Report:

• Market analysis projecting growth from USD 15,740.00 million (2024) to USD 33,292.88 million (2033) with 8.68% CAGR

• Investment in private equity and venture capital space surged from USD 220 million (2014) to over USD 1.3 billion (2024) representing 491% increase

• Philippines ranks close second to Indonesia in Southeast Asia deal value breakdown climbing from 2% (2020) to 19% (2024)

• October 2024 Creador announced PHP 20 billion investment over next five years with USD 930 million sixth fund closing January 2025

• July 2025 Macquarie delegation representing USD 1.1 trillion funds with CEO named Australian Government Business Champion

• Philippine Economic Zone Authority investment approvals reached over PHP 170 billion from January to October 2025

• Government Service Insurance System December 2024 divestment payout marking institutional engagement turning point

• Philippines requires cumulative investment over USD 300 billion through 2040 to meet renewable energy targets

Frequently Asked Questions (FAQs):

Q1: What are the primary factors driving Philippines private equity market growth to USD 33,292.88 million by 2033?

A1: Market driven by 5-7% annual GDP growth, PE/VC investment surging 491% from USD 220 million (2014) to USD 1.3 billion (2024), corporate tax reduction to 20%, PEZA approvals exceeding PHP 170 billion, and PHP 2.5 trillion PPP projects supporting 8.68% CAGR.

Q2: How are institutional engagement and mid-market focus transforming the Philippines private equity landscape?

A2: December 2024 GSIS infrastructure divestment, July 2025 Macquarie USD 1.1 trillion delegation, January 2025 Creador USD 930 million fund closing with PHP 20 billion commitment, and March 2025 BCG Venture Capital Report demonstrate institutional maturation supporting mid-market deals across fintech healthcare logistics.

Q3: What opportunities exist for private equity stakeholders in emerging Philippines market segments?

A3: Opportunities include USD 300 billion renewable energy investment requirements through 2040, mid-market consumer fintech healthcare logistics companies, institutional capital deployment, digital transformation investments, PHP 2.5 trillion PPP projects, and regional expansion across Luzon Visayas Mindanao supporting diversification.

Note: If you require specific information not currently within the scope of the report, we can provide it as part of the customization.

Ask an analyst for your customized sample: https://www.imarcgroup.com/request?type=report&id=40840&flag=C

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: Sales@imarcgroup.com

Tel. No.: (D) +91 120 433 0800

Americas: +1 201-971-6302

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Philippines Private Equity Market 2025 | Worth USD 33,292.88 Million by 2033 here

News-ID: 4246227 • Views: …

More Releases from IMARC Group

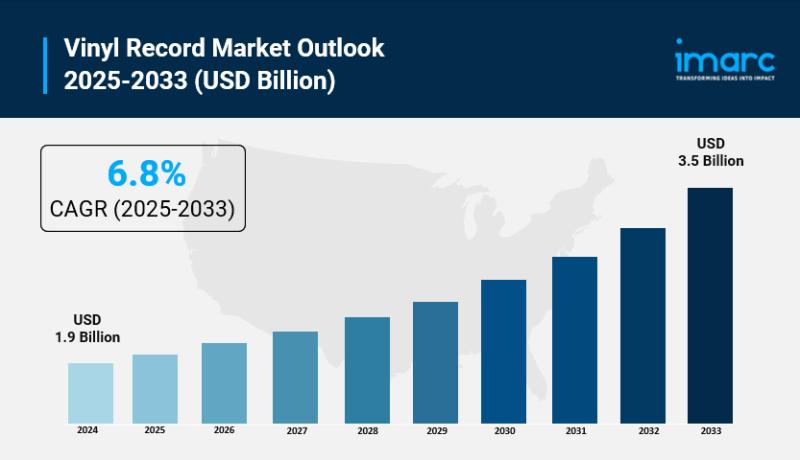

Vinyl Record Market Size to Reach USD 3.5 Billion by 2033 | With a 6.8% CAGR

Market Overview:

According to IMARC Group's latest research publication, "Vinyl Record Market Report by Product (LP/EP Vinyl Records, Single Vinyl Records), Feature (Colored, Gatefold, Picture), Gender (Men, Women), Age Group (13-17, 18-25, 26-35, 36-50, Above 50), Application (Private, Commercial), Distribution Channel (Supermarkets and Hypermarkets, Independent Retailers, Online Stores, and Others), and Region 2025-2033", The global vinyl record market size reached USD 1.9 Billion in 2024. Looking forward, IMARC Group expects the…

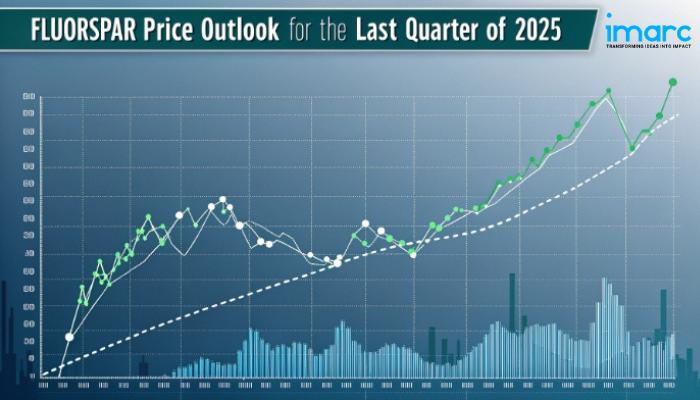

North America Fluorspar Prices Rise in Q4 2025: USA at USD 484/MT, Canada Peaks …

North America Fluorspar Prices Movement Q4 2025:

Fluorspar Prices in USA:

In Q4 2025, fluorspar prices in the USA averaged USD 484 per metric ton. Stable demand from aluminum production and chemical manufacturing supported price levels. Domestic mining operations maintained consistent output, while transportation and energy costs influenced overall supply. Moderate industrial activity and inventory management helped prevent significant price fluctuations across the regional market.

Get the Real-Time Prices Analysis: https://www.imarcgroup.com/fluorspar-pricing-report/requestsample

Note: The analysis…

Brazil Hybrid Electric Vehicle Market: Growth Dynamics, Consumer Shifts, and Com …

The Brazil hybrid electric vehicle market size was 348.75 Thousand Units in 2025 and is forecasted to reach 2,551.74 Thousand Units by 2034, reflecting a CAGR of 24.75% during 2026-2034. This robust expansion is fueled by increasing environmental awareness, rising fuel costs, and government policies aimed at emission reduction. Advances in battery technology and flex-fuel hybrid variants leveraging Brazil's ethanol resources also contribute to market growth.

Sample Request Link: https://www.imarcgroup.com/brazil-hybrid-electric-vehicle-market/requestsample

Study Assumption…

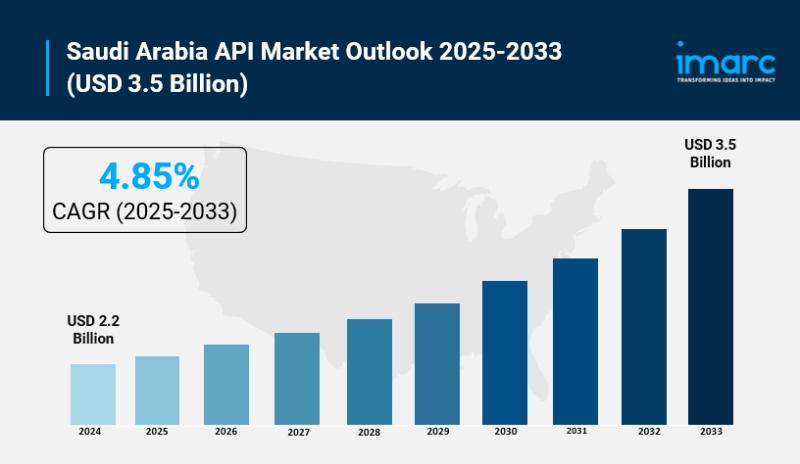

Saudi Arabia API Market Size to Expand USD 3.5 Billion by 2033 at a CAGR of 4.85 …

Saudi Arabia API Market Overview

Market Size in 2024: USD 2.2 Billion

Market Forecast in 2033: USD 3.5 Billion

Market Growth Rate 2025-2033: 4.85%

According to IMARC Group's latest research publication, "Saudi Arabia API Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033", The Saudi Arabia API market size reached USD 2.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.5 Billion by 2033, exhibiting a growth rate…

More Releases for USD

Bone Cement Market Outlook USD 1,871.10M-USD 3,512.31M

How Is the Bone Cement Market Supporting the Rise of Modern Orthopedic Surgery?

The Bone Cement Market plays a critical role in modern orthopedic and spinal procedures, acting as a foundational material for joint replacement, fracture fixation, and vertebral stabilization. Bone cement is widely used to anchor implants, restore bone structure, and improve patient mobility-making it an essential component of musculoskeletal care.

In 2025, the global bone cement market was valued at…

Autologous Cell Therapy Market Outlook USD 9.31B-USD 54.83B

How Is the Autologous Cell Therapy Market Redefining the Future of Precision Medicine?

The Autologous Cell Therapy Market is rapidly emerging as one of the most transformative areas in modern healthcare, offering highly personalized treatment options for complex and chronic diseases. By using a patient's own cells to repair, replace, or regenerate damaged tissues, autologous cell therapy minimizes immune rejection risks while maximizing therapeutic effectiveness.

In 2025, the global autologous cell therapy…

PACS Market USD 5.59B in 2025, USD 9.73B by 2035

Picture Archiving and Communication System (PACS) Market Expands as Digital Imaging Transforms Global Healthcare

Introduction: PACS at the Core of Modern Medical Imaging

The healthcare industry is undergoing a rapid digital transformation, with medical imaging playing a critical role in diagnosis, treatment planning, and patient monitoring. At the heart of this transformation lies the Picture Archiving and Communication System (PACS)-a technology that enables the storage, retrieval, management, and sharing of medical images…

Global HEOR Market USD 1.70B-USD 6.03B

Health Economics and Outcomes Research (HEOR) Market Accelerates as Value-Based Healthcare Redefines Global Decision-Making

Introduction: The Growing Importance of HEOR in Modern Healthcare

The global healthcare industry is undergoing a profound transformation, shifting from volume-driven care models to value-based healthcare systems that prioritize patient outcomes, cost efficiency, and real-world effectiveness. At the center of this transformation lies Health Economics and Outcomes Research (HEOR)-a discipline that evaluates the economic value, clinical outcomes, and…

Foam Tape Market Outlook 2035: Industry Growth from USD USD 4.89 Billion (2025) …

The Foam Tape Market plays a vital role in modern industrial and manufacturing ecosystems. Foam tapes are pressure-sensitive adhesive products manufactured using materials such as polyurethane, polyethylene, PVC, and acrylic foam. These tapes are widely used for bonding, sealing, insulation, cushioning, vibration damping, and noise reduction across multiple industries. Their ability to replace traditional mechanical fasteners like screws, bolts, and rivets has positioned foam tapes as a preferred solution in…

Chlorella Market Reach USD 465.85 Million USD by 2030

Market Growth Fueled by Increased Adoption of Plant-Based Proteins and Health Supplements

Global Chlorella Market size was valued at USD 303.75 Mn. in 2023 and the total Chlorella revenue is expected to grow by 6.3 % from 2024 to 2030, reaching nearly USD 465.85 Mn. . The growth of the market is majorly due to increase in the consumer awareness about health, the inclination towards plant-based food such as chlorella and…