Press release

India Ediscovery Market Size, Growth, and Trends Forecast 2025-2033

Market Overview:According to IMARC Group's latest research publication, "India eDiscovery Market Size, Share, Trends and Forecast by Component, Deployment Type, End User, Vertical and Region, 2025-2033", the India eDiscovery market size reached USD 518.4 Million in 2024. Looking forward, the market is expected to reach USD 1,098.3 Million by 2033, exhibiting a growth rate (CAGR) of 8.10% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-ediscovery-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the India eDiscovery Market

● Explosive Growth in Digital Data and Legal Proceedings Creating Urgent Demand

India's eDiscovery market is experiencing remarkable momentum driven by the explosion of electronically stored information across organizations. The sheer volume of digital data being generated is staggering-companies are dealing with emails, instant messages, social media communications, cloud storage, mobile device data, and collaborative platform exchanges that all become potential evidence in legal matters. What makes this particularly interesting is how India's rapid digitalization is amplifying this trend. With over 954 million internet users as of recent reports, the country is witnessing unprecedented data creation daily. This digital footprint spans everything from corporate communications and financial records to customer interactions and operational documents. Legal proceedings increasingly involve sifting through massive repositories of this electronic information to find relevant evidence. Law firms handling corporate disputes, regulatory investigations, intellectual property cases, and compliance audits need sophisticated eDiscovery solutions to efficiently identify, collect, process, and analyze this electronic evidence. The traditional manual review methods simply can't keep pace with the volume and complexity of modern digital evidence. Banking and financial services institutions dealing with regulatory inquiries need to quickly produce relevant documentation from their vast digital archives. IT and telecommunications companies facing patent disputes must analyze years of development communications and technical documentation. Manufacturing enterprises involved in contract disputes need to retrieve and review procurement emails, design files, and internal communications. The government sector, managing public interest litigation and Right to Information requests, increasingly relies on eDiscovery tools to locate and produce relevant electronic records. What's driving sustained demand is that electronic evidence isn't just supplementary anymore-it's often the primary evidence in modern litigation. From WhatsApp messages in fraud investigations to email chains in contractual disputes, digital communications have become central to establishing facts in legal proceedings.

● Government Digitalization Initiatives and Regulatory Framework Strengthening Foundation

The Indian government's comprehensive Digital India initiative is creating perfect conditions for eDiscovery market expansion. Launched to transform the country into a digitally empowered society, this nationwide program encompasses everything from broadband connectivity in rural areas to digital literacy campaigns reaching millions of citizens. The E-Courts project, a transformative initiative aimed at digitizing judicial processes, has computerized court systems across the country, making electronic filing and digital case management standard practice. This shift toward digital court procedures naturally increases the need for proper handling of electronic evidence. The enactment of the Bharatiya Sakshya Adhiniyam in 2023 marks a watershed moment-this legislation formally recognizes electronic records as primary evidence and introduces structured procedures for authenticating digital evidence. For the first time, Indian law explicitly addresses how electronic evidence should be collected, preserved, and presented in court, creating clear guidelines that make eDiscovery practices not just beneficial but legally essential. The Data Protection and Digital Privacy Act is reshaping how organizations handle personal information, requiring robust systems for managing consent, tracking data flows, and demonstrating compliance-capabilities that eDiscovery platforms provide. Organizations now need to prove they can identify where personal data resides, track how it's processed, and produce evidence of compliance when regulators come calling. The Digital India Act being developed will provide comprehensive guidelines for emerging technologies including artificial intelligence and blockchain, further formalizing the digital legal framework. What makes this regulatory environment particularly supportive is that it's not creating barriers-it's establishing clear rules of the road that give organizations confidence to invest in proper eDiscovery infrastructure. Companies recognize that having robust eDiscovery capabilities isn't just about responding to current litigation; it's about being prepared for the regulatory scrutiny that comes with India's increasingly sophisticated digital governance framework. The government's push toward transparency and accountability in digital matters creates consistent demand for solutions that can demonstrate proper information handling.

● Growing Corporate Compliance Requirements and Cross-Border Business Expansion

India's integration into global business networks is creating sophisticated eDiscovery demands that extend beyond domestic legal requirements. Multinational corporations operating in India must comply with diverse regulatory frameworks-from Indian laws to international standards like GDPR when dealing with European data subjects. This complexity requires eDiscovery solutions capable of handling multi-jurisdictional requirements. Indian IT services companies serving global clients face eDiscovery obligations when their client organizations undergo litigation or regulatory investigations. A major Indian IT firm supporting a European bank, for instance, may need to produce communications and development records when that bank faces regulatory scrutiny. The outsourcing and business process management sector, where India holds significant global market share, creates unique eDiscovery challenges. When disputes arise, companies need to retrieve relevant communications and transactional records from distributed systems spanning multiple geographic locations. The BFSI sector's stringent regulatory environment generates consistent eDiscovery demand. Banks dealing with fraud investigations, insurance companies handling claim disputes, and investment firms facing regulatory inquiries all need sophisticated capabilities to locate and produce relevant electronic evidence quickly. Retail and consumer goods companies managing product liability cases or consumer protection matters require eDiscovery solutions to analyze customer communications, supply chain documentation, and internal quality control records. Manufacturing companies involved in patent litigation or contract disputes need to review technical documentation, development communications, and procurement records-often spanning years of operations. Healthcare and life sciences organizations handling medical malpractice cases or regulatory compliance reviews must navigate complex electronic health records while maintaining patient confidentiality. What's particularly driving growth is that organizations are adopting eDiscovery not just reactively when litigation occurs, but proactively as part of their information governance strategies. Companies are implementing systems that make their electronic information more discoverable and manageable from the outset, reducing costs and risks when legal matters arise. The recognition that poor information management can lead to adverse legal outcomes and significant costs is pushing enterprises to invest in comprehensive eDiscovery capabilities as part of their risk management framework.

Key Trends in the India eDiscovery Market

● Cloud-Based Solutions Gaining Strong Traction Over Traditional On-Premises Deployments

The deployment landscape in India's eDiscovery market is witnessing a significant shift toward cloud-based solutions, driven by compelling advantages in scalability, cost-effectiveness, and accessibility. Organizations are recognizing that cloud platforms eliminate the need for substantial upfront infrastructure investments while providing the flexibility to scale resources up or down based on case requirements. A law firm handling a major litigation matter can quickly provision additional processing capacity and storage for document review, then scale back when the matter concludes-paying only for what they use. This economic model is particularly attractive for mid-sized firms and corporate legal departments that face fluctuating eDiscovery demands. The cloud's accessibility advantage allows legal teams to collaborate remotely, with lawyers, paralegals, and clients accessing the same document repository and review platform from different locations. This became especially valuable during the pandemic and continues to support India's growing remote work culture. Cloud providers' investments in security infrastructure often exceed what individual organizations can afford, with features like encryption, access controls, audit trails, and regular security updates built into the platform. For organizations concerned about data protection requirements under India's privacy regulations, reputable cloud eDiscovery providers offer compliance frameworks and certifications that demonstrate adherence to security standards. However, on-premises solutions maintain relevance for specific use cases. Government agencies and organizations handling highly sensitive matters may prefer keeping data within their own infrastructure for security and sovereignty reasons. Large enterprises with consistent, high-volume eDiscovery requirements sometimes find on-premises solutions more economical over the long term. The hybrid approach is emerging as a practical middle ground-organizations maintain some capabilities on-premises while leveraging cloud resources for overflow capacity or specialized processing requirements. What's interesting about the Indian market is how rapidly cloud acceptance has grown. Initial skepticism about security and data sovereignty has given way to broader recognition that well-implemented cloud solutions can actually enhance security compared to less sophisticated on-premises setups. The availability of Indian data centers from major cloud providers has helped address data residency concerns, allowing organizations to keep their data within India's borders while still benefiting from cloud architecture's advantages.

● Services Component Dominating Over Software as Organizations Seek Comprehensive Support

The India eDiscovery market shows interesting dynamics in the services versus software balance, with services currently holding the larger market share. This reflects the reality that eDiscovery isn't just about technology-it's about applying that technology correctly within complex legal contexts. Organizations engaging in eDiscovery need more than software platforms; they need expertise in legal procedures, data forensics, project management, and regulatory compliance. Service providers offer managed eDiscovery solutions where they handle the entire process-from initial data collection and forensic preservation through processing, review, analysis, and production of responsive documents. This comprehensive approach is particularly valuable for organizations facing their first significant eDiscovery obligation or those without internal expertise to manage complex technical and legal requirements. Law firms representing clients in litigation can engage eDiscovery service providers to handle the technical heavy lifting-collecting data from client systems, processing it into reviewable formats, applying technology-assisted review to prioritize documents, and managing review teams. This allows attorneys to focus on legal strategy rather than technical infrastructure. Corporate legal departments dealing with regulatory investigations benefit from service providers' experience navigating specific regulatory requirements and producing compliant responses. The consulting aspect of eDiscovery services is particularly valuable-experts help organizations develop information governance policies, implement legal hold procedures, and establish workflows that make future eDiscovery efforts more efficient. Training services help internal legal and IT teams understand eDiscovery best practices and properly utilize available tools. However, software adoption is growing as organizations develop internal capabilities. Companies facing recurring eDiscovery obligations increasingly invest in software platforms that their own teams can operate, reducing per-case costs. The software segment includes document review platforms with advanced analytics, automated processing tools that reduce manual work, and predictive coding systems that use machine learning to identify relevant documents more efficiently. What's driving the services segment's continued dominance is the specialized knowledge required. Even organizations with software tools often engage services for particularly complex matters or to supplement internal capacity during high-volume cases. The learning curve for effective eDiscovery is steep, and many organizations find it more practical to rely on specialized providers rather than developing comprehensive internal expertise.

● Enterprise Segment Leading Adoption While Government and Legal Firms Show Strong Growth

The end-user landscape in India's eDiscovery market reveals distinct adoption patterns across different organizational types. Enterprises-particularly large corporations in regulated industries-currently represent the largest user segment. These organizations face diverse eDiscovery scenarios including litigation defense, internal investigations, regulatory compliance reviews, and merger-related document productions. Major BFSI institutions maintain ongoing eDiscovery capabilities because they operate under constant regulatory oversight and frequently handle disputes, fraud investigations, and compliance audits. A national bank dealing with a regulatory inquiry needs to quickly identify and produce relevant communications and transaction records from systems spanning hundreds of branches and multiple business lines. IT and telecommunications companies, given their scale and business complexity, face substantial eDiscovery demands from contract disputes, intellectual property litigation, employment matters, and regulatory investigations. A leading Indian IT services company might handle multiple concurrent eDiscovery obligations related to client disputes, employee lawsuits, and vendor disagreements. Retail and consumer goods companies increasingly encounter eDiscovery requirements related to product liability claims, consumer protection investigations, and franchise disputes. Manufacturing enterprises dealing with contract disputes, patent litigation, or environmental compliance matters need to review technical documentation, production records, and internal communications. Government and federal agencies are emerging as significant users, driven by Right to Information requests, public interest litigation, and administrative proceedings. Government departments managing large volumes of citizen communications, policy documents, and administrative records need efficient systems to locate and produce relevant information. The judiciary's digitalization efforts are increasing the volume of electronic evidence being submitted, creating demand for proper handling and review. Legal and regulatory firms represent a critical user segment, deploying eDiscovery solutions to serve their clients more efficiently. Law firms handling complex litigation need advanced document review platforms with features like predictive coding, concept clustering, and email threading that help their attorneys work through massive document collections efficiently. Litigation boutiques specializing in specific practice areas invest in eDiscovery expertise as a competitive differentiator. What's interesting is how eDiscovery adoption is spreading beyond traditional legal contexts. Organizations are using eDiscovery platforms for internal investigations unrelated to litigation-examining employee conduct, investigating data breaches, or reviewing business practices. The tools developed for legal discovery prove valuable for any situation requiring systematic analysis of large electronic information collections.

● Artificial Intelligence and Advanced Analytics Transforming Document Review Efficiency

The technological evolution of India's eDiscovery market centers on artificial intelligence and machine learning capabilities that are fundamentally changing how organizations approach document review. Technology-assisted review-where AI algorithms learn from attorney decisions to predict document relevance-can reduce review populations by identifying the most important documents for human examination. Instead of reviewing every document sequentially, legal teams can prioritize materials most likely to be relevant, dramatically reducing time and cost. Predictive coding systems achieve accuracy rates that often exceed traditional manual review while processing documents far faster. A case that might require months of attorney review can be completed in weeks using AI-assisted approaches. Advanced analytics provide insights that manual review can't match. Email threading capabilities identify conversation chains, eliminating the need to review each individual message when the complete thread provides context. Concept clustering groups documents by similar themes, helping reviewers understand patterns in large datasets. Sentiment analysis can flag communications that express concern, frustration, or urgency-potentially identifying key documents in investigations. Near-duplicate detection identifies substantially similar documents, allowing reviewers to examine one representative version rather than multiple iterations. What makes these capabilities particularly valuable in the Indian context is cost efficiency. Traditional document review often involves large teams of contract attorneys billing hourly-costs that scale linearly with document volume. AI-powered solutions reduce the human review population, sometimes by 60-70%, generating substantial savings. For organizations facing discovery obligations involving millions of documents, this cost reduction is transformative. The accuracy improvements also matter enormously. Inconsistent human review decisions-where different attorneys might disagree about document relevance-can create legal risks. AI systems apply learned criteria consistently, reducing variability. Natural language processing capabilities are advancing to handle multiple languages, increasingly important in India's multilingual business environment. Systems that can process Hindi, Tamil, Telugu, and other regional languages alongside English make eDiscovery more comprehensive. Visual analytics help legal teams understand document populations through interactive visualizations-timeline views showing communication patterns, network diagrams illustrating relationships between parties, and heat maps highlighting activity concentrations. These visual tools help attorneys quickly grasp key facts in complex matters.

Leading Companies Operating in the India eDiscovery Market:

The market features both global technology leaders and specialized eDiscovery providers serving Indian organizations. Major players include:

● Microsoft Corporation

● OpenText Corporation

● IBM Corporation

● CloudNine

● Deloitte

● AccessData Group

● Nuix Pty Ltd

● FTI Consulting

● Veritas Technologies

● Micro Focus International

India eDiscovery Market Report Segmentation:

Breakup by Component:

● Services

● Software

Breakup by Deployment Type:

● On-premises

● Cloud-based

● Hybrid

Breakup by End User:

● Government/Federal Agencies

● Legal and Regulatory Firms

● Enterprises

Breakup by Vertical:

● BFSI

● Retail and Consumer Goods

● Manufacturing

● Legal

● IT and Telecommunication

● Government

● Energy and Utilities

● Healthcare and Life Science

● Others

Regional Insights:

● North India

● West and Central India

● South India

● East and Northeast India

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=21519&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Ediscovery Market Size, Growth, and Trends Forecast 2025-2033 here

News-ID: 4238242 • Views: …

More Releases from IMARC Group

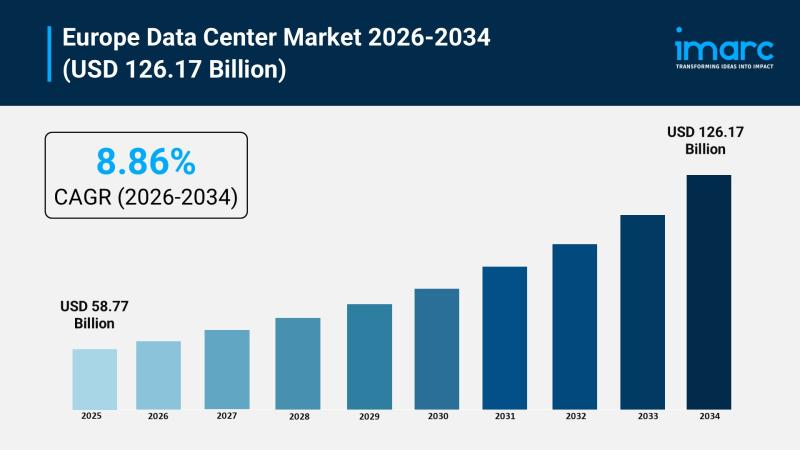

IMARC Group Forecasts 8.86% CAGR for Europe Data Center Market Amidst AI and Clo …

The Europe data center market is experiencing a critical phase of infrastructure evolution, having reached a valuation of USD 58.77 Billion in 2025. Propelled by the accelerating digitalization of the region's economy and sovereign cloud ambitions, the market is projected to reach USD 126.17 Billion by 2034. This growth trajectory represents a solid Compound Annual Growth Rate (CAGR) of 8.86% during the forecast period of 2026-2034.

Key Market Trends &…

Hot Sauce Manufacturing Plant DPR & Unit Setup - 2026: Demand Analysis and Proje …

Setting up a hot sauce manufacturing plant positions investors within one of the fastest-growing and flavor-driven segments of the global condiment industry, fueled by rising consumer appetite for spicy, bold, and ethnic flavors, increasing demand for clean-label and premium condiment products, and expanding utilization of hot sauce across food service, retail, and food processing applications. Made primarily from chili peppers, vinegar, salt, and complementary flavoring ingredients, hot sauce is recognized…

Glyoxylic Acid Prices Q4 2025: US Stable While Europe Remains High Price Trend

The Glyoxylic Acid Price Trend Analysis indicates dynamic shifts in global supply-demand balance, feedstock volatility, and regional trade flows. In 2026, Glyoxylic Acid Prices are reflecting fluctuations in raw material costs and downstream demand from pharmaceuticals, cosmetics, and agrochemicals. Market participants closely track the Glyoxylic Acid price index and forecast data to understand pricing momentum, risk exposure, and procurement strategies across key global regions.

Glyoxylic Acid Current Glyoxylic Acid Price Movements:

Recent…

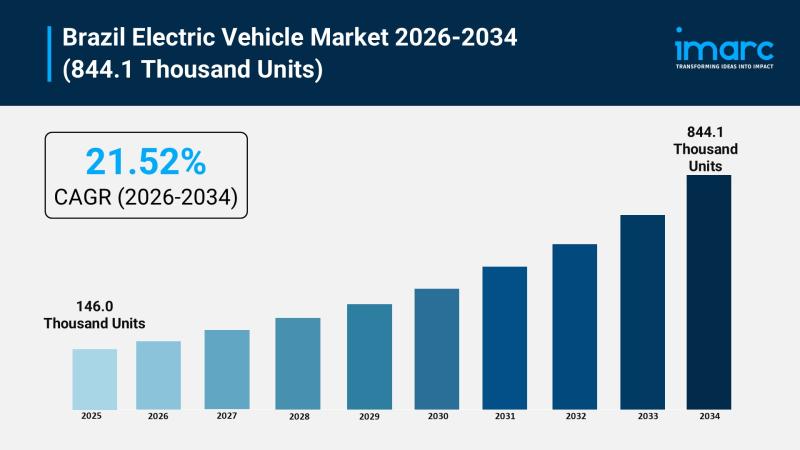

IMARC Group Forecasts 21.52% CAGR for Brazil EV Market as BYD and GWM Ramp Up Lo …

The Brazil electric vehicle (EV) market is currently witnessing an unprecedented surge, having reached a volume of 146.0 Thousand Units in 2025. Fueled by a combination of stringent environmental policies and a strategic shift toward domestic production by global automakers, the market is projected to reach 844.1 Thousand Units by 2034. This rapid expansion represents a robust Compound Annual Growth Rate (CAGR) of 21.52% during the forecast period of 2026-2034.

Key…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…