Press release

Australia Courier, Express and Parcel Market Projected to Reach USD 17.7 Billion by 2033

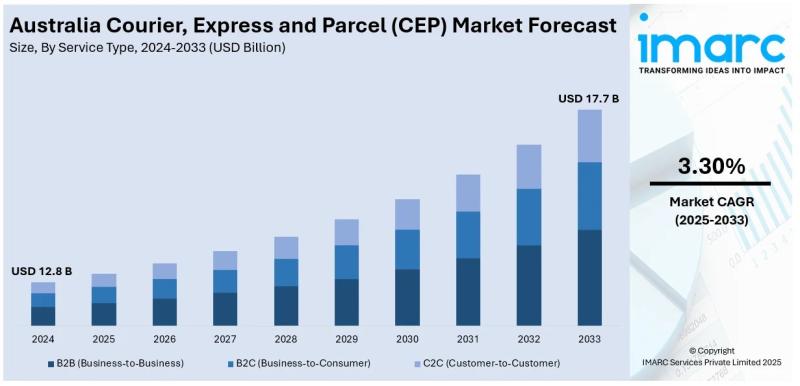

The latest report by IMARC Group, titled "Australia Courier, Express and Parcel (CEP) Market Report by Service Type (B2B (Business-to-Business), B2C (Business-to-Consumer), C2C (Customer-to-Customer)), Destination (Domestic, International), Type (Air, Ship, Subway, Road), End Use Sector (Services (BFSI- Banking, Financial Services and Insurance), Wholesale and Retail Trade (E-commerce), Manufacturing, Construction and Utilities, Others), and Region 2025-2033," offers comprehensive analysis of the Australia courier, express and parcel market growth. The report includes competitor and regional analysis, along with detailed breakdown of the market segmentation. The Australia courier, express and parcel market size reached USD 12.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 17.7 Billion by 2033, exhibiting a CAGR of 3.30% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 12.8 Billion

Market Forecast in 2033: USD 17.7 Billion

Market Growth Rate (2025-2033): 3.30%

Australia Courier, Express and Parcel Market Overview

The Australia courier, express and parcel (CEP) market is experiencing steady growth driven by rapid e-commerce expansion leading to higher parcel volumes and demand for fast, reliable deliveries particularly in post-pandemic era, significant technological advancements with automation, artificial intelligence (AI), and Internet of Things (IoT) powering logistics innovations and operational efficiency, shift towards sustainable eco-friendly logistics practices with electric vehicle adoption and recyclable packaging materials, integration of advanced robotics and warehouse automation processing thousands of orders daily with improved accuracy, and consumer expectations for quicker, more convenient delivery solutions transforming last-mile logistics. The market expansion is supported by major retailers investing in AI-powered fulfillment centers enhancing order processing capabilities, live-tracking tools increasing transparency enabling customers to monitor packages easily, predictive analytics optimizing delivery routes making shipments faster and more cost-effective, regulatory pressure and consumer demand driving green technology adoption, and expanding delivery networks with enhanced logistics infrastructure meeting diverse customer needs.

Australia's CEP industry demonstrates strong performance across B2C segment with e-commerce growth driving residential delivery demands, B2B services supporting business supply chains and inter-company shipments, domestic destinations dominating with extensive road network coverage and metropolitan concentration, air freight enabling express deliveries for time-sensitive shipments, and e-commerce end users creating largest service demand across retail sectors. The proliferation of warehouse robots reducing operational errors and costs, drones and autonomous vehicles transforming last-mile delivery capabilities, electric vehicle fleets supporting sustainability commitments and emission reduction targets, route optimization software minimizing fuel consumption and delivery times, and recyclable packaging innovations addressing environmental concerns is creating favorable market conditions. Australia Capital Territory and New South Wales lead regional growth with high population density, major urban centers including Sydney, and concentrated e-commerce activity. Australia's logistics transformation through technology adoption, combined with sustainability imperatives and evolving consumer delivery expectations from same-day to contactless options, makes it an increasingly dynamic market for CEP innovation and customer-centric service delivery models.

Request For Sample Report:

https://www.imarcgroup.com/australia-courier-express-parcel-market/requestsample

Australia Courier, Express and Parcel Market Trends

• E-commerce acceleration: Fast-growing online shopping particularly in post-pandemic era dramatically increasing parcel volumes, with consumers expecting quicker and more convenient delivery solutions pushing CEP providers to improve operational efficiency, expand networks, and adopt new technologies.

• Automation and robotics integration: Advanced warehouse automation with AI-powered fulfillment centers processing over 10,000 orders daily, robotic sorting systems improving accuracy and speed, autonomous vehicles and drones transforming last-mile delivery, and reducing operational errors and costs.

• Real-time tracking emphasis: Live-tracking tools becoming standard offering increasing transparency and customer confidence, enabling package monitoring throughout delivery journey, providing accurate delivery time estimates, and enhancing customer satisfaction through visibility and communication.

• Sustainable logistics adoption: Companies increasingly using electric delivery vehicles with Australia Post expanding EV fleets, optimizing routes to reduce fuel consumption and emissions, utilizing recyclable packaging materials, and eliminating single-use plastics addressing environmental concerns and regulatory requirements.

• Last-mile innovation: Focus on efficient last-mile delivery solutions including click-and-collect options, parcel lockers in convenient locations, same-day and next-day delivery services, contactless delivery methods, and flexible time slot selections improving customer convenience and reducing failed deliveries.

• Predictive analytics utilization: Advanced data analytics optimizing delivery route planning, forecasting demand patterns for capacity management, improving shipment efficiency and cost-effectiveness, enabling proactive issue resolution, and enhancing overall operational performance through data-driven decision making.

Market Drivers

• E-commerce growth surge: Rapid online shopping expansion particularly accelerated by pandemic driving significant parcel volume increases, with consumers across demographics adopting digital purchasing behaviors and expecting fast, reliable delivery services creating sustained CEP demand across retail categories.

• Technology investment increase: Major retailers and logistics providers investing heavily in AI-powered fulfillment centers, automated sorting facilities, warehouse robotics, IoT tracking systems, and route optimization software enhancing operational efficiency, accuracy, and delivery speed capabilities.

• Consumer expectation evolution: Rising customer demands for quicker delivery options including same-day and next-day services, real-time package tracking transparency, flexible delivery time slots, contactless delivery methods, and convenient collection alternatives transforming service requirements.

• Sustainability imperatives: Regulatory pressure for carbon emission reduction combined with consumer preference for eco-friendly services driving adoption of electric vehicle fleets, route optimization reducing fuel consumption, recyclable packaging materials, and green logistics practices.

• Urban population concentration: High metropolitan population density particularly in Sydney, Melbourne, Brisbane, and Perth creating concentrated delivery volumes, enabling efficient last-mile logistics, supporting parcel locker networks, and facilitating rapid delivery service expansion.

• Cross-border commerce expansion: Growing international e-commerce with Australian consumers purchasing from overseas retailers and domestic businesses exporting products increasing demand for international shipping services, customs clearance expertise, and integrated global logistics solutions.

Challenges and Opportunities

Challenges:

• Last-mile delivery complexity with urban congestion causing delays, traffic restrictions in city centers limiting access, failed delivery attempts due to recipient unavailability increasing costs, and expanding service areas to remote rural regions requiring infrastructure investment and longer transit times

• Rising operational costs with fuel price volatility affecting profitability, labor shortages creating recruitment and retention challenges, wage pressure increasing expenses, fleet maintenance and replacement requirements, and technology infrastructure investments requiring significant capital allocation

• Regulatory compliance burden with varying state and territory regulations creating operational complexity, environmental standards requiring fleet upgrades and sustainable practices, customs procedures for international shipments, and workplace safety requirements increasing administrative overhead and compliance costs

• Customer service expectations with demand for faster delivery times challenging operational capacity, free shipping expectations pressuring margins, return logistics complexities requiring reverse supply chain management, and addressing delivery exceptions and customer complaints requiring dedicated resources

Opportunities:

• Advanced automation adoption implementing AI-powered sorting facilities, robotic warehouse systems, autonomous delivery vehicles, drone technology for remote areas, and machine learning algorithms optimizing operations reducing costs while improving speed, accuracy, and scalability

• Sustainable delivery solutions developing comprehensive electric vehicle fleets, bicycle and e-bike delivery networks for urban areas, carbon-neutral delivery options, solar-powered facilities, and circular economy packaging programs appealing to environmentally conscious consumers and meeting regulatory requirements

• Last-mile innovation expansion establishing extensive parcel locker networks in shopping centers, transit hubs, and residential areas, partnering with convenience stores for click-and-collect services, implementing smart home delivery boxes, and offering flexible delivery windows enhancing customer convenience

• E-commerce partnership growth collaborating with online retailers providing integrated logistics solutions, offering fulfillment services including warehousing and inventory management, developing white-label delivery platforms, and creating seamless customer experiences from purchase to delivery

• Regional and rural service development implementing hub-and-spoke models improving coverage efficiency, deploying drone delivery for remote areas, establishing regional distribution centers, and partnering with local businesses for final-mile delivery expanding market reach and inclusivity

Australia Courier, Express and Parcel Market Segmentation

By Service Type:

• B2B (Business-to-Business)

• B2C (Business-to-Consumer)

• C2C (Customer-to-Customer)

By Destination:

• Domestic

• International

By Type:

• Air

• Ship

• Subway

• Road

By End Use Sector:

• Services (BFSI- Banking, Financial Services and Insurance)

• Wholesale and Retail Trade (E-commerce)

• Manufacturing

• Construction and Utilities

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-courier-express-parcel-market

Australia Courier, Express and Parcel Market News (2024-2025)

• 2024: Coles invested in AI-powered fulfillment center at Wetherill Park in Sydney employing advanced robotics processing over 10,000 orders daily, increasing order accuracy and delivery speed for over five million customers demonstrating major retailer commitment to automation.

• 2024: Australia Post expanded electric vehicle fleet supporting greener deliveries and emission reduction targets, responding to regulatory pressure and consumer demand for sustainable logistics practices while maintaining service quality and efficiency.

• 2024: Amazon eliminated approximately 3 million tonnes of unnecessary packaging since 2015 by replacing single-use plastics with recyclable paper and cardboard materials, demonstrating corporate commitment to environmental sustainability and waste reduction.

• 2024: CEP providers implemented extensive live-tracking tools increasing transparency and customer confidence, enabling real-time package monitoring throughout delivery journey with accurate time estimates enhancing overall customer satisfaction and service quality.

• 2024: Logistics companies deployed predictive analytics systems optimizing delivery route planning, forecasting demand patterns for capacity management, and improving shipment efficiency reducing operational costs while enhancing delivery speed and reliability.

• 2024: Major retailers expanded click-and-collect services and parcel locker networks in shopping centers, transit hubs, and residential areas providing convenient delivery alternatives and reducing failed delivery attempts improving customer convenience and cost efficiency.

• 2024: Warehouse automation technology adoption accelerated with robotic sorting systems, autonomous vehicles, and IoT tracking systems becoming increasingly common reducing operational errors, lowering costs, and improving processing speed across logistics facilities.

• 2024: Same-day and next-day delivery services expanded in major metropolitan areas responding to evolving consumer expectations for faster delivery times, with providers investing in local distribution centers and optimized logistics networks.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Service Type, Destination, Type, End Use Sector, and Regional Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=31799&flag=F

Q&A Section

Q1: What drives growth in the Australia courier, express and parcel market?

A1: Market growth is driven by rapid e-commerce expansion increasing parcel volumes and delivery demands, significant technology investment in AI-powered fulfillment centers and warehouse automation, consumer expectation evolution demanding faster and more convenient delivery options, sustainability imperatives driving electric vehicle adoption and green logistics, urban population concentration enabling efficient last-mile delivery, and cross-border commerce expansion requiring integrated international shipping solutions.

Q2: What are the latest trends in this market?

A2: Key trends include e-commerce acceleration with post-pandemic online shopping surge, automation and robotics integration processing thousands of orders daily, real-time tracking emphasis providing delivery transparency, sustainable logistics adoption with EV fleets and recyclable packaging, last-mile innovation including parcel lockers and flexible delivery options, and predictive analytics utilization optimizing routes and forecasting demand patterns.

Q3: What challenges do companies face?

A3: Major challenges include last-mile delivery complexity with urban congestion and remote area coverage, rising operational costs from fuel volatility and labor shortages, regulatory compliance burden across varying state regulations and environmental standards, and customer service expectations demanding faster deliveries, free shipping, and seamless return logistics while maintaining profitability.

Q4: What opportunities are emerging?

A4: Emerging opportunities include advanced automation adoption with AI sorting and autonomous vehicles, sustainable delivery solutions with comprehensive EV fleets and carbon-neutral options, last-mile innovation expansion through parcel locker networks and smart delivery boxes, e-commerce partnership growth providing integrated fulfillment services, and regional rural service development using hub-and-spoke models and drone technology.

Q5: What is the market forecast for Australia CEP?

A5: The Australia courier, express and parcel market was valued at USD 12.8 Billion in 2024 and is projected to reach USD 17.7 Billion by 2033, exhibiting a CAGR of 3.30% during 2025-2033, driven by e-commerce growth, technological advancement, and evolving consumer delivery expectations.

Q6: Which segments dominate the market?

A6: B2C services dominate due to e-commerce growth driving residential deliveries, domestic destinations lead with extensive road network coverage, road transport remains primary delivery mode for cost-effectiveness and flexibility, and wholesale and retail trade (e-commerce) represents the largest end-use sector creating sustained parcel volume demand.

Q7: What sustainability initiatives are being implemented?

A7: Key sustainability initiatives include Australia Post expanding electric vehicle fleets, Amazon eliminating 3 million tonnes of packaging since 2015 by replacing plastics with recyclable materials, route optimization reducing fuel consumption and emissions, green logistics practices addressing regulatory requirements, and companies investing in solar-powered facilities and carbon-neutral delivery options.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Courier, Express and Parcel Market Projected to Reach USD 17.7 Billion by 2033 here

News-ID: 4246108 • Views: …

More Releases from IMARC Group

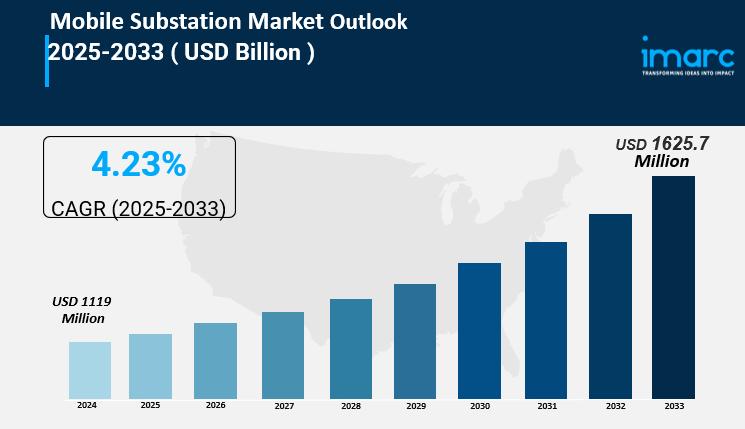

Mobile Substation Market is Expected to Grow USD 1,625.7 Million by 2033 | At CA …

IMARC Group, a leading market research company, has recently released a report titled " Mobile Substation Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2025-2033." The study provides a detailed analysis of the industry, including the Mobile Substation Market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mobile Substation Market…

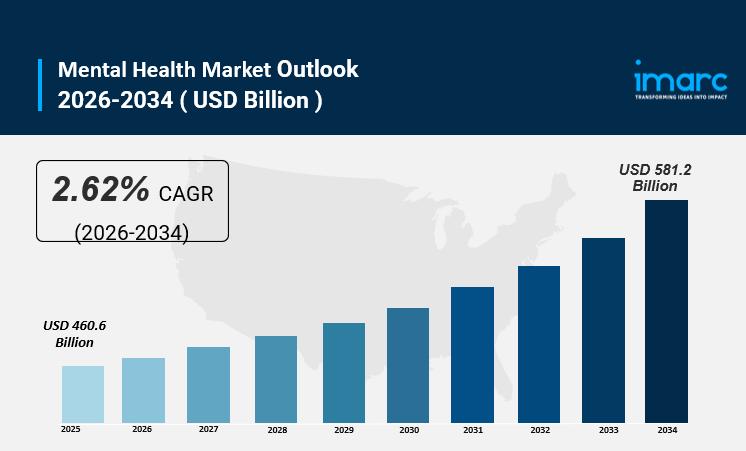

Mental Health Market Size, Share, Trends, and Forecast by Disorder, Service, Age …

IMARC Group, a leading market research company, has recently released a report titled " Mental Health Market Size, Share, Trends and Forecast by Product, Material, Distribution Channel, Pricing, End-User, and Region, 2026-2034."The study provides a detailed analysis of the industry, including the Mental Health Market size, share, trends, and growth forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

Mental Health Market Overview

The…

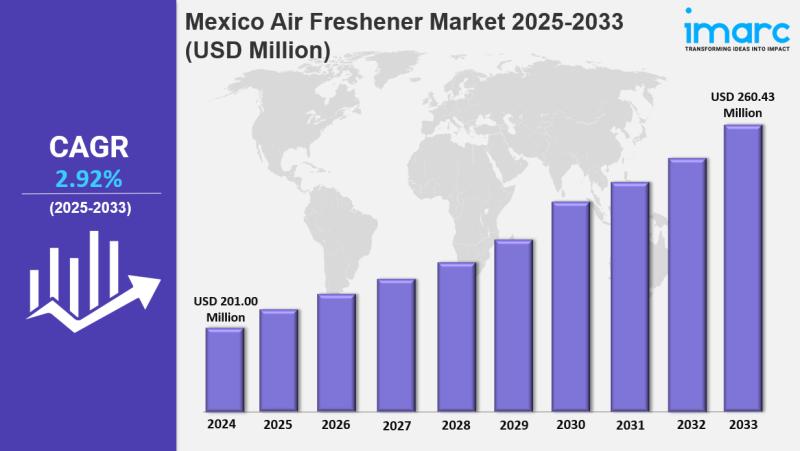

Mexico Air Freshener Market Size, Share, Latest Insights and Forecast to 2033

IMARC Group has recently released a new research study titled "Mexico Air Freshener Market Size, Share, Trends and Forecast by Product Type, Application, Distribution Channel, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico air freshener market reached USD 201.00 Million in 2024 and is projected to grow to USD…

Global Video Conferencing Market Report 2026-2034: Size, Share, Trends & Strateg …

The global video conferencing market size was valued at USD 13.8 Billion in 2025 and is forecasted to reach USD 31.4 Billion by 2034, exhibiting a CAGR of 9.60% during the forecast period of 2026-2034. The market growth is driven by increased reliance on high-speed internet, mobile devices, and the adoption of advanced features that enhance virtual communication. North America leads the market with a share of over 39.8% in…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…