Press release

Enterprise Risk Management Market to Reach USD 7.5 Billion by 2035 as AI and Cloud Turn Risk Functions Into Real-Time Governance

Enterprise Risk Management Market to Reach USD 7.5 Billion by 2035 as AI and Cloud Turn Risk Functions Into Real-Time Governance

The enterprise risk management market is smaller than most software categories, but it's doing something bigger than the headline suggests. In 2025 it sits at USD 4.7 billion; by 2035 it is expected to reach USD 7.5 billion (CAGR 4.9%). The growth story isn't "more dashboards." It's that risk teams are moving from after-action reporting to live oversight. Boards want early warnings, not postmortems. CROs want a single line of sight across operational, financial, cyber, regulatory, and ESG risk without stitching data from six tools.

Get the Detailed Industry Analysis (including the Table of Contents, List of Figures, and List of Tables) - from the Enterprise Risk Management Market Research Report: https://marketgenics.co/press-releases/enterprise-risk-management-market-74862

Two things changed inside large enterprises:

Risk now moves at system speed (cloud stacks, third parties, remote access, supply chain).

Regulation didn't slow down to match. That gap is where modern ERM lives.

From binders to models - and why software leads

In 2025, software accounts for ~65% of total spend because integrated risk analytics and scenario modeling are no longer optional. The days of quarterly heat maps are ending; leaders need predictive governance that ranks threats by likelihood, impact, and velocity.

Recent moves underline the pivot:

IBM OpenPages (Feb 2025) added generative AI for risk scenario modeling and regulatory impact assessments - less debate, more modeled evidence.

MetricStream (Jan 2025) rolled out AI-driven risk prioritization so teams see what really deserves attention first.

A follow-on cloud-native uplift (mid-2025) added multi-tenancy and real-time visualization, nudging ERM toward continuous monitoring rather than episodic reviews.

These aren't cosmetic features; they shift ERM from documentation to decision support.

Forecast with context (and where the budget lands)

Between 2025 and 2035, the enterprise risk management market adds USD 2.9 billion in opportunity. The near-term budget goes to three lines:

Cloud-based ERM deployment (speed to value, lighter integration debt).

AI-enhanced risk models (early signal detection, faster remediation routing).

Integration services (linking ERM with finance, audit, security, and ESG reporting).

If you're selling or buying ERM, this is the practical checklist: connect to the systems where risk originates, score it in real time, and route action to owners without creating a second workflow.

To know more about the Enterprise Risk Management Market - Download our Sample Report: https://marketgenics.co/download-report-sample/enterprise-risk-management-market-74862

What accelerates adoption - and what drags it

Driver. Regulatory pressure + cyber exposure = board-level urgency. Distributed operations make third-party risk, IT risk, and operational resilience show up in the same week. That's why leadership now asks for enterprise risk management solutions that present a single "risk truth" and map it to strategy.

Restraint. Integration pain. Mid-market firms still wrestle with legacy ERP, siloed data, and limited risk headcount. Some traditional sectors perceive ERM as overhead instead of a governance backbone. Without solid onboarding and templates tailored to the domain, projects stall.

Opportunity. AI-assisted triage. The winner isn't the tool with more fields; it's the platform that can say: "These three issues matter today; here's the modeled impact if you wait." That's how ERM earns operating influence, not just compliance credit.

Cloud-native ERM becomes the default pattern

The market is standardizing on cloud-native ERM for a simple reason: risk doesn't sit in one place anymore. Cloud brings multi-entity roll-ups, real-time dashboards, and continuous controls. AI then rides on top: anomaly spotting, scenario stress tests, automatic mapping to control libraries. In effect, the platform becomes a risk operating system, not a filing cabinet.

Where the demand is strongest

North America leads with ~51% share (about USD 2.4B in 2025). Mature regulation, cybersecurity mandates, and board scrutiny keep ERM front and center.

Europe is steady, compliance-led, and increasingly ESG-anchored.

Asia Pacific scales fastest as regional expansion and multi-country governance force standardized tooling.

Market structure and how vendors really compete

The space is highly consolidated; the top five hold ~70%. At the enterprise tier you'll find IBM, SAP, Oracle, Microsoft, MetricStream, SAS. Mid-market and specialized needs are covered by LogicManager, Resolver, Quantivate, Protecht, and others. On paper, everyone offers registers, workflows, and reports. In practice, the separation comes from:

Model quality (how well AI surfaces cross-domain risk),

Integration depth (ERP, security, finance, audit, ESG),

Time to control (how quickly alerts become accountable actions).

Buy Now: https://marketgenics.co/buy/enterprise-risk-management-market-74862

What ERM looks like by 2035

Expect fewer "risk projects" and more embedded governance. The enterprise risk management market won't be judged by how fast it captures incidents, but by how early it changes outcomes. AI in enterprise risk management will be routine: scenario modeling before board meetings, risk-adjusted planning for budgets, and automated evidence for audits. The tool disappears into the operating rhythm - which is exactly where it belongs.

As risk surfaces multiply and regulation tightens, the enterprise risk management market will keep expanding, not as a reporting function but as a real-time control layer. The shift to cloud-based ERM platforms and AI-assisted risk analytics explains the forecast to USD 7.5 billion by 2035-and why buyers now evaluate ERM on prevention, not paperwork.

About Us

MarketGenics is a global market research and management consulting company empowering decision makers across healthcare, technology, and policy domains. Our mission is to deliver granular market intelligence combined with strategic foresight to accelerate sustainable growth.

We support clients across strategy development, product innovation, healthcare infrastructure, and digital transformation.

Contact:

Mr. Debashish Roy

MarketGenics India Pvt. Ltd.

800 N King Street, Suite 304 #4208, Wilmington, DE 19801, United States

USA: +1 (302) 303-2617

Email: sales@marketgenics.co

Website: https://marketgenics.co

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Enterprise Risk Management Market to Reach USD 7.5 Billion by 2035 as AI and Cloud Turn Risk Functions Into Real-Time Governance here

News-ID: 4235827 • Views: …

More Releases from MarketGenics India Pvt. Ltd.

APAC Deepfake Detection Market Accelerates as Governments Tighten Digital Trust …

A Market Transforming How the World Verifies Reality

The global deepfake detection technology market, valued at USD 0.6 billion in 2025, is positioned to accelerate at a powerful 37.2% CAGR, reaching USD 15.1 billion by 2035.

This growth is driven by one undeniable truth:

Synthetic media is reshaping the threat landscape faster than humans can recognize it.

Deepfake detection technologies now determine:

How newsrooms verify breaking content

How financial institutions prevent identity-spoofing

How governments protect election integrity

How…

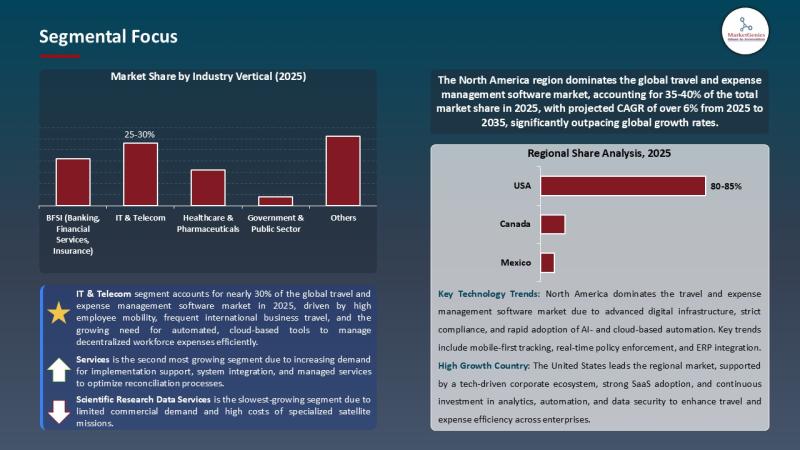

Travel & Expense Management Software Market Signals a Digital Pivot | AI, Cloud …

The Travel and Expense Management (TEM) Market Crossroads | A Sector Accelerating, Repricing Efficiency, and Redrawing the Corporate Spend Map

(Is TEM a Back-Office Tool-or the Operating System of the Next Enterprise Economy?)

For years, the travel and expense management software market lived in the administrative shadows-handed off to finance teams, constrained by spreadsheets, and dismissed as a routine cost-control tool. But the numbers now tell a radically different story.

In 2025, the…

Oilfield Equipment Market hits USD 116.2B in 2025 and grows to USD 156.5B by 203 …

Oilfield Equipment Market | The $156.5B Hardware Backbone of the Global Energy System

Every headline loves clean energy. Yet the global energy mix still demands a brutal truth: oil and gas remain the world's primary supply of heat, mobility, and petrochemicals - and the machines that drill, lift, complete, and produce hydrocarbons continue to define industrial capability.

That's why the Oilfield Equipment Market remains a strategic industry - not a relic.

In 2025,…

Machine Tools Market 2025-2035 | USD 109.9B Growth, CNC & Automation Trends

Machine Tools Market | The $109.9B Intelligence Engine of Global Manufacturing

Factories don't work without machine tools. They shape, cut, drill, grind, and define the physical world around us. Yet most end-products - cars, aircraft parts, electronics housings, surgical devices - never reveal the precision machinery behind them.

The Machine Tools Market is the invisible infrastructure that turns digital models into physical reality.

In 2025, the global Machine Tools Market stands at USD…

More Releases for ERM

Unlock High-Growth Investment Opportunities with UPEIDA Plots Through ERM Global …

Noida, Uttar Pradesh, India - ERM Global Investors, a trusted name in real estate advisory and investment services, is thrilled to announce the launch of strategic UPEIDA plots and industrial land opportunities designed to match the booming infrastructure growth led by the Uttar Pradesh Expressways Industrial Development Authority (UPEIDA). With the rapid expansion of world-class expressways and industrial corridors across Uttar Pradesh, now is the moment for investors, developers, and…

ERM Global Investors Unveils Premium Plots in Vrindavan - A Sacred Investment Op …

launch of premium residential and investment plots in Vrindavan, one of India's most revered spiritual and cultural hubs. Strategically located and designed for high returns, these plots offer a unique blend of spiritual significance and modern real estate potential.

Why Invest in Plots in Vrindavan?

Vrindavan, the holy land of Lord Krishna, attracts millions of pilgrims and tourists annually, making it a high-demand real estate hotspot. Key highlights of this investment opportunity…

ERM Global Investors: Leading the Way in Residential & Commercial Plot Investmen …

ERM Global Investors One of the top names in the investment field is pleased to offer our readers and once again lead in residential and commercial plot investment.. Backed by the iron will of absolute excellence and innovation, ERM Global Investors have opened a blue-chip, double-digit return and sustainable growth era for strategic land investments.

ERM Global InvestorsThe Firm Founded on the triple bottom line of ethics, competence and client centric…

Understanding Enterprise Risk Management (ERM) Market Size | MRFR Reports

In today's rapidly changing business landscape, companies face a multitude of risks that can impact their operations, finances, and reputation. These risks can stem from various sources such as economic downturns, cybersecurity threats, regulatory changes, and natural disasters. To navigate these challenges effectively, organizations implement Enterprise Risk Management (ERM) strategies and solutions. The ERM market plays a crucial role in providing tools and frameworks for businesses to identify, assess, and…

ERM and LRA Tactile Actuator Market 2022 | Detailed Report

ReportsnReports publishes the report titled ERM and LRA Tactile Actuator that presents a 360-degree overview of the market under one roof. The report is developed with the meticulous efforts of an enthusiastic and experienced team of experts, analyts, and researchers that makes the report a valuable asset for stakeholders to make robust decisions. This report also provides an in-depth overview of product type, specification, technology, and production analysis considering vital…

Global Erm Software Market Research and Forecast -2027 | LogicManager, AGCO, SAS

Understand the influence of COVID-19 on the Erm Software Market with our analysts monitoring the situation across the globe.

Report Description:

Market Strides published report titled Erm Software Market By Type, By Application, Regional Analysis, Growth Opportunity and Industry Forecast 2021-2027. The Erm Software Market Report provides a comprehensive overview including Current scenario and the future growth prospects. The Erm Software market report analyzes the various factors and trends in forthcoming years…