Press release

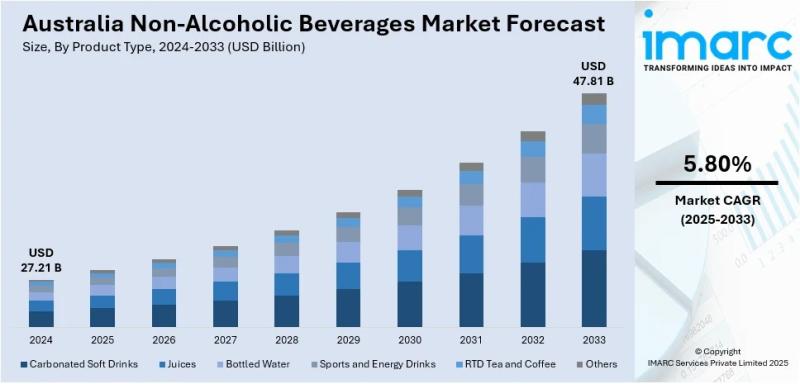

Australia Non-Alcoholic Beverages Market Projected to Reach USD 47.81 Billion by 2033

The latest report by IMARC Group, titled "Australia Non-Alcoholic Beverages Market Report by Product Type (Carbonated Soft Drinks, Juices, Bottled Water, Sports and Energy Drinks, RTD Tea and Coffee, Others), Packaging Type (Bottles, Cans, Cartons, Others), Distribution Channel (Retail, Food Service, Supermarkets and Hypermarkets, Online Stores, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia non-alcoholic beverages market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia non-alcoholic beverages market size reached USD 27.21 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 47.81 Billion by 2033, exhibiting a CAGR of 5.80% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 27.21 Billion

Market Forecast in 2033: USD 47.81 Billion

Market Growth Rate (2025-2033): 5.80%

Australia Non-Alcoholic Beverages Market Overview

The Australia non-alcoholic beverages market is growing because health consciousness is spreading, low-sugar and functional beverages are more available, plant-based consumption is shifting, wellness is rising fast, interest is growing in flavored waters, kombucha, craft sodas, probiotic drinks, energy drinks, health supplements, sports drinks, and plant-based beverages. Rising health awareness drives the market too. This awareness aims for diet-related diseases. Examples include obesity, diabetes, and heart diseases. Premiumization also drives the market. Examples are artisanal sodas and alcohol-free spirits. Immunity-improving and health-increasing drinks are trending throughout the COVID pandemic. Beer and wine without alcohol are common in Australia. To perceive better mental clarity with physical wellbeing, and to associate long-term health within a broader lifestyle trend will drive products to innovate, plus cause Australia's non-alcoholic beverages market to grow, particularly inside the premium segment.

Request For Sample Report:

https://www.imarcgroup.com/australia-non-alcoholic-beverages-market/requestsample

Australia Non-Alcoholic Beverages Market Trends

• Health-consciousness acceleration: Rising consumer awareness of diet-related health concerns driving demand for lower-sugar drinks, natural ingredients, functional beverages with vitamins and probiotics, and clean-label products particularly among millennials and Gen Z.

• Premiumization and experiential demand: Growing consumer investment in artisanal sodas, hand-crafted tonics, plant-infused waters, and alcohol-free spirits offering sophistication, prestige, and sensory indulgence beyond conventional soft drinks.

• Functional beverage innovation: Increasing popularity of kombucha, drinks with superfoods, adaptogens, and natural sweeteners like stevia or monk fruit addressing immunity-boosting and mental health-promoting requirements.

• Non-alcoholic spirits emergence: Rapid growth of alcohol-free beers, wines, and sophisticated mocktails in high-end restaurants and bars attracting consumers seeking social drinking experiences without intoxication.

• Plant-based alternative expansion: Shift toward plant-based beverages including alternative milk options, botanical extracts, and natural ingredient formulations aligning with sustainable and ethical consumption values.

• Clean-label transparency: Consumer demand for authentic brands with ingredient provenance, storytelling connecting craft and heritage, and bespoke packaging reflecting premium positioning and artisanship.

Market Drivers

• Rising health awareness: Growing consumer focus on preventing obesity, diabetes, and heart disease driving demand for healthier beverage alternatives with functional attributes supporting holistic wellness strategies.

• Lifestyle evolution: Millennial and Gen Z consumers well-educated about nutritional content actively seeking products fitting healthier lifestyles beyond basic hydration and refreshment requirements.

• Premiumization trend: Rising disposable incomes and changing preferences creating demand for sophisticated consumption experiences offering luxury, novelty, and sensory indulgence.

• COVID-19 wellness impact: Pandemic acceleration of immunity-boosting and mental health-promoting beverage popularity creating sustained consumer interest in functional and wellness-focused products.

• Social drinking culture shift: Growing acceptance of alcohol-free options in social settings with sophisticated mocktails and non-alcoholic spirits becoming mainstream in upscale venues.

• Product innovation momentum: Brand investment in unusual flavor profiles, limited-edition variants, and artisanship-produced beverages attracting consumers seeking novelty and premium experiences.

Challenges and Opportunities

Challenges:

• Sugar content concerns with regulatory pressure and consumer scrutiny requiring reformulation investments while maintaining taste profiles and market appeal

• Market saturation risks in established categories requiring continuous innovation and differentiation to maintain consumer interest and competitive positioning

• Premium pricing barriers limiting mass market penetration particularly for artisanal and functional beverages compared to conventional alternatives

• Supply chain complexities sourcing natural ingredients, botanical extracts, and specialized packaging materials affecting cost structures and product availability

• Consumer education needs explaining functional benefits, ingredient value propositions, and premium positioning requiring marketing investment and brand building

Opportunities:

• Functional beverage expansion developing specialized products targeting immunity, mental clarity, gut health, and energy enhancement meeting specific consumer wellness needs

• Alcohol-alternative sophistication creating premium non-alcoholic spirits, craft mocktails, and adult-oriented beverages capturing social drinking occasions without alcohol

• Plant-based innovation leveraging sustainability trends through botanical ingredients, alternative proteins, and environmentally conscious formulations appealing to ethical consumers

• E-commerce channel growth enabling direct-to-consumer models, subscription services, and personalized beverage solutions reaching tech-savvy and convenience-oriented customers

• Indigenous ingredient integration utilizing native Australian botanicals, superfoods, and traditional ingredients creating unique differentiation and cultural authenticity

Australia Non-Alcoholic Beverages Market Segmentation

By Product Type:

• Carbonated Soft Drinks

• Juices

• Bottled Water

• Sports and Energy Drinks

• RTD Tea and Coffee

• Others

By Packaging Type:

• Bottles

• Cans

• Cartons

• Others

By Distribution Channel:

• Retail

• Food Service

• Supermarkets and Hypermarkets

• Online Stores

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-non-alcoholic-beverages-market

Australia Non-Alcoholic Beverages Market News (2024-2025)

• 2024: Health-conscious consumer trends accelerated with increasing demand for low-sugar, natural ingredient beverages featuring functional attributes addressing immunity, mental health, and holistic wellness requirements.

• 2024: Premiumization momentum continued with sophisticated alcohol-free spirits, artisanal sodas, and craft mocktails becoming mainstream in upscale restaurants, bars, and boutique establishments.

• 2024: Functional beverage innovation expanded including kombucha, adaptogen-infused drinks, and products featuring superfoods and natural sweeteners meeting diverse wellness-focused consumer preferences.

• 2024: Plant-based beverage alternatives gained market share with botanical extracts, alternative milk options, and sustainable ingredient formulations aligning with ethical consumption values.

• 2024: E-commerce channel growth accelerated enabling direct-to-consumer models, subscription services, and personalized beverage offerings reaching tech-savvy and convenience-oriented consumer segments.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Product Type, Packaging Type, and Distribution Channel Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=36002&flag=F

Q&A Section

Q1: What drives growth in the Australia non-alcoholic beverages market?

A1: Market growth is driven by rising health awareness addressing diet-related concerns like obesity and diabetes, lifestyle evolution among millennials and Gen Z seeking nutritional benefits, premiumization trend with rising disposable incomes, COVID-19 wellness impact accelerating immunity-focused products, social drinking culture shift toward alcohol-free options, and product innovation momentum creating novel experiences.

Q2: What are the latest trends in this market?

A2: Key trends include health-consciousness acceleration driving low-sugar and functional beverages, premiumization creating demand for artisanal products, functional beverage innovation with kombucha and adaptogens, non-alcoholic spirits emergence in upscale venues, plant-based alternative expansion, and clean-label transparency with authentic brand storytelling.

Q3: What challenges do companies face?

A3: Major challenges include sugar content concerns requiring reformulation while maintaining taste, market saturation risks demanding continuous innovation, premium pricing barriers limiting mass adoption, supply chain complexities sourcing specialized ingredients, and consumer education needs explaining functional benefits and premium value.

Q4: What opportunities are emerging?

A4: Emerging opportunities include functional beverage expansion targeting specific wellness needs, alcohol-alternative sophistication creating premium social drinking options, plant-based innovation leveraging sustainability trends, e-commerce channel growth enabling personalized solutions, and indigenous ingredient integration creating unique cultural authenticity.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Non-Alcoholic Beverages Market Projected to Reach USD 47.81 Billion by 2033 here

News-ID: 4244066 • Views: …

More Releases from IMARC Group

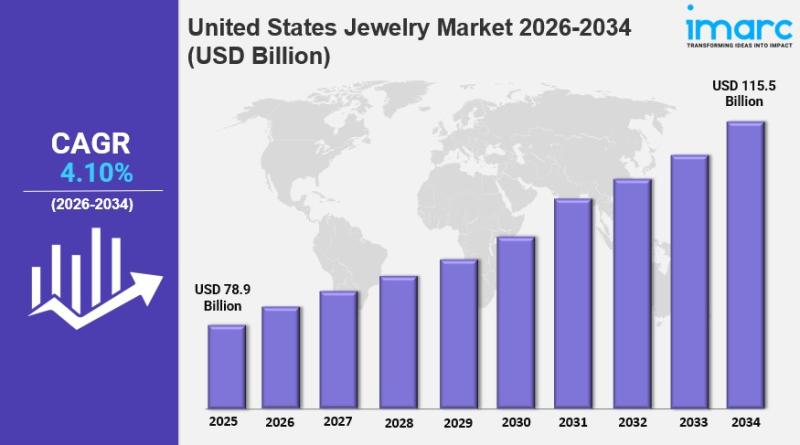

United States Jewelry Market Size, Share, Industry Overview, Growth and Forecast …

IMARC Group has recently released a new research study titled "United States Jewelry Market Report by Product (Necklace, Ring, Earrings, Bracelet, and Others), Material (Gold, Platinum, Diamond, and Others), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Jewelry Market Overview

The United States jewelry market size reached USD 78.9 Billion in 2025.…

United States Air Freight Market Size, Share, Industry Trends, Growth and Foreca …

IMARC Group has recently released a new research study titled "United States Air Freight Market Size, Share, Trends and Forecast by Service, Destination, End User, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

United States Air Freight Market Overview

The United States air freight market size was valued at USD 64.06 Billion in 2025.…

Mexico Medical Tourism Market 2026 : Industry Size to Reach USD 10.6 Billion by …

IMARC Group has recently released a new research study titled "Mexico Medical Tourism Market Size, Share, Trends and Forecast by Type, Treatment Type, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Mexico Medical Tourism Market Overview

The Mexico medical tourism market size reached USD 2.1 Billion in 2025. Looking forward, the market is projected…

Saudi Arabia Pilates & Yoga Studios Market Size to Surpass USD 3.6 Billion by 20 …

Saudi Arabia Pilates & Yoga Studios Market Overview

Market Size in 2024: USD 1.6 Billion

Market Forecast in 2033: USD 3.6 Billion

Market Growth Rate 2025-2033: 8.20%

According to IMARC Group's latest research publication, "Saudi Arabia Pilates & Yoga Studios Market Size, Share, Trends and Forecast by Activity Type, Application, and Region, 2025-2033", the Saudi Arabia pilates & yoga studios market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…