Press release

Financial Coaching Services Business Plan 2025: Profit Margins and ROI Explained

Overview:IMARC Group's "Financial Coaching Services Business Plan and Project Report 2025" offers a comprehensive framework for establishing a successful financial coaching services business. This in-depth report covers critical aspects such as market trends, investment opportunities, revenue models, and financial forecasts, making it an essential tool for entrepreneurs, consultants, and investors. Whether assessing a new venture's feasibility or optimizing an existing business, the report provides a deep dive into all components necessary for success, from business setup to long-term profitability.

What is Financial Coaching Services?

Financial coaching services help clients control their finances through personalized advice and assist in the real world by budgeting, saving, reducing debt, planning investments, and planning long-term. A financial coach gives advice, grows knowledge of finance, builds assurance, and grows a scheme to aid clients in reaching aims regarding finance.

Request for a Sample Report: https://www.imarcgroup.com/financial-coaching-services-business-plan-project-report/requestsample

Financial Coaching Services Business Setup:

Starting and Selling Financial Coaching Services provides an opportunity to help others manage their finances, while creating a profitable business. It covers the steps to obtain relevant financial certifications, build a business model, create tailored coaching services, and create a website to market the business. Entrepreneurs can provide services catering to individuals, startups and small businesses and help them gain financial literacy to gain control over their own financial decisions. Financial independence grows in popularity and people manage money which results in people demanding more financial coaches. A financial coaching business can build long-term trust and succeed sustainably in an evolving financial world by combining technology tools, consulting online, and practicing ethical finance.

Report Coverage

The financial coaching services Business Plan and Project Report includes the following areas of focus:

• Business Model & Operations Plan

• Technical Feasibility

• Financial Feasibility

• Market Analysis

• Marketing & Sales Strategy

• Risk Assessment & Mitigation

• Licensing & Certification Requirements

The comprehensive nature of this report ensures that all aspects of the business are covered, from market trends and risk mitigation to regulatory requirements and sales strategies.

Key Elements of Financial Coaching Services Business Setup

Business Model & Operations Plan

A solid business model is crucial to a successful venture. The report covers:

• Services Overview: A breakdown of the services offered

• Services Workflow: How each services is delivered to clients

• Revenue Model: An exploration of the mechanisms driving revenue

• SOPs & Services Standards: Guidelines for consistent services delivery and quality assurance

This section ensures that all operational and services aspects are clearly defined, making it easier to scale and maintain business quality.

Request For Customization: https://www.imarcgroup.com/request?type=report&id=43323&flag=E

Technical Feasibility

Setting up a successful business requires proper technical and infrastructure planning. The report includes:

• Site Selection Criteria: Key factors to consider when choosing a location

• Space & Costs: Estimations for the required space and associated costs

• Equipment & Suppliers: Identifying essential equipment and reliable suppliers

• Interior Setup & Fixtures: Guidelines for designing functional, cost-effective spaces

• Utility Requirements & Costs: Understanding the utilities necessary to run the business

• Human Resources & Wages: Estimating staffing needs, roles, and compensation

This section provides practical, actionable insights into the physical and human infrastructure needed for setting up your business, ensuring operational efficiency.

Financial Feasibility

The financial coaching services Business Plan and Project Report provides a detailed analysis of the financial landscape, including:

• Capital Investments & Operating Costs: Breakdown of initial and ongoing investments

• Revenue & Expenditure Projections: Projected income and cost estimates for the first five years

• Profit & Loss Analysis: A clear picture of expected financial outcomes

• Taxation & Depreciation: Understanding tax obligations and asset depreciation

• ROI, NPV & Sensitivity Analysis: Comprehensive financial evaluations to assess profitability

This in-depth financial analysis supports effective decision-making and helps secure funding, making it an essential tool for evaluating the business's potential.

Market Insights & Strategy

Market Analysis

A deep dive into the financial coaching services market, including:

• Industry Trends & Segmentation: Identifying emerging trends and key market segments

• Regional Demand & Cost Structure: Regional variations in demand and cost factors

• Competitive Landscape: An analysis of the competitive environment and positioning

Profiles of Key Players

The report provides detailed profiles of leading players in the industry, offering a valuable benchmark for new businesses. It highlights their strategies, offerings, and geographic reach, helping you identify strategic opportunities and areas for differentiation.

Buy Report Now: https://www.imarcgroup.com/checkout?id=43323&method=1911

Capital & Operational Expenditure Breakdown

The report includes a comprehensive breakdown of both capital and operational costs, helping you plan for financial success. The detailed estimates for equipment, facility development, and operating costs ensure you're well-prepared for both initial investments and ongoing expenses.

• Capital Expenditure (CapEx): Focused on facility setup, machinery, and essential equipment

• Operational Expenditure (OpEx): Covers ongoing costs like salaries, utilities, and overheads

Financial projections ensure you're prepared for cost fluctuations, including adjustments for inflation and market changes over time.

Profitability Projections

The report outlines a detailed profitability analysis over the first five years of operations, including projections for:

• Total income, expenditure, gross profit, and net profit

• Profit margins for each year of operation.

These projections offer a clear picture of the expected financial performance and profitability of the business, allowing for better planning and informed decision-making.

About Us: IMARC Group is a leading global market research and management consulting firm. We specialize in helping organizations identify opportunities, mitigate risks, and create impactful business strategies.

Our expertise includes:

• Market Entry and Expansion Strategy

• Feasibility Studies and Business Planning

• Company Incorporation and Factory Setup Support

• Regulatory and Licensing Navigation

• Competitive Analysis and Benchmarking

• Procurement and Supply Chain Research

• Branding, Marketing, and Sales Strategy

Contact Us:

IMARC Group

134 N 4th St., Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No:(D) +91 120 433 0800

United States: (+1-201971-6302)

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Financial Coaching Services Business Plan 2025: Profit Margins and ROI Explained here

News-ID: 4239984 • Views: …

More Releases from IMARC Group

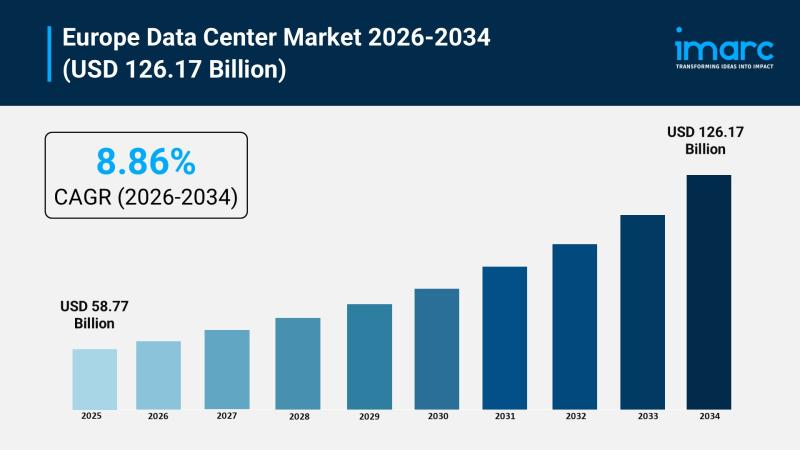

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

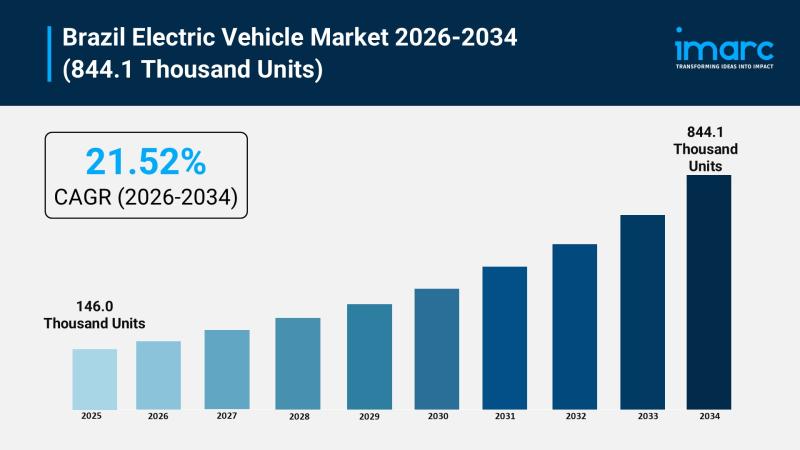

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for Financial

Financial Leasing Services Market Share, Size, Financial Summaries Analysis from …

Infinity Business Insights has recently released a comprehensive research report titled "Financial Leasing Services Market Insights, Extending to 2031." This publication spans over 110+ pages and offers an engaging presentation with visually appealing tables and charts that are self-explanatory. The worldwide Financial Leasing Services market is expected to grow at a booming CAGR of 6.3% during 2024-2031. It also shows the importance of the Financial Leasing Services market main players…

Global Financial Aid Management Software Market Streamlining Financial Assistanc …

Overview for the report "Financial Aid Management Software Market" Helps in providing scope and definations, Key Findings, Growth Drivers, and Various Dynamics by Infinitybusinessinsights.com. This report will help the viewer in Better Decision Making.

At a predicted CAGR of 10.9% from 2023 to 2028, The Market for Financial Assistance Management Software will increase from USD 1.07 billion in 2022 to USD X.XX billion by 2030. The market's expansion can be attributed…

What will be Driving Growth Financial Leasing Market 2027 | Bank Financial Leasi …

Financial Leasing Market research is an intelligence report with meticulous efforts undertaken to study the right and valuable information. The data which has been looked upon is done considering both, the existing top players and the upcoming competitors. Business strategies of the key players and the new entering market industries are studied in detail. Well explained SWOT analysis, revenue share and contact information are shared in this report analysis.

Ask for…

Financial Leasing Market 2017 Analysis – CDB Leasing, ICBC Financial Leasing C …

A financial lease is a method used by a business for acquisition of equipment with payment structured over time. To give proper definition, it can be expressed as an agreement wherein the lessor receives lease payments for the covering of ownership costs. Moreover, the lessor holds the responsibility of maintenance, taxes, and insurance.

In this report, RRI studies the present scenario (with the base year being 2017) and the growth prospects…

Financial Leasing Market Is Booming | KLC Financial, SMFL Leasing, GM Financial, …

HTF MI recently introduced Global Financial Leasing Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are Sumitomo Mitsui Finance and Leasing, Maldives, HNA Capital, KUKE S.A., KLC…

Financial Analytics Market: Banking & financial sector expected to make most of …

The Financial Analytics Market deals with the development, manufacture and distribution of financial analytics tools for enterprises of all kinds and sizes. Financial data analytics can be described as a set of tools, techniques and processes used to find out answers for various business questions as well as to forecast future scenarios regarding finance and the economy.

The services provided by the Financial Analytics Market are used for analyzing the equity…