Press release

Australia Dishwasher Market Projected to Reach USD 600.69 Million by 2033

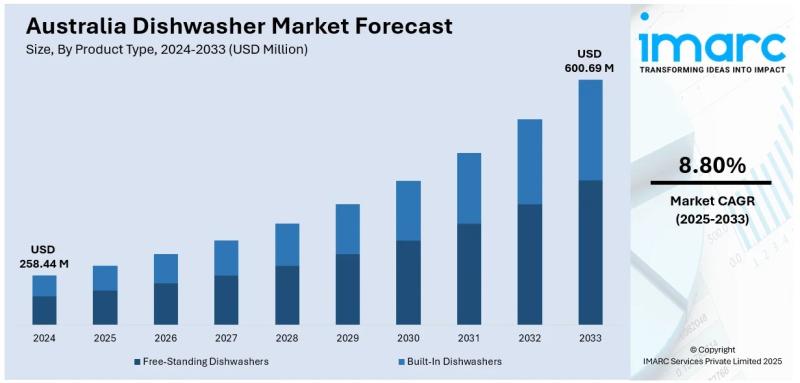

The latest report by IMARC Group, titled "Australia Dishwasher Market Report by Product Type (Free-Standing Dishwashers, Built-In Dishwashers), Distribution Channel (Online, Hypermarket/Supermarket, Multi Branded Stores, Exclusive Stores, Others), End User (Commercial, Residential), and Region 2025-2033," offers comprehensive analysis of the Australia dishwasher market growth. The report includes competitor and regional analysis, along with detailed breakdown of the market segmentation. The Australia dishwasher market size reached USD 258.44 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 600.69 Million by 2033, exhibiting a CAGR of 8.80% during2025-2033.

Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 258.44 Million

Market Forecast in 2033: USD 600.69 Million

Market Growth Rate (2025-2033): 8.80%

Australia Dishwasher Market Overview

Top drivers of growth include: The modern lifestyle requiring convenience by the use of time-saving appliances, Improved lifestyle standards and household disposable income increasing the purchase of premium appliances, Energy-efficiency by reducing the cost of running appliances after learning about sustainable living and electricity costs, Consumer demand for appliances such as dishwashers making minimal noise, especially open-plan living and smaller spaces such as apartments, Urbanization leading to increased adoption of apartment living and increasing popularity of built-in dishwashers, Changing lifestyles where dual income is the concept with the largest proportion of homes occupied by families with two incomes, Product innovation as manufacturers expand offerings with features such as smart connectivity with app-based programming and specialist wash cycles, Price competitiveness of dishwashers within the key brands, especially for consumers from all income brackets, Water-saving features, for sustainable living and reduced water bills, and Lifestyle-based features such as matte finishes and customizable panel colors and finishes that match kitchen colors.

Australia's dishwasher market trends and motivators are energy-efficient dishwashers with inverter motors, eco-wash cycles and smart sensors to match to load size, low-noise dishwashers with advanced sound-proofing and acoustic engineering with a noise output of 45 dB or less, built-in or integrated dishwashers which are increasingly being used by the renovation and new build sectors, high-output and energy-efficient commercial dishwashers for hotels, clubs and the restaurant sector, the rise of e-commerce allowing online appliance purchasing and home delivery services, smart appliances with ThinQ appliance connectivity and app connectivity for remote monitoring, TrueSteam technology for superior cleaning, wine glass racks and adjustable drawer shelves, design-led features in black matte and stainless-steel finishes, and collaborative partnerships between appliance manufacturers and retailers. The Australian Capital Territory and the State of New South Wales have the highest population densities with the highest levels of urbanization. The trend towards quality, efficiency and convenience in consumer purchasing decisions, in addition to manufacturers' focus on innovation and a competitive market make Australia an attractive market for dishwashers, particularly premium-priced models.

Request For Sample Report:

https://www.imarcgroup.com/australia-dishwasher-market/requestsample

Australia Dishwasher Market Trends

• Energy efficiency prioritization: Growing consumer preference for dishwashers with superior energy ratings driven by rising electricity prices and environmental concerns, featuring improved inverter motors, eco-wash programs, smart sensors adjusting energy use based on load size and soil levels meeting stricter regulations.

• Quiet operation emphasis: Low-noise appliances becoming top priority particularly in open-plan layouts and compact apartments, with advanced insulation, quieter inverter motors, and specialized wash programs achieving noise levels below 45 decibels enabling night operation without disrupting household activities.

• Smart connectivity integration: Increasing adoption of dishwashers with app-based controls, Wi-Fi connectivity, remote monitoring capabilities, voice assistant compatibility, and smart sensors optimizing wash cycles based on load detection and soil level assessment enhancing user convenience and efficiency.

• Premium design aesthetics: Rising demand for stylish finishes including matte black, stainless steel, and customizable panel-ready designs matching contemporary kitchen aesthetics, with sleek interfaces and seamless integration capabilities appealing to design-conscious consumers and modern renovations.

• Water conservation focus: Growing interest in models featuring advanced water-saving technologies, multiple spray arm systems, efficient filtration, and eco-friendly wash programs reducing water consumption while maintaining cleaning performance addressing environmental sustainability and utility cost concerns.

• Flexible loading innovation: Enhanced interior configurations with adjustable racks, fold-down tines, specialized wine glass holders, cutlery trays, and third-level racks maximizing capacity and accommodating various dish sizes and shapes improving user convenience and cleaning versatility.

Market Drivers

• Convenience demand increase: Busy modern lifestyles with dual-income households prioritizing time-saving appliances reducing domestic workload, enabling more leisure time, and eliminating manual dishwashing labor particularly appealing to working professionals and families with children.

• Living standards improvement: Rising household disposable incomes and improved economic conditions enabling premium appliance purchases, with consumers willing to invest in quality dishwashers offering long-term convenience, efficiency benefits, and enhanced kitchen functionality.

• Urbanization acceleration: Expanding urban population with apartment living and modern kitchen designs increasing built-in dishwasher adoption, particularly in new constructions and renovations where integrated appliances complement contemporary open-plan layouts and compact spaces.

• Sustainability awareness: Growing environmental consciousness driving preference for energy-efficient and water-saving models reducing household carbon footprint and utility costs, with eco-conscious buyers seeking appliances meeting or exceeding efficiency standards and environmental certifications.

• Electricity cost concerns: Rising energy prices motivating consumers to invest in energy-efficient dishwashers with superior ratings reducing long-term operational costs, featuring technologies that minimize power consumption while maintaining cleaning performance and reliability.

• Product innovation advancement: Manufacturer introduction of next-generation features including smart connectivity, TrueSteam technology for superior cleaning, specialized wash programs for delicate items, and acoustic engineering for quiet operation differentiating products and attracting quality-conscious consumers.

Challenges and Opportunities

Challenges:

• High upfront investment costs with premium energy-efficient and smart-enabled dishwashers requiring substantial initial expenditure creating affordability barriers particularly for budget-conscious consumers and first-time buyers despite long-term savings potential

• Space constraints in older Australian homes with traditional kitchen layouts lacking adequate built-in appliance accommodation requiring costly renovations or limiting consumers to free-standing models affecting premium built-in segment penetration and market expansion

• Water quality variability across Australian regions with hard water areas causing mineral buildup and reducing appliance efficiency requiring additional maintenance, descaling treatments, and potentially shortened lifespan affecting consumer satisfaction and long-term ownership costs

• Competition from hand-washing habits with traditional consumer segments preferring manual dishwashing particularly in smaller households or among older demographics perceiving dishwashers as unnecessary luxury or questioning cleaning effectiveness requiring market education initiatives

Opportunities:

• Smart home integration expansion incorporating AI-powered load detection, automatic detergent dispensing, predictive maintenance alerts, voice assistant compatibility, and energy usage tracking appealing to tech-savvy millennials and Gen Z consumers embracing connected home ecosystems

• Compact and portable segment development designing space-efficient countertop and slimline models for small apartments, studios, and rental properties addressing urban density challenges while maintaining cleaning performance and energy efficiency standards

• Commercial segment growth targeting restaurants, cafes, hotels, and healthcare facilities requiring high-capacity efficient cleaning solutions with rapid cycle times, heavy-duty construction, and sanitization capabilities supporting hospitality and institutional expansion

• Sustainable technology innovation developing eco-friendly materials, recyclable components, water recirculation systems, solar-compatible models, and biodegradable detergent compatibility addressing environmental regulations and conscious consumer preferences differentiating premium offerings

• Rental and subscription models introducing flexible ownership alternatives including appliance rental programs, lease-to-own arrangements, and subscription services with maintenance included lowering entry barriers for budget-conscious consumers and expanding market accessibility

Australia Dishwasher Market Segmentation

By Product Type:

• Free-Standing Dishwashers

• Built-In Dishwashers

By Distribution Channel:

• Online

• Hypermarket/Supermarket

• Multi Branded Stores

• Exclusive Stores

• Others

By End User:

• Commercial

• Residential

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-dishwasher-market

Australia Dishwasher Market News (2024-2025)

• November 2024: Midea Australia announced plans to launch next-generation kitchen, refrigeration, and laundry appliances including stylish dishwashers in Q1 2025, focusing on energy efficiency and customizable designs ranging from innovative refrigerators to tiered laundry solutions meeting modern consumer demands.

• April 2025: LG introduced its quietest dishwasher, the 15 Place QuadWash, in Australia for AUD $1,899, operating at just 40dBA with TrueSteam technology for superior cleaning, wine glass rack, smart connectivity via ThinQ, and sleek Matte Black design enhancing kitchen aesthetics.

• 2024: Major manufacturers increased investment in acoustic engineering and noise reduction technology achieving dishwasher noise levels below 45 decibels responding to consumer demand for quiet operation in open-plan living spaces and compact apartments.

• 2024: Energy-efficient models with improved inverter motors, eco-wash programs, and smart sensors gained market traction as electricity prices rose and environmental concerns prompted consumers to prioritize appliances meeting or exceeding efficiency standards.

• 2024: Online distribution channels expanded significantly with e-commerce platforms offering competitive pricing, convenient purchasing experiences, home delivery services, and virtual product demonstrations increasing dishwasher accessibility across Australian regions.

• 2024: Built-in dishwasher segment experienced growth driven by rising urbanization, modern kitchen renovations, and new construction projects incorporating integrated appliances complementing contemporary open-plan layouts and design aesthetics.

• 2024: Smart connectivity features including Wi-Fi enabled controls, app-based monitoring, voice assistant compatibility, and automated maintenance alerts gained popularity among tech-savvy consumers embracing connected home ecosystems.

• 2024: Manufacturers introduced flexible loading innovations with adjustable racks, fold-down tines, specialized wine glass holders, cutlery trays, and third-level racks maximizing capacity and accommodating various dish sizes improving user convenience.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Product Type, Distribution Channel, End User, and Regional Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=34320&flag=F

Q&A Section

Q1: What drives growth in the Australia dishwasher market?

A1: Market growth is driven by increasing demand for convenience and time-saving appliances amid busy modern lifestyles, improved living standards enabling premium appliance purchases, sustainability awareness driving energy-efficient model preference, rising electricity costs motivating investment in efficient appliances, urbanization acceleration with apartment living increasing built-in dishwasher adoption, and product innovation introducing smart connectivity and advanced features.

Q2: What are the latest trends in this market?

A2: Key trends include energy efficiency prioritization with superior ratings and eco-wash programs, quiet operation emphasis achieving below 45 decibel performance for open-plan layouts, smart connectivity integration with app-based controls and remote monitoring, premium design aesthetics featuring matte black and stainless steel finishes, water conservation focus with advanced saving technologies, and flexible loading innovation with adjustable racks and specialized holders.

Q3: What challenges do companies face?

A3: Major challenges include high upfront investment costs creating affordability barriers for budget-conscious consumers, space constraints in older homes with traditional kitchen layouts limiting built-in segment penetration, water quality variability causing mineral buildup and efficiency reduction, and competition from hand-washing habits requiring market education particularly among traditional consumer segments and older demographics.

Q4: What opportunities are emerging?

A4: Emerging opportunities include smart home integration with AI-powered features and voice assistant compatibility, compact and portable segment development for small apartments and rental properties, commercial segment growth in hospitality and institutional facilities, sustainable technology innovation with eco-friendly materials and water recirculation systems, and rental subscription models lowering entry barriers and expanding market accessibility.

Q5: What is the market forecast for Australia dishwashers?

A5: The Australia dishwasher market was valued at USD 258.44 Million in 2024 and is projected to reach USD 600.69 Million by 2033, exhibiting a CAGR of 8.80% during 2025-2033, driven by convenience demand, living standards improvement, urbanization, sustainability awareness, and continuous product innovation.

Q6: Which features are most important to Australian consumers?

A6: Key consumer priorities include energy efficiency with superior ratings reducing electricity costs, quiet operation below 45 decibels for open-plan living, water-saving capabilities addressing environmental concerns, smart connectivity with app-based controls, flexible loading configurations accommodating various dish sizes, and stylish designs with matte finishes matching contemporary kitchen aesthetics.

Q7: What recent product launches have occurred?

A7: Recent launches include LG's 15 Place QuadWash operating at 40dBA with TrueSteam technology priced at AUD $1,899 in April 2025, and Midea Australia's announced next-generation appliances focusing on energy efficiency and customizable designs scheduled for Q1 2025 release, demonstrating manufacturer focus on performance, aesthetics, and sustainability.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Dishwasher Market Projected to Reach USD 600.69 Million by 2033 here

News-ID: 4246156 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…