Press release

Phosphated Ester Market to Reach USD 2,079 Million by 2031 Top 10 Company Globally

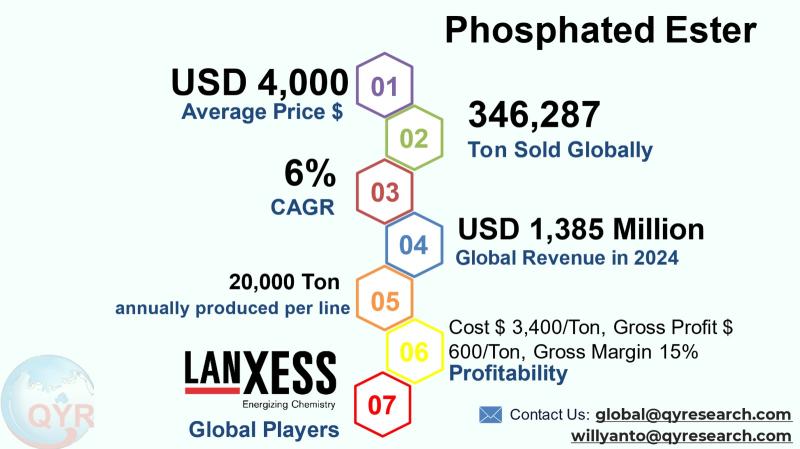

Phosphated esters are a class of organophosphorus compounds used as flame retardants, plasticizers, surfactants/dispersants and specialty lubricants (including fire-resistant hydraulic fluids). They are produced by esterification of phosphoric acid (or derivatives) with alcohols or phenolic compounds and are valued where thermal stability, hydrolytic stability and flame resistance are required. The industry serves end markets such as plastics and polymers, coatings and paints, lubricants & hydraulic fluids (notably in aerospace and industrial applications), agrochemical formulations and certain specialty formulation chemistries. Recent product development has emphasized lower-toxicity chemistries, biodegradable dispersant grades for agrochemical formulations, and performance blends tailored for high-temperature plastics and fire-resistant fluid applications.The 2024 global market size of USD 1,385 million and a forecast compound annual growth rate of 6% to 2031 reaching market size USD 2,079 million by 2031, with an average market price at USD 4,000 per ton, total global volume sold in 2024 is at approximately 346,287 tons. The factory gross margin of 15%, which implies an average factory gross profit around USD 600 per ton and cost of goods sold around USD 3,400 per ton. A COGS breakdown is as: raw materials, additives & reagents, energy and utilities, manufacturing overhead and direct labor. A single-line full machine capacity production is around 20,000 tons per line per year. Downstream demand is concentrated in plastics/flame retardant markets, hydraulic fluids, and lubricant additives.

Latest Trends and Technological Developments

The sector has seen three converging trends through 20242025: (1) formulators replacing legacy phenolic or halogenated flame retardants with triaromatic and alkyl-aryl phosphate esters or engineered blends to meet tighter regulatory and customer preferences for lower-halogen systems; (2) development of biodegradable phosphate-based dispersants for crop protection formulations (notably new product introductions and patent activity from specialty chemical suppliers); and (3) capacity expansions and supply-chain repositioning in Asia as demand for flame-retardant and hydraulic-lubricant grades grows in automotive, electronics and aerospace segments. Notable vendor and market-report activity includes major market reports and competitive analyses released in 2024 (ResearchAndMarkets, Feb 2024) and continuing market intelligence coverage in 2025 emphasizing Asia-Pacific as the fastest growing region for phosphate esters. Recent product-level announcements include biodegradable alkoxylated phosphate ester dispersants for crop formulations introduced by established surfactant producers (product literature posted in 20242025). Dates and sources: Research & Markets industry report (Feb 2024); product pages and supplier bulletins 20242025.

BASF SE, a leading global chemical company, regularly purchases large quantities of Phosphated Ester from Lubrizol Corporation, a major specialty chemical supplier. BASF procures this specific additive for its high-performance industrial lubricant formulations, with a typical annual contract amounting to several hundred metric tons. The price is negotiated based on purity and volume, generally falling within the range of USD 4,500 to 6,000 per metric ton. This procurement is critical for BASF to meet the stringent technical requirements of its customers in the metalworking and hydraulic fluid sectors.

The product is successfully applied by Boeing in its aircraft manufacturing facilities. Phosphated Ester-based fire-resistant hydraulic fluid, specifically the Skydrol® brand (which utilizes phosphated ester chemistry), is installed in the hydraulic systems of commercial airliners like the 787 Dreamliner. For a single aircraft, the initial fill and maintenance cycles require several hundred liters of this specialized fluid, with the procurement value for a fleet-wide program amounting to millions of dollars annually, translating to a cost of approximately USD 15 to 20 per liter for the finished fluid.

Asia dominates both production and consumption of phosphated esters. China and India host major production clusters for both basic triaryl/trialkyl phosphate grades and commodity phosphate-based surfactants and dispersants, supported by integrated chemical intermediates and lower-cost production economics. Demand drivers across Asia are a combination of (a) rising electronics and electrical equipment production requiring flame retardant additives, (b) growth in automotive and aerospace supply chains demanding fire-resistant hydraulic fluids and specialty lubricants, and (c) expanding agrochemical formulation markets that require dispersants and adjuvants. Several domestic manufacturers in India and China produce a wide range of phosphate ester grades for local and export markets. Market analyses consistently call out Asia-Pacific as the region with the fastest growth profile for phosphate esters given the presence of large polymer and coating sectors and rising industrial base.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5206519

Phosphated Ester by Type:

Alkyl Aryl Phosphated Ester

Trialkyl Phosphated Ester

Triaryl Phosphated Ester

Phosphated Ester by Product Category:

Synthetic

Natural

Phosphated Ester by Market Segment:

Lubricant

Surfactant

Fire Retardant

Pesticides

Others

Phosphated Ester by Features:

High Thermal Stability Grades

Hydrolytically Stabe Grades

Eco Label Compliant Grades

Biodegradable and Water Compatible Dispersant Grades

Others

Phosphated Ester by Shape:

Liquid Ester Blends

High Viscosity Fluids

Solid Esters

Encapsulated forms

Others

Phosphated Ester by Application:

Automotive

Agrochemicals

Paints & Coatings

Plastic

Others

Global Top 10 Key Companies in the Phosphated Ester Market

Lanxess Deutschland GmbH

Exxon Mobil Corporation

Solvay

Eastman Chemical Company

Dow Chemical Company

Ashland

Castrol Limited

Croda International Plc

BASF SE

Afton Chemical

Regional Insights

Within Southeast Asia, ASEAN markets show differentiated demand: Indonesias large agricultural sector supports demand for phosphate-based dispersants and agrochemical adjuvants while growing downstream plastics and construction sectors raise demand for flame-retardant plasticizers and additives. Malaysia and Thailand are notable for electronics and electrical assembly demand; Vietnam is emerging as a production hub for appliances and electronics which increases local additive consumption. Supply in ASEAN is a mix of imports (from China, India and specialty suppliers) and local batch producers that often serve domestic formulations markets; regional trade also sees finished grades shipped to neighboring countries for final blending. Indonesia specifically presents demand tied to agrochemical formulations, building/construction insulation and rising automotive components manufacturing, making it a priority growth market for specialty phosphated ester grades. Industry reports and supplier directories identify ASEAN as a strategic growth pocket, but capacity constraints and logistics can make local sourcing patchy buyers frequently balance imported specialty grades vs. locally produced commodity grades.

The industry faces several systemic challenges: hydrolytic stability and long-term performance requirements in humid tropical climates make specification and quality control more demanding for ASEAN customers; regulatory trends toward restricted additives (especially halogenated flame retardants) push formulators to qualify new phosphate-ester chemistries which can be time consuming and costly; feedstock volatility for alcohols/phenolics and global energy price swings affect raw material costs and margins; and the commoditization of basic grades squeezes smaller producers. Additionally, environmental and occupational safety expectations are rising, requiring producers to improve waste handling, reduce by-product emissions and invest in cleaner process technologies. These factors create both risk and opportunity for producers who can offer differentiated, compliant, and performance-backed products.

Producers and investors should prioritize (a) developing and certifying lower-toxicity, higher-performance specialty grades tailored to automotive and electronics customers; (b) establishing regional blending/packaging hubs in ASEAN to lower freight and speed customer qualification; (c) securing feedstock and backward integration opportunities to stabilize margins; and (d) offering technical services (formulation labs, co-development programs) as a differentiator for OEM and formulator customers. For buyers, long-term offtake arrangements or toll-manufacturing with qualified local producers in Indonesia and other ASEAN countries can reduce lead times and supply risk. From a manufacturing-capacity standpoint, modular single-line investments (~30k60k tpa per line) allow scalable expansion where demand is confirmed

Product Models

Phosphated esters are a class of organic phosphate compounds widely used in industrial applications as flame retardants, plasticizers, lubricants, and hydraulic fluids. Their chemical versatility allows for tailored performance across different formulations depending on the alkyl or aryl group structures.

Alkyl aryl phosphated esters combine the flexibility of alkyl chains with the aromatic stability of aryl groups, making them ideal for applications in metalworking fluids, lubricants, and flame-retardant additives. Notable products include:

Reofos 65 - Lanxess: A versatile alkyl aryl phosphate ester used as a flame retardant plasticizer in PVC and engineering plastics.

Kronitex 100 - ICL Industrial Products: Used as an anti-wear additive and flame retardant in synthetic lubricants.

Phosflex 4 - ExxonMobil Chemical: A plasticizer that enhances fire resistance in coatings and flexible PVC.

Durad 220B - Chemtura (now Lanxess): Provides antiwear and antioxidation protection in industrial lubricants.

KR-810 - Daihachi Chemical Industry: Acts as a flame retardant and plasticizer for polyester and epoxy resins.

Trialkyl phosphated esters are fully aliphatic, offering superior hydrolytic stability and low-temperature fluidity. They are common in hydraulic fluids, lubricants, and antifoam agents. Examples include:

Tributyl Phosphate (TBP) - Solvay: A solvent and plasticizer widely used in cellulose and resins.

Tris(2-ethylhexyl) Phosphate (TEHP) - Eastman Chemical: Used as a flame retardant and plasticizer for flexible PVC.

Tricresyl Phosphate (TCP) - Lanxess: Provides antiwear properties in lubricants and flame resistance in polymers.

Tris(Butoxyethyl) Phosphate (TBEP) - ICL Industrial Products: Used in coatings and flexible PVC as a flame retardant.

Trioctyl Phosphate (TOP) - Tokyo Chemical Industry (TCI): Serves as a solvent for extraction and flame retardant additive.

Triaryl phosphated esters are primarily aromatic, offering excellent fire resistance, high-temperature performance, and chemical stability, ideal for electrical insulation, phenolic resins, and engineering plastics. Notable products include:

Reofos 50 - Lanxess: Triaryl phosphate ester used as a flame retardant plasticizer in phenolic resins and PVC.

TXP (Tri cresyl phosphate) - Eastman Chemical: Classic triaryl phosphate offering both plasticizing and flame-retardant properties.

Fyrolflex TPP - ICL Industrial Products: Triphenyl phosphate variant commonly used in engineering plastics.

Adeka FP-600 - Adeka Corporation: Flame-retardant triaryl phosphate for polycarbonate and ABS applications.

Santicizer 141 - Valtris Specialty Chemicals: Provides both flexibility and fire resistance in polymer compounds.

Phosphated esters remain a mid-sized but strategically important specialty chemical market with stable growth driven by electronics, automotive/aerospace, coatings, and agrochemical formulation demand. Asia and ASEAN (including Indonesia) are central to future growth because of expanding manufacturing bases and formulation industries. Producers that invest in compliant, higher-value grades, regional supply points and technical service capabilities are best positioned to capture margin expansion as commodity pressure continues on basic grades.

Investor Analysis

What to watch: market size and stable mid-single-digit CAGR, regional demand concentration in Asia/ASEAN, feedstock and margin sensitivity, and product substitution trends away from halogenated flame retardants. How it benefits investors: knowing the split between high-margin specialty grades and low-margin commodity grades helps prioritize investment (e.g., capex into specialty continuous reactors and QA labs vs. commodity batch capacity). Why it matters: a factory gross margin environment for specialty grades combined with favorable demand growth in Asia and Indonesia can deliver predictable returns when complemented by offtake agreements, backward integration, or partnerships with regional formulators. Investors should favor assets with technical capabilities (R&D/formulation), regional logistics/packaging, and contracts that mitigate feedstock volatility. Strategic M&A of regional formulators or toll-blenders can accelerate market access in ASEAN.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5206519

5 Reasons to Buy This Report

To obtain a consolidated market-size and demand-volume snapshot for 2024 with regional focus on Asia and ASEAN.

To see supplier and competitive positioning (global majors vs. regional producers) and recent product/technology developments.

To access practical manufacturing economics (price/ton, COGS structure, factory gross profit and margin) and typical line capacities for investment planning.

To understand downstream demand segmentation (plastics/coatings, lubricants/hydraulics, agrochemicals) and tactical go-to-market recommendations for ASEAN.

To gain investor-focused analysis that links operational levers (integration, blending hubs, technical services) to margin expansion opportunities.

5 Key Questions Answered

What was the global market size (USD) and volume (tonnes) for phosphated esters in 2024 and what growth rate is reasonable to 2031?

What are the representative price/ton, COGS/ton and factory gross profit and margin benchmarks for producers?

Which downstream industries absorb the largest share of phosphated esters and how do these shares differ in Asia and ASEAN?

Who are the principal global players and what is the competitive mix in Asia and Southeast Asia?

What strategic moves (capacity, integration, technical services, regional blending hubs) most improve producer margins and investor returns?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Phosphated Ester Market Research Report 2025

https://www.qyresearch.com/reports/5206519/phosphated-ester

Phosphated Ester - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5206520/phosphated-ester

Global Phosphated Ester Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5206518/phosphated-ester

Global Phosphated Ester Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5206517/phosphated-ester

Global Alkyl Phosphate Esters Market Research Report 2025

https://www.qyresearch.com/reports/4484312/alkyl-phosphate-esters

Global Anionic Phosphate Ester Market Research Report 2025

https://www.qyresearch.com/reports/3661626/anionic-phosphate-ester

Global Silicone Phosphate Esters Market Research Report 2025

https://www.qyresearch.com/reports/3456777/silicone-phosphate-esters

Global Phosphate Ester Electrolyte Market Research Report 2025

https://www.qyresearch.com/reports/4431984/phosphate-ester-electrolyte

Global Halogen-free Phosphate Ester Market Research Report 2025

https://www.qyresearch.com/reports/3456957/halogen-free-phosphate-ester

Global Phosphate Ester Flame Retardants Market Research Report 2025

https://www.qyresearch.com/reports/3821733/phosphate-ester-flame-retardants

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Phosphated Ester Market to Reach USD 2,079 Million by 2031 Top 10 Company Globally here

News-ID: 4238804 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Phosphate

Calcium Phosphate Market - Latest Report on the Current Trends and Future Opport …

The New Market Research Report - Calcium Phosphate Market

The analysis tracks the impact of key market dynamics on the major challenges and the strategies adopted by key vendors and market players to overcome the challenges and expand their market presence. The study takes a closer look at the strategies and measures adopted by key stakeholders and investors to boost the development of product; the analysis will be useful in understanding…

Global Phosphate Rock Market 2022 Growing Opportunity and Competitive landscape …

The market study based on the Global Phosphate Rock market published by The Brainy Insights provides an up-to-date and accurate market picture. It also provides important data on the various components which affect the progress of the Phosphate Rock market through a brief scan and detailed information. The report will help stakeholders and partners define the best development methods and take advantage of the opportunities prevailing in the Phosphate Rock…

Monoammonium Phosphate (MAP) and Diammonium Phosphate (DAP) Market 2021 | Detail …

ReportsnReports publishes the report titled Monoammonium Phosphate (MAP) and Diammonium Phosphate (DAP) that presents a 360-degree overview of the market under one roof. The report is developed with the meticulous efforts of an enthusiastic and experienced team of experts, analyts, and researchers that makes the report a valuable asset for stakeholders to make robust decisions. This report also provides an in-depth overview of product type, specification, technology, and production analysis…

Phosphate Rock Market In-depth Insights, Revenue Details, Regional Analysis by 2 …

A new report from Report Ocean examines the global Phosphate Rock Market for the forecast period of 2021-2027. Evaluating and responding to consumer needs in a more efficient, proactive, and comprehensive way than the competition.

The report examines the key drivers and restraints for the forecast period and their impact on the market. In addition to learning about the newest technologies, the Global Phosphate Rock Market Report clients gain valuable perspectives…

Hyperphosphatemia Therapeutics Market Size, Share & Growth Analysis By Product ( …

The Hyperphosphatemia Therapeutics Market Research Reports is provide a great offer Insight to the market in terms of definition, segmentation, market trends and potential and facing the challenge which market is assuming. The report is research through analysis the Research Methodology such as Primary Research, Secondary Research, company share analysis, macro- economic indicator and Industry indicator

The Hyperphosphatemia Therapeutics market also offering the Competitor with analysis of the…

Calcium Phosphate Market 2019 Analysis By Regional Outlook Competitive Landscape …

LOS ANGELES, United States: The report offers an industry-standard and a highly authentic research study on the global Calcium Phosphate market. With qualitative and quantitative analysis, it throws light on some of the crucial factors contributing to the growth of the global Calcium Phosphate market. As part of a study on market dynamics, it also explains factors affecting the global market growth. The authors of the report have provided a…