Press release

Agriculture Insurance Market to Reach USD 70.02 Billion by 2033 | DataM Intelligence

Rising Climate Uncertainties, Government Initiatives, and Technological Innovation Drive GrowthThe Global Agriculture Insurance Market was valued at USD 41.47 billion in 2024 and is projected to reach USD 70.02 billion by 2033, expanding at a CAGR of 5.96% from 2025 to 2033, according to DataM Intelligence. The market growth is primarily driven by the escalating frequency of climate-related disasters such as floods, droughts, pest outbreaks, and hurricanes, which have intensified risks for farmers across the globe. Agricultural insurance is increasingly viewed as a critical safety net, protecting farmers against unpredictable losses and ensuring financial stability amid growing environmental volatility.

North America dominated the global agriculture insurance market in 2024, accounting for 40.68% of total revenue, while Asia Pacific is anticipated to record the fastest growth through 2033. The multi-peril crop insurance (MPCI) segment led the market by covering a wide range of natural and biological risks, while public insurance providers captured a 77.58% share owing to strong government support and subsidies.

Get a Free Sample PDF Brochure of the Report (Use Corporate Email ID for a Quick Response): https://www.datamintelligence.com/download-sample/agricultural-insurance-market?utm_source=OpenPR&utm_campaign=Onkar

Key Highlights from the Report

➤ Global agriculture insurance market to reach USD 70.02 billion by 2033 at a CAGR of 5.96% (2025-2033).

➤ North America held the largest market share (40.68%) in 2024, with the U.S. projected to record the fastest growth rate.

➤ Multi-Peril Crop Insurance (MPCI) segment accounted for the highest market share (59.89%) in 2024.

➤ Public insurance providers dominated with 77.58% share due to subsidy-driven participation.

➤ Banks led distribution channels, owning 48.17% share through credit-linked insurance systems.

➤ Asia Pacific expected to witness the fastest regional growth led by India, China, and Indonesia.

Market Segmentation

Product Type Insights

The multi-peril crop insurance (MPCI) segment led the global agriculture insurance market, covering losses from drought, floods, pests, and diseases. Governments in India, the U.S., and China continue to promote MPCI through subsidies and awareness programs, driving higher adoption among farmers. In contrast, the livestock insurance segment is projected to grow at the fastest CAGR due to the rising occurrence of animal diseases and increasing livestock valuation in rural economies. Globally, premium subsidies and mandatory lending-linked insurance policies are improving livestock coverage penetration.

Provider Insights

The public insurance segment dominated the market in 2024, supported by government-owned schemes that mitigate catastrophic risk and offer premium discounts to smallholder farmers. Public programs such as India's Pradhan Mantri Fasal Bima Yojana (PMFBY) and the U.S. Federal Crop Insurance Program continue to enhance trust and transparency in the insurance ecosystem. Meanwhile, private insurers are increasing their footprint through tailored products, digital claims systems, and participation in public-private partnerships (PPPs).

Distribution Channel Insights

Banks are the leading distribution channel, integrating crop and livestock insurance products into agricultural loans. This linkage ensures both credit security and insurance adoption among rural borrowers. Additionally, collaborations between financial institutions and insurance providers streamline disbursement and claims. The insurance company channel is expected to expand rapidly as digital tools such as IoT sensors and satellite imagery enable data-driven risk pricing and improved claims processing.

Get Customization in the Report as Per Your Business Requirements: https://www.datamintelligence.com/customize/agricultural-insurance-market?utm_source=OpenPR&utm_campaign=Onkar

Regional Insights

North America dominated the global agriculture insurance market in 2024, accounting for more than 40% of total revenue. Increased investments in digital agriculture, combined with advanced disaster compensation models and AI-based risk assessment, make North America a frontrunner in agricultural risk management.

The United States leads in innovation within crop and livestock insurance, with evolving pilot programs addressing climate-resilient farming and parametric coverage. The U.S. Department of Agriculture's recent USD 2 billion initiative to aid specialty crops also reinforces structured support for producers facing climate-induced losses.

The Asia Pacific region is the fastest-growing market, driven by rising vulnerability to floods, cyclones, and heatwaves. Countries such as India, China, and Indonesia are leading through farmer awareness programs, government premium subsidies, and aggressive public-private collaborations. For example, India's Karnataka Government disbursed USD 7.4 million in insurance claims to over 200,000 farmers in 2025.

Europe is witnessing steady growth, with the EU prioritizing sustainable agriculture and risk protection incentives under its Common Agricultural Policy. Spain, in particular, has emerged as a regional benchmark in structured farmer insurance systems.

Latin America and the Middle East & Africa (MEA) markets are gradually expanding with state-backed schemes and cooperative-based insurance programs. The Saudi Arabian government's 2024 cooperative agricultural insurance initiative underscores regional momentum toward food security and agricultural resilience.

Market Dynamics

Market Drivers:

Frequent climate disruptions, global food supply challenges, and heightened weather volatility underpin strong demand for agricultural insurance. The collective role of government subsidies, public-private models, and increased farmer education is transforming insurance from a niche product into a mainstream financial necessity.

Market Restraints:

Despite policy support, limited penetration in smallholder communities and high premium costs remain challenges. The lack of adequate claim infrastructure and awareness in emerging economies further restrains growth.

Market Opportunities:

Digital disruption presents significant opportunities. Tools such as satellite mapping, drones, AI-based analytics, and parametric insurance models improve underwriting precision and claims settlement speed. Expanding adoption of index-based products in Africa, Asia, and Latin America opens new insurance frontiers.

Purchase This Exclusive Report at Just USD 5260 Only: https://www.datamintelligence.com/buy-now-page?report=agricultural-insurance-market?utm_source=OpenPR&utm_campaign=Onkar

Reasons to Buy the Report

✔ Insights into global market trends, size, and growth across product and provider segments.

✔ Identification of major regional opportunities and government-supported schemes.

✔ Evaluation of innovative technologies reshaping agricultural risk management.

✔ Profiles of major players and industry mergers driving competitive advantage.

✔ Data-driven projections to support strategic product and investment decisions.

Frequently Asked Questions (FAQs)

◆ How big is the global agriculture insurance market in 2025?

◆ What is the projected CAGR of the agriculture insurance market through 2033?

◆ Who are the leading players in the global agriculture insurance industry?

◆ Which region dominates the agriculture insurance market?

◆ What are the main factors driving demand for multi-peril crop insurance (MPCI)?

Company Insights

Zurich Insurance Company Ltd.

Tokio Marine HCC (HCC Insurance Holdings, Inc.)

Farmers Mutual Hail Insurance Company of Iowa

Sompo International Holdings Ltd.

Allianz SE

Munich Re

AXA SA

ICICI Lombard General Insurance Company Ltd.

HDFC ERGO General Insurance Company Ltd.

Anhua Agricultural Insurance Co., Ltd.

Suncorp Group Ltd.

Agro Nacional Seguros S.A.

MAPFRE S.A.

Recent Developments:

In January 2025, the Government of India extended major crop insurance schemes-PMFBY and RWBCIS-until 2026 and announced a USD 92.94 million Fund for Innovation and Technology (FIAT) to infuse advanced technology into agriculture insurance.

In November 2024, Farmers Edge launched its Managed Technology Services platform to streamline crop insurance and agribusiness operations using AI-driven data architecture and real-time farm analytics.

Conclusion

The global agriculture insurance market is positioned for strong growth through 2033 as climate variability, digital transformation, and government-led programs reshape the agricultural ecosystem. Increased farmer awareness, financial inclusion, and the integration of technology in risk assessment are making insurance a cornerstone of global food security. Backed by public-private innovation and expanding coverage in emerging regions, agriculture insurance will remain vital in safeguarding farmer livelihoods and ensuring resilient agricultural production worldwide.

Contact Us

Mr. Sai Kiran

DataM Intelligence 4market Research LLP Ground floor

DSL Abacus IT Park, Industrial Development Area

Uppal, Hyderabad, Telangana 500039

USA: +1 877-441-4866

Email: Sai.k@datamintelligence.com

Visit Our Website: https://www.datamintelligence.com

About Us

DataM Intelligence 4Market Research is a comprehensive market intelligence platform offering syndicated and customized reports along with expert consulting across multiple industries, including chemicals, healthcare, agriculture, food & beverages, and more. With extensive experience and a strategy-focused approach, DataM provides businesses and individuals with reliable market insights, statistical forecasts, and personalized research solutions to help them make informed decisions and successfully bring innovations to market.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Agriculture Insurance Market to Reach USD 70.02 Billion by 2033 | DataM Intelligence here

News-ID: 4237449 • Views: …

More Releases from DataM Intelligence

U.S. Radiopharmaceuticals Market to Reach USD 2.36 Billion by 2033, Growing at 6 …

The United States radiopharmaceuticals market was valued at USD 2.21 billion in 2024 and is projected to reach USD 2.36 billion by 2033, exhibiting a CAGR of 6.3% during the forecast period, according to DataM Intelligence. The market expansion is primarily fueled by the growing prevalence of chronic diseases such as cancer and cardiovascular disorders, advancements in diagnostic imaging, and regulatory support for nuclear medicine infrastructure. Radiopharmaceuticals play a pivotal…

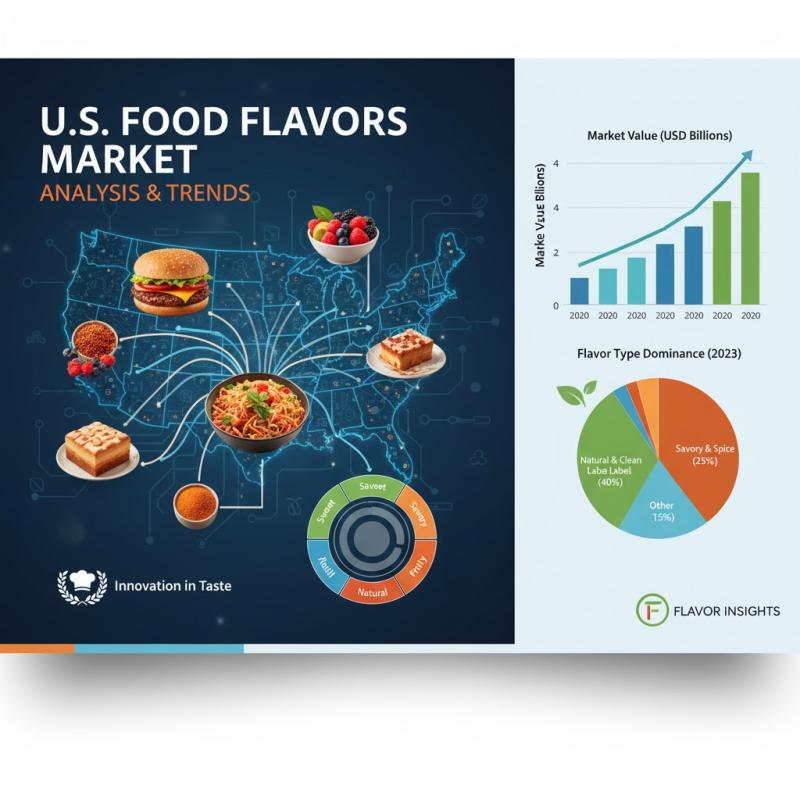

U.S. Food Flavors Market to Reach USD 6.1 Billion by 2033, Registering 5.2% CAGR …

The U.S. flavors market was valued at USD 3,887.7 million in 2024 and is projected to reach USD 6,108.4 million by 2033, growing at a CAGR of 5.2% during 2025-2033, according to DataM Intelligence. The market's growth is driven by surging demand for processed foods, global flavor innovation, and increasing consumer preference for natural, clean-label, and wellness-oriented products. Flavors continue to play a vital role in enhancing the sensory experience…

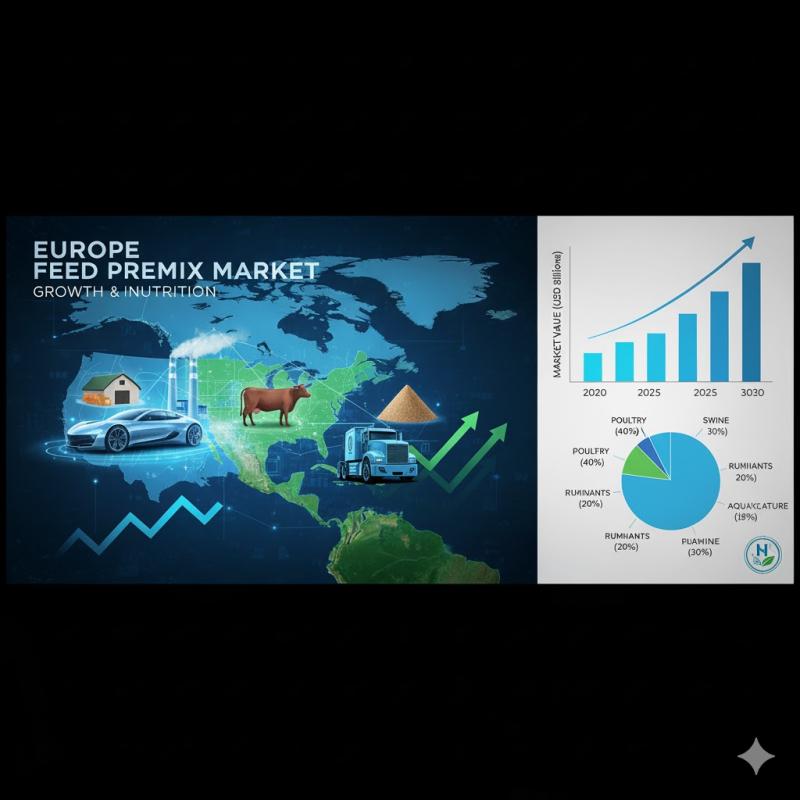

Europe Feed Premix Market to Reach USD 7.31 Billion by 2030, Growing at a 4.32% …

The Europe Feed Premix Market is estimated to grow from USD 5.92 billion in 2025 to USD 7.31 billion by 2030, registering a CAGR of 4.32% during the forecast period, according to DataM Intelligence. The market's growth is driven by increasing demand for nutrient-rich animal feed formulations, expanding livestock production, and a rising preference for high-quality, antibiotic-free animal products. Feed premixes-comprising essential vitamins, minerals, amino acids, and other additives-are vital…

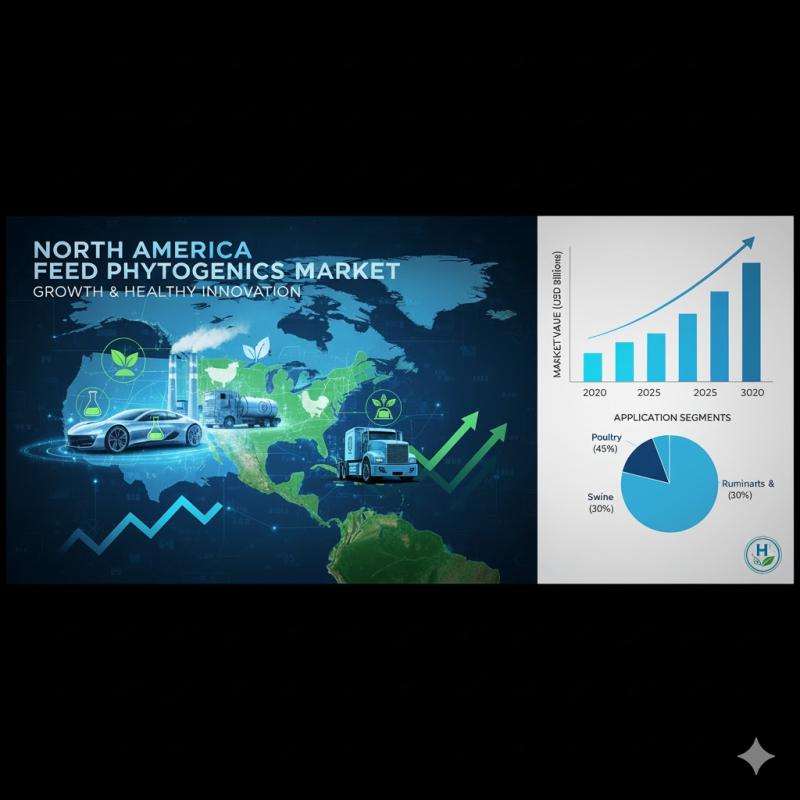

North America Feed Phytogenics Market to Reach USD 500.6 Million by 2030, Growin …

The North America Feed Phytogenics Market is projected to grow from USD 383.10 million in 2025 to USD 500.60 million by 2030, at a CAGR of 5.5% during the forecast period, according to DataM Intelligence. The market is witnessing robust growth due to rising demand for high-quality animal-derived products and increasing regulatory restrictions on antibiotics in livestock production. As a result, plant-based feed solutions have gained widespread adoption for improving…

More Releases for Insurance

Renters Insurance Market Dazzling Worldwide with Major Giants Travelers Insuranc …

According to HTF Market Intelligence, the Global Renters Insurance market to witness a CAGR of xx% during the forecast period (2024-2030). The Latest research study released by HTF MI "Renters Insurance Market with 120+ pages of analysis on business Strategy taken up by key and emerging industry players and delivers know-how of the current market development, landscape, technologies, drivers, opportunities, market viewpoint, and status. Understanding the segments helps in identifying…

Renters Insurance Market to See Competition Rise | Travelers Insurance, Geico In …

HTF MI introduces new research on Renters Insurance covering the micro level of analysis by competitors and key business segments (2023-2029). The Renters Insurance explores a comprehensive study of various segments like opportunities, size, development, innovation, sales, and overall growth of major players. The research is carried out on primary and secondary statistics sources and it consists of both qualitative and quantitative detailing. Some of the major key players profiled…

Insurance Road Assistance Services Market Is Booming Worldwide | Travelers Insur …

Insurance Road Assistance Services Market: The extensive research on Insurance Road Assistance Services Market, by Qurate Research is a clear representation on all the essential factors that are expected to drive the market considerably. Thorough study on Insurance Road Assistance Services Market helps the buyers of the report, customers, the stakeholders, business owners, and stockholders to understand the market in detail. The updated research report comprises key information on the…

Agriculture Crop Insurance Market Type (MPCI Insurance, Hail Insurance, Livestoc …

Agriculture Crop Insurance market worldwide Agriculture is an important contributor to any economy. The extensive use of crops for direct human consumption and industrial processes has resulted in increasing the pressure on the existing supply demand gap. Increasing need for food security is expected to augment the demand for insurance policies. The two major risks in agricultural sector are price risk, caused due to volatility in prices in the market…

Household Insurance Market By Key Players: Discount Insurance Home Insurance, On …

Household Insurance Industry Overview

The Household Insurance market research study relies upon a combination of primary as well as secondary research. It throws light on the key factors concerned with generating and limiting Household Insurance market growth. In addition, the current mergers and acquisition by key players in the market have been described at length. Additionally, the historical information and current growth of the market have been given in the scope of the research report. The latest trends, product portfolio, demographics, geographical segmentation, and regulatory framework of the Household Insurance market…

Life Insurance Market in Kuwait By Warba Insurance Company, Al Ahleia Insurance …

GlobalData’s 'Life Insurance in Kuwait, Key Trends and Opportunities to 2021' report provides a detailed outlook by product category for the Kuwaiti life insurance segment, and a comparison of the Kuwaiti insurance industry with its regional counterparts.

It provides key performance indicators such as written premium, incurred loss, loss ratio, commissions and expenses, total assets, total investment income and retentions during the review period (2012-2016) and forecast period (2016-2021).

The report also…