Press release

India Edge Data Center Market Trends, Growth, and Demand Forecast 2025-2033

Market Overview:According to IMARC Group's latest research publication, "India Edge Data Center Market Size, Share, Trends and Forecast by Component, Facility Size, Vertical, Region, and Company, 2025-2033", the India edge data center market size reached USD 524.8 Million in 2024. Looking forward, the market is expected to reach USD 3,005.8 Million by 2033, exhibiting a growth rate (CAGR) of 19.5% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-edge-data-center-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the India Edge Data Center Market

● Explosive IoT Adoption Creating Massive Data Processing Demands

India's edge data center market is experiencing phenomenal growth, riding the massive wave of IoT device proliferation that's fundamentally changing how data gets processed and stored. The numbers tell a compelling story-India's IoT market reached USD 1.4 Billion in 2024 and is growing rapidly across consumer, industrial, and smart city applications. What makes this particularly interesting for edge data centers is the sheer volume of connected devices coming online. Enterprise IoT spending in India grew 14% year-over-year in 2024, one of the highest growth rates globally, driven by smart city initiatives and industrial automation. The government's ambitious project to install 250 million smart electricity meters countrywide creates enormous demand for localized data processing. Think about what happens when millions of sensors, cameras, and connected devices generate data continuously-traditional centralized data centers simply can't handle the latency requirements. Manufacturing facilities implementing Industry 4.0 practices need real-time analytics on production lines. Smart city infrastructure monitoring traffic patterns, managing utilities, and ensuring public safety requires instantaneous data processing. Healthcare providers using IoT-enabled remote patient monitoring devices need ultra-low latency to make critical decisions. Edge data centers solve these challenges by bringing computing power closer to where data originates. According to ICRA estimates, India's edge data center capacity is set to triple from 60-70 MW in 2024 to 200-210 MW by 2027, driven precisely by these emerging technology use cases. What's particularly fascinating is how diverse industries are adopting edge solutions-retail chains optimizing inventory through real-time tracking, logistics companies improving supply chain visibility, financial institutions processing transactions faster, and entertainment platforms delivering seamless streaming experiences. The retail and e-commerce sector alone is witnessing significant IoT integration for inventory management and customer analytics, creating sustained demand for edge infrastructure that can process this data locally before sending aggregated insights to central systems.

● 5G Revolution Enabling Edge Computing at Unprecedented Scale

The nationwide rollout of 5G technology is creating perfect conditions for edge data center expansion across India. By October 2024, 5G services reached all states and union territories, with coverage extending to 779 out of 783 districts nationwide, supported by over 460,000 5G base transceiver stations deployed across the country. India achieved around 95% population coverage with 5G mid-band deployments in 2024, one of the fastest rollouts globally. The scale is staggering-270 million Indians were using 5G by end of 2024, representing 23% of mobile subscriptions, and this number is projected to reach 970 million by 2030, accounting for 74% of total subscriptions. What makes this particularly relevant for edge data centers is that 5G isn't just about faster mobile internet-it fundamentally enables edge computing applications that were previously impossible. The ultra-low latency that 5G provides, combined with massive device connectivity, makes edge data centers essential infrastructure. India leads globally in monthly data consumption per smartphone at 32 GB compared to the global average of 19 GB, and this is expected to grow to 66 GB by 2030. Where does all this data get processed efficiently? At the edge. Both Reliance Jio and Bharti Airtel, the dominant telecom operators, have invested heavily in 5G standalone architecture that's specifically designed to work seamlessly with edge computing infrastructure. Fixed Wireless Access (FWA), one of the first major 5G use cases in India, relies heavily on edge infrastructure to deliver broadband to homes and businesses. India is set to account for 20% of global FWA subscriptions by 2030, creating enormous demand for edge processing capabilities. The gaming and entertainment vertical is witnessing explosive growth-cloud gaming, augmented reality, and virtual reality applications all require the kind of low-latency, high-bandwidth connectivity that only edge data centers combined with 5G can provide. Automotive applications, particularly connected vehicles and eventually autonomous driving systems, generate massive amounts of data that must be processed at the edge for safety-critical decisions. Companies like CtrlS are already planning over 20 edge data centers across Tier II and Tier III locations specifically to capitalize on this 5G-enabled edge computing revolution.

● Strategic Government Initiatives and Digital Infrastructure Development

The Indian government's comprehensive policy framework is actively accelerating edge data center deployment across the country. The Digital India initiative has created a favorable ecosystem for data center investments, while specific measures like the Draft Data Centre Policy aim to simplify infrastructure setup and promote domestic manufacturing of data center equipment. What's particularly impactful is the government's proposal to establish at least four Data Centre Economic Zones (DCEZ) as a Central Sector Scheme, creating ecosystems specifically designed for hyperscale and edge data centers. These zones offer fiscal and non-fiscal incentives for companies using domestic equipment related to servers, storage, telecom, and network devices. The Production Linked Incentive (PLI) schemes promote domestic manufacturing of IT hardware vital to the data center industry, reducing import dependency and fostering a self-reliant supply chain. India's data center industry is expected to add more than 681 MW capacity, leading to a doubling of existing capacity to 1,318 MW with 7.8 million square feet of real estate space. The government's BharatNet project to provide broadband connectivity to all gram panchayats is creating demand for distributed edge infrastructure to serve rural and semi-urban areas. The classification of data centers under the Essential Services Maintenance Act (ESMA) demonstrates government recognition of their critical importance to national infrastructure. State governments are equally proactive-Gujarat's IT/ITES policy offers incentives including land support, infrastructure subsidies, capital cost assistance, and electricity subsidies for up to five years specifically for data center and cable landing station development. Tamil Nadu has signed MOUs for data center investments exceeding Rs 2,500 crore. The government allows 100% FDI ownership in data centers, lowering entry barriers and attracting global players, financial institutions, and private capital. Data localization mandates, while creating compliance requirements, simultaneously drive domestic data center capacity expansion as companies must store and process sensitive data within India's borders. The National Digital Communications Policy (NDCP) seeks to provide universal broadband access, laying critical foundation for edge computing infrastructure. The Union Budget 2025-26 proposal to set up a center of excellence in AI for education, coupled with deep-tech fund of funds for AI, cybersecurity, and cloud computing, signals continued government commitment to digital infrastructure that inherently requires robust edge computing capabilities.

Key Trends in the India Edge Data Center Market

● Rapid Expansion Beyond Metro Cities into Tier II and III Markets

India's edge data center ecosystem is witnessing a fascinating geographical transformation as investments shift from traditional metro hubs into smaller cities across the country. Historically, data center infrastructure concentrated in major metros like Mumbai, Chennai, Bengaluru, Hyderabad, and Delhi, which collectively accounted for 60% of capacity. However, the edge computing paradigm is fundamentally changing this landscape. Tier II and Tier III cities are emerging as focal points for edge data center expansion, driven by compelling economics and strategic necessity. Companies like CtrlS are leading this shift, already operating centers in cities like Patna and Lucknow, with concrete plans to establish over 20 edge data centers across smaller locations. What makes this expansion particularly interesting is the convergence of multiple factors-operational costs in Tier II and III cities are significantly lower, with affordable real estate, reduced labor expenses, and lower power costs making these locations financially attractive while maintaining cutting-edge infrastructure. North India, West and Central India, South India, and East and Northeast India are all witnessing investments, but the patterns differ. Cities like Ahmedabad, Gurugram, Noida, and Kolkata are emerging as important locations beyond traditional hubs. Hyderabad already accounts for 6% of market share with 38 MW capacity and 0.71 million square feet, demonstrating how second-tier cities can build significant data center ecosystems. Chennai, with the second-highest number of undersea cables after Mumbai, holds 57 MW capacity and 8% market share, and is projected to become the second-largest market by 2030. Kolkata serves as the only data center hub in East India with 67 MW capacity. Government incentives from state bodies are accelerating this geographic distribution-policies offering tax benefits, real estate subsidies, and infrastructure support encourage private sector investments in smaller cities. The availability of land in these regions enables implementation of green infrastructure incorporating renewable energy sources like solar and wind power, which is increasingly important given sustainability mandates. Data localization compliance requirements mean organizations need edge infrastructure geographically distributed to ensure regional users' data remains close, optimizing both security and performance. The shift toward edge centers meets growing demand from Tier II and III cities, ensuring lower latency and better service delivery as digital penetration deepens in these previously underserved regions.

● Component and Facility Size Segmentation Driving Market Diversity

The edge data center market is exhibiting interesting dynamics in how infrastructure gets deployed and configured. Breaking down by component, the market segments into solutions and services, with both categories experiencing robust growth but serving different needs. Solution components include the physical infrastructure-servers, storage systems, networking equipment, cooling systems, power management, and security apparatus that form the backbone of edge facilities. Services encompass everything from installation and integration to ongoing management, maintenance, monitoring, and consulting that keep these facilities running optimally. What's particularly noteworthy is how edge deployments differ from traditional hyperscale facilities-they require specialized solutions optimized for smaller footprints, remote management capabilities, and modular designs that allow incremental capacity expansion. India's modular data center market was valued at USD 1.07 Billion in 2024 and is forecasted to reach USD 3.44 Billion by 2033, driven specifically by edge computing requirements, cloud migration, and sustainability initiatives. These modular approaches let companies deploy edge capacity quickly without massive upfront capital expenditure. Facility size segmentation reveals two distinct categories-small and medium facilities versus large facilities. Small and medium edge facilities typically range from a few kilowatts to a few megawatts, strategically positioned close to end-users in locations where traditional large data centers wouldn't be economically viable. These serve specific geographical areas, enterprise campuses, telecom points of presence, or industry-specific applications. Large edge facilities, while still smaller than traditional hyperscale operations, handle more substantial workloads and serve as regional aggregation points for multiple smaller edge nodes. The interesting dynamic is that both categories are growing simultaneously because they serve different use cases. Retail chains might deploy small edge facilities in individual stores for real-time inventory analytics, while simultaneously using larger regional edge facilities for aggregating data from multiple stores. Manufacturing companies implement small edge nodes on factory floors for real-time production monitoring, with larger facilities handling enterprise-wide analytics. The flexibility in sizing allows organizations to right-size infrastructure investments based on specific latency, bandwidth, and processing requirements rather than forcing every application into centralized or fully distributed models.

● Vertical-Specific Applications Driving Differentiated Edge Adoption

Different industry verticals are adopting edge data center infrastructure at varying rates and for distinctly different use cases, creating a rich mosaic of applications and requirements. The IT and telecom sector leads adoption, which makes intuitive sense-telecom operators need edge infrastructure to support 5G deployments, content delivery networks require distributed processing, and cloud service providers build edge presence to reduce latency for customers. BFSI (Banking, Financial Services, and Insurance) represents another major vertical where edge computing is becoming essential. Real-time fraud detection, high-frequency trading, ATM networks, and branch operations all benefit from edge processing that minimizes latency and ensures transaction reliability. Retail and e-commerce have emerged as significant edge adopters-companies implementing smart stores with computer vision for checkout-free shopping, real-time inventory tracking across supply chains, personalized customer analytics, and augmented reality shopping experiences all require edge computing capabilities. Government applications span smart city infrastructure, traffic management systems, public safety monitoring, and digital service delivery that necessitate distributed processing closer to citizens. The healthcare and life sciences vertical is witnessing particularly interesting edge adoption-remote patient monitoring generates continuous data streams that require real-time analysis, medical imaging applications benefit from local processing to accelerate diagnosis, and telemedicine platforms need low-latency infrastructure for quality consultations. IoT devices in healthcare reached USD 5.0 Billion in 2024 and are projected to grow substantially. Manufacturing sector adoption centers on Industry 4.0 initiatives-predictive maintenance systems analyzing equipment sensors, quality control using computer vision, supply chain optimization through real-time tracking, and robotics integration all depend on edge infrastructure. Industrial IoT market in India reached USD 9.40 Billion in 2024, with substantial portions requiring edge processing. Gaming and entertainment represent explosive growth verticals-cloud gaming services need edge infrastructure to deliver console-quality experiences with minimal latency, streaming platforms use edge caching to ensure smooth content delivery, and augmented/virtual reality applications require distributed processing for responsive experiences. The automotive sector, while still emerging in India, shows tremendous potential-connected vehicles generate massive data requiring edge processing, vehicle-to-everything (V2X) communications for safety systems depend on ultra-low latency, and fleet management systems benefit from distributed analytics. What's fascinating is how verticals aren't mutually exclusive-a smart city deployment might incorporate retail analytics, traffic management, public safety, and healthcare applications, all leveraging shared edge infrastructure but with vertical-specific processing requirements.

Leading Companies Operating in the India Edge Data Center Market:

Companies actively investing in and deploying edge data center infrastructure across India include global and domestic players recognizing the market opportunity. CtrlS Datacenters has emerged as a leading domestic player with aggressive expansion plans, operating facilities in multiple cities and targeting over 20 edge locations across Tier II and Tier III cities. Sify Technologies maintains significant data center presence including edge deployments. Yotta Infrastructure has been expanding its data center footprint with investments in distributed infrastructure. STT GDC India, NTT, and Princeton Digital have established operations in key markets. Global hyperscalers including Amazon Web Services, Microsoft Azure, and Google Cloud are building edge presence in India to serve their cloud customers' latency-sensitive applications. NES announced plans in 2024 to grow total data center capacity in India to over 100MW within three years. ESDS is developing new facilities including a 30MW site in Ghaziabad with solar power. Reliance Jio, as a major telecom operator with extensive 5G infrastructure, is positioned to leverage edge computing infrastructure. Companies like CapitaLand, Adani Enterprises, and various international players are either operating facilities or announcing investments in India's growing edge data center market.

India Edge Data Center Market Report Segmentation:

Breakup by Component:

● Solution

● Services

Breakup by Facility Size:

● Small and Medium Facility

● Large Facility

Breakup by Vertical:

● IT and Telecom

● BFSI

● Retail and E-commerce

● Government

● Healthcare and Life Sciences

● Manufacturing

● Gaming and Entertainment

● Automotive

● Others

Regional Insights:

●North India

● West and Central India

● South India

● East and Northeast India

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=21562&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Edge Data Center Market Trends, Growth, and Demand Forecast 2025-2033 here

News-ID: 4234345 • Views: …

More Releases from IMARC Group

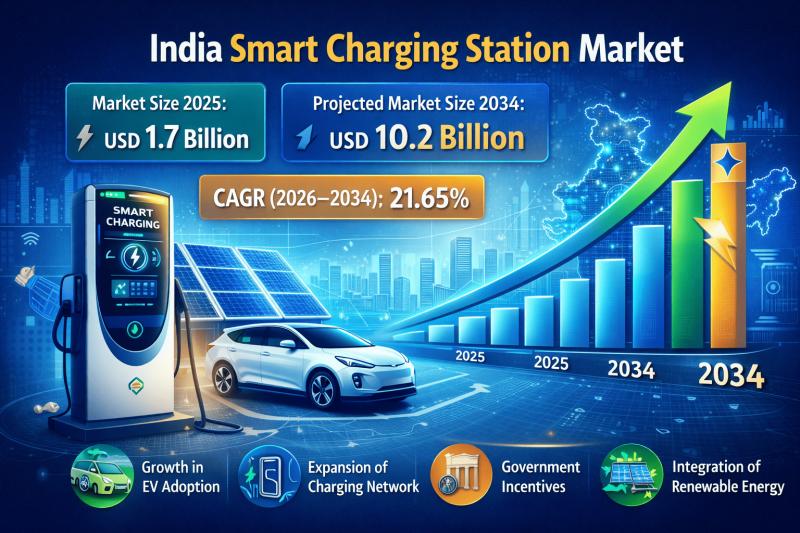

India Smart Charging Station Market Expected to Reach USD 10.2 Billion by 2034, …

IMARC Group's latest research publication "India Smart Charging Station Market Size, Share, Trends and Forecast by Charging Technology, Connectivity, Battery Technology, Application, and Region, 2026-2034" the India smart charging station market size reached USD 1.7 Billion in 2025. The market is expected to reach USD 10.2 Billion by 2034, exhibiting a growth rate (CAGR) of 21.65% during 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/india-smart-charging-station-market/requestsample

What is a Smart Charging Station?

A smart charging station…

India Home Diagnostic Testing Market Expected to Reach USD 332.6 Million by 2034 …

IMARC Group's latest research publication "India Home Diagnostic Testing Market Size, Share, Trends and Forecast by Test Type, Form, Distribution Channel, and Region, 2026-2034" the India home diagnostic testing market size reached USD 222.7 Million in 2025. The market is expected to reach USD 332.6 Million by 2034, exhibiting a growth rate (CAGR) of 4.56% during 2026-2034.

Request a Sample Report: https://www.imarcgroup.com/india-home-diagnostic-testing-market/requestsample

What is Home Diagnostic Testing?

Home diagnostic testing refers to medical…

India Catering Services Market Expected to Reach USD 7.7 Billion by 2034, Indust …

Report Introduction

According to IMARC Group's latest report titled "India Catering Services Market Size, Share, Trends and Forecast by Service Type, End-User, and Region, 2026-2034", the study offers a granular analysis of the nation's burgeoning food service and hospitality sectors. The study offers a profound analysis of the industry, encompassing India catering services market research report, share, size, growth factors, key trends, and regional insights. The report covers critical market dynamics,…

India Smart Home Lighting Market Expected to Reach USD 9,991.3 Million by 2034, …

According to recent reports by IMARC Group, the India smart home lighting market is witnessing rapid growth as consumers increasingly adopt energy-efficient and automated living solutions.

Request Sample Link: https://www.imarcgroup.com/india-smart-home-lighting-market/requestsample

Market Overview and Statistics

✤ Current Market Size (2025): The India smart lighting market reached a value of USD 1,032.1 Million in 2025.

✤ Projected Market Size (2034): It is expected to grow to USD 9,991.3 Million by 2034.

✤ Growth Rate (CAGR): The market…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2018 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2018 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2018 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…