Press release

HealthData.gov Highlights the Rise of No Medical Exam Life Insurance Options

Life insurance is meant to provide peace of mind, yet for many, the process of getting covered feels anything but simple. According to industry data, there are about 102 million uninsured and underinsured adults in the U.S.Lengthy applications, medical exams, and uncertainty about the process may discourage people from securing the protection they need. This is where no medical exam life insurance policies come in!

By removing traditional insurance gaps, these policies make faster and easier to obtain for people from all walks of life.

Key Takeaways

* Traditional life insurance can leave many people behind, especially seniors, those with pre-existing conditions, and individuals who can't afford high premiums or don't want to wait weeks for approval.

* No medical exam policies simplify access to life insurance by eliminating the need for physical tests and lengthy approval processes.

* These policies bridge the insurance gap by offering fast, inclusive, and stress-free coverage for people who might otherwise remain uninsured.

* Choosing the right plan requires comparing coverage, costs, and insurer reliability to find a policy that matches your long-term financial goals.

What are No Medical Exam Policies?

No medical exam life insurance policies let you obtain insurance coverage without undergoing a medical exam, blood test, or doctor visit.

Insurers evaluate your application using , prescription records, and by asking health-related questionnaires.

These policies are ideal for individuals who value speed, simplicity, and convenience. They eliminate the waiting period, often providing approval within days instead of weeks.

How No Medical Exam Policies Help Close the Insurance Gap

According to, life insurance need is highest among the following segments:

* Households earning under $50,000 per year

* Those identifying as Hispanic or Black Americans

* Millennials and Gen Z

* Women

No medical exam life insurance policies are helping bridge the coverage gap by making protection more accessible and inclusive for all.

These policies remove several barriers that often discourage older individuals or those with pre-existing diseases from applying for traditional insurance.

* Faster approvals: Applications are processed quickly, often within days, ensuring timely coverage.

* Inclusive access: People with minor health issues can get easier access to life insurance.

* Simplified process: No additional medical tests or doctor visits, which makes applying convenient.

* Broader reach: These policies encourage more people to get insured, reducing the overall coverage gap.

* Emotional ease: By removing medical scrutiny, these policies make getting insured less stressful and more empowering.

Should You Get No Medical Exam Life Insurance?

If you want quick, simple coverage without the hassle of health exams or long waiting periods, Ethos could be the perfect choice. Ethos offers one of the fastest and easiest ways to get no medical exam life insurance online. It's especially beneficial if:

* You have a busy schedule and prefer an easy, online application process.

* You have minor or pre-existing health conditions that could make traditional approval difficult.

* You're older and want coverage without medical scrutiny.

* You're buying life insurance for the first time and want a straightforward option.

* You need immediate protection to secure your family's financial safety.

Choosing the Right No Exam Policy

Selecting the right no medical exam life insurance policy [https://www.ethos.com/life/term-life-insurance-no-medical-exam/] requires balancing convenience with long-term value. Here's what to consider:

* Compare plans to evaluate coverage limits, premiums, and benefits.

* Choose between the different types of no medical exam policies available to find the one best suited for you, based on your budget and needs.

* Check the insurer's financial strength and customer reviews for reliability.

* Make sure the policy fits your budget and long-term protection goals.

* Read the fine print carefully to understand exclusions, waiting periods, and renewal terms.

Types of No Medical Exam Policies

No medical exam policies fall into three main categories, each designed for different health situations and coverage needs.

Accelerated Underwriting Life Insurance:

In this process, applicants answer health questions on the application. Insurers use this data, along with prescription histories, medical databases, and lifestyle habits of the applicant to make underwriting [https://en.wikipedia.org/wiki/Underwriting] decisions. Healthy applicants can often qualify for the same low rates as fully underwritten policies without undergoing any medical tests.

Simplified Issue Life Insurance:

This policy type skips the medical exam but still asks a few basic health questions. The insurer uses your answers and some background data to decide on your eligibility and coverage amount.

Guaranteed Issue Life Insurance:

This is the most accessible option wherein coverage is issued regardless of health status. There are no health questions or medical tests involved, making it easy to qualify. However, premiums are higher and benefits are smaller, often with a limited payout period early on.

Major Gaps in Traditional Life Insurance Policies

Traditional life insurance policies, while comprehensive, often leave significant portions of the population underserved due to strict requirements and outdated processes.

* Medical exam barriers: Many potential applicants avoid coverage because they fear medical exams or have pre-existing conditions that make approval difficult.

* Lengthy underwriting: Traditional policies can take weeks or months to approve, discouraging people who need quick protection.

* Complex procedures: Paperwork, medical scheduling, and in-person consultations can make the process intimidating and time-consuming.

* Limited accessibility: Lower-income individuals, seniors, and those with chronic illnesses are often excluded due to high premiums or restrictive eligibility.

Media Contact

Company Name: Healthdata

Email:Send Email [https://www.abnewswire.com/email_contact_us.php?pr=healthdatagov-highlights-the-rise-of-no-medical-exam-life-insurance-options]

Country: United States

Website: https://healthdata.gov/

Legal Disclaimer: Information contained on this page is provided by an independent third-party content provider. ABNewswire makes no warranties or responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you are affiliated with this article or have any complaints or copyright issues related to this article and would like it to be removed, please contact retract@swscontact.com

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release HealthData.gov Highlights the Rise of No Medical Exam Life Insurance Options here

News-ID: 4241481 • Views: …

More Releases from ABNewswire

SEO Agency Dubai: How Data-Driven Search Strategies Are Shaping Digital Growth

Explore how a data-driven SEO agency in Dubai helps businesses grow online through advanced search strategies, analytics, and performance-based SEO. Visit us today!

Dubai's digital economy is moving fast, and visibility has become a decisive factor in growth. Businesses competing in saturated markets can no longer rely solely on paid ads. They need organic authority, credibility, and long-term discoverability. This is where an SEO agency Dubai [https://www.google.com/search?SEO+agency+Dubai&kgmid=/g/11v3f6wqbl] businesses trust becomes essential,…

The Life and Loves of an Artist Illuminates the Remarkable Journey Behind a Life …

Authors Paul and Gail King present The Life and Loves of an Artist. This sweeping biographical narrative traces the extraordinary story of a family whose lives were intertwined with art, resilience, and history.

Rooted in meticulous research and personal reflection, the book offers a moving portrait of two generations shaped by both hardship and inspiration.

Purpose of the Book

What started as an attempt to remember family memories became a vivid journey of…

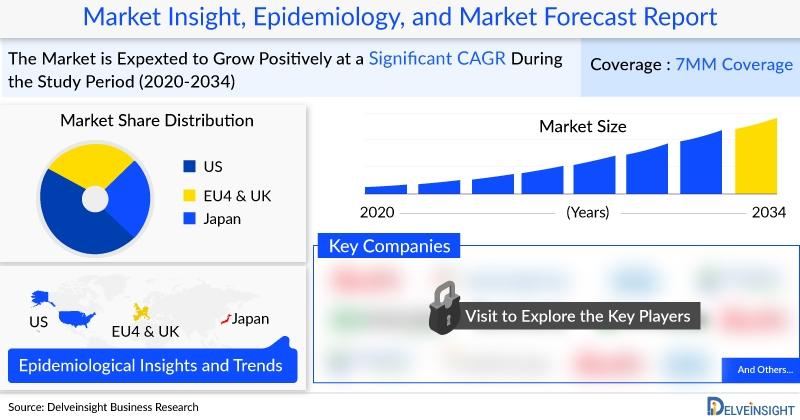

Alzheimer's Disease Market in the 7MM is projected to reach USD 34 Billion by 20 …

Key players operating in the Alzheimer's disease market include Eisai, Biogen, Changchun Huayang High-tech Co. Ltd., Hoffmann-La Roche, vTv Therapeutics, AZTherapies, Cerecin, Neurotrope, Lyndra, AC Immune, INmune Bio, Cassava Sciences, EIP Pharma, Neuraly, AB Science, Cortexyme, Anavex Life Sciences, Athira Pharma, Time Therapeutics, Prilenia Therapeutics, Denali Therapeutics Inc., Stemedica Cell Technologies, Inc., along with several other emerging and established companies.

The Alzheimer's disease market was valued at approximately USD 3,610 million…

Glaucoma Market Forecast 2034: USD 4,073 Million Market Size, 30+ Companies, and …

Major Glaucoma players include Allergan (AbbVie), Sun Pharma Advanced Research Company Limited, Santen Pharmaceutical Co., Ltd., Alcon, D. Western Therapeutics Institute (DWTI), Kowa Ltd., Senju Pharmaceuticals, Otsuka Pharmaceuticals, Bausch and Lomb, Novartis, Merck & Co., Aerie Pharmaceuticals, Nicox Ophthalmics, Sylentis, Envisia Therapeutics, Ocuphire Pharma, TearClear, Peregrine Ophthalmic, and others.

The Glaucoma Market across the seven major markets (7MM) - the United States, EU4 (Germany, France, Italy, and Spain), the United Kingdom,…

More Releases for Life

Life Heater Reviews - How Does Life Heater Work? Read life heater reviews consum …

The Life Heater emerges as a revolutionary heating solution, redefining efficiency and safety standards for residents in the United States and Canada. More than a conventional heater, it boasts impressive energy savings of up to 30%, making it a beacon of sustainability in the realm of home heating. The device's convection heating system ensures rapid warmth, promising to elevate the comfort of spaces across North American homes with unprecedented speed.

The…

Russia Life Insurance Market to Eyewitness Massive Growth by 2026 | Renaissance …

A new research document is added in HTF MI database of 74 pages, titled as 'Russia Life Insurance - Key Trends and Opportunities to 2025' with detailed analysis, Competitive landscape, forecast and strategies. Latest analysis highlights high growth emerging players and leaders by market share that are currently attracting exceptional attention. The identification of hot and emerging players is completed by profiling 50+ Industry players; some of the profiled…

Life Insurance Market is Booming Worldwide | Sumitomo Life Insurance, Nippon Lif …

HTF MI recently added Global Life Insurance Market Study that gives deep analysis of current scenario of the Market size, demand, growth, trends, and forecast. Revenue for Life Insurance Market has grown substantially over the five years to 2019 as a result of strengthening macroeconomic conditions and healthier demand, however with current economic slowdown and Face-off with COVID-19 Industry Players are seeing Big Impact in operations and identifying ways to…

Online Life Insurance Market Swot Analysis by Key Players Nippon Life Insurance, …

Global Online Life Insurance Market Report 2020 by Key Players, Types, Applications, Countries, Market Size, Forecast to 2026 (Based on 2020 COVID-19 Worldwide Spread) is latest research study released by HTF MI evaluating the market, highlighting opportunities, risk side analysis, and leveraged with strategic and tactical decision-making support. The study provides information on market trends and development, drivers, capacities, technologies, and on the changing investment structure of the Global Online…

Life Insurance Market Next Big Thing with Major Giants HDFC Life Insurance, SBI …

A new business intelligence report released by HTF MI with title "Life Insurance Market in India 2019" is designed covering micro level of analysis by manufacturers and key business segments. The Life Insurance Market survey analysis offers energetic visions to conclude and study market size, market hopes, and competitive surroundings. The research is derived through primary and secondary statistics sources and it comprises both qualitative and quantitative detailing. Some of…

Life Insurance Market to Witness Massive Growth| Allan Gray Life, Coronation Lif …

HTF Market Intelligence released a new research report of 35 pages on title 'Strategic Market Intelligence: Life Insurance in South Africa - Key Trends and Opportunities to 2022' with detailed analysis, forecast and strategies. The study covers key regions and important players such as Allan Gray Life, Coronation Life Assurance, Sygnia Life etc.

Request a sample report @ https://www.htfmarketreport.com/sample-report/1854964-strategic-market-intelligence-38

Summary

The ""Strategic Market Intelligence: Life Insurance in South Africa - Key Trends…