Press release

Australia Travel Insurance Market Projected to Reach USD 451.8 Million by 2033

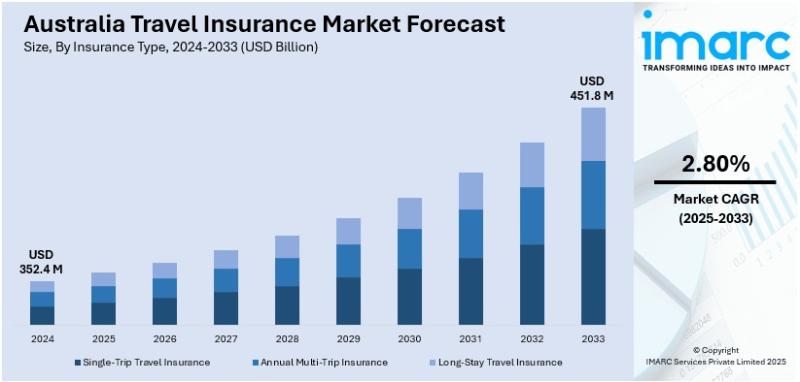

The latest report by IMARC Group, titled "Australia Travel Insurance Market Report by Insurance Type (Single-Trip Travel Insurance, Annual Multi-Trip Insurance, Long-Stay Travel Insurance), Coverage (Medical Expenses, Trip Cancellation, Trip Delay, Property Damage, Others), Distribution Channel (Insurance Intermediaries, Banks, Insurance Companies, Insurance Aggregators, Insurance Brokers, Others), End User (Senior Citizens, Education Travelers, Business Travelers, Family Travelers, Others), and Region 2025-2033," offers a comprehensive analysis of the Australia travel insurance market growth. The report includes competitor and regional analysis, along with a detailed breakdown of the market segmentation. The Australia travel insurance market size reached USD 352.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 451.8 Million by 2033, exhibiting a CAGR of 2.80% during 2025-2033.Base Year: 2024

Forecast Years: 2025-2033

Historical Years: 2019-2024

Market Size in 2024: USD 352.4 Million

Market Forecast in 2033: USD 451.8 Million

Market Growth Rate (2025-2033): 2.80%

Australia Travel Insurance Market Overview

The Australian travel insurance market is experiencing steady growth, driven by rising international and domestic travel, greater awareness of unforeseen travel risks, increasing demand for comprehensive coverage, and higher disposable incomes enabling travel to adventurous and remote destinations. Market expansion is further supported by approximately 1.94 million total travel arrivals in 2024, the rapid growth of digital platforms facilitating easy policy comparison and purchase, and strategic partnerships between insurers, airlines, and travel agencies that position travel insurance as an essential component of trip planning. Government initiatives promoting the importance and affordability of travel insurance-reflected in average policy costs of around $235.37-are reinforcing consumer adoption and strengthening the market's focus on risk management and protection.

Australia's travel insurance sector is underpinned by a strong recovery in travel activity, supported by both domestic and international movement. A comprehensive regulatory framework under the Australian Prudential Regulation Authority (APRA) ensures consumer protection, while growing consumer awareness of medical, cancellation, and disruption risks continues to drive demand for reliable coverage. The market also benefits from Australia's active travel culture across business and leisure segments, where protection against unpredictable events, high overseas medical expenses, and financial losses has become a priority.

The increasing adoption of digital platforms, greater customization for specialized travel needs, and ongoing government awareness campaigns are creating favorable market conditions. These trends are prompting significant investment in technology integration, innovative policy development, and consumer education. With a national emphasis on travel safety, growing travel complexity, and heightened risk consciousness, Australia is emerging as an attractive market for next-generation travel insurance solutions designed to enhance consumer confidence and protection.

Request For Sample Report:

https://www.imarcgroup.com/australia-travel-insurance-market/requestsample

Australia Travel Insurance Market Trends

• Digital platform adoption acceleration: Increased consumer preference for online and mobile applications enabling transparent policy comparison, convenient purchasing, and real-time customer support through AI-powered chatbots handling up to 80% of customer inquiries.

• Comprehensive coverage demand surge: Growing traveler preference for broader risk protection including medical evacuation, trip cancellation, and baggage loss with study showing 16% of Australians previously traveled without any insurance coverage.

• Sustainable and ethical focus: Rising emphasis on eco-responsible travel policies incorporating carbon-neutral travel options and green hotel coverage with 20% of insured travelers thoroughly reading policy disclosure statements before traveling.

• Customization and specialization: Insurance providers offering personalized policies tailored to specific activities including adventure sports, medical evacuation, COVID-related disruptions, and specialized coverage for eco-tourism and long-term excursions.

• Government regulatory support: Robust framework through Australian Prudential Regulation Authority ensuring transparent operations, consumer rights protection, and mandatory clear presentation of terms, conditions, and exclusions.

• Partnership ecosystem expansion: Strategic collaborations between insurers, airlines, and travel agencies promoting insurance as essential travel component while providing integrated booking and coverage solutions.

Market Drivers

• Travel activity resurgence: Marked rise in domestic and international travel post-pandemic with approximately 1.94 million travel arrivals in 2024 creating increased demand for risk protection and financial safeguards.

• Consumer awareness enhancement: Significant increase in understanding travel-related risks including medical emergencies, trip cancellations, terrorism, and natural disasters driving proactive coverage adoption for financial investment protection.

• Digital transformation benefits: Technology-enabled policy comparison, mobile accessibility, and data analytics customization improving customer experience and enabling insurers to develop targeted products for specific consumer segments.

• Regulatory framework confidence: Government-established system ensuring fair and transparent operations with APRA financial standards compliance building consumer trust in claim honoring and coverage reliability.

• Rising medical cost concerns: Increasing awareness of high international medical expenses and potential financial losses from unexpected travel disruptions making insurance essential safeguard for travel investments.

• Flexible coverage options: Expanding availability of specialized policies for seniors, students, families, and travelers with medical complications addressing diverse demographic needs and travel purposes.

Challenges and Opportunities

Challenges:

• Market saturation pressure with numerous established insurance companies, specialized travel insurers, and emerging digital platforms creating intense competition requiring differentiation through coverage options and pricing strategies

• Consumer education barriers with significant percentage of travelers historically unaware of insurance importance requiring ongoing awareness campaigns and educational initiatives to drive adoption rates

• Policy complexity issues where travelers struggle to understand coverage terms, exclusions, and claim procedures potentially leading to dissatisfaction and reduced market confidence

• Economic sensitivity affecting discretionary spending on travel and associated insurance during economic downturns or uncertainty impacting market growth and policy uptake rates

• Regulatory compliance costs for maintaining APRA standards, transparent operations, and consumer protection requirements creating operational expenses particularly for smaller insurance providers

Opportunities:

• Adventure tourism specialization developing comprehensive coverage for extreme sports, remote destination travel, and high-risk activities appealing to growing adventure travel segment seeking specialized protection

• Corporate travel market expansion providing tailored business travel insurance including liability protection, emergency assistance, and trip disruption coverage for frequent business travelers and corporate accounts

• Technology integration advancement through telemedicine services, real-time claim processing, mobile apps, and AI-driven customer service enhancing user experience and operational efficiency

• Partnership expansion opportunities with airlines, hotels, travel agencies, and online booking platforms creating integrated insurance offerings and streamlined purchasing experiences

• Sustainability-focused products development incorporating carbon offset options, eco-friendly travel coverage, and environmentally conscious policy features appealing to sustainability-minded travelers and supporting responsible tourism initiatives

Australia Travel Insurance Market Segmentation

By Insurance Type:

• Single-Trip Travel Insurance

• Annual Multi-Trip Insurance

• Long-Stay Travel Insurance

By Coverage:

• Medical Expenses

• Trip Cancellation

• Trip Delay

• Property Damage

• Others

By Distribution Channel:

• Insurance Intermediaries

• Banks

• Insurance Companies

• Insurance Aggregators

• Insurance Brokers

• Others

By End User:

• Senior Citizens

• Education Travelers

• Business Travelers

• Family Travelers

• Others

By Region:

• Australia Capital Territory & New South Wales

• Victoria & Tasmania

• Queensland

• Northern Territory & Southern Australia

• Western Australia

Browse Full Report:

https://www.imarcgroup.com/australia-travel-insurance-market

Australia Travel Insurance Market News (2024-2025)

• 2024: Australian Bureau of Statistics reported total travel arrivals of approximately 1.94 million demonstrating strong travel activity recovery creating increased demand for travel insurance coverage and risk protection services.

• 2024: Study revealed 16% of Australians traveled internationally without any travel insurance coverage highlighting significant market opportunity for awareness campaigns and consumer education initiatives.

• 2024: AI-powered chatbots implementation expanded across travel insurance providers handling up to 80% of customer inquiries streamlining customer experience and improving operational efficiency.

• 2024: Average travel insurance cost for Australians stabilized around $235.37 providing relatively affordable risk protection and financial hedge for travelers across different demographic segments.

• 2024: Government consumer awareness campaigns intensified promoting travel insurance significance particularly for international trips while emphasizing potential financial risks and medical cost protection benefits.

Key Highlights of the Report

• Market Performance (2019-2024)

• Market Outlook (2025-2033)

• Industry Catalysts and Challenges

• Segment-wise historical and future forecasts

• Competitive Landscape and Key Player Analysis

• Insurance Type, Coverage, Distribution Channel, and End User Analysis

Ask analyst for your customized sample:

https://www.imarcgroup.com/request?type=report&id=21979&flag=F

Q&A Section

Q1: What drives growth in the Australia travel insurance market?

A1: Market growth is driven by travel activity resurgence with 1.94 million arrivals in 2024, consumer awareness enhancement about travel-related risks and financial protection needs, digital transformation benefits enabling easy policy comparison and purchasing, regulatory framework confidence through APRA standards building consumer trust, rising medical cost concerns particularly for international travel, and flexible coverage options addressing diverse demographic and travel purpose requirements.

Q2: What are the latest trends in this market?

A2: Key trends include digital platform adoption acceleration with online policy comparison and AI-powered customer service, comprehensive coverage demand surge for broader risk protection including medical and trip cancellation coverage, sustainable and ethical focus incorporating eco-responsible travel options, customization and specialization for specific activities and demographics, government regulatory support ensuring transparent operations, and partnership ecosystem expansion between insurers and travel industry stakeholders.

Q3: What challenges do companies face?

A3: Major challenges include market saturation pressure from numerous competing providers requiring differentiation strategies, consumer education barriers with significant percentage historically unaware of insurance importance, policy complexity issues affecting customer understanding and satisfaction, economic sensitivity impacting discretionary spending on travel insurance during downturns, and regulatory compliance costs for maintaining APRA standards and consumer protection requirements.

Q4: What opportunities are emerging?

A4: Emerging opportunities include adventure tourism specialization for extreme sports and high-risk activities, corporate travel market expansion with tailored business coverage and liability protection, technology integration advancement through telemedicine and AI-driven services, partnership expansion with airlines and booking platforms for integrated offerings, and sustainability-focused products incorporating carbon offset options and environmentally conscious features appealing to responsible travelers.

Contact Us

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses. IMARC's information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company's expertise.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Australia Travel Insurance Market Projected to Reach USD 451.8 Million by 2033 here

News-ID: 4241725 • Views: …

More Releases from IMARC Group

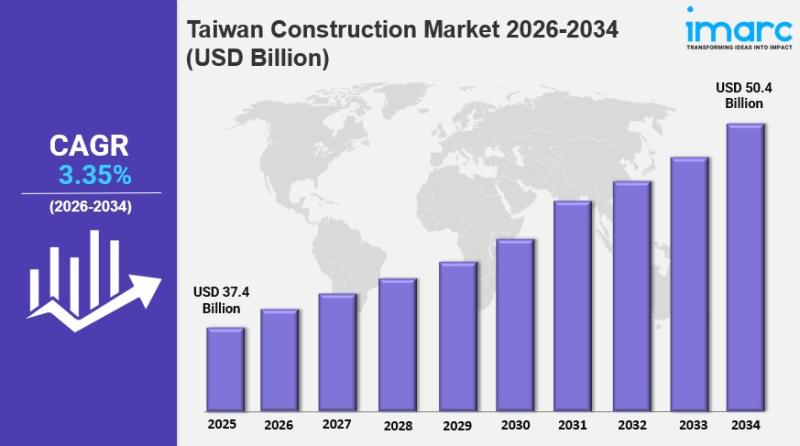

Taiwan Construction Market Size, Share, In-Depth Insights, Trends and Forecast 2 …

IMARC Group has recently released a new research study titled "Taiwan Construction Market Report by Sector (Residential, Commercial, Industrial, Infrastructure (Transportation), Energy and Utilities Construction), and Region 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Taiwan construction market size reached USD 37.4 Billion in 2025 and is projected to grow to USD 50.4…

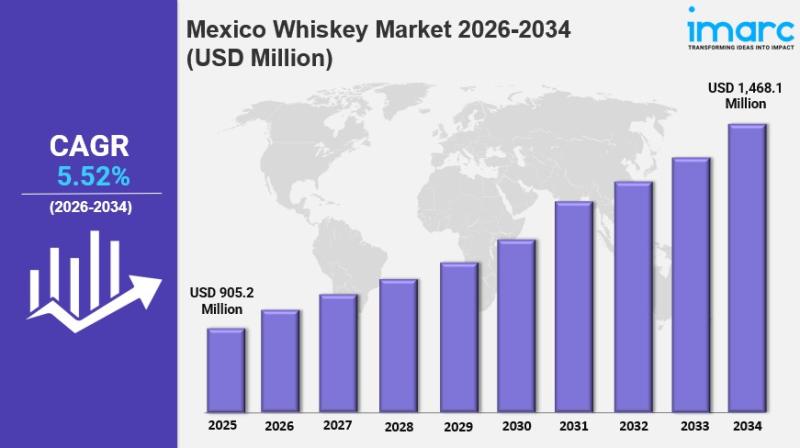

Mexico Whiskey Market Size to Hit USD 1,468.1 Million by 2034: Trends & Forecast

IMARC Group has recently released a new research study titled "Mexico Whiskey Market Size, Share, Trends and Forecast by Product Type, Quality, Distribution Channel, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico whiskey market size reached USD 905.2 Million in 2025. It is projected to grow to USD 1,468.1 Million…

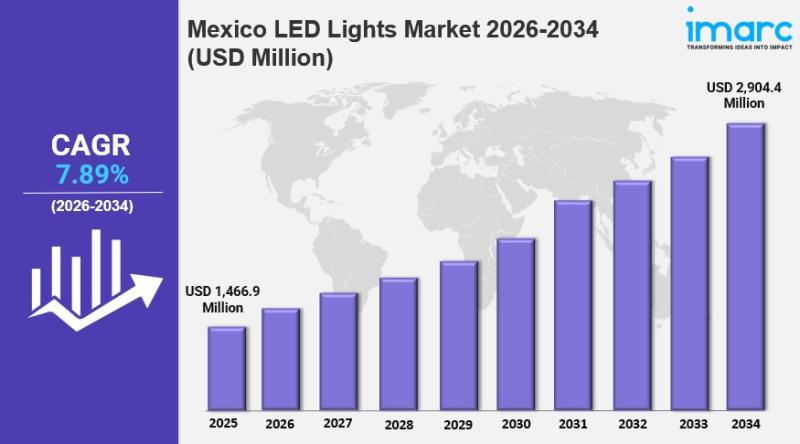

Mexico LED Lights Market 2026 : Industry Size to Reach USD 2,904.4 Million by 20 …

IMARC Group has recently released a new research study titled "Mexico LED Lights Market Size, Share, Trends and Forecast by Product Type, Application, Import and Domestic Manufacturing, and Region, 2026-2034", offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico LED lights market was valued at USD 1,466.9 million in 2025 and is projected to…

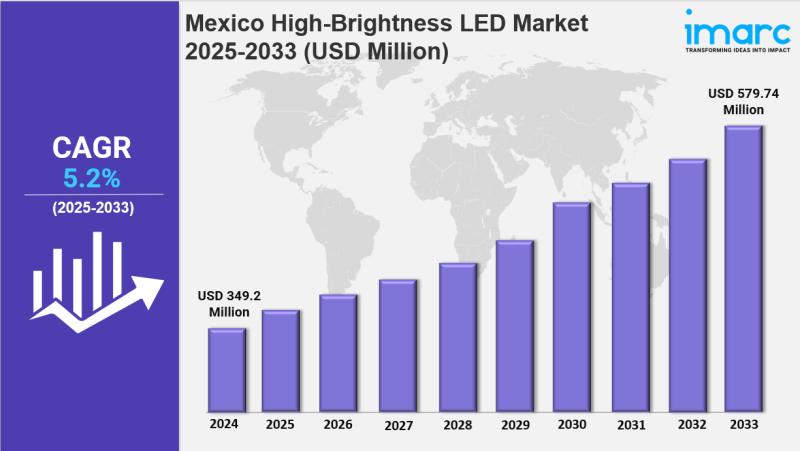

Mexico High-Brightness LED Market Size, Share, Latest Insights and Forecast 2025 …

IMARC Group has recently released a new research study titled "Mexico High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033" which offers a detailed analysis of the market drivers, segmentation, growth opportunities, trends, and competitive landscape to understand the current and future market scenarios.

Market Overview

The Mexico high-brightness LED market size reached USD 349.2 Million in 2024 and is…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…