Press release

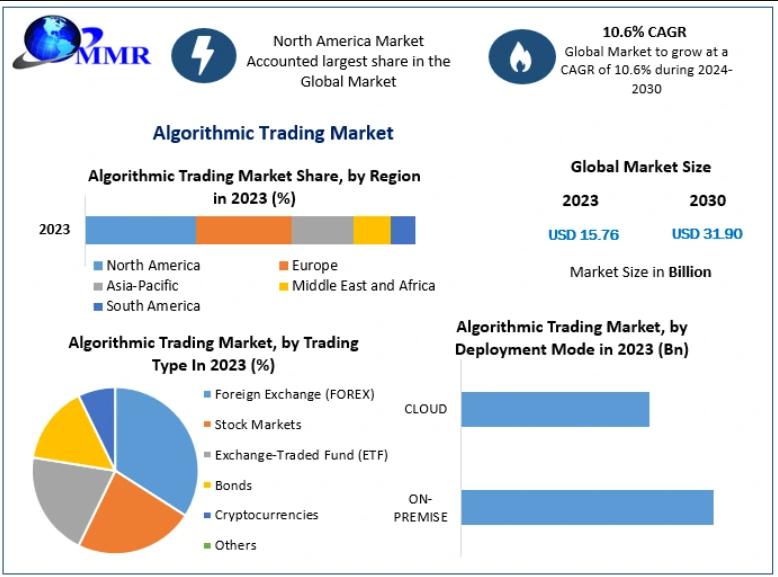

Algorithmic Trading Market Valued at USD 15.76 Billion in 2023, Expected to Reach USD 31.90 Billion by 2030, Growing at a CAGR of 10.6%

Global Algorithmic Trading Market size was valued at USD 15.76 Bn. in 2023 and the total Algorithmic Trading revenue is expected to grow by 10.6 % from 2024 to 2030, reaching nearly USD 31.90 Bn.Algorithmic Trading Market Overview:

The Algorithmic Trading Market is driven by the increasing automation of trading processes across global financial institutions. Algorithmic trading involves the use of pre-programmed computer instructions to execute trades based on parameters such as price, timing, and volume, offering traders an edge over traditional manual methods through superior speed and accuracy. The technology leverages advanced mathematical models, artificial intelligence (AI), and data analytics to make real-time trading decisions and execute large volumes of transactions efficiently. The adoption of high-frequency trading (HFT) systems, which enable thousands of trades per second, has further enhanced market liquidity and operational efficiency. The growing integration of algorithmic solutions in financial institutions to optimize trade execution, reduce costs, and improve accuracy continues to propel market expansion.

Download a Free Sample Report Today:https://www.maximizemarketresearch.com/request-sample/29843/

Algorithmic Trading Market Dynamics:

The market growth is primarily fueled by technological advancements in AI, machine learning, and cloud computing, which have transformed trading ecosystems. Institutional investors and brokerage firms are increasingly adopting algorithmic trading to minimize human error, lower transaction costs, and improve trade precision. The growing need for market surveillance, coupled with favorable government regulations promoting transparency and fairness, also supports market growth. Moreover, the rise of AI-driven trading strategies enables traders to process vast amounts of financial data, identify patterns, and execute profitable trades faster than manual methods. However, the lack of risk valuation capabilities and the potential for system failures or market manipulation pose challenges to market stability. Despite these constraints, the increasing digital transformation in financial services and the integration of blockchain and data analytics offer lucrative opportunities for sustained market development.

Algorithmic Trading Market Outlook and Future Trends:

The Algorithmic Trading Market is expected to witness robust growth from 2025 to 2032, driven by increasing automation and the adoption of AI-powered trading solutions across global financial institutions. The growing prominence of high-frequency and quantitative trading, along with the development of hybrid AI-algorithmic systems, will reshape trading strategies. The use of cloud-based algorithmic trading platforms is projected to expand due to scalability, cost efficiency, and real-time analytics capabilities. Additionally, the adoption of AI and big data analytics will enhance predictive modeling and improve portfolio optimization. North America will continue to dominate due to strong regulatory support, technological infrastructure, and high market liquidity, while Asia Pacific is anticipated to experience the fastest growth owing to increasing investments in trading technologies and expanding digital finance ecosystems. The trend toward decentralized finance (DeFi) and algorithmic cryptocurrency trading is also expected to open new avenues for innovation and profitability.

Algorithmic Trading Market Key Recent Developments:

In March 2021, Virtu Financial acquired Investment Technology Group (ITG) to strengthen its broker-neutral client offerings and enhance its Client Information Security Program (CISP).

AlgoTrader launched AlgoTrader 6.0 in March 2021, introducing new crypto exchange adapters for Deribit, Huobi, Kraken, and Bithumb, along with full Level II Order Book data support for enhanced trading visibility.

Financial institutions globally are increasingly investing in AI-driven algorithmic platforms to improve trading efficiency, predictive analysis, and regulatory compliance.

The growing integration of blockchain technology and data analytics into algorithmic trading systems is enabling more transparent, secure, and efficient trading environments, paving the way for next-generation trading models.

To Gain More Insights into the Market Analysis, Browse Summary of the Research Report:https://www.maximizemarketresearch.com/request-sample/29843/

Algorithmic Trading Market Segmentation:

by Component

Solutions

Platforms

Software Tools

Services

Professional Services

Managed Services

by Trading Type

Foreign Exchange (FOREX)

Stock Markets

Exchange-Traded Fund (ETF)

Bonds

Cryptocurrencies

Others

by Deployment Mode

ON-PREMISE

CLOUD

by Enterprise Size

SME's

Large Enterprises

Some of the current players in the Algorithmic Trading Market are:

1. Algo Trader GmbH (Switzerland)

2. Trading Technologies (USA)

3. Info Reach (USA)

4. Tethys Technology (USA)

5. Lime Brokerage LLC (USA)

6. Flex Trade Systems (USA)

7. Tower Research Capital (USA)

8. Virtu Financial (USA)

9. Hudson River Trading (USA)

10. Citadel (USA)

11. Technologies International (USA)

12. Argo Software Engineering (USA)

13. Automated Trading Soft-Tech (India)

14. Kuberre Systems (USA)

15. Meta Quotes Software Corp. (Cyprus)

16. Software AG (Germany)

17. Thomson Reuters Corporation (Canada)

18. uTrade (India)

19. Vela Trading Systems LLC (USA)

For additional reports on related topics, visit our website:

♦ Low-Code Development Platform Market https://www.maximizemarketresearch.com/market-report/global-low-code-development-platform-market/55407/

♦ Global Power Management Integrated Circuit (PMIC) Market https://www.maximizemarketresearch.com/market-report/global-power-management-integrated-circuit-pmic-market/10740/

♦ Global Online On-Demand Home Services Market https://www.maximizemarketresearch.com/market-report/global-online-on-demand-home-services-market/39167/

♦ Cloud Kitchen Market https://www.maximizemarketresearch.com/market-report/global-cloud-kitchen-market/109430/

♦ Higher Education Market https://www.maximizemarketresearch.com/market-report/global-higher-education-market/7167/

MAXIMIZE MARKET RESEARCH PVT. LTD.

⮝ 3rd Floor, Navale IT park Phase 2,

Pune Banglore Highway, Narhe

Pune, Maharashtra 411041, India.

✆ +91 9607365656

🖂 sales@maximizemarketresearch.com

Maximize Market Research is a premier market research and consulting firm known for its comprehensive insights and actionable business strategies across diverse sectors such as healthcare, automotive, technology, and pharmaceuticals. The company is dedicated to providing accurate data, forward-thinking analysis, and strategic guidance that empower organizations to uncover new growth opportunities, mitigate potential risks, and drive sustainable success. With a strong blend of advanced research techniques and deep industry expertise, Maximize Market Research helps businesses make informed decisions, optimize performance, and enhance their competitive positioning in the global marketplace.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Algorithmic Trading Market Valued at USD 15.76 Billion in 2023, Expected to Reach USD 31.90 Billion by 2030, Growing at a CAGR of 10.6% here

News-ID: 4244986 • Views: …

More Releases from MAXIMIZE MARKET RESEARCH PVT. LTD.

Procurement Software Market Forecast: Automation, Analytics and Cloud Adoption

Procurement Software Market size was valued at USD 8.18 billion in 2024, and the total revenue is expected to grow at CAGR of 10.8 % from 2025 to 2032, reaching nearly USD 18.58 billion.

Procurement Software Market Overview:

The procurement software market is a core component of enterprise digital transformation, enabling organizations to automate, standardize, and optimize purchasing activities across goods and services. Procurement software solutions support functions such as supplier discovery,…

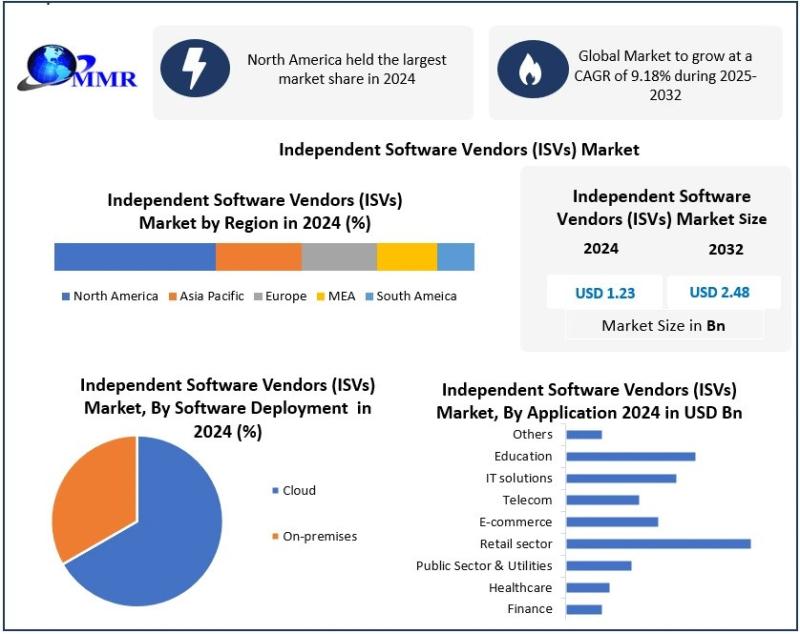

What Is Driving Growth in the Independent Software Vendors (ISVs) Market?

Independent Software Vendors (ISVs) Market was valued at USD 1.23 Bn in 2024, and total global Independent Software Vendors (ISVs) Market revenue is expected to grow at a CAGR of 9.18% and reach nearly USD 2.48 Bn from 2025 to 2032. Driven by Rising Demand for Multi-cloud & Hybrid Cloud.

Independent Software Vendors (ISVs) Market Overview:

The Independent Software Vendors (ISVs) market represents a critical layer of the global software ecosystem, delivering…

India Lighting Market Analysis: Industry Dynamics and Growth Forecast

India Lighting Market size was valued at USD 4139.2 Million in 2024 and the total India Lighting Market size is expected to grow at a CAGR of 7.1% from 2025 to 2032, reaching nearly USD 7674 Million by 2032.

India Lighting Market Overview:

The India lighting market is a rapidly evolving sector driven by urbanization, infrastructure expansion, and the transition toward energy-efficient illumination solutions. Lighting demand spans residential, commercial, industrial, and outdoor…

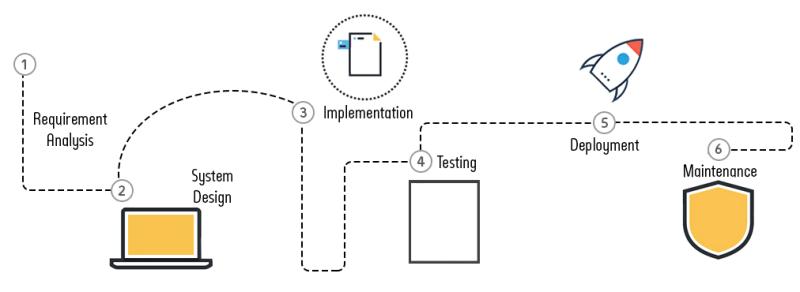

Custom Software Development Services Market Forecast: Cloud, AI and DevOps Trend …

Agricultural Waste Market size was valued at USD 20.20 Billion in 2025 and the total Agricultural Waste revenue is expected to grow at a CAGR of 7.20% from 2025 to 2032, reaching nearly USD 32.86 Billion by 2032.

Custom Software Development Services Market Overview:

The custom software development services market plays a pivotal role in enabling enterprises to align digital systems with specific operational, regulatory, and customer-experience requirements. Unlike off-the-shelf solutions, custom…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…