Press release

Banking as a Service Industry Forecasted to Grow at a 17.8% CAGR, Surpassing USD 70 Billion by 2032

Overview of the MarketThe global Banking as a Service (BaaS) market is projected to witness substantial growth over the forecast period. Valued at US$22.5 billion in 2025, the market is expected to reach US$70.8 billion by 2032, exhibiting a robust CAGR of 17.8% from 2025 to 2032. This rapid growth is driven by the rising demand for embedded finance, where non-financial platforms integrate banking capabilities, enhancing convenience for consumers and businesses alike.

The key growth drivers behind this expansion include the increasing adoption of digital payments, integration of lending and financial services into non-banking platforms, and rising consumer preference for seamless financial experiences. Among market segments, platform-based BaaS solutions are leading due to their scalability and flexibility in serving fintechs, neobanks, and traditional banks. Geographically, North America dominates the market, owing to early adoption of digital banking, regulatory support for fintech innovations, and strong technological infrastructure.

Elevate your business strategy with comprehensive market data. Request a sample report now: https://www.persistencemarketresearch.com/samples/33606

Key Highlights from the Report

The BaaS market is projected to reach US$70.8 billion by 2032.

Embedded finance adoption is accelerating the demand for BaaS solutions.

Platform-based solutions account for the largest market share.

North America is the leading regional market due to early fintech adoption.

Integration of digital payments and lending services drives market expansion.

Fintech partnerships with non-banking platforms are enhancing market reach.

Market Segmentation

The Banking as a Service market is segmented based on product type, end-user, and deployment model. By product type, the market includes platform-based BaaS solutions, APIs, and white-label banking solutions. Platform-based offerings dominate, owing to their ability to provide integrated banking services across multiple channels. APIs are increasingly adopted by fintech startups for enabling digital banking services seamlessly.

From an end-user perspective, the market caters to neobanks, fintech companies, traditional banks, and non-financial enterprises. Neobanks and fintech companies are leading the adoption due to their agile operations, while non-financial enterprises, including e-commerce and ride-hailing platforms, are integrating BaaS to offer embedded finance services, thus driving new revenue streams and enhancing customer loyalty.

Regional Insights

North America remains the largest market for BaaS, fueled by technological advancements, supportive regulations, and a strong fintech ecosystem. The U.S. leads the region, with significant investments in API-driven banking platforms and embedded finance solutions.

Europe is witnessing rapid growth, particularly in the UK, Germany, and France, where fintech adoption is strong and regulatory frameworks like PSD2 facilitate banking service integration. Emerging economies in the Asia Pacific are also showing increasing adoption due to the rise of digital wallets and mobile banking platforms.

Read More: https://www.persistencemarketresearch.com/market-research/banking-as-a-service-market.asp

Market Drivers

The primary drivers of the Banking as a Service market include the rising consumer demand for digital-first banking experiences, increasing collaborations between fintechs and traditional banks, and the expansion of embedded finance across non-financial platforms. Additionally, the growing need for cost-effective and scalable banking solutions is encouraging enterprises to adopt BaaS solutions rapidly.

Market Restraints

Despite its growth, the BaaS market faces challenges such as regulatory compliance complexities, data security concerns, and integration difficulties with legacy banking systems. These factors may slow down adoption in certain regions, particularly where fintech regulations are still evolving.

Market Opportunities

The BaaS market presents significant opportunities in emerging regions such as Asia Pacific and Latin America, where digital banking penetration is low but growing rapidly. Innovations in AI-driven banking, blockchain-enabled financial services, and mobile-first solutions offer additional avenues for expansion and differentiation in a competitive market landscape.

Do You Have Any Query Or Specific Requirement? Request Customization of Report: https://www.persistencemarketresearch.com/request-customization/33606

Reasons to Buy the Report

✔ Comprehensive analysis of global and regional BaaS market trends.

✔ Detailed segmentation based on product type, deployment, and end-user.

✔ Insights into key growth drivers, challenges, and emerging opportunities.

✔ Competitive landscape and strategies of major market players.

✔ Accurate market forecasts up to 2032 to support strategic planning.

Frequently Asked Questions (FAQs)

How Big is the Banking as a Service Market?

Who are the Key Players in the Global Banking as a Service Market?

What is the Projected Growth Rate of the Banking as a Service Market?

What is the Market Forecast for 2032?

Which Region is Estimated to Dominate the Banking as a Service Industry through the Forecast Period?

Company Insights

Key players in the Banking as a Service market include:

Solarisbank AG

Bankable

Railsbank

ClearBank

Treezor

Fidor Bank

Marqeta

Recent Developments:

Solarisbank AG launched a new API platform to expand embedded finance solutions for fintech partners.

Marqeta partnered with global payment providers to enhance its BaaS offerings in Europe and North America.

Related Reports:

3D Sensors Market https://www.persistencemarketresearch.com/market-research/3d-sensors-market.asp

Radio Frequency Components Market https://www.persistencemarketresearch.com/market-research/radio-frequency-components-market.asp

Classroom 3D Printing Market https://www.persistencemarketresearch.com/market-research/classroom-3d-printing-market.asp

Contact Us:

Persistence Market Research

Second Floor, 150 Fleet Street,

London, EC4A 2DQ, United Kingdom

USA Phone: +1 646-878-6329

UK Phone: +44 203-837-5656

Email: sales@persistencemarketresearch.com

Web: https://www.persistencemarketresearch.com

About Persistence Market Research:

At Persistence Market Research, we specialize in creating research studies that serve as strategic tools for driving business growth. Established as a proprietary firm in 2012, we have evolved into a registered company in England and Wales in 2023 under the name Persistence Research & Consultancy Services Ltd. With a solid foundation, we have completed over 3600 custom and syndicate market research projects, and delivered more than 2700 projects for other leading market research companies' clients.

Our approach combines traditional market research methods with modern tools to offer comprehensive research solutions. With a decade of experience, we pride ourselves on deriving actionable insights from data to help businesses stay ahead of the competition. Our client base spans multinational corporations, leading consulting firms, investment funds, and government departments. A significant portion of our sales comes from repeat clients, a testament to the value and trust we've built over the years.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Banking as a Service Industry Forecasted to Grow at a 17.8% CAGR, Surpassing USD 70 Billion by 2032 here

News-ID: 4234546 • Views: …

More Releases from Persistence Market Research

Bicycle Spokes Market Set for Strong Growth at 5.4% CAGR Through 2032 - Persiste …

The global bicycle spokes market is rapidly gaining traction as bicycles continue to be adopted as preferred choices for commuting, fitness, recreation, and eco‐friendly mobility. The global bicycle spokes market size is likely to be valued at US$2.9 billion in 2025 and is expected to reach US$4.2 billion by 2032, registering a steady CAGR of 5.4 % between 2025 and 2032.

➤ Download Your Free Sample & Explore Key Insights: https://www.persistencemarketresearch.com/samples/30615

Bicycle…

Herbal Toothpaste Market Growth Poised at 6.5% CAGR Through 2033 Amid Rising Hea …

The global oral care industry is undergoing a transformational shift as consumers increasingly prioritize natural, chemical free alternatives. Central to this transformation is the herbal toothpaste market, which is rapidly emerging as a mainstream segment driven by rising health consciousness, sustainability trends, and demand for botanical formulations. The global herbal toothpaste market size is likely to be valued at US$ 2.6 billion in 2026 and is projected to reach US$…

Dead Sea Mud Cosmetics Market Set for Steady Expansion Amid Rising Demand for Na …

The global beauty and personal care industry continues to evolve as consumers shift toward natural, mineral-based, and wellness-oriented skincare solutions. Among these, Dead Sea mud cosmetics have gained strong traction for their mineral content and perceived therapeutic benefits. According to industry estimates, the global dead sea mud cosmetics market is likely to be valued at US$1.5 billion in 2026 and is projected to reach US$2.3 billion by 2033, expanding at…

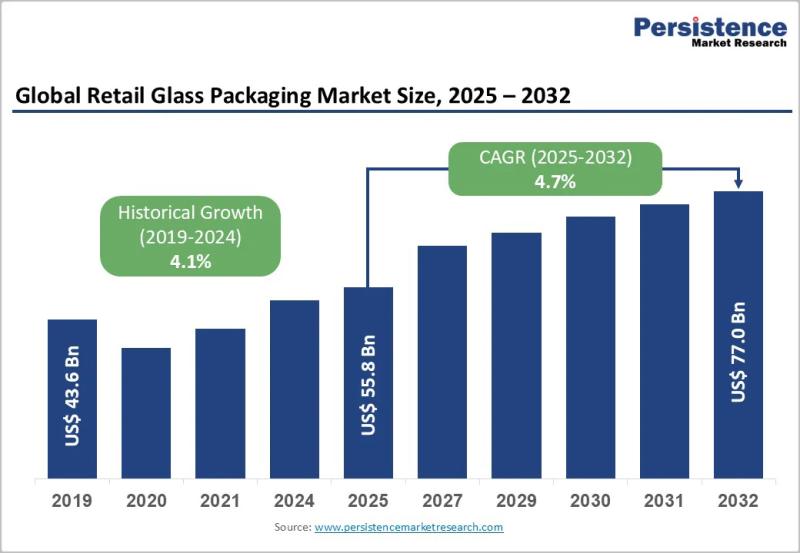

Retail Glass Packaging Market Projected to Reach US$77.0 Billion by 2032 at 5.3% …

The retail glass packaging market continues to play a crucial role in the global packaging ecosystem, particularly across food, beverage, cosmetics, and pharmaceutical retail channels. Glass packaging remains a preferred solution due to its premium appearance, chemical inertness, recyclability, and ability to preserve product integrity. As consumers increasingly prioritize sustainability, safety, and high quality packaging, retail glass packaging has regained strategic importance across both developed and emerging economies. Brands are…

More Releases for Bank

Mortgage-Backed Security Market 2022: Industry Manufacturers Forecasts- Construc …

The Mortgage-Backed Security research report is the professional report with the premium insights which includes the size of the business, the ongoing patterns, drivers, dangers, conceivable outcomes and primary segments. The Market Report predicts the future progress of the Mortgage-Backed Security market based on accurate estimations. Furthermore, the report offers actionable insights into the future growth of the market based on inputs from industry experts to help readers formulate effective…

Doorstep Banking Services Market Challenges and Opportunities in Banking Service …

Doorstep banking is a facility provided so that user don't have to visit bank branches for routine banking activities like cash deposit, cash withdrawal, cheque deposit, or making a demand draft. The bank extends these facilities at user work place by appointing a service provider on your behalf.

This service was earlier available only to senior citizens but it is available to everyone with nominal fee charges, depending on the type…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank of …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance,…

Payments Landscape in Iran: Opportunities and Risks to 2021- Bank Saderat Iran, …

Payments Landscape in Iran: Opportunities and Risks to 2021

Publisher's "Payments Landscape in Iran: Opportunities and Risks to 2021", report provides detailed analysis of market trends in the Iranian cards and payments industry. It provides values and volumes for a number of key performance indicators in the industry, including payment cards and cheques during the review-period (2013-17e).

The report also analyzes various payment card markets operating in the industry, and provides detailed…

India Retail Banking Market Dynamics 2018 by SBI ICICI, HDFC, Axis Bank, Bank o …

Margins among Indian banks remained high at 6.3% in 2017 in comparison to its peers China (2.8%) and Malaysia (2.6%). The average cost-to-income ratio remained at around 53% during 2013-17, marginally higher than China (50%) and Malaysia (51%). However, there remain large disparities in operating efficiencies within the market. The same is also true for profitability, with large disparities in return on assets figures. This is due to rising compliance, regulatory, and other…