Press release

Australia Legal Services Market Projected to Reach USD 34.5 Billion by 2033

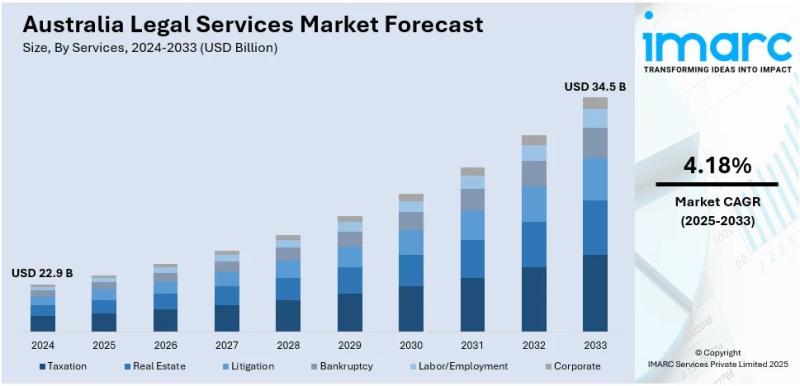

The latest report by IMARC Group, titled "Australia Legal Services Market Report by Services (Taxation, Real Estate, Litigation, Bankruptcy, Labor/Employment, Corporate), Firm Size (Large Firms, Medium Firms, Small Firms), Provider (Private Practicing Attorneys, Legal Business Firms, Government Departments, Others), and Region 2025-2033," offers comprehensive analysis of the Australia legal services market growth. The report includes competitor and regional analysis, along with detailed breakdown of the market segmentation. The Australia legal services market size reached USD 22.9 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 34.5 Billion by 2033, exhibiting a CAGR of 4.18% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 22.9 Billion

Market Forecast in 2033: USD 34.5 Billion

Market Growth Rate (2025-2033): 4.18%

Australia Legal Services Market Overview

The Australia legal services market is growing and expanding due to more complex regulatory frameworks requiring strong compliance support in financial services, healthcare and energy sectors, increasing value of corporate transactions, including technology and healthcare M&A, IP protection and litigation, business disputes, contract breaches and IP litigation, increasing technology adoption in legal services including artificial intelligence-backed document research and contract automation, growing ESG advisory services including climate transition and corporate accountability advice, rapid growth in family law, estate and migration services. Supporting these trends is the evolution of the Australian economy, where clean energy and technology startups are creating increasingly complex commercial issues, strong trade integration with Asia-Pacific economies driving demand for cross-border transactions, a growing digital economy including fintech and cybersecurity regulatory and advisory services, and increasing population growth including immigration work driving property conveyancing and tenancy-related legal services.

In addition to strong commercial practice in Sydney's financial district and Melbourne's technology and innovation precincts, Australia has developed a strong legal market in areas related to mining, agriculture and energy regulatory practice, corporate governance and investment, infrastructure and renewable energy regulatory work, advice on Indigenous heritage law, alternative dispute resolution including mediation and arbitration, business advisory services to clients seeking to trade with other Asia-Pacific jurisdictions, digital health and agri-tech law, sustainability-linked finance and green finance, and multicultural practice. Australia continues to adapt to the challenges presented by the fragmented legal and regulatory landscape across federal and state jurisdictions, the regional distribution of legal talent in remote areas, technological disruption and changing client demands for alternative fee arrangements. Australia's complex federal-state landscape, the increased expectations around ESG compliance, and the need to ease digital transformation are driving opportunities in innovation and client-centric business models for legal services.

Request For Sample Report:

https://www.imarcgroup.com/australia-legal-services-market/requestsample

Australia Legal Services Market Trends

• ESG advisory services expansion: Rapid growth in environmental, social, and governance consulting with legal practitioners advising on climate transition planning, carbon offset initiatives, environmental compliance, workplace diversity policies, modern slavery reporting, and director fiduciary duties regarding sustainability.

• Legal technology integration: Revolutionary implementation of AI-powered research platforms, automated contract preparation tools, legal project management software, remote consultations, and virtual court hearings improving efficiency while requiring significant investment and professional upskilling.

• Cross-border transaction demand: Increasing legal advisory for Australian companies expanding into Southeast Asian and East Asian markets navigating bilateral trade agreements, foreign investment review procedures, international dispute resolution, and multicultural client representation.

• Digital economy specialization: Growing expertise in fintech regulation, intellectual property protection for tech startups, software-as-a-service agreements, data licensing, cybersecurity compliance, digital identity verification, and data breach litigation addressing digital resilience priorities.

• Alternative dispute resolution growth: Rising adoption of arbitration and mediation services as companies seek expert guidance to minimize risks associated with lengthy litigation, with Australia's neutral jurisdiction attracting Asia-Pacific commercial dispute resolution.

• Compliance and regulatory advisory: Heightened demand for proactive auditing, policy formulation, internal investigations, and dispute resolution as enforcement increases across Australian Competition and Consumer Commission oversight, privacy regulations, and industry-specific legislation.

Market Drivers

• Regulatory complexity increase: Evolving compliance environment across financial services, healthcare, energy, and telecommunications with federal regimes including APRA guidelines, ACCC oversight, privacy laws, and industry-specific legislation driving sustained advisory demand.

• Corporate transaction growth: Expanding mergers and acquisitions activity particularly in technology and healthcare sectors requiring due diligence, contract preparation, regulatory approvals, and international legal advice adhering to Australian incorporation laws.

• Economic transformation impact: New industries including clean energy, technology startups, and high-technology agriculture creating sophisticated commercial issues requiring navigation of corporate structures, joint ventures, and cross-border contracting.

• Asia-Pacific trade relationships: Strong trade connections with Japan, South Korea, Singapore, and growing Chinese investment beyond mining into education, property, and agriculture necessitating transaction structuring and FIRB compliance guidance.

• Litigation demand persistence: Consistent need for commercial dispute resolution, employment issue handling, and contract breach intervention with large firms capitalizing on companies seeking risk minimization through expert legal representation.

• Demographic and social changes: Urbanization of capital cities, population growth through immigration and skilled migration programs, and increasing awareness of mental health and aged care elevating demand for family law, estate planning, property conveyancing, and migration services.

Challenges and Opportunities

Challenges:

• Fragmented legal and regulatory framework across federal, state, and local jurisdictions with concurrent legal systems creating sophisticated compliance environments, particularly burdensome for SMEs lacking resources to manage multi-jurisdictional legal risks and requiring specialized counsel for each region

• Regional legal workforce shortages in rural, regional, and remote areas particularly affecting Northern Territory, Western Australia, and inner Queensland with legal service access gaps, expensive legal education, difficulty attracting practitioners to relocate, and Aboriginal Australians facing cultural barriers

• Technology pressure and shifting client expectations demanding quicker turnaround, greater transparency, flexible service delivery, alternative billing arrangements challenging traditional billable hour models, requiring heavy technology investment in AI research platforms and automation tools

• Access equity disparities with government-funded programs and community legal centers having minimal staffing and resources, uneven internet access and digital literacy limiting technology solutions, and systemic discrimination affecting culturally safe legal representation

Opportunities:

• ESG advisory services expansion addressing climate transition, carbon offsets, environmental compliance in mining/agriculture/energy/transport, biodiversity protection, workplace diversity, modern slavery reporting, director sustainability duties, and sustainability-linked financing in mineral-rich and ecologically sensitive regions

• Digital economy legal specialization serving thriving tech startup ecosystem with venture capital support requiring fintech regulation expertise, IP protection, startup equity structuring, tech contracts, data licensing, SaaS agreements, cybersecurity incident response, and data breach litigation

• Asia-Pacific trade advisory supporting Australian multinational expansion into Southeast and East Asian markets navigating CPTPP and bilateral agreements, Chinese investment structuring, foreign investment review, international arbitration, and bilingual multicultural representation

• Indigenous and community legal services co-designing culturally grounded solutions for land rights, community property, rural labor contracts, conflict resolution, and specialized outreach to remote Queensland, Northern Territory, Tasmania, and Western Australia populations

• Legal technology innovation developing online advice platforms, remote consultation capabilities, AI-powered research efficiency, automated document preparation, and virtual court proceedings improving access while maintaining professional excellence standards

Australia Legal Services Market Segmentation

By Services:

• Taxation

• Real Estate

• Litigation

• Bankruptcy

• Labor/Employment

• Corporate

By Firm Size:

• Large Firms

• Medium Firms

• Small Firms

By Provider:

• Private Practicing Attorneys

• Legal Business Firms

• Government Departments

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-legal-services-market

Australia Legal Services Market News (2024-2025)

• 2024: Financial institutions increased consultations with law firms for APRA regulatory compliance following heightened scrutiny from regulatory bodies ensuring adherence to evolving guidelines across financial services sector.

• 2024: Technology and healthcare sectors experienced significant M&A activity growth driving demand for corporate legal services managing due diligence, contract preparation, and cross-border regulatory approvals.

• 2024: Large law firms with established litigation teams expanded capabilities capitalizing on rising commercial disputes, employment issues, and contract breaches with clients seeking arbitration and mediation expertise.

• 2024: Sydney's Tech Central and Melbourne's Cremorne Digital Hub development accelerated legal advisory demand for startup equity structuring, fintech regulation, IP protection, and venture capital transactions.

• 2024: Mining businesses in Western Australia increased engagement with legal professionals for Native Title requirements, environmental impact approvals, and land access compliance under state-specific legislation.

• 2024: Legal firms developed enhanced outreach and online advice services targeting remote Queensland, Northern Territory, Tasmania, and Western Australia clients addressing access equity challenges.

• 2024: ESG advisory services gained prominence with companies seeking legal guidance on climate transition planning, carbon offset initiatives, environmental compliance, and modern slavery reporting requirements.

• 2024: Community legal centers expanded cooperation with private firms delivering pro bono services in multicultural hotspots including Brisbane and Perth supporting access to justice initiatives.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Services, Firm Size, Provider, and Regional Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=24769&flag=F

Q&A Section

Q1: What drives growth in the Australia legal services market?

A1: Market growth is driven by increasing regulatory complexity across multiple sectors requiring compliance support, corporate transaction growth particularly M&A in technology and healthcare, economic transformation with new industries creating sophisticated commercial issues, Asia-Pacific trade relationships necessitating cross-border transaction advisory, persistent litigation demand for dispute resolution, and demographic changes elevating family law, estate planning, and migration services.

Q2: What are the latest trends in this market?

A2: Key trends include ESG advisory services expansion addressing climate transition and corporate accountability, legal technology integration with AI-powered research and automation, cross-border transaction demand for Asia-Pacific expansion, digital economy specialization in fintech and cybersecurity regulation, alternative dispute resolution growth through arbitration and mediation, and compliance advisory intensification across federal and state regulatory frameworks.

Q3: What challenges do companies face?

A3: Major challenges include fragmented legal and regulatory framework across federal, state, and local jurisdictions complicating multi-jurisdictional compliance, regional legal workforce shortages limiting access in rural and remote areas particularly for Indigenous populations, technology pressure with shifting client expectations toward alternative billing models, and access equity disparities with resource constraints in community legal centers.

Q4: What opportunities are emerging?

A4: Emerging opportunities include ESG advisory expansion in sustainability and environmental compliance, digital economy legal specialization serving tech startup ecosystem, Asia-Pacific trade advisory supporting multinational expansion, Indigenous and community legal services with culturally grounded solutions, and legal technology innovation improving access through remote consultations and AI-powered efficiency.

Q5: What is the market size and forecast?

A5: The Australia legal services market was valued at USD 22.9 Billion in 2024 and is projected to reach USD 34.5 Billion by 2033, exhibiting a CAGR of 4.18% during 2025-2033, driven by regulatory complexity, economic diversification, and digital transformation.

Q6: Which regions lead the market?

A6: New South Wales and Victoria lead the market, driven by Sydney and Melbourne financial centers hosting tech incubators, innovation precincts, and major law firms. Queensland, Western Australia, and other regions show growth through infrastructure development, mining sector activity, renewable energy projects, and specialized regional legal services.

Q7: What are key service segments?

A7: Major service segments include corporate law for M&A and business transactions, litigation and dispute resolution for commercial conflicts, taxation advisory for compliance planning, real estate services for property conveyancing, labor/employment law for workplace matters, and bankruptcy services for insolvency proceedings.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Legal Services Market Projected to Reach USD 34.5 Billion by 2033 here

News-ID: 4244000 • Views: …

More Releases from IMARC Group

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Australia

Derila Memory foam pillow Australia: Honest Reviews About Derila Australia

Derila is one of the best memory foam pillows sold in Australia today.

Priced at around 30 dollars (USD), derila is currently the most reviewed and the cheapest memory pillow available in Australia.

What is Derila? Is Derila Pillow the best in Australia? Keep reading to discover everything worth knowing about Derila Australia.

OVERVIEW

Recently, Memory foam pillow has been trending and there is a lot of brands to choose from. Which one is…

CeraCare Australia - Where to Buy Legit CeraCare Supplement in Australia?

CeraCare Australia - Ceracare is a glucose support supplement that proposes to augment cardiovascular prosperity and to stay aware of perfect glucose assimilation in Australia. CeraCare supplement is conceptualized and executed by a threesome – Christine, Dr. Jihn and Michael. It is a natural supplement that helps one stay aware of ideal glucose levels, cardiovascular prosperity, and glucose assimilation.

Take Advantage of 80% Discount Offer in Australia >> https://boostsxproaustralia.com/ceracare-new

The indications…

Glucofort Australia - Where to Buy Legit Glucofort Supplement in Australia?

Glucofort Australia - Glucofort is an efficient, all-natural progressive glucose support supplement in Australia. This formula is made out of 12 key ingredients, 7 nutrients, and minerals, and a little of Vanadium. This supplement upholds regulated glucose levels and glucose digestion. Glucofort prides itself as the most inventive supplements available in Oceania, accentuating its solidarity, wellbeing, and quality.

Take Advantage of 75% Discount Offer in Australia >> https://boostsxproaustralia.com/glucofort-new

Rather than simply…

Australia Agriculture Market, Australia Agriculture Industry, Australia Agricult …

Australia Agriculture has been as vital within the development of Australia, because it was within the United States. Australia's ancient dominance in wheat and sheep continues into the 21st century. Recently Australian agriculture has become more and more diversified. The considerable expanses of productive land have helped Australia to become a number one world exporter of grains, meats, and wool. Each grains (predominantly wheat and barley) and wool markets round…

Australia Conveyor Maintenance Analysis by Top Companies Habasit Australia Pty l …

Global Australia Conveyor Maintenance Market and Competitive Analysis

Know your current market situation! Not only a vital element for brand new products but also for current products given the ever-changing market dynamics. The study allows marketers to remain involved with current consumer trends and segments where they'll face a rapid market share drop. Discover who you actually compete against within the marketplace, with Market Share Analysis know market position, to push…

Australia Conveyor Maintenance Market Analysis By Manufacturers Rema Tip Top Aus …

A conveyor system is a common piece of mechanical handling device that moves materials/objects from one location. A conveyor is often lifeline to a company’s ability to effectively move its products in a timely manner. While it is used constantly in a manufacturing plant, proper maintenance from trained technicians can extend the lifespan of conveyor. Furthermore, conveyor maintenance is essential as it may be subjected to different types of failures…