Press release

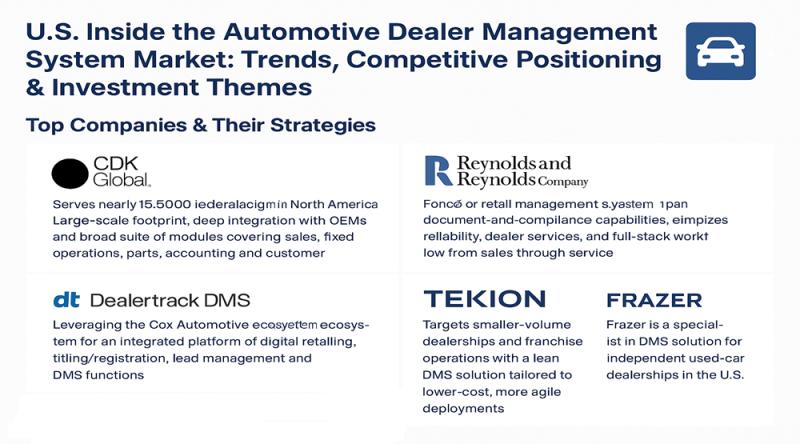

U.S. Inside the Automotive Dealer Management System Market: Trends, Competitive Positioning & Investment Themes

Top Companies & Their StrategiesIn the U.S. automotive dealer management system market, several vendors dominate through scale, technological depth or niche focus. Below are six key players driving competitive dynamics in the DMS arena.

Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-3759

CDK Global

CDK Global is the longstanding market leader serving nearly 15,000 dealer locations in North America. Its strength lies in large-scale footprint, deep integration with OEMs and broad suite of modules covering sales, fixed operations, parts, accounting and customer relationship management. With its legacy in dealership software and established dealer ecosystem, CDK enjoys switching-cost advantage and entrenched market share. However, its legacy architecture and recent high-profile cyber incident (see later) may raise concerns over agility and vulnerability.

The Reynolds and Reynolds Company

Reynolds and Reynolds is another leading incumbent in the DMS space, known for its retail management system (RMS) and deep document-and-compliance capabilities.The firm emphasises reliability, dealer services, and full-stack workflow from sales through service. Its strength is in institutional trust and comprehensive coverage of dealership departments. In contrast, it may face challenges in faster cloud transition and modern user experience compared to newer entrants.

Dealertrack DMS

Dealertrack's DMS offering leverages the Cox Automotive ecosystem to deliver an integrated platform of digital retailing, titling/registration, lead management and DMS functions.Its competitive edge lies in being part of a broader automotive-technology conglomerate, enabling cross-sell of other dealer tools and strong data flows. Dealertrack targets dealerships seeking integrated digital-retail and service workflows. The challenge is competing against the large incumbents on sheer install-base and overcoming inertia of dealers embedded in legacy systems.

Tekion Corp

Tekion is an emerging, cloud-native DMS vendor seeking to disrupt the incumbent landscape. Its Automotive Retail Cloud (ARC) platform is AI-driven, mobile-friendly and built for modern dealerships.Tekion's strength is its innovative architecture, real-time analytics and appeal to progressive dealer groups focused on transformation. However, it must scale installation base, manage complex legacy migrations and overcome customer risk-averse behaviour in a mission-critical system category.

Get deeper insights into competitive positioning and strategic benchmarking: Download our sample U.S Automotive Dealer Management System Market → https://www.researchnester.com/sample-request-3759

Autosoft Corporation

Autosoft targets smaller-volume dealerships and franchise operations with a lean DMS solution tailored to lower-cost, more agile deployments. Its strength is cost-effectiveness, simplicity and appeal to independents and regional groups seeking modern DMS without fortress-scale budgets. The limitation is smaller network effects, less OEM certification and potentially lower switching barriers for competitors.

Frazer Software

Frazer is a specialist in DMS solutions for independent used-car dealerships in the U.S., with cloud-hosting, mobile apps and integration into advertising networks. Its niche strength allows penetration of underserved segments (independent dealers) and offers affordability and ease of use. The trade-off is limited appeal to large franchise groups and less proprietary capability compared to major incumbent DMS vendors.

View our U.S Automotive Dealer Management System Market Report Overview here: https://www.researchnester.com/reports/automotive-dealer-management-system-market/3759

SWOT Analysis (combined for leading companies)

Below is a consolidated SWOT analysis of the leading DMS providers in the U.S. automotive dealer management system market.

Strengths

• The leading vendors (CDK, Reynolds, Dealertrack) benefit from high switching-costs, deep integrations with multiple dealership workflows and large installed bases.

• Many have broad product lines covering sales, service, inventory, parts, and accounting - making them central to dealer operations and giving them recurring revenue streams.

• Emerging players like Tekion introduce modern cloud-native architecture, AI-driven workflows and appeal to digitally mature dealers - enhancing differentiation in a slowly evolving market.

Weaknesses

• Many incumbent DMS systems were originally built as on-premises or older architectures, making cloud transition, user-experience redesign and rapid innovation difficult.

• Vendor lock-in and legacy deployments may slow adoption among dealers seeking agility; newcomers (such as Tekion or Autosoft) might struggle to convince large enterprises to migrate.

• Dependence on dealership budgets (which vary cyclically with vehicle sales) introduces operational risk; smaller dealers may find full-stack DMS cost-prohibitive, allowing niche competitors to undercut incumbents.

Opportunities

• The push for digital retailing (online vehicle sales, remote service bookings), rising electrification of vehicles and connected-dealer operations create demand for modern DMS capabilities (real-time data, AI analytics, cloud) in the U.S. automotive dealer management system market.

• Consolidation among dealer groups (multi-location roll-ups) opens opportunities for DMS vendors to offer enterprise-grade, multi-site solutions and cross-sell value-added modules (CRM, business intelligence, service-upsell).

• Regulatory changes (data security, privacy), parts-service monetisation and aftermarket growth can drive upgrades among dealers, creating refresh cycles for DMS deployments.

Threats

• Cybersecurity incidents and vendor concentration pose systemic risk: a major outage or hack can erode trust in large DMS providers and open doors for new entrants.

• Competitive disruption from cloud-native entrants and mid-market specialists may erode market share of incumbents if they do not adapt quickly.

• Dealer consolidation and shifting margins (e.g., pressure on fixed-ops profits, rising used-car volatility) may reduce budgets for DMS upgrades or extend replacement cycles.

Interested in a customized SWOT for your target competitor? Request your tailored assessment → https://www.researchnester.com/sample-request-3759

Investment Opportunities & Trends

Within the U.S. automotive dealer management system market, several strategic investment themes are worth monitoring.

M&A activity and consolidation: Traditional DMS providers may seek acquisitions of niche players (cloud-native vendors, service-oversight platforms, aftermarket analytics) to bolster capabilities across the dealer lifecycle. Observe smaller DMS or adjacencies being acquired by larger tech/auto-services firms, as the "dealer technology stack" expands beyond core DMS.

Funding in startup/modern-architecture DMS platforms: Companies like Tekion that offer cloud-native, AI-enabled dealer management systems represent attractive growth opportunities in a segment hungry for modernisation. Investors can consider exposure to next-generation DMS providers aiming to displace legacy incumbents.

Technology integration-digital retail, AI analytics, connected service: The integration of DMS with online retailing, remote sales, service-lane connectivity and AI analytics is a key trend. Dealers increasingly demand systems that do more than run operations-they must enable customer engagement, inventory optimisation and aftermarket revenue growth. Firms that deliver these integrated capabilities in the U.S. automotive dealer management system market are attractive strategic targets.

Regional expansion and independent-dealer segment: While large franchise groups dominate major DMS deployments, there is a large underserved market of independent and used-car dealers. Firms targeting this segment (e.g., Autosoft, Frazer) with cost-effective solutions offer scaled-down investment opportunities in the DMS market.

Recent notable events (last 12 months)

• CDK Global agreed to pay a US$630 million settlement to resolve antitrust claims that it restricted access to dealer data, underscoring regulatory risks in the dealer-DMS market.

• Tekion won a major multi-store pilot with a large U.S. dealership group (Ken Garff Automotive Group) in which it will replace incumbent DMS at selected locations - illustrating competition dynamics shifting in DMS.

• The June 2024 cyber-attack on CDK's systems disrupted operations at thousands of dealerships, highlighting the threat of vendor reliance and opening the door for alternative DMS solutions built on resilience.

Get exclusive intelligence on M&A, funding pipelines and regional opportunities: Download your sample report → https://www.researchnester.com/sample-request-3759

Related News:

https://www.linkedin.com/pulse/what-future-automotive-wheel-rims-market-biohealth-trends-5q23f/

https://www.linkedin.com/pulse/can-radar-detectors-keep-up-evolving-vehicle-technologies-aixaf/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release U.S. Inside the Automotive Dealer Management System Market: Trends, Competitive Positioning & Investment Themes here

News-ID: 4245358 • Views: …

More Releases from Research Nester Pvt Ltd

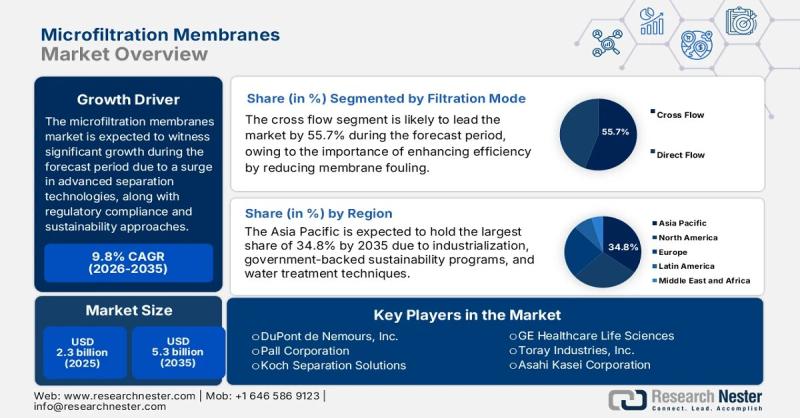

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for DMS

Dimethyl Sebacate(DMS) Market Size And Global Industry Forecast 2034

"The Dimethyl Sebacate Market Is Set To Grow At An Estimated CAGR Of 6% From 2025 To 2034, Rising From $300 Million In 2024 To $500 Million By 2034."

On May , 2025, Exactitude Consultancy., Ltd. released a research report titled "Dimethyl Sebacate(DMS) Market". This report covers the global Dimethyl Sebacate(DMS) market sales, sales volume, price, market share, ranking of major companies, etc., and provides a detailed analysis by region, country,…

HBS Systems Earns Elite Status Kubota DMS Certification

HBS Systems, a leading provider of dealership management solutions for agricultural and heavy equipment dealerships, proudly announces its attainment of Elite Status in the prestigious Kubota Dealership Management System Certification (DMS) for 2024. This significant achievement follows a rigorous two-year certification process spanning 2022 to 2023, during which HBS Systems demonstrated exceptional performance in project participation, timely deliverables, and dealer usage statistics.

Certified with an impressive score of 484 points out…

Massage Gun Market is Going to Boom : DMS, Hyperice, Pleno

HTF MI introduces new research on Massage Gun covering the micro level of analysis by competitors and key business segments (2023-2029). The Massage Gun explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing.

Some of the major key players profiled…

Digital Marketing Software (DMS) Market Set for More Growth

The Digital Marketing Software (DMS) market has witnessed growth from USD XX million to USD XX million from 2017 to 2022. With the CAGR of X.X%, this market is estimated to reach USD XX million in 2029.

The report focuses on the Digital Marketing Software (DMS) market size, segment size (mainly covering product type, application, and geography), competitor landscape, recent status, and development trends. Furthermore, the report provides detailed cost analysis,…

Automotive DMS Market (Driver Monitoring System) Size, Industry Chain, Developme …

Automotive DMS Market research: the installations of DMS soared by 244% on a like-on-like basis in the first nine months of 2021.

Our data show that in the first nine months of 2021, China sold 251,511 sets of DMS for new passenger cars, 244% more than in the same period of the previous year, of which 15,201 sets, or 6% of the total were for joint venture brand cars, and 236,310…

Devacon presents ECM solution eMODAT at DMS Expo in Stuttgart

Devacon GmbH is participating as one of the exhibitors of the DMS Expo taking place in Stuttgart from 24th to 26th September. The leading trade fair for business IT is the perfect venue for the software developers to display their mobile data capturing software eMODAT which allows users to manage workflows via smartphone and tablet PC. During those three days Devacon is supported by the IT consulting company milanconsult, a…