Press release

Crypto Credit Card Market Development Driven by User Demand for Secure and Flexible Blockchain-Based Payment Options

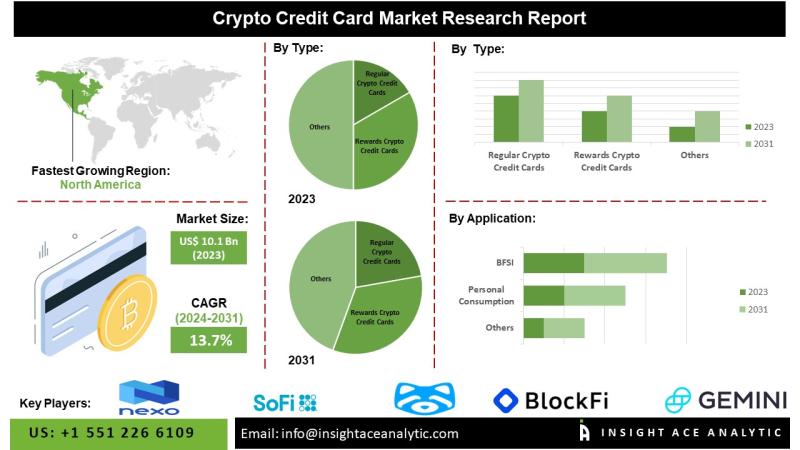

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Crypto Credit Card Market - (By Type (Regular Crypto Credit Cards, Rewards Crypto Credit Cards, Others), By Application (BFSI, Personal Consumption, Business, Others)), Trends, Industry Competition Analysis, Revenue and Forecast To 2034."According to the latest research by InsightAce Analytic, the Global Crypto Credit Card Market is valued at USD 1.6 billion in 2024, and it is expected to reach USD 9 billion by the year 2034 with a CAGR of 19.0% during the forecast period of 2025-2034.

Get Free Access to Demo Report, Excel Pivot and ToC: https://www.insightaceanalytic.com/request-sample/2652

The crypto credit card market is experiencing rapid evolution, functioning as a pivotal interface between conventional financial systems and the expanding digital asset economy. These cards enable the seamless, real-time conversion of cryptocurrencies into fiat currencies at the point of transaction, allowing users to leverage their digital assets for everyday purchases across global merchant networks. Major industry players are increasingly introducing innovative solutions that support leading cryptocurrencies, including Bitcoin and Ethereum, to enhance transactional efficiency, accessibility, and financial flexibility for consumers.

Ongoing regulatory developments and strategic collaborations between fintech innovators and traditional financial institutions are playing a crucial role in advancing the market. These efforts address key challenges related to transaction security, regulatory compliance, and user trust-factors essential for broader adoption.

Additionally, growing consumer engagement with cryptocurrencies, fueled by both investment appeal and their expanding utility in everyday financial interactions, continues to accelerate market growth. Collectively, these trends are positioning crypto credit cards as a transformative financial tool that effectively bridges the gap between legacy banking systems and the decentralized finance (DeFi) landscape.

List of Prominent Players in the Crypto Credit Card Market:

• Nexo Mastercard

• BlockFi Visa Card

• Crypto.com Visa Card

• Gemini Mastercard

• Shakepay Visa

• SoFi Credit Card

• Coinbase Visa

• Bitpay Mastercard

• Wirex Visa

• Club Swan Mastercard

Expert Knowledge, Just a Click Away: https://calendly.com/insightaceanalytic/30min?month=2025-03

Market Dynamics

Drivers:

The crypto credit card market is expanding rapidly, supported by several fundamental growth drivers. A primary catalyst is the increasing mainstream acceptance of cryptocurrencies as legitimate financial assets for both investment and everyday transactions. This growing recognition has fueled demand for innovative financial instruments that seamlessly bridge digital and traditional currencies. Crypto credit cards have emerged as a key enabler in this evolution, allowing users to convert and spend their cryptocurrency holdings in real time across global merchant networks.

Technological advancements in payment processing and blockchain integration have substantially enhanced transaction speed, reliability, and security, making these cards more attractive to a broader consumer base. Moreover, the inclusion of major cryptocurrencies such as Bitcoin and Ethereum, combined with dynamic conversion mechanisms that mitigate volatility risks, has strengthened user confidence and expanded market accessibility. Collectively, these innovations are driving the global adoption of crypto credit cards and reinforcing their role as a cornerstone of the evolving digital payments ecosystem.

Challenges:

Despite its strong growth trajectory, the crypto credit card market faces several significant challenges. Regulatory ambiguity remains one of the most pressing issues, as the absence of standardized global frameworks complicates compliance with anti-money laundering (AML) and know-your-customer (KYC) regulations. This uncertainty increases operational costs and constrains cross-border market expansion. In addition, cryptocurrency price volatility presents financial risks for both users and service providers, potentially undermining transactional stability and discouraging widespread merchant adoption.

Cybersecurity threats also pose a critical challenge, as the broader digital asset ecosystem remains vulnerable to hacking, phishing, and data breaches. While blockchain technology provides a secure foundation, the surrounding infrastructure-including payment gateways and user interfaces-requires continual enhancement to maintain trust and safeguard user assets. Addressing these challenges through regulatory clarity, risk mitigation strategies, and advanced security measures will be essential to ensuring the sustained growth and credibility of the crypto credit card market.

Regional Trends:

North America is projected to dominate the global crypto credit card market, driven by a well-established fintech ecosystem, a large base of cryptocurrency users, and relatively mature regulatory frameworks that encourage innovation. The United States, in particular, has witnessed substantial investment in crypto-enabled financial solutions, fostering early adoption and market leadership.

Europe also represents a key market, supported by increasing consumer awareness, the growing integration of crypto assets into mainstream finance, and supportive policy developments in certain countries. Meanwhile, the Asia-Pacific (APAC) region is emerging as a high-growth market, with Japan and South Korea at the forefront due to high cryptocurrency adoption rates and technologically advanced financial infrastructures.

However, regulatory inconsistencies across APAC markets continue to pose deployment challenges, as some countries actively embrace digital currencies while others adopt a more cautious or restrictive stance. Despite this, the region's expanding digital economy and rising fintech innovation are expected to drive long-term opportunities for crypto credit card adoption.

Unlock Your GTM Strategy: https://www.insightaceanalytic.com/customisation/2652

Recent Developments

• In July 2021, Visa launched a crypto rewards card in partnership with BlockFi. Card recipients were able to earn 1.5% back in Bitcoin on every purchase they made. Furthermore, cardholders received a 3.5% Bitcoin rewards rate for the first 90 days.

Segmentation of Crypto Credit Card Market-

By Type-

• Regular Crypto Credit Cards

• Rewards Crypto Credit Cards

• Others

By Application-

• BFSI

• Personal Consumption

• Business

• Others

By Region-

North America-

• The US

• Canada

• Mexico

Europe-

• Germany

• The UK

• France

• Italy

• Spain

• Rest of Europe

Asia-Pacific-

• China

• Japan

• India

• South Korea

• South East Asia

• Rest of Asia Pacific

Latin America-

• Brazil

• Argentina

• Rest of Latin America

Middle East & Africa-

• GCC Countries

• South Africa

• Rest of Middle East and Africa

Read Overview Report- https://www.insightaceanalytic.com/report/crypto-credit-card-market/2652

About Us:

InsightAce Analytic is a market research and consulting firm that enables clients to make strategic decisions. Our qualitative and quantitative market intelligence solutions inform the need for market and competitive intelligence to expand businesses. We help clients gain competitive advantage by identifying untapped markets, exploring new and competing technologies, segmenting potential markets and repositioning products. Our expertise is in providing syndicated and custom market intelligence reports with an in-depth analysis with key market insights in a timely and cost-effective manner.

Contact us:

InsightAce Analytic Pvt. Ltd.

Visit: https://www.insightaceanalytic.com/

Tel : +1 607 400-7072

Asia: +91 79 72967118

info@insightaceanalytic.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Crypto Credit Card Market Development Driven by User Demand for Secure and Flexible Blockchain-Based Payment Options here

News-ID: 4244339 • Views: …

More Releases from Insightace Analytic Pvt Ltd.

Automotive Lead Acid Battery Market Strategic Growth Drivers and Outlook 2026 to …

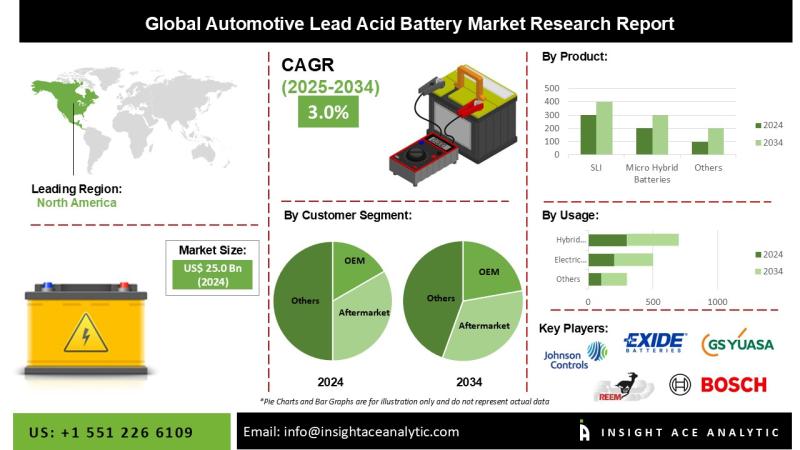

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Lead Acid Battery Market Size, Share & Trends Analysis Report By Product (SLI and Micro-Hybrid Batteries), Type (Flooded, Enhanced Flooded, and VRLA), Customer Segment (OEM and Aftermarket), End User (Passenger Car, Light Commercial Vehicles, Heavy Commercial Vehicles, Two-Wheeler, and Three-Wheeler), and Application (Hybrid Vehicles, Electric Vehicles, Light Motor Vehicles, and Heavy Motor Vehicles)- Market…

Automotive Interior Market Investment Opportunities and Forecast 2026 to 2035

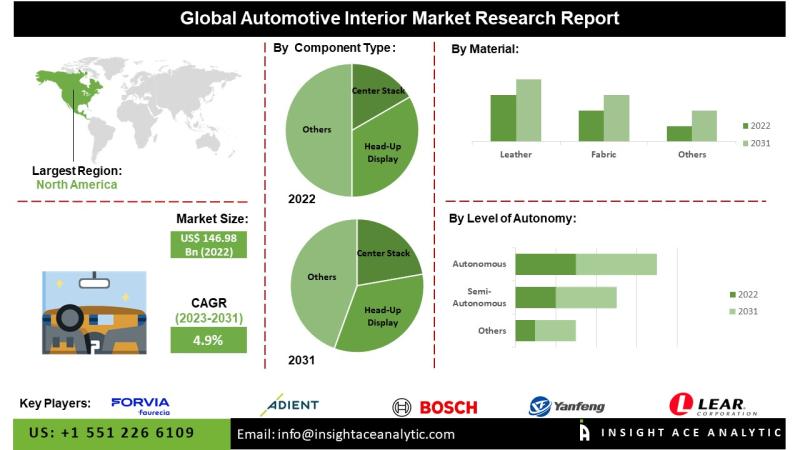

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Automotive Interior Market- (By Component Type (Center Stack, Head-up Display, Instrument Cluster, Rear Sear Entertainment, Dome Module, Headliner, Seat, Interior Lighting Door Panel, Center Console, Adhesives & Tapes, Upholstery, Others), By Material (Leather, Fabric, Vinyl, Wood, Glass Fiber Composite, Carbon Fiber Composite, Metal), By Level of Autonomy (Semi-Autonomous, Autonomous, Non-Autonomous),By Electric Vehicle (Battery Electric Vehicle…

Artificial General Intelligence Market Future Landscape and Industry Evolution 2 …

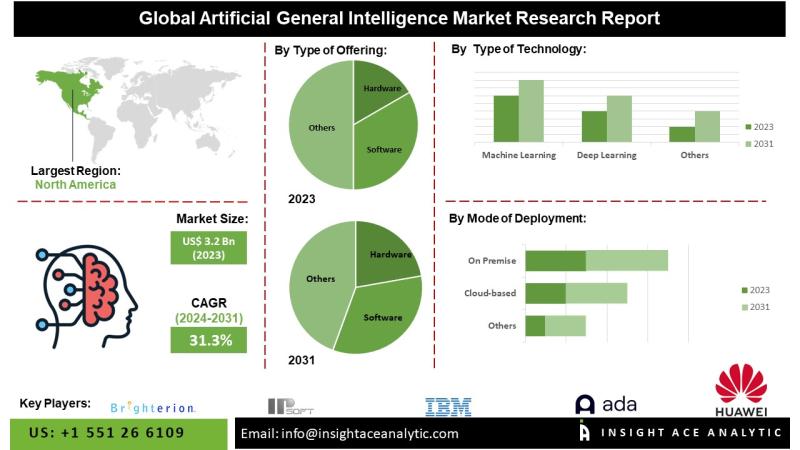

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Artificial General Intelligence (AGI) Market - (By Type of Offering (Hardware, Software and Service), Type of Technology (Machine Learning, Deep Learning, Natural Language Processing and Robotics), Mode of Deployment (Cloud-based, On Premise and Web-based), Type of AI (Weak AI, Strong AI and Superintelligence), Type of Processing (Image, Text and Voice Processing), Company Size (SMEs and…

Allogenic Cell Therapies Market Revenue Trends and Growth Potential 2026 to 2035

InsightAce Analytic Pvt. Ltd. announces the release of a market assessment report on the "Global Allogenic Cell Therapies Market- by Cell Type(Cardiosphere-Derived Cells (CDCs), Fibroblasts, T-cells, Mesenchymal Stem Cells (MSCs), Hematopoietic Stem Cells (HSCs) and Others),Tissue Source(Skin, Blood, PBC, BM and Others), Indication (Acute graft-versus-host disease (GVHD), Chronic Ulcers and Diabetic Foot Ulcers, Osteoarthritis, Crohn's Disease, Cardiovascular Disease, Solid Tumors/Cancers and Others (Alzheimer's Disease, etc.)), Trends, Industry Competition Analysis, Revenue…

More Releases for Card

Gift Card and Incentive Card Market Set for Explosive Growth | National Gift Car …

A new business intelligence report released by AMA with title "Gift Card and Incentive Card Market" has abilities to raise as the most significant market worldwide as it has remained playing a remarkable role in establishing progressive impacts on the universal economy. The Global Gift Card and Incentive Card Market Report offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through…

IC Card/Smart Card Market 2022 | Detailed Report

The IC Card/Smart Card research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the IC Card/Smart Card research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future.

A new report published by Allied Market Research, titled, Prepaid Card Market…

Prepaid Card Market by Card Type (Single-purpose prepaid card, and Multi-purpose …

Higher preference of prepaid cards to bank account cards has attributed to cost-effectiveness and flexibility. Moreover, increase in awareness and convenience of these cards enhance the adoption of prepaid cards. Furthermore, emerging applications & acceptance of these prepaid cards for various transactions and increasing popularity among individuals traveling abroad are expected to boost the market growth in the future

Prepaid Card Market is projected to grow at a CAGR of 22.7%…

Card Intelligent Lock Market Report 2018: Segmentation by Type (Magnetic card Lo …

Global Card Intelligent Lock market research report provides company profile for Tri-circle, Dessmann, Royalwand, Bangpai, ZKTeco, Schlage, KEYLOCK, Yale, Tenon, KAADAS, BE-TECH and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also…

Prepaid Card Market Report 2018: Segmentation by Card Type (Single-purpose prepa …

Global Prepaid Card market research report provides company profile for Green Dot Corporation, NetSpend Holdings, Inc., H&R Block Inc., American Express Company, JPMorgan Chase & Co., PayPal Holdings, Inc., BBVA Compass Bancshares, Inc. and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and…