Press release

Petrochemical Market Key Players - Share Consolidation Trends & Capital Growth Signals

The global petrochemical market remains the cornerstone of industrial manufacturing, enabling the production of plastics, fertilizers, detergents, packaging, and fuels. As economies transition toward sustainability, petrochemical companies are under immense pressure to balance profitability with environmental responsibility. Leading players are responding with technological innovation, capacity expansion, and diversification into circular and low-carbon solutions. This article explores the strategic moves, competitive strengths, and emerging investment opportunities shaping the global petrochemical landscape.Get deeper insights into competitive positioning and strategic benchmarking: Download our sample report here → https://www.researchnester.com/sample-request-4125

Top Companies & Their Strategies

The petrochemical market is dominated by a blend of integrated oil & gas giants and specialized chemical producers. Each of these players is adopting a distinct strategy - from decarbonization and digital transformation to regional expansion and feedstock optimization.

1. ExxonMobil Chemical Company

ExxonMobil continues to lead the global petrochemical market through its vertically integrated model and extensive production capacity across polyethylene, polypropylene, and aromatics. The company's key strength lies in its technological innovation and low-cost feedstock advantage derived from its upstream oil operations. Its recent investment in advanced recycling facilities in the U.S. and Singapore reflects a strong commitment to circular economy practices.

2. SABIC (Saudi Basic Industries Corporation)

SABIC, a subsidiary of Saudi Aramco, is central to Saudi Arabia's petrochemical diversification strategy. The company focuses on high-performance materials, sustainable polymers, and specialty chemicals. SABIC's regional strength in the Middle East and its growing footprint in Asia make it a critical player in global trade. Through partnerships like the joint venture with ExxonMobil in the U.S. Gulf Coast, SABIC is expanding its global supply chain and enhancing resilience against market volatility.

3. Dow Inc.

Dow's strategy centers around product innovation, digital transformation, and sustainability. The company is pioneering low-carbon plastics production through its Path2Zero initiative, which aims for net-zero carbon emissions by 2050. Dow's focus on specialty polymers and chemical recycling technologies strengthens its competitive edge, while its strong presence in North America and Europe ensures stable market positioning.

Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-4125

4. BASF SE

BASF remains a global leader in chemical innovation and integrated production systems (Verbund structure). The company's diversification across chemicals, plastics, performance products, and agricultural solutions enables it to navigate demand fluctuations effectively. BASF's emphasis on sustainable chemistry and green hydrogen integration demonstrates its leadership in aligning petrochemical operations with Europe's net-zero goals.

5. LyondellBasell Industries N.V.

LyondellBasell is renowned for its technological excellence in polymer production and circular plastics. The company has recently expanded its global recycling capabilities through the acquisition of Mepol Group and investments in chemical recycling startups. Its strong financial discipline and efficient global logistics give it a cost advantage, particularly in the polyethylene and polypropylene segments.

6. INEOS Group

INEOS operates as one of the largest privately owned petrochemical firms, with a portfolio covering olefins, polymers, and intermediates. The company's aggressive acquisition strategy, including the purchase of BP's global aromatics and acetyls business, has strengthened its downstream integration. INEOS's agility in adapting to regional market shifts and its ongoing investment in hydrogen fuel technologies underscore its forward-looking growth approach.

7. Reliance Industries Limited (RIL)

Reliance Industries dominates India's petrochemical landscape with a fully integrated value chain - from refining to polymer production. The company's ongoing expansion into renewable energy and green hydrogen signifies its dual focus on energy security and sustainability. RIL's scale, cost efficiency, and digital infrastructure position it as a competitive force across emerging markets.

8. Chevron Phillips Chemical Company (CPChem)

CPChem leverages the strength of its parent companies - Chevron and Phillips 66 - to operate efficiently across ethylene and polyethylene segments. Its recent announcement to construct a new ethane cracker in Texas reflects confidence in long-term demand. CPChem's strategy centers around optimizing feedstock utilization, expanding sustainable product lines, and maintaining low operational costs.

View our Petrochemical Market Report Overview here: https://www.researchnester.com/reports/petrochemical-market/4125

SWOT Analysis of Leading Petrochemical Companies

A combined SWOT analysis highlights the key competitive and structural factors influencing top petrochemical market players.

Strengths

Leading petrochemical companies benefit from strong vertical integration, which ensures control over feedstock supply, refining, and downstream production. Their global manufacturing networks and large-scale operations enable economies of scale, while advanced R&D capabilities foster innovation in sustainable materials and process efficiency. The integration of digital twins, AI-driven maintenance, and advanced analytics has also enhanced operational reliability and reduced energy intensity.

Weaknesses

Despite their strengths, the petrochemical industry faces high capital intensity and significant exposure to oil price volatility. Environmental challenges such as carbon emissions, plastic waste, and regulatory scrutiny increase compliance costs. Many legacy facilities rely on fossil-based feedstocks, which limits flexibility in transitioning to renewable or bio-based alternatives. Additionally, geopolitical tensions can disrupt raw material supply chains and hinder long-term investment decisions.

Opportunities

The shift toward a circular economy and the rising adoption of bio-based and recycled plastics present vast opportunities for petrochemical firms. Companies investing in chemical recycling, carbon capture, and hydrogen-based feedstocks can position themselves as sustainability leaders. Emerging markets in Asia and Africa offer significant demand potential due to industrialization and urban infrastructure growth. Strategic partnerships in green chemistry, as well as digital innovation, will unlock new revenue streams and operational efficiencies.

Threats

The biggest threats stem from tightening environmental regulations and global decarbonization mandates. Governments worldwide are implementing stricter controls on single-use plastics and emissions, compelling companies to innovate rapidly or risk obsolescence. Competitive pressures from alternative materials, such as bioplastics and composites, may also erode traditional petrochemical demand. Furthermore, fluctuating feedstock availability and price instability due to geopolitical events or energy transitions can undermine profitability.

Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-4125

Investment Opportunities & Market Trends

The petrochemical sector is undergoing a strategic transformation as investors prioritize sustainability, circularity, and energy efficiency. Over the past 12 months, key themes have emerged that are reshaping global investment patterns.

Sustainability-Driven Investments

Leading firms like Dow, LyondellBasell, and SABIC are channeling capital into chemical recycling, carbon capture, and bio-based materials. The expansion of advanced recycling plants across Europe and Asia underscores growing investor interest in sustainable feedstocks. Additionally, government-backed green initiatives - particularly in Europe and Japan - are catalyzing public-private partnerships for decarbonizing petrochemical clusters.

Digital Transformation

Investors are increasingly supporting companies adopting digitalization in petrochemical operations. Technologies such as AI-driven predictive maintenance, blockchain-based supply chain transparency, and smart refinery systems are enabling cost reductions and improved environmental monitoring. Firms that embrace digital twins and IoT-enabled process optimization are gaining investor confidence due to higher operational efficiency and resilience.

Mergers & Acquisitions Activity

M&A continues to play a vital role in consolidating the petrochemical industry. INEOS's acquisition of BP's aromatics business, LyondellBasell's expansion in circular polymer startups, and ExxonMobil's partnerships for recycling innovation highlight a robust M&A pipeline. These deals not only expand product portfolios but also enable access to next-generation technologies and strategic markets.

Regional Expansion

Asia Pacific remains the top investment destination, driven by its strong manufacturing base and growing demand for polymers and intermediates. China's petrochemical self-sufficiency strategy and India's refinery expansions are creating massive opportunities for both domestic and international investors. Meanwhile, the Middle East is leveraging its feedstock advantage to attract long-term foreign investments in downstream petrochemical projects.

Policy and Regulatory Shifts

Governments are increasingly incentivizing low-carbon petrochemical manufacturing through subsidies and carbon credits. The U.S. Inflation Reduction Act and the EU Green Deal are reshaping how petrochemical companies plan their long-term sustainability goals. In response, leading players are accelerating their net-zero roadmaps and investing in renewable power integration.

Stay ahead of investment moves in the Petrochemical Market - view our analyst-verified insights → https://www.researchnester.com/sample-request-4125

Related News:

https://www.linkedin.com/pulse/how-coenzyme-q10-revolutionizing-nutraceutical-ookfc/

https://www.linkedin.com/pulse/why-ammonia-market-becoming-central-global-b4rqc/

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Petrochemical Market Key Players - Share Consolidation Trends & Capital Growth Signals here

News-ID: 4240840 • Views: …

More Releases from Research Nester Pvt Ltd

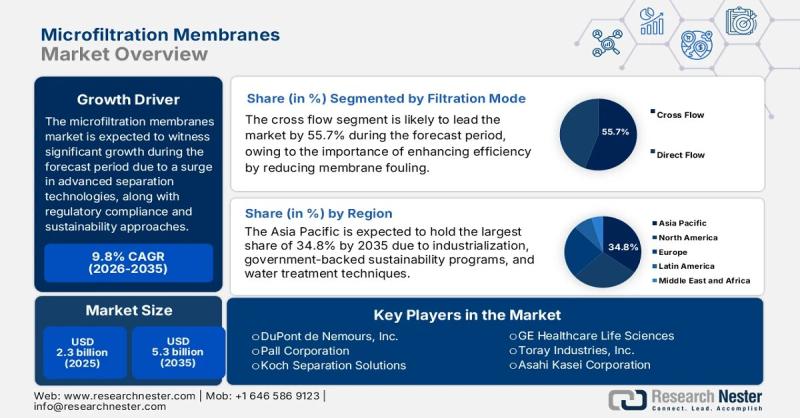

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for Petrochemical

Petrochemical Heaters Market Powering Sustainable and Efficient Petrochemical Pr …

The petrochemical heaters market has become an essential pillar in modern industrial operations, enabling efficient energy management, process optimization, and sustainable production within petrochemical plants. Petrochemical heaters are critical components for maintaining precise temperature control in processes such as distillation, cracking, reforming, and other chemical reactions. The demand for reliable, energy-efficient, and technologically advanced heaters is rising as the petrochemical industry focuses on improving operational efficiency, reducing environmental impact, and…

Global Petrochemical Market Outlook Report 2025

On Sep 26, Global Info Research released "Global Petrochemical Market 2025 by Manufacturers, Regions, Type and Application, Forecast to 2031". This report includes an overview of the development of the Petrochemical industry chain, the market status of Petrochemical Market, and key enterprises in developed and developing market, and analysed the cutting-edge technology, patent, hot applications and market trends of Petrochemical.

According to our (Global Info Research) latest study, the global Petrochemical…

Global Petrochemical Market Size by Application, Type, and Geography: Forecast t …

𝐔𝐒𝐀, 𝐍𝐞𝐰 𝐉𝐞𝐫𝐬𝐞𝐲- According to Market Research Intellect, the global Petrochemical market in the Internet, Communication and Technology category is projected to witness significant growth from 2025 to 2032. Market dynamics, technological advancements, and evolving consumer demand are expected to drive expansion during this period.

The growing need for chemicals used in manufacturing, packaging, and building around the world is propelling the petrochemical market's significant rise. The need for plastics, synthetic…

Basic Petrochemical Market 2022 | Detailed Report

The Basic Petrochemical research report combines vital data incorporating the competitive landscape, global, regional, and country-specific market size, market growth analysis, market share, recent developments, and market growth in segmentation. Furthermore, the Basic Petrochemical research report offers information and thoughtful facts like share, revenue, historical data, and global market share. It also highlights vital aspects like opportunities, driving, product scope, market overview, and driving force.

Download FREE Sample Report @ https://www.reportsnreports.com/contacts/requestsample.aspx?name=5388520…

Global Alkylbenzene Sulfonate Market Analysis 2020 Indian Oil, Jintung Petrochem …

Global Alkylbenzene Sulfonate Market Size, Type, Application, End-User, and Regional Analysis, Trade Analysis, Market Overview, Premium Insights,Patent Analysis, Market Attractiveness, Company Profiles, Traders/Distributors, Key Buyers, Forecasts 2020 - 2025

The Alkylbenzene Sulfonate market study exhibits a comprehensive analysis of the historic, current, and future trends across the globe. The report comprises of definitions, classifications, product specifications, and market overview, manufacturing processes, cost structures, and raw material analysis. The Alkylbenzene Sulfonate market…

GLOBAL ACRYLONITRILE MARKET: TAEKWANG INDUSTRIAL, SHANGHAI SECCO PETROCHEMICAL, …

Global Market Study Evaluate on Acrylonitrile Industry by Type, Manufacturers, Application, Type, and Regions, Forecast up to 2022

The scope of the global Acrylonitrile market report is:

This report offers a comprehensive evaluation of the Acrylonitrile market. It does so by in-depth qualitative insights, historical Acrylonitrile market data, and verifiable projections about global Acrylonitrile market size. The projections featured in the Acrylonitrile market report have been derived using proven research assumptions and…