Press release

United State Digital Banking Solution Market to hit 8.62% CAGR to US$ 24.96 Billion By 2032 | Top Most Keyplayers - Worldline S.A., Fiserv Inc., JP Morgan's, HSBC

Market Size and Forecast:Global Digital Banking Solution Market reached US$ 13.04 billion in 2024 and is expected to reach US$ 24.96 billion by 2032, growing with a CAGR of 8.62% during the forecast period 2025-2032.

The Digital Banking Solutions Market report, published by DataM Intelligence, provides in-depth insights and analysis on key market trends, growth opportunities, and emerging challenges. Committed to delivering actionable intelligence, DataM Intelligence empowers businesses to make informed decisions and stay ahead of the competition. Through a combination of qualitative and quantitative research methods, it offers comprehensive reports that help clients navigate complex market landscapes, drive strategic growth, and seize new opportunities in an ever-evolving global market.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID): https://datamintelligence.com/download-sample/digital-banking-solutions-market?ca

Digital banking solutions enable seamless online and mobile financial services, including payments, fund transfers, and account management. They enhance customer convenience, security, and efficiency while driving financial inclusion and digital transformation in the banking sector.

Industry Recent Developments:

United States:

October 2025: U.S. financial institutions launched enhanced digital banking platforms integrating AI-powered chatbots for 24/7 customer service, improving engagement and support.

September 2025: Major banks adopted blockchain-based payment and settlement systems to increase transaction transparency and reduce settlement times.

Japan:

August 2025: Japanese banks expanded use of cloud-native core banking solutions, allowing faster rollout of digital services and personalized customer experiences.

October 2025: Collaboration between traditional banks and fintech startups increased to develop seamless mobile wallets and integrated payment platforms, enhancing cashless payment adoption.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://datamintelligence.com/customize/digital-banking-solutions-market?ca

Major Key Players:

Worldline S.A.

Fiserv, Inc.

JPMorgan's

HSBC

Digital Banking Solutions

CSI

Finastra

FIS

PwC

Capgemini

Segments Covered in the Digital Banking Solutions Market:

➥ By Component: Software, Services

➥ By Type of Banking: Retail Banking, Corporate Banking, Investment Banking

➥ By Deployment: On-premises, Cloud-based

➥ By Mode: App-based, Web-based

Regional Analysis:

⇥ North America (U.S., Canada, Mexico)

⇥ Europe (U.K., Italy, Germany, Russia, France, Spain, The Netherlands and Rest of Europe)

⇥ Asia-Pacific (India, Japan, China, South Korea, Australia, Indonesia Rest of Asia Pacific)

⇥ South America (Colombia, Brazil, Argentina, Rest of South America)

⇥ Middle East & Africa (Saudi Arabia, U.A.E., South Africa, Rest of Middle East & Africa)

Looking For Full Report? Get it Here: https://www.datamintelligence.com/buy-now-page?report=digital-banking-solutions-market

Chapter Outline

⏩ Market Overview: It contains five chapters, as well as information about the research scope, major manufacturers covered, market segments, Digital Banking Solutions Market segments, study objectives, and years considered.

⏩ Market Landscape: The competition in the Global Digital Banking Solutions Market is evaluated here in terms of value, turnover, revenues, and market share by organization, as well as market rate, competitive landscape, and recent developments, transaction, growth, sale, and market shares of top companies.

⏩ Companies Profiles: The Global Digital Banking Solutions Market leading players are studied based on sales, main products, gross profit margin, revenue, price, and growth production.

⏩ Market Outlook by Region: The report goes through gross margin, sales, income, supply, market share, CAGR, and market size by region in this segment. North America, Europe, Asia Pacific, Middle East & Africa, and South America are among the regions and countries studied in depth in this study.

⏩ Market Segments: It contains the deep research study which interprets how different end-user/application/type segments contribute to the Digital Banking Solutions Market.

⏩ Market Forecast: Production Side: In this part of the report, the authors have focused on production and production value forecast, key producers forecast, and production and production value forecast by type.

⏩ Research Findings: This section of the report showcases the findings and analysis of the report.

⏩ Conclusion: This portion of the report is the last section of the report where the conclusion of the research study is provided.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

People Also Ask:

◆ How big is the Digital Banking Solutions Market in 2025?

◆ What is the projected growth rate of the Digital Banking Solutions Market through 2033?

◆ Who are the key players in the Digital Banking Solutions Market?

◆ Which region is expected to dominate the industry during the forecast period?

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release United State Digital Banking Solution Market to hit 8.62% CAGR to US$ 24.96 Billion By 2032 | Top Most Keyplayers - Worldline S.A., Fiserv Inc., JP Morgan's, HSBC here

News-ID: 4234759 • Views: …

More Releases from DataM Intelligence 4 Market Research LLP

Mental Health Software Market to Reach US$ 7.5 Billion by 2030 at 15.2% CAGR | N …

Mental Health Software Market reached US$ 2.6 billion in 2022 and is expected to reach US$ 7.5 billion by 2030, growing at a CAGR of 15.2% during the forecast period of 2024 to 2031. The market is expanding rapidly as increasing global awareness of mental health conditions, rising prevalence of anxiety and depression, and growing demand for accessible digital care solutions accelerate adoption of mental health software across healthcare providers,…

Operational Intelligence Market to Reach US$ 38.82 Billion by 2033 at 12.1% CAGR …

Operational Intelligence Market reached US$ 16.82 billion in 2024 and is expected to reach US$ 38.82 billion by 2033, growing at a CAGR of 12.1% during the forecast period of 2025 to 2033. The market is expanding rapidly as businesses across industries seek real-time visibility into operations, enabling faster decision-making, improved efficiency, and reduced risk. Operational intelligence platforms integrate streaming data, analytics, and dashboards to deliver actionable insights that help…

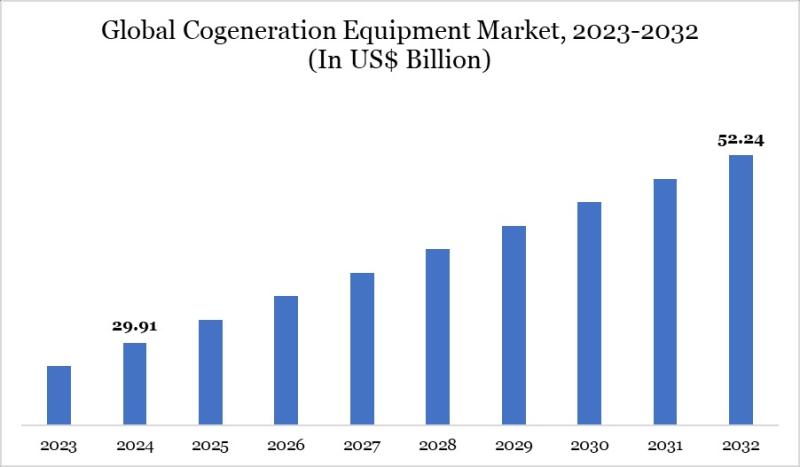

Cogeneration Equipment Market to Reach US$ 52.24 Billion by 2032 at 7.22% CAGR | …

Cogeneration Equipment Market reached US$ 29.91 billion in 2024 and is expected to reach US$ 52.24 billion by 2032, growing at a CAGR of 7.22% during the forecast period of 2025 to 2032. The market is expanding steadily as rising demand for energy efficient and low emission power generation solutions encourages industries to adopt cogeneration or combined heat and power systems that simultaneously produce electricity and useful thermal energy from…

Premium Skin Care Products Market Growth Opportunities, Key Developments, M & A, …

Skin Care Products Market Growth to hit at a high (CAGR) during ther forecast period (2026-2033), says DataM Intelligence

Get a Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/skincare-products-market?kb

Latest Mergers and Acquisitions

• Marico's arm Marico South-East Asia Corp. agreed to acquire a 75% equity stake in Vietnam's D2C skincare company Skinetiq (owners of Candid brand & Murad Vietnam distribution) for ₹350 cr (Rs 261-262 cr) -…

More Releases for Banking

Banking ERP Software Market: A Catalyst for Banking Excellence

The Banking ERP Software Market is at the forefront of a financial revolution, poised to redefine the way banking institutions operate in the digital age. As the industry grapples with evolving customer expectations, regulatory demands, and technological advancements, ERP software solutions have emerged as indispensable tools for financial institutions. These systems streamline operations, enhance data management, and empower banks to deliver more efficient and customer-centric services. In an era where…

Digital Banking Market Report, Worth, Size, Share, Trends, Segmented by Applicat …

Digital Banking Market Size:

In 2018, the global Digital Banking market size was 5.180 Billion USD and it is expected to reach 16.200 Billion US$ by the end of 2025, with a CAGR of 15.3% during 2019-2025.

Get Free Sample: https://reports.valuates.com/request/sample/QYRE-Auto-4N473/Global_Digital_Banking

Digital Banking Market Share:

• In 2017, North America's economy accounted for about 48.73% of the global Digital Banking market share, while Europe and Asia-Pacific accounted for about 30.22%, 16.54%, respectively.

• European countries such…

Online Banking Market by Banking Type - Retail Banking, Corporate Banking, and I …

The Online Banking Market size is expected to reach $29,976 million in 2023 from $7,305 million in 2016, growing at a CAGR of 22.6% from 2017 to 2023. Digital banking includes all kinds of online/internet transactions done for various purposes. It is the incorporation of new technologies, to deliver enhanced customer services.

Customer convenience, higher interest rates, and technologically advanced interface majorly drive the market. High security risk of customer’s data…

Explore Mobile Banking Market with Top Players like Barclays, BOC, SBI, HSBC Mob …

Mobile Banking allow various users to avail banking and financial services through any telecommunication devices. Different kind of services include both information and monetary transaction. Increase in the use of number of smart phones and mobile phones mobile Banking Market has gained its popularity. It is preferable and comfortable by the users than any other means of transaction.

Global Mobile Banking Market anticipated to grow at a CAGR of +35% over…

Mobile Banking Market Is Booming Worldwide | HSBC Mobile Banking, ICICI Bank Mob …

HTF MI recently introduced Global Mobile Banking Market study with in-depth overview, describing about the Product / Industry Scope and elaborates market outlook and status to 2023. The market Study is segmented by key regions which is accelerating the marketization. At present, the market is developing its presence and some of the key players from the complete study are HSBC Mobile Banking, ICICI Bank Mobile Banking, U.S. Bank, Santander Mobile…

Online Banking Market Report 2018: Segmentation by Banking Type (Retail Banking, …

Global Online Banking market research report provides company profile for ACI Worldwide (U.S.), Microsoft Corporation (U.S.), Fiserv, Inc. (U.S.), Tata Consultancy Services (India), Cor Financial Solutions Ltd. (UK), Oracle Corporation (U.S.) and Others.

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for…