Press release

Offshore Drilling Rigs Market: Leaders - Competitive Positioning, Strategic Strengths & Investor Outlook

The offshore drilling rigs market remains a cornerstone of the global oil and gas value chain, underpinning exploration and production (E&P) activities across deepwater and ultra-deepwater fields. Despite the volatility in crude prices and increasing sustainability pressures, offshore exploration continues to experience renewed investor interest as energy companies seek stable, long-term reserves and higher production efficiency. This article explores the strategic positioning of leading offshore drilling companies, offers a comprehensive SWOT analysis of the sector, and outlines the emerging investment trends shaping the future of offshore exploration.Get deeper insights into competitive positioning and strategic benchmarking: Download our sample Offshore Drilling Rigs Market report here → https://www.researchnester.com/sample-request-4895

Top Companies & Their Strategies

The offshore drilling rigs market is characterized by a concentrated competitive landscape where a few global players dominate through advanced rig technology, geographic reach, and strategic partnerships. These companies are investing heavily in automation, digitalization, and hybrid energy systems to enhance operational efficiency and environmental compliance.

Transocean Ltd.

Transocean remains a leader in ultra-deepwater and harsh-environment drilling, operating one of the world's most technically advanced rig fleets. The company's strength lies in its deepwater specialization, enabling it to command long-term contracts with oil majors like Shell and Equinor. Transocean's strategy focuses on optimizing fleet utilization through automation, predictive maintenance, and fuel efficiency improvements, while maintaining a strong order backlog in high-specification floaters.

Valaris Limited

Valaris has built its competitive edge through operational excellence and cost discipline. Following its merger with EnscoRowan, Valaris became one of the largest offshore drilling contractors globally, with an extensive portfolio of jack-ups, drillships, and semisubmersibles. The company is leveraging data analytics to improve drilling precision and minimize downtime. Its balanced exposure to both shallow and deepwater operations provides flexibility in responding to regional demand fluctuations.

Noble Corporation

Noble Corporation has positioned itself as a technology-driven offshore driller, focusing on safety, sustainability, and performance optimization. Its merger with Maersk Drilling has enhanced its fleet capabilities and geographic footprint across the North Sea, the Gulf of Mexico, and West Africa. Noble's competitive differentiation lies in its advanced automation systems, integrated rig management, and strong partnerships with major oil companies seeking sustainable drilling solutions.

Seadrill Limited

Seadrill's turnaround strategy has been defined by balance sheet restructuring and an intensified focus on deepwater opportunities. With a modern fleet of drillships and semisubmersibles, the company emphasizes cost competitiveness and digital transformation. Seadrill is targeting strategic contracts in the North Sea, Brazil, and the Gulf of Mexico, where offshore E&P spending is rebounding. Its focus on operational reliability and low-emission technologies positions it as a resilient contender in the global offshore drilling market.

Explore detailed profiles of top players and new entrants in this space - access your free sample report → https://www.researchnester.com/sample-request-4895

Diamond Offshore Drilling Inc.

Diamond Offshore stands out for its emphasis on performance optimization and technological innovation. Its proprietary Pressure Control by the Hour (PCbtH) model is redefining how drilling efficiency is monetized by offering performance-based contracts rather than time-based billing. The company's focus on rig reactivation and digital twin technologies has enhanced equipment uptime and operational transparency, helping it compete effectively in a cyclical industry.

Shelf Drilling Ltd.

Shelf Drilling has carved out a niche in the shallow-water and jack-up rig segment, particularly across the Middle East, Southeast Asia, and West Africa. Its low-cost operational model and regional specialization make it an agile player in markets where national oil companies (NOCs) prefer flexible, short-term contracts. The company's strategic advantage lies in optimizing legacy rigs through refurbishment, cost-efficient upgrades, and localized service models.

China Oilfield Services Limited (COSL)

COSL, a subsidiary of CNOOC, plays a pivotal role in Asia's offshore drilling market. Backed by strong state support and integrated service offerings-from drilling to engineering and logistics-it is rapidly expanding its global presence. COSL's strength lies in its cost competitiveness and large-scale operations in the South China Sea and offshore Africa. The company is also investing in environmentally friendly rig technologies to align with China's carbon neutrality goals.

Borr Drilling Limited

Borr Drilling is one of the fastest-growing emerging players in the offshore drilling rigs market, focusing on premium jack-up rigs and operational efficiency. By maintaining a young fleet and flexible contracting strategy, Borr has attracted investments from major oil-producing regions such as the Middle East and Latin America. The company's agility and cost optimization enable it to adapt quickly to short-term demand surges.

View our Offshore Drilling Rigs Market Report Overview here: https://www.researchnester.com/reports/offshore-drilling-market/4895

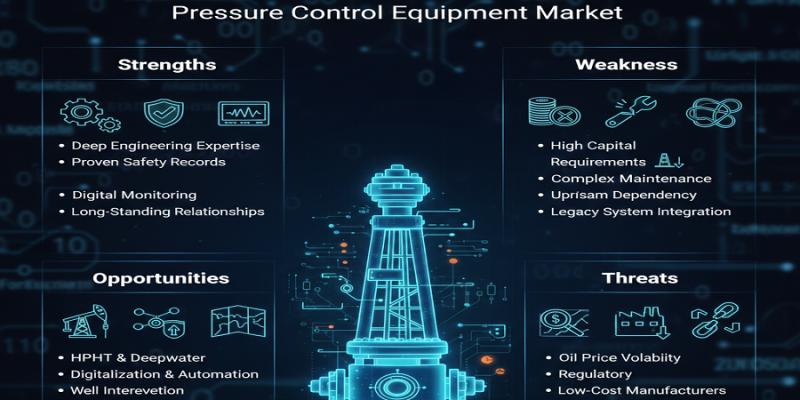

SWOT Analysis of Leading Offshore Drilling Companies

Strengths

Leading offshore drilling companies benefit from advanced rig technologies, strong partnerships with global oil majors, and decades of offshore engineering expertise. Their diversified fleets, capable of operating across deepwater, ultra-deepwater, and shallow-water projects, enable resilience against regional demand fluctuations. Furthermore, their focus on digital transformation and predictive analytics enhances equipment reliability, reduces downtime, and boosts profit margins in a capital-intensive industry.

Weaknesses

Despite technological advancements, the offshore drilling industry remains highly capital-intensive with significant exposure to oil price volatility. Debt levels across many operators-especially post-bankruptcy restructurings-remain elevated, limiting financial flexibility. Operational downtime due to maintenance, harsh environments, or regulatory compliance can further constrain profitability. Moreover, the transition toward renewable energy sources poses long-term uncertainty for traditional exploration-focused business models.

Opportunities

The offshore drilling rigs market is witnessing a surge in deepwater exploration investments, especially in regions like Brazil, Guyana, the North Sea, and the Gulf of Mexico. As onshore reserves mature, national and international oil companies are expanding exploration into frontier basins. There is also an increasing opportunity in hybrid-powered rigs and electrification projects, which reduce carbon intensity and attract ESG-focused investors. Emerging partnerships between drilling companies and technology firms are enabling AI-driven rig automation, a game-changer for operational efficiency and sustainability.

Threats

The market faces threats from volatile crude oil prices, stringent environmental regulations, and competition from renewable energy investments. Supply chain disruptions and skilled labor shortages continue to challenge project timelines and cost structures. Additionally, the increasing scrutiny from financial institutions-which are reducing exposure to fossil fuel-related projects-could limit access to capital for future rig expansions. Cybersecurity risks tied to the digitalization of rig operations also present growing vulnerabilities.

Access a complete SWOT breakdown with company-specific scorecards: Claim your sample report → https://www.researchnester.com/sample-request-4895

Investment Opportunities & Trends

Growing Focus on Deepwater and Ultra-Deepwater Projects

Investment momentum is shifting toward deepwater and ultra-deepwater exploration, as these reserves often promise higher yields and longer production lifespans. The Gulf of Mexico, Brazil's pre-salt fields, and West Africa are among the top destinations attracting capital. Major oil companies are signing long-term drilling contracts with offshore rig providers to lock in capacity, ensuring stability in the supply chain amid tightening global rig availability.

Mergers, Acquisitions, and Consolidation Activity

The offshore drilling industry has entered a phase of strategic consolidation, as companies seek economies of scale and improved fleet utilization. The Noble-Maersk Drilling merger and Valaris's acquisition of newbuild rigs reflect ongoing efforts to streamline operations and strengthen balance sheets. Consolidation also facilitates capital efficiency and enables operators to deploy advanced technologies across a unified global fleet.

Technology Integration and Digital Transformation

Technological integration is reshaping investment patterns within the offshore drilling rigs market. Companies are adopting digital twins, IoT-based monitoring, and predictive maintenance systems to enhance safety and reduce non-productive time (NPT). Hybrid-powered rigs using battery-assisted systems are gaining attention for their ability to lower fuel consumption and emissions. Investments in AI-driven drilling automation, spearheaded by collaborations between rig contractors and digital solution providers, are becoming a critical differentiator.

Regional Expansion and Local Partnerships

The Middle East, Africa, and Latin America are witnessing rising offshore activity, driven by national oil company initiatives and regional energy diversification programs. Partnerships between global contractors and local operators are unlocking new exploration frontiers. For example, Shelf Drilling's partnerships with ADNOC in the UAE and Borr Drilling's expansion in Mexico highlight the growing importance of localized strategies in capturing new opportunities.

Emergence of ESG-Driven Investments

Environmental, social, and governance (ESG) principles are reshaping capital flows into the offshore drilling sector. Investors are prioritizing companies that actively reduce emissions, improve safety standards, and adopt circular economy principles. The introduction of low-emission rigs and green retrofitting programs is drawing attention from institutional investors seeking exposure to sustainable energy infrastructure.

Stay ahead of investment moves in the Offshore Drilling Rigs Market- view our analyst-verified insights → https://www.researchnester.com/sample-request-4895

Related News-

https://www.linkedin.com/pulse/how-innovations-transforming-neurodegenerative-drugs-market-turdf

https://www.linkedin.com/pulse/how-innovations-reshaping-buccal-cavity-devices-market-3z5zf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Offshore Drilling Rigs Market: Leaders - Competitive Positioning, Strategic Strengths & Investor Outlook here

News-ID: 4240820 • Views: …

More Releases from Research Nester Pvt Ltd

Key Players in the Returnable Packaging Market: Share Positioning & Investor Per …

The returnable packaging market is gaining strategic importance as companies across logistics, food & beverage, automotive, and retail industries seek cost efficiency, sustainability, and supply chain resilience. Returnable packaging solutions-such as reusable pallets, crates, containers, drums, and intermediate bulk containers (IBCs)-are increasingly favored over single-use packaging due to regulatory pressure, circular economy goals, and operational efficiency.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8352

Top Companies

1. Brambles (CHEP)

Brambles, through its…

Pressure Control Equipment Market Dominance: Top Companies Strengthening Share & …

Pressure control equipment plays a mission-critical role in ensuring safety, operational integrity, and regulatory compliance across oil & gas exploration, well intervention, drilling, and production activities. From blowout preventers (BOPs) and control heads to manifolds and pressure valves, these systems are essential for managing high-pressure environments in both onshore and offshore operations.

As upstream operators focus on deeper wells, high-pressure high-temperature (HPHT) environments, and complex well architectures, demand for advanced pressure…

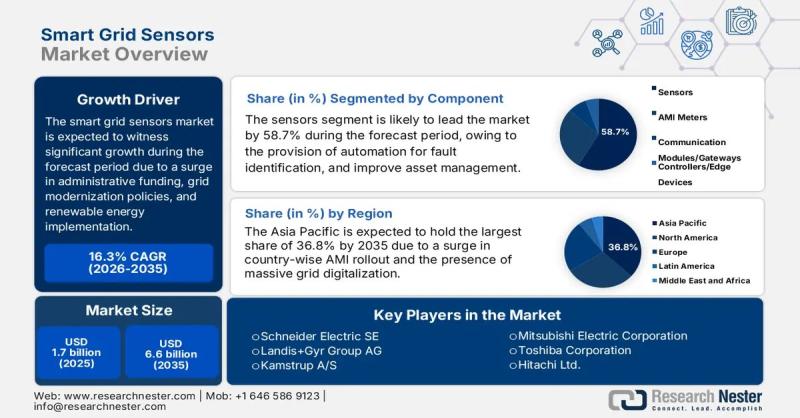

Smart Grid Sensors Market size to exceed $6.6 Billion by 2035 | General Electric …

Market Outlook and Forecast

The smart grid sensors market is emerging as a critical enabler of next-generation power infrastructure, supporting utilities and grid operators in transitioning from conventional, centralized electricity networks to intelligent, data-driven energy systems. Smart grid sensors provide real-time visibility into grid performance, enabling advanced monitoring, predictive maintenance, fault detection, and efficient energy distribution across transmission and distribution networks.

In 2025, the global smart grid sensors market is valued at…

Top Companies in Architectural Lighting Market - Benchmarking Performance & Futu …

The architectural lighting market has evolved into a design-driven, technology-intensive segment of the global lighting industry. Beyond illumination, architectural lighting now plays a critical role in enhancing aesthetics, supporting energy efficiency goals, and enabling smart building environments. Demand is increasingly shaped by urban development, commercial real estate upgrades, hospitality projects, and public infrastructure modernization.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8342

Top Companies & Their Strategies

1. Signify (Philips Lighting)

Signify…

More Releases for Drilling

Offshore Drilling Market to Rise at 7.9% CAGR till 2026; Archer Well Company, Bo …

The global offshore drilling market size is slated to reach USD 56.97 billion by 2026, exhibiting a CAGR of 7.9% during the forecast period. Surging demand for electricity worldwide is expected to drive the growth of this market, states Fortune Business Insights™ in its new report, titled “Offshore Drilling Market Size, Share and Industry Analysis, By Rig Type (Drill-ships, Semi-submersibles, and Jackups), By Water Depth (Shallow Water, Deepwater, and Ultra-Deepwater),…

What's driving the Offshore Drilling Market Growth? Prominent Players: Archer - …

The global offshore drilling market size is slated to reach USD 56.97 billion by 2026, exhibiting a CAGR of 7.9% during the forecast period. Surging demand for electricity worldwide is expected to drive the growth of this market, states Fortune Business Insights™ in its new report, titled “Offshore Drilling Market Size, Share and Industry Analysis, By Rig Type (Drill-ships, Semi-submersibles, and Jackups), By Water Depth (Shallow Water, Deepwater, and Ultra-Deepwater),…

What's driving the Offshore Drilling Market Growth? Prominent Players: Archer - …

The global offshore drilling market size is slated to reach USD 56.97 billion by 2026, exhibiting a CAGR of 7.9% during the forecast period. Surging demand for electricity worldwide is expected to drive the growth of this market, states Fortune Business Insights(TM) in its new report, titled "Offshore Drilling Market Size, Share and Industry Analysis, By Rig Type (Drill-ships, Semi-submersibles, and Jackups), By Water Depth (Shallow Water, Deepwater, and Ultra-Deepwater),…

What's driving the Offshore Drilling Market Growth? Prominent Players: Archer - …

The global offshore drilling market size is slated to reach USD 56.97 billion by 2026, exhibiting a CAGR of 7.9% during the forecast period. Surging demand for electricity worldwide is expected to drive the growth of this market, states Fortune Business Insights(TM) in its new report, titled "Offshore Drilling Market Size, Share and Industry Analysis, By Rig Type (Drill-ships, Semi-submersibles, and Jackups), By Water Depth (Shallow Water, Deepwater, and Ultra-Deepwater),…

Air Core Drilling Market By Application Dust Drilling, Mist Drilling and Foam Dr …

Allied Market Research published a new report, titled, " Air Core Drilling Market by Application (Dust Drilling, Mist Drilling, Foam Drilling, Aerated Fluid Drilling, and Nitrogen Membrane Drilling), by End-use Industry (Oil & Gas, Mining, and Construction) - Global Opportunity Analysis and Industry Forecast, 2020-2027." The report offers an extensive analysis of key growth strategies, drivers, opportunities, key segment, Porter's Five Forces analysis, and competitive landscape. This study is a…

Global Drilling Tools Market Analysis 2020 3D Drilling Tools, Sandvik, Redback D …

Global Drilling Tools market represents the advanced technology manufacturer with high quality data such as segment wise data, region wise data and qualitative analysis of the data which is collected from industry expert and market participants across the key points of market value chain. The market report is also comes up with the comprehensive study of Drilling Tools market insight, historical data from 2015-2019, forecast data from 2020-2025, and variations…