Press release

RF Front End Modules Market to Reach USD 19,413 Million by 2031 Top 10 Company Globally

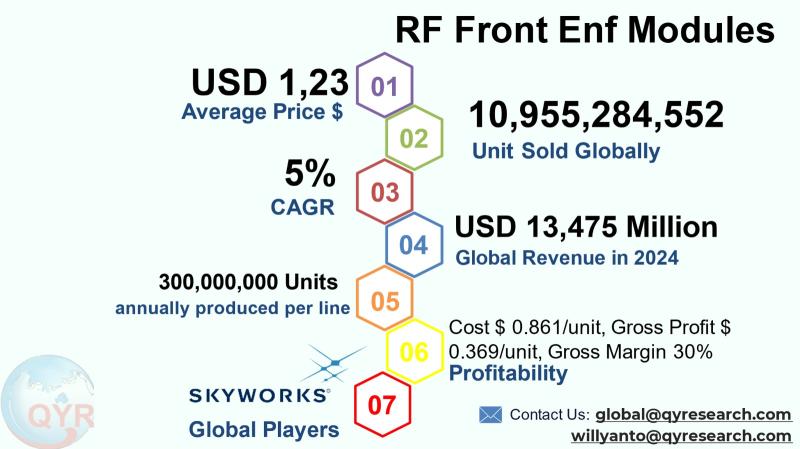

The Radio Frequency (RF) Front End Module (FEM) industry designs, integrates and supplies the front-line RF building blocks that connect radios to the real world: switches, power amplifiers (PAs), low-noise amplifiers (LNAs), filters, antenna tuners and related subassemblies that move and condition radio signals in smartphones, Wi-Fi equipment, fixed wireless access, CPEs, automotive telematics, and industrial IoT devices. FEMs sit between the transceiver/chipset and the antenna and are therefore critical to overall system sensitivity, spectral efficiency, battery life and regulatory compliance. OEMs demand ever higher integration (multi-band, multi-function FEMs), lower board area and cost, and solutions that span sub-6 GHz to mmWave bands as 5G densification, Wi-6/Wi-Fi 7 and vehicle connectivity expand.The global RF Front End Module market in 2024 is valued at USD 13,475 million with a forecast CAGR of 5% to 203, reaching market size USD 19,412 million by 2031. With an average selling price of USD 1.23 per unit implies a total global units sold in 2024 approximately 10,955,284,552 units. With a factory gross margin of 30%, the factory gross profit per unit is about USD 0.369 and the cost of goods sold per unit is about USD 0.861. A cost-of-goods-sold breakdown is PA, LNA, filters, packaging, and testing. A single line full machine production capacity is around 300,000,000 units per line per year. Downstream demand Is span in smartphones, tablets, laptops, vehicle connectivity units, IoT modules and wearables, with smartphones dominate the market demand.

Latest Trends and Technological Developments

Industry activity in 2025 has emphasized higher integration for Wi-Fi 7 and 5G access, tighter system-level power and thermal optimization, and a surge in patenting and product introductions around advanced filtering, SAW/BAW technologies, and mmWave integration. On June 2025 Qorvo announced compact solutions designed to reduce radio footprint and improve thermal performance for 5G infrastructure, reflecting the push for denser, more power-efficient FEMs. On October 2025 Skyworks publicly expanded its Wi-Fi 7 front-end portfolio with next-generation, high-efficiency FEMs and filters aimed at high-performance client and infrastructure devices. Patent-activity trackers and Q2 to Q3 2025 analyses show intensifying IP competition Murata and other Asian suppliers dominated filings in recent quarters while Chinese applicants increased volume, signaling regional R&D acceleration and strategic IP accumulation around SAW/BAW, PA topologies and integrated module packaging (Q2 to Q3 2025 patent reports).

Apple Inc. purchases sophisticated RF Front End Modules (FEMs) in volumes of hundreds of millions of units annually from leading semiconductor suppliers like Qorvo Inc. and Skyworks Solutions Inc. For a high-volume model like the iPhone, Apple procures these multi-band FEMs, which integrate components like power amplifiers, filters, and switches, at a negotiated price typically ranging from $5 to $12 per unit, depending on the complexity and supported cellular/Wi-Fi/Bluetooth standards required for each device generation.

The advanced RF Front End Modules are installed in the latest Samsung Electronics' Galaxy S-series smartphones. A single flagship device, such as the Galaxy S24, utilizes multiple FEMs to manage its complex 5G sub-6 GHz and mmWave, Wi-Fi 6E, and GPS connections. The total bill of materials (BOM) cost for the complete set of RF Front End components integrated into a single high-end smartphone unit amounts to approximately $15 to $20 per device, a critical investment to ensure global connectivity, superior signal reception, and power efficiency.

Asia (and in practice Asia-Pacific) remains the single largest regional market and production hub for RF FEMs, driven by handset manufacturing scale, dense 5G urban rollouts, and highly integrated supply chains spanning compound semiconductor fabs, filter (SAW/BAW) vendors, and high-volume module assembly. Industry reports and market analyses consistently place Asia-Pacific as the dominant region in 2024 to 2025, holding a plurality or majority share of industry revenues and unit volumes thanks to Chinas handset output and South Korea/Japan supplier ecosystems. Key regional strengths include cost-effective manufacturing, localized supply chains for critical RF materials and components, an active innovation pipeline (patents and new product introductions) and proximity to the large OEMs buying integrated FEM assemblies.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5202047

RF Front End Modules by Type:

L-PAMiD

L-PAMiF

RF Front End Modules by Product:

Sub 3GHz

Sub 6GHz

RF Front End Modules by Market Segment:

Low-frequency L-PAMiD

Medium-high frequency L-PAMiD

High-frequency L-PAMiF

RF Front End Modules by Product Division:

4G

5G

RF Front End Modules by Material:

Gallium Arsenide

Gallium Nitride

Silicon Germanium

Silicon on Insulator

Others

RF Front End Modules by Application:

Smartphones

Non Handset Devices

Global Top 10 Key Companies in the RF Front End Modules Market

Qualcomm

Broadcom

Skyworks Solutions

Murata Manufacturing

Qorvo

NXP

TI

OnMicro

Vanchip

Maxscend

Regional Insights

Within Southeast Asia, demand is growing but remains heterogeneous. Indonesia is a strategically important market both as a domestic demand center for smartphones and IoT and as a near-shoring location for some electronics assembly services. Across ASEAN, mobile handset replacement cycles, rising mobile broadband penetration and nascent 5G deployments are the primary demand drivers for FEM volumes, while local government incentives and industrial policy in some countries are encouraging higher value-added electronic manufacturing. ASEANs supply-chain role is more skewed toward assembly, test and packaging than high-end wafer fabrication; nonetheless, contract manufacturers in the region participate in module final assembly and testing for global brands, creating pockets of capability and investment opportunities, particularly in test & calibration services and turnkey module assembly. Regional constraints include intermittent component lead times, skills gaps for advanced RF integration, and price sensitivity on consumer device BOMs.

The industry faces several structural and tactical challenges. First, ongoing ASP compression and intense cost pressure from OEMs force volume suppliers to drive yield, automation and materials engineering improvements. Second, spectrum diversity (many regional 5G bands plus Wi-Fi 7/multi-band client needs) increases BOM complexity, pushing engineering cost into multi-band, multi-function integration that is harder to scale at low cost. Third, supply-chain concentration for some compound semiconductor substrates and high-performance filters creates geopolitical and supply risk. Fourth, IP and patent skirmishes especially as new entrants and Chinese suppliers escalate filings raise litigation and freedom-to-operate risks. Finally, mmWave and phased-array requirements for certain segments require new packaging, thermal and system-level design investments that raise up-front R&D and capital costs.

To compete profitably, suppliers should prioritize four strategic moves: deepen integration (offer multi-band FEM solutions that reduce OEM RF-front BOM complexity), invest selectively in mmWave / beamforming and filter technologies where ASPs justify R&D, pursue manufacturing automation and vertical testing capabilities to protect margins against ASP decline, and cultivate design-win partnerships with system-chip vendors and hyperscalers to lock in longer-term demand. Regionally, firms should leverage Asias supplier ecosystems while diversifying wafer and critical-filter sources across trusted partners to reduce single-point risks. For OEMs and contract manufacturers in ASEAN such as Indonesia, moving up the value chain into system test and module final-assembly services (rather than purely box-build) captures higher margin and enhances resilience.

Product Models

RF Front-End Module (RF FEM) is a critical component in modern wireless communication systems, responsible for managing signal transmission and reception between antennas and transceivers.

L-PAMiD (Low-band Power Amplifier Module integrated Duplexer) is an advanced RF front-end module that combines a low-band power amplifier and a duplexer into a single compact package. Notable products include:

QPM5679 Qorvo: High-performance L-PAMiD designed for global 4G/5G bands with integrated duplexers for low-band operation.

SKY78190 Skyworks Solutions: Multi-band PAMiD supporting 3G/4G LTE low-band frequencies with advanced envelope tracking.

SMR8260 Murata: Compact module integrating PA, duplexer, and switch for enhanced low-band LTE performance.

MBN240 Broadcom: Low-band PAMiD optimized for power efficiency and low insertion loss in 5G-ready devices.

MAMF-011098 MACOM: Integrated PA and duplexer L-PAMiD with high linearity for low-band LTE devices.

L-PAMiF (Low-band Power Amplifier Module integrated Filter) is a compact RF module that integrates a low-band power amplifier with a filter instead of a duplexer. Examples include:

SKY78268 Skyworks: PAMiF solution for high linearity and low current consumption in low-band operation.

AFEM-9090 Broadcom: Compact L-PAMiF with integrated filtering for low-band 4G and 5G applications.

OM9577-11 OnMicro: A 5G L-PAMiF module covering 5G and 4G LTE, integrating PA, multi-gain LNA, band-pass filter and Tx/Rx switch in a package.

SKY78297 Skyworks: Integrates low-band amplifier and filter functions, improving isolation between frequency bands.

MBN220 Broadcom: Designed for efficient low-band filtering in multi-band 5G front-end architectures.

The RF Front End Module industry in 2024 sits at a mature but evolutionary point: large unit volumes and continued demand from smartphones and connectivity devices coexist with ASP pressure and growing R&D intensity around integration, filtering and mmWave. Asia and particularly players clustered around China, Japan, South Korea and increasingly ASEAN manufacturing footprints will continue to dominate production, innovation and near-term demand. Suppliers who can reduce BOM complexity for OEMs while protecting margins through automation, design wins and selective technology differentiation (e.g., mmWave, advanced filters, integrated antenna tuning) will be best positioned through 2031.

Investor Analysis

This research aggregates the most investor-relevant inputs: the 2024 market size baseline and projected CAGR provide the demand envelope; unit economics reveal margin sensitivity to cost reductions; regional concentration in Asia highlights geopolitical and supply risks that can materially affect earnings; patent and product activity indicate where R&D spending and future pricing power may concentrate; and the top-player concentration points to likely M&A and partnership targets. Investors can use this to prioritize exposure: invest in vertically integrated suppliers with diversified IP and wafer access to defend margins, consider contract manufacturers capturing assembly/test economics in ASEAN for higher-margin services, and watch companies leading in mmWave and filter technologies that command higher ASPs. The how is practical: evaluate balance-sheet strength to fund automation, review patent portfolios and design wins to assess sustainability of revenue, and stress-test valuation for scenarios where ASP compression continues versus scenarios where premium mmWave/Wi-Fi 7 modules re-inflate prices. The why is that small changes in COGS or a successful design win at a major smartphone OEM can swing margins and valuation meaningfully given the large unit volumes.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5202047

5 Reasons to Buy This Report

Establishes a clear 2024 baseline and unit economics (ASP, COGS, factory gross profit) to evaluate supplier margins.

Provides Asia and ASEAN regional insights that help identify where production and demand are concentrated and where investment in capacity or near-shoring may be effective.

Summarizes the latest product and patent activity (with dated, cited examples) to highlight where technology differentiation and pricing power will come from.

Lists the current top suppliers and competitive dynamics to inform M&A, supplier selection, or partnership decisions.

Offers tactical manufacturing metrics (typical per-line capacity ranges and BOM breakdown guidance) to model capex payback and margin-improvement scenarios.

5 Key Questions Answered

What was the market size in 2024 and how many units does that equate to at the stated ASP?

What are the per-unit factory economics (COGS, gross profit and margin) and a representative BOM cost breakdown?

How is demand and production distributed across Asia and Southeast Asia, and what role does Indonesia play?

What are the near-term technology and IP trends (5G sub-6/mmWave, Wi-Fi 7, filters, patent activity) that could shift supplier positioning?

Who are the dominant suppliers and what strategic moves increase the likelihood of capturing higher ASPs and margin recovery?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

RF Front End Modules - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5202048/rf-front-end-modules

Global RF Front End Modules Market Research Report 2025

https://www.qyresearch.com/reports/5202047/rf-front-end-modules

Global RF Front End Modules Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5202046/rf-front-end-modules

Global RF Front End Modules Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5202045/rf-front-end-modules

Global 5G RF Front End Module Market Research Report 2025

https://www.qyresearch.com/reports/3977803/5g-rf-front-end-module

Global Wi-Fi RF Front-End Module Market Research Report 2025

https://www.qyresearch.com/reports/3663387/wi-fi-rf-front-end-module

Global RF Front-End Chips and Modules Market Research Report 2025

https://www.qyresearch.com/reports/3836558/rf-front-end-chips-and-modules

Global Electronics RF Front-end Module Market Research Report 2025

https://www.qyresearch.com/reports/3535865/electronics-rf-front-end-module

Global Next Generation RF Front-end Module Market Research Report 2025

https://www.qyresearch.com/reports/3847898/next-generation-rf-front-end-module

Global Smartphone RF Front End Chips and Modules Market Research Report 2025

https://www.qyresearch.com/reports/3582048/smartphone-rf-front-end-chips-and-modules

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release RF Front End Modules Market to Reach USD 19,413 Million by 2031 Top 10 Company Globally here

News-ID: 4235122 • Views: …

More Releases from QY Research

Top 30 Indonesian Coal Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Alamtri Resources Indonesia Tbk (formerly Adaro Energy)

PT Bumi Resources Tbk

PT Bayan Resources Tbk

PT Indo Tambangraya Megah Tbk

PT Bukit Asam Tbk (PTBA)

PT Golden Energy Mines Tbk (GEMS)

PT Dian Swastatika Sentosa Tbk (DSSA)

PT Indika Energy Tbk (INDY)

PT Akbar Indo Makmur Stimec Tbk (AIMS)

PT Atlas Resources Tbk (ARII)

PT Borneo Olah Sarana Sukses Tbk (BOSS)

PT Baramulti…

From Sugar to Profit: Economics of the Global Ready-to-Roll Icings Industry

Ready-to-roll icings (also known as rolled fondant or sugar paste) are pre-formulated sugar-based sheets used for cake covering, decorative modeling, and bakery finishing in commercial and artisan baking.

Products are supplied in bulk slabs, sheets, and blocks and are valued for: Consistent elasticity, Reduced preparation time, Uniform finish, Extended shelf stability.

Industrial buyers include industrial bakeries, frozen dessert processors, QSR chains, supermarkets, and cake studios.

Growing demand for celebration cakes, premium bakery products,…

Sustainable Staples: Why Investors Are Targeting Organic Pulse Processing

Organic dry pulses include organically cultivated lentils, chickpeas, peas, mung beans, pigeon peas, and dry beans produced without synthetic pesticides, fertilizers, or GMOs.

Industry benefits from: Rising plant-protein adoption, Gluten-free and clean-label trends, Soil-friendly nitrogen-fixing crop rotation, Government organic agriculture subsidies across Asia.

Global trade dominated by exporters in India, Australia, Canada, and Turkey

Growing consumption in China, Japan, Indonesia, and Vietnam.

Global Overview

Market size (2025): USD 5,266 million

Market size (2032): USD 8,231 million

CAGR…

Baby Care Boom: USD 9.1B Global Bath & Shower Market Driven by Asia Growth

Baby bath and shower products include liquid cleansers, tear-free shampoos, head-to-toe washes, soaps, bath oils, foam washes, and sensitive-skin dermatological formulations designed specifically for infants and toddlers.

Products emphasize mild surfactants, hypoallergenic formulations, pH-balanced systems (5.56.0), and natural/plant-derived ingredients to minimize irritation and comply with pediatric dermatology standards.

Demand is driven by rising hygiene awareness, premiumization of infant care, urban middle-class expansion, and increased birth rates in emerging Asia.

Strong shift from bar…

More Releases for Module

New Product Release: FH3WF-57BK 1.2W LED Module, 12V~24V Low Voltage Module

Image: https://ecdn6.globalso.com/upload/p/797/image_other/2024-08/fh3wf-57bk-4.jpg

We are pleased to announce the launch of our latest LED module, the FH3WF-57BK 1.2W LED Module. This state-of-the-art module is designed to deliver exceptional performance and numerous advantages, making it ideal for a wide range of applications.

Image: https://ecdn6.globalso.com/upload/p/797/image_other/2024-06/module-core-details-page-new_04.jpg

Superior Brightness: High Luminous Efficiency with Low Power Draw

The FH3WF-57BK 1.2W LED Module is engineered to provide superior brightness while maintaining low power consumption. This high luminous efficiency ensures bright and…

FH3WF-57P 1.2W LED Module, 12V~24V Low Voltage Module

Image: https://ecdn6.globalso.com/upload/p/797/image_other/2024-08/fh3wf-57p-1.jpg

We are excited to introduce our latest LED module, the FH3WF-57P 1.2W LED Module. This advanced module is designed to offer outstanding performance and a range of benefits, making it an ideal choice for a variety of applications.

Image: https://ecdn6.globalso.com/upload/p/797/image_other/2024-06/module-core-details-page-new_04.jpg

High-Performance Illumination: Superior Brightness with Energy Efficiency

The FH3WF-57P 1.2W LED Module delivers high-performance illumination with exceptional brightness, while still maintaining energy efficiency. This ensures powerful lighting with minimal power consumption.

Image: https://ecdn6.globalso.com/upload/p/797/image_other/2024-06/module-core-details-page-new_05.jpg

Wide…

Liquid Cooling Module 40KW DC Charging Module

Image: https://www.abnewswire.com/uploads/7890912dbfa5212a3465334b0eaeea09.png

Image: https://www.abnewswire.com/uploads/0a53754ffb3f5f7e6c13db44894392b7.png

Short Description:

1.Output voltage Voltage : 150-1000V

2. Output current: 0~133.3A

3. Voltage stabilized accuracy: less than or equal to plus-minus 0.5%

4. Current stabilized accuracy: less than or equal to plus-minus 1%

5. Voltage ripple: less than or equal to plus-minus 1%

6. Startup time less than or equal to 1s

7. EfficiencyHighest efficiency>97%

Product [https://www.evsegroup.com/] Detail

Liquid Cooling Module 40KW DC Charging Module [https://www.evsegroup.com/liquid-cooling-module-40kw/]

Image: https://www.abnewswire.com/uploads/b629b3548bacdfe56f5af1634dc952dc.jpg

KEY FEATURES

Ultra-wide output voltage range

LED panel displaying voltage, current, group, protocol,…

Solar Photovoltaic Glass Market Global Key Players, Installation Technology, Gro …

The solar photovoltaic glass market is projected to grow from USD 6.2 billion in 2022 to USD 21.1 billion by 2027, at a CAGR of 27.9% from 2022 to 2027. The global market for solar PV glass market driven by increase in various utility applications around the globe.

Download a Free Sample Copy of the Global Solar Photovoltaic Glass Market Research Report at https://www.reportsnreports.com/contacts/requestsample.aspx?name=1077569

"By type, the TCO coated PV glass…

Touch Screen Module

Global Touch Screen Module Market report provides a comprehensive study that takes account of the historical data, presents the current state, and anticipates the future. Additionally, it includes extremely useful information for new and growing company to mark themselves over the market. This report also contains important details such as End Users/Application, Trends in Future, Status and Outlook, production capacity, revenue, and Scope.

This report presents the worldwide Touch Screen Module…

Skew Correction Module Release & Improved Text Recognition Module inside Cloud A …

What’s new in this release?

We are pleased to announce the release of Aspose.OCR Cloud 18.6. Aspose team has released Skew Correction module that allows to recognise slightly rotated images, integrated Tensor-flow-Serving technology into Aspbose's pipeline and improved Text Recognition module to fix a lot of issues in Aspose roadmap. There are some important new features part of this release, such as released skew correction module that allows to recognise slightly…