Press release

Electricity Trading Market Size to Reach USD 26.11 billion by 2035 | From USD 20.4 billion in 2025

Market Outlook and ForecastThe electricity trading market is entering a phase of strategic evolution - propelled by energy transition mandates, integration of renewables, and the digitalization of power systems. As global electricity demand continues to rise and grids evolve into more decentralized, intelligent networks, electricity trading is becoming a critical pillar of energy market liberalization and efficiency.

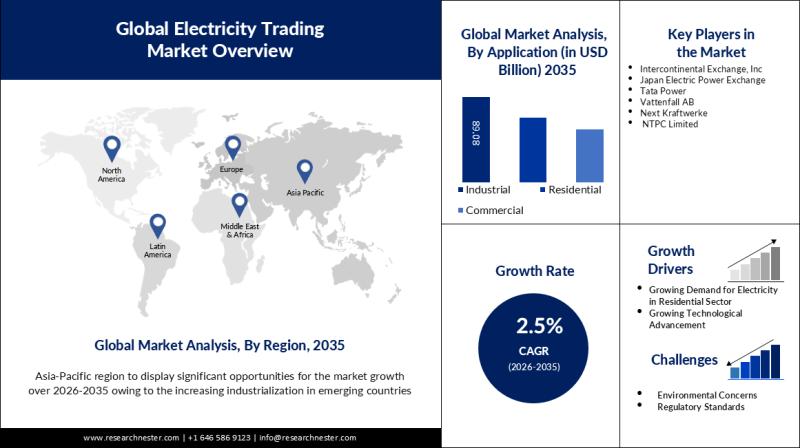

According to recent analysis, the global electricity trading market is valued at USD 20.4 billion in 2025 and is projected to reach USD 26.11 billion by 2035, registering a compound annual growth rate (CAGR) of around 2.5% from 2026 to 2035. This moderate yet steady growth reflects how electricity trading is transforming from a utility-driven function to a dynamic, digital marketplace where participants include industrial users, independent power producers, renewable asset owners, and financial institutions.

The market's evolution is anchored in three pillars: grid modernization, policy reforms favoring deregulated electricity markets, and rapid advancements in trading platforms - all of which are enhancing transparency, liquidity, and cross-border power flows.

Discover how the Electricity Trading Market is evolving globally - access your free sample report → https://www.researchnester.com/sample-request-2977

Regional Performance Highlights

North America is expected to remain a key region in electricity trading, supported by the advanced deregulated power markets of the United States and Canada. The U.S. wholesale market - operated by entities like PJM, CAISO, and ERCOT - continues to innovate through real-time balancing mechanisms and renewable integration programs. Increasing adoption of distributed energy resources (DERs), combined with smart-grid modernization initiatives, is driving flexibility and transparency in regional electricity exchanges.

Europe remains at the forefront of cross-border electricity trading, with a highly integrated power market under the European Internal Energy Market (IEM). The region's focus on decarbonization and grid interconnectivity is reflected in the strong performance of trading hubs such as EPEX SPOT, Nord Pool, and the Italian Power Exchange (IPEX). Market coupling across EU nations continues to enhance price convergence and enable more efficient cross-border energy flows.

Asia Pacific is poised to dominate with approximately 54.7% share by 2035, emerging as the largest regional market for electricity trading. Countries such as China, India, Japan, and Australia are advancing power-market liberalization and promoting renewable energy participation in trading platforms. The establishment of regional power exchanges (e.g., India's IEX and PXIL) and ongoing integration initiatives across ASEAN nations are further catalyzing market development.

Together, these regions underscore a global transition toward flexible, transparent, and technology-enabled electricity trading systems - reflecting how energy markets are aligning with decarbonization and digital transformation goals.

Gain access to expanded insights on competitive strategies, market size, and regional analysis. View our Electricity Trading Market Report Overview here: https://www.researchnester.com/reports/electricity-trading-market/2977

Segment Demand and Use Cases

From a segmental perspective, industrial demand remains the backbone of the electricity trading market. Large-scale industrial consumers - such as steel, manufacturing, data centers, and chemical facilities - are increasingly participating in power markets to manage costs, hedge volatility, and meet sustainability targets through renewable energy procurement.

The spot market outlook continues to strengthen, with growing reliance on real-time or short-term electricity trading to balance variable generation from renewables. Market operators are introducing enhanced forecasting tools and flexible trading windows to accommodate renewable intermittency, particularly from wind and solar resources.

Industrial participants increasingly leverage bilateral contracts, power purchase agreements (PPAs), and virtual trading mechanisms to manage energy portfolios efficiently. As carbon neutrality and sustainability commitments rise, these players are expanding participation in green energy auctions and certificates, driving liquidity and diversification in trading portfolios.

Collectively, these segmental shifts signal a maturing ecosystem where electricity trading is no longer confined to traditional utilities but open to a broader range of participants empowered by technology and regulation.

Explore the complete Electricity Trading Market forecast and regional insights in our detailed report. Download our sample report here → https://www.researchnester.com/sample-request-2977

Top Market Trends

1. Digitalization and AI-Enabled Trading Platforms

One of the most transformative developments in the electricity trading market is the digitalization of trading systems through artificial intelligence (AI), blockchain, and advanced analytics. These technologies enable real-time decision-making, predictive pricing, and automated trading execution, enhancing market efficiency and transparency.

For instance, AI-driven algorithms are increasingly used by trading firms to predict load patterns, renewable output, and market volatility. Meanwhile, blockchain-based trading platforms in Europe and Asia are piloting peer-to-peer (P2P) energy trading models that enable prosumers to trade excess electricity securely and transparently.

This digital shift marks a fundamental redefinition of how electricity markets operate - from centralized clearing mechanisms to decentralized, data-driven ecosystems.

2. Renewable Energy Integration and Green Trading Instruments

As global energy systems decarbonize, renewable energy integration has become central to the growth of electricity trading. Solar, wind, and hydroelectric generation now play a pivotal role in shaping day-ahead and spot market dynamics.

To accommodate variable renewable generation, markets are introducing new trading products such as green certificates, carbon credits, and renewable energy guarantees of origin (REGO). The increasing use of these instruments helps align electricity trading with sustainability goals while enabling investors to monetize environmental value.

In regions like Asia Pacific and Europe, green-trading platforms are fostering a surge in renewable-linked contracts, reflecting the growing intersection between electricity trading and the carbon economy.

3. Cross-Border Power Exchanges and Market Coupling

Another major trend driving growth is the expansion of cross-border electricity trading and market coupling initiatives. Regional interconnections - such as those between Nordic countries via Nord Pool, or within ASEAN through the Lao PDR-Thailand-Malaysia-Singapore Power Integration Project - exemplify how transnational power exchanges are unlocking new efficiencies.

Cross-border integration not only enhances supply reliability but also enables renewable balancing across geographies. For instance, surplus solar power in one region can be exported to neighboring zones during peak demand, reducing wastage and stabilizing grid frequency.

This trend reflects how electricity trading is becoming an instrument for global energy cooperation - integrating renewables, enhancing resilience, and optimizing generation portfolios.

4. Regulatory Evolution and Market Liberalization

Policy and regulatory frameworks are evolving rapidly to support transparent, competitive, and open electricity markets. Governments are implementing reforms to encourage independent power producers, digital aggregators, and new entrants to participate in trading ecosystems.

For example, India's recent Electricity (Amendment) Bill aims to strengthen open-access trading and enable multi-discom participation. Similarly, the European Union's market design reforms focus on improving flexibility, consumer participation, and renewable integration.

This liberalization wave is unlocking new opportunities for innovation, efficiency, and investment - transforming electricity trading into a cornerstone of modern power systems.

Stay ahead of the curve with the latest Electricity Trading Market trends. Claim your sample report → https://www.researchnester.com/sample-request-2977

Recent Company Developments

The global electricity trading landscape is marked by dynamic activity among traditional utilities, energy exchanges, and technology firms expanding into digital energy services. Below are notable company developments from the past year:

1. Nord Pool AS - Expanded its intraday trading platform across Europe, enhancing cross-border liquidity and transparency.

2. EPEX SPOT SE - Introduced a new suite of automated trading APIs and data-driven insights to improve algorithmic participation for traders.

3. Indian Energy Exchange (IEX) - Launched green-day-ahead and real-time renewable trading segments, boosting India's energy transition goals.

4. Powernext (France) - Enhanced integration with EEX Group platforms for pan-European electricity and gas trading harmonization.

5. Australian Energy Market Operator (AEMO) - Rolled out market reforms supporting distributed resource participation and flexible trading models.

Get the full details on the latest company launches, investments, and M&A in the Electricity Trading Market. Download your free sample report → https://www.researchnester.com/sample-request-2977

These developments underscore how utilities, exchanges, and energy service providers are converging through digital innovation, sustainability, and cross-sector collaboration - shaping the next phase of global electricity trading.

Related News -

https://www.linkedin.com/pulse/why-does-oil-storage-terminal-market-play-critical-imzpf

https://www.linkedin.com/pulse/can-food-grade-carbon-dioxide-drive-innovation-preservation-gbibf

Contact Data

AJ Daniel

Corporate Sales, USA

Research Nester

77 Water Street 8th Floor, New York, 10005

Email: info@researchnester.com

USA Phone: +1 646 586 9123

Europe Phone: +44 203 608 5919

About Research Nester

Research Nester is a one-stop service provider with a client base in more than 50 countries, leading in strategic market research and consulting with an unbiased and unparalleled approach towards helping global industrial players, conglomerates and executives for their future investment while avoiding forthcoming uncertainties. With an out-of-the-box mindset to produce statistical and analytical market research reports, we provide strategic consulting so that our clients can make wise business decisions with clarity while strategizing and planning for their forthcoming needs and succeed in achieving their future endeavors. We believe every business can expand to its new horizon, provided a right guidance at a right time is available through strategic minds.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Electricity Trading Market Size to Reach USD 26.11 billion by 2035 | From USD 20.4 billion in 2025 here

News-ID: 4238223 • Views: …

More Releases from Research Nester Pvt Ltd

Microfiltration Membranes Market size to reach $5.3Billion by 2035 | Key players …

Market Outlook and Forecast

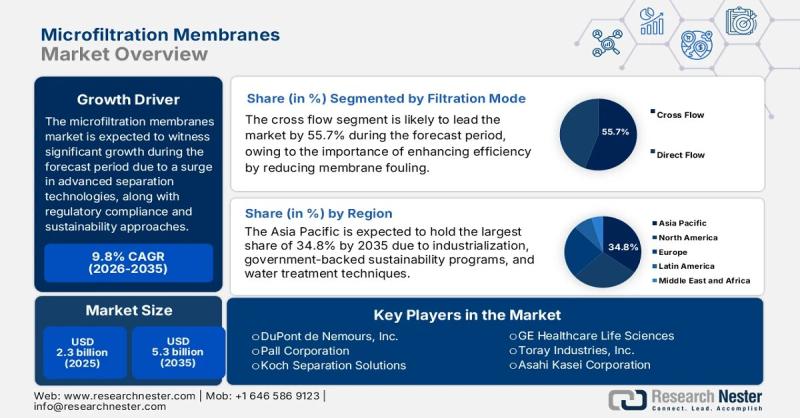

The microfiltration membranes market size reached USD 2.3 billion in 2025 and is projected to expand to USD 5.3 billion by 2035, reflecting strong industry fundamentals and sustained adoption across diverse end-use industries. The market is expected to grow at a compound annual growth rate (CAGR) of 9.8% between 2026 and 2035, driven by industrial modernization, environmental regulations, and technological innovation.

➤ Request Free Sample PDF Report @…

Top Companies in Food Grade Alcohol Market - Benchmarking Performance & Future V …

The food grade alcohol market is shaped by multinational ingredient producers, regional distillation leaders, and specialized ethanol processors. Competitive positioning is largely determined by feedstock access, regulatory compliance, supply chain resilience, and product customization for food and beverage applications.

➤ Request Free Sample PDF Report @ https://www.researchnester.com/sample-request-8307

Top Companies & Their Strategies

Archer Daniels Midland Company (ADM)

ADM remains one of the most influential players in the Food Grade Alcohol Market due to…

Energy Harvesting System Market Dominance: Top Companies Strengthening Share & I …

The energy harvesting system market is rapidly evolving as industries seek sustainable, maintenance-free power solutions for IoT devices, wireless sensor networks, industrial automation, healthcare wearables, and smart infrastructure. Energy harvesting systems convert ambient energy sources - including solar, thermal, vibration, and radio frequency (RF) - into usable electrical power.

As the global transition toward energy efficiency and decentralized power accelerates, the competitive landscape within the energy harvesting system market is intensifying.…

Luxury Hotel Market Players - Competitive Positioning, Strategic Strengths & Inv …

The Luxury Hotel Market is undergoing structural transformation as global travelers increasingly prioritize curated experiences, sustainability, and digital-first service models. No longer defined solely by opulence, the luxury hotel market now revolves around personalization, wellness integration, brand storytelling, and technological innovation. Leading hospitality companies are repositioning portfolios, expanding into high-growth destinations, and investing in asset-light models to strengthen competitive positioning.

This strategic analysis explores the top companies shaping the luxury hotel…

More Releases for Trading

Algorithmic Trading Market Showing Impressive Growth : Hudson River Trading, Jum …

The competitive landscape which incorporates the Algorithmic Trading Market ranking of the major players, along with new service/product launches, partnerships, business expansions and acquisitions in the past five years of companies profiled are also highlighted in the Algorithmic Trading Market report. Extensive company profiles comprising of company overview, company insights, product benchmarking and SWOT analysis for the major Algorithmic Trading Market players.

Top 10 key companies…

Increasing Awareness about Algorithmic Trading Market In Coming Years By Virtu F …

Global Algorithmic Trading Industry 2019 Research report provides information regarding market size, share, trends, growth, cost structure, capacity, revenue and forecast 2025. This report also includes the overall and comprehensive study of the Algorithmic Trading market with all its aspects influencing the growth of the market. This report is exhaustive quantitative analyses of the Algorithmic Trading industry and provides data for making Strategies to increase the market growth and effectiveness.

Algorithmic…

Algorithmic Trading Market 2024 SWOT Analysis by Key Players like Virtu Financia …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time. Algorithmic Trading are mainly used in investment banks, pension funds, mutual funds, hedge funds, etc.

Key trend which will predominantly effect the market in coming…

Automated Trading Market By Top Key Players- Citadel, KCG, Optiver, DRW Trading, …

The report "Automated Trading Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast 2016 - 2024", has been prepared based on an in-depth market analysis with inputs from industry experts.

An automated trading system, also referred to as mechanical trading system or algorithmic trading system, enables vendors to set up specific rules for money management, trade entries, and trade exits. Automated trading systems are generally programmed in a way…

Search4Research Announced Algorithmic Trading Market Forecast to 2024 - Virtu Fi …

Algorithmic trading is a method of executing a large order (too large to fill all at once) using automated pre-programmed trading instructions accounting for variables such as time, price, and volume to send small slices of the order (child orders) out to the market over time.

Algorithmic Trading Market provides a detail overview of latest technologies and in-depth analysis that reflect top vendor’s portfolios and technology; examines the strategic planning, challenges…

Algorithmic Trading Market 2019 | Flow Traders, Jump Trading, Spot Trading, DRW …

Global Algorithmic Trading market is also presented to the readers as a holistic snapshot of the competitive landscape within the given forecast period. The report also educates about the market strategies that are being adopted by your competitors and leading organizations. The report also focuses on all the recent industry trends. It presents a comparative detailed analysis of the all regional and player segments, offering readers a better knowledge of…