Press release

India Saline Solution Market Growth, Share, and Trends Report 2025-2033

Market Overview:According to IMARC Group's latest research publication, "India Saline Solution Market Report by Product Type (Normal Saline, Ringer's Lactate Solution, Dextrose, and Others), Packaging Type (500 ml, 100 ml, 1000 ml, 250 ml), End-Use (Hospitals, Clinics, Ambulatory Surgery Center, Home Care Center, and Others), Application (IV Drips, Nasal Drops, Cleaning Wounds, Eye Drops, NaCl Inhalation, and Others), and Region 2025-2033", the India saline solution market size reached USD 682.4 Million in 2024. Looking forward, the market is expected to reach USD 1,408.0 Million by 2033, exhibiting a growth rate (CAGR) of 7.96% during 2025-2033.

This detailed analysis primarily encompasses industry size, business trends, market share, key growth factors, and regional forecasts. The report offers a comprehensive overview and integrates research findings, market assessments, and data from different sources. It also includes pivotal market dynamics like drivers and challenges, while also highlighting growth opportunities, financial insights, technological improvements, emerging trends, and innovations. Besides this, the report provides regional market evaluation, along with a competitive landscape analysis.

Grab a sample PDF of this report: https://www.imarcgroup.com/india-saline-solution-market/requestsample

Our report includes:

● Market Dynamics

● Market Trends and Market Outlook

● Competitive Analysis

● Industry Segmentation

● Strategic Recommendations

Growth Factors in the India Saline Solution Market

● Expanding Healthcare Infrastructure Creating Massive Demand

India's saline solution market is riding a powerful wave driven by the country's aggressive healthcare expansion. The government allocated Rs. 99,858 crore to the healthcare sector in Union Budget 2025-26, representing nearly a 10% jump from the previous allocation. This isn't just about numbers on paper-real infrastructure is taking shape across the country. As of mid-2024, India operates 759 district hospitals and 12,453 Primary Health Centres functioning round-the-clock. The number of First Referral Units providing comprehensive obstetric care has exploded from just 940 facilities in 2005 to 3,108 in 2024. Each of these facilities requires consistent supplies of saline solutions for everything from IV drips to wound cleaning. What's particularly interesting is how this infrastructure boom is happening across both urban and rural areas. The PM Ayushman Bharat Health Infrastructure Mission saw its allocation increase by 63% in 2024-25 compared to the previous year, specifically targeting primary healthcare strengthening and disease surveillance. Hospital chains in India are planning USD 2.2 billion in bed expansions, which translates directly into baseline demand for IV fluids and saline products. The Ayushman Bharat-Pradhan Mantri Jan Arogya Yojana received a Rs. 9,406 crore outlay in FY26, marking a substantial 28.8% increase-and with over 30,174 hospitals now empanelled under this scheme, the institutional demand for medical consumables including saline solutions continues climbing. This creates a virtuous cycle where better healthcare access drives higher consumption, which justifies further infrastructure investment, which then drives even more demand.

● Rising Chronic Disease Burden Fueling Medical Consumables Demand

The demographic and health profile of India is undergoing dramatic shifts that directly impact saline solution consumption. Chronic respiratory conditions like asthma, cystic fibrosis, and COPD are becoming increasingly prevalent due to lifestyle changes, aging population, and concerning air pollution levels. These conditions often require hospitalization and regular medical interventions where saline solutions play a critical role-whether for medication dilution, nebulization treatments, or maintaining hydration. Cardiovascular diseases and neurological disorders are similarly on the rise, frequently requiring surgeries and extended hospital stays where saline becomes an essential component of patient care. What's also driving demand is the growing incidence of hyponatremia, or sodium deficiency, particularly among the geriatric population. As people participate more actively in physical activities, there's increased need for saline solutions to treat chronic dehydration that causes fatigue, appetite loss, and irritability. The institutional healthcare segment-comprising hospitals, clinics, and ambulatory surgery centers-is showing impressive growth momentum as these facilities continuously need saline for menu preparations ranging from IV drips to wound cleaning. Home healthcare is another emerging consumption channel, with manufacturers introducing easy-to-use, portable packaging materials for saline solutions that can be used as drips in homecare settings. The expansion of medical tourism in India, where the hospital market is valued at USD 99 billion and expected to reach USD 193 billion by 2032, brings additional patients requiring medical interventions that depend heavily on saline products.

● Government Initiatives and 'Make in India' Push Strengthening Domestic Production

The Indian government's strategic focus on healthcare self-sufficiency is creating favorable conditions for the saline solution market. The 'Make in India' initiative specifically encourages domestic production of medical consumables, reducing dependence on imports and ensuring consistent supply chains. The National Health Mission's flexible funding approach allows high-focus states to spend up to 33% of their allocated funds on infrastructure, which includes procurement of essential medical supplies like saline solutions. The government has established population norms for healthcare facilities-one Primary Health Centre for every 30,000 people in general areas and one for every 20,000 in difficult or tribal regions-creating predictable, scalable demand patterns that manufacturers can plan around. Digital health initiatives are also contributing to market growth. Over 73 crore Ayushman Bharat Health Accounts have been created, and more than 5 lakh health professionals are now registered on digital platforms, streamlining healthcare delivery and tracking medical supply usage more efficiently. The Tele MANAS initiative, with 53 cells established across states and handling over 17.6 lakh calls, is expanding access to healthcare consultations that often result in prescriptions requiring saline-based treatments. The government's focus on setting up more AIIMS facilities-with 22 new AIIMS approved and 12 already operational-is creating centers of excellence that maintain high standards for medical consumables including saline solutions. These institutions serve as anchors for quality benchmarking across the industry.

Key Trends in the India Saline Solution Market

● North India's Market Leadership and Regional Healthcare Expansion

North India has emerged as the commanding leader in India's saline solution market, a position driven by multiple converging factors. The region's healthcare infrastructure has seen continual improvements, with major cities like Delhi, Lucknow, and Chandigarh hosting numerous multi-specialty hospitals and medical institutions. Delhi alone, functioning as a major healthcare hub for the entire northern region, generates substantial institutional demand through its thousands of hospitals, clinics, and surgical centers. The region also benefits from better connectivity and distribution networks, making it easier for manufacturers to maintain consistent supply chains. Uttar Pradesh, India's most populous state with over 230 million residents, represents enormous consumption potential-the state's traditional sweet-making culture and medical needs both contribute to steady demand for various saline applications. The presence of established medical colleges and teaching hospitals in cities like Varanasi, Allahabad, and Agra further drives institutional consumption. West and Central India, anchored by states like Maharashtra, Gujarat, and Madhya Pradesh, show robust market activity driven by commercial centers like Mumbai and Ahmedabad. South India is witnessing impressive growth momentum, particularly in Karnataka, Tamil Nadu, and Telangana, where the IT boom has created affluent urban populations with higher healthcare expectations. The expansion of corporate hospitals in Bangalore, Chennai, and Hyderabad is driving premium product demand. East India, while currently a smaller market, is showing acceleration as healthcare infrastructure develops in states like West Bengal, Bihar, and Odisha. The government's push to reduce regional healthcare disparities is particularly benefiting this region with new medical colleges and upgraded district hospitals.

● IV Drips Dominating Application Segment with Hospitals Leading End-Use

The application breakdown of saline solutions reveals interesting consumption patterns that shape market dynamics. IV drips account for the largest market share among all applications-this makes sense given that virtually every hospitalized patient requires intravenous therapy at some point, whether for hydration, resuscitation, medication administration, or nutritional support. The prevalence of surgical procedures, emergency treatments, and critical care situations ensures consistent, high-volume demand for IV saline products. Other significant applications include nasal drops for respiratory conditions, wound cleaning for surgical and trauma care, eye drops for ophthalmic treatments, and NaCl inhalation for respiratory therapy. The diversity of applications provides market stability, as demand drivers vary across different medical needs. On the end-use front, hospitals clearly dominate the market landscape, representing the largest consumption segment. This dominance reflects the reality that hospitals handle the most acute and critical cases requiring extensive saline use. The average empanelled hospital under the Ayushman Bharat scheme has 48 beds, and with over 30,000 hospitals empanelled, the institutional demand is substantial. Clinics represent the second major consumption segment, particularly important in urban areas where specialty clinics for diabetes, kidney disorders, and other chronic conditions require regular saline supplies. Ambulatory surgery centers are showing strong growth as day-care surgical procedures become more common, reducing hospitalization while still maintaining demand for medical consumables. Home care centers represent an emerging and rapidly growing segment, driven by aging population, preference for home-based treatment, and availability of portable saline packaging formats that make home administration feasible and safe.

● Product Innovation and Packaging Differentiation Driving Market Evolution

The saline solution market is witnessing increasing sophistication as manufacturers recognize that healthcare providers and patients are becoming more discerning. Normal saline remains the dominant product type, accounting for the largest market share due to its versatility and wide range of applications-it's the go-to solution for most IV applications, wound irrigation, and dilution purposes. However, Ringer's lactate solution is gaining traction for specific clinical scenarios, particularly in surgical settings and trauma care where electrolyte balance is critical. Dextrose-based saline solutions serve important roles in nutritional support and specific metabolic conditions. Packaging innovation is becoming a key differentiator in the market. The 500 ml format accounts for the largest packaging segment, striking an optimal balance between usability and cost-effectiveness for most hospital applications. The 1000 ml format serves high-volume requirements in intensive care units and surgical theaters. The 100 ml and 250 ml formats are gaining importance for pediatric applications, specific drug dilutions, and home healthcare settings where smaller, more manageable volumes are preferred. Manufacturers are investing heavily in packaging improvements-moving toward formats that extend shelf life while maintaining sterility. Quality assurance has become a major competitive factor, with companies emphasizing their adherence to stringent manufacturing standards and cold chain maintenance throughout distribution. The focus on minimizing contamination risk through better packaging design and handling protocols reflects growing awareness of hospital-acquired infections. Some manufacturers are also exploring eco-friendly packaging alternatives, responding to healthcare facilities' sustainability goals without compromising product safety or efficacy.

Leading Companies Operating in the India Saline Solution Market:

● Abaris Healthcare

● Aculife Healthcare Pvt. Ltd. (Nirma Chemical Works Pvt Ltd.)

● Albert David limited

● Althea Pharma

● Amanta Healthcare

● B Braun India Pvt. Ltd.

● Eurolife Healthcare Pvt. Ltd.

● Fresenius Kabi India Pvt. Ltd. (Fresenius Kabi AG)

● Otsuka Pharmaceutical Co. Ltd. (Otsuka Holdings Co., Ltd)

India Saline Solution Market Report Segmentation:

Breakup by Product Type:

● Normal Saline

● Ringer's Lactate Solution

● Dextrose

● Others

According to the report, normal saline represented the largest segment.

Breakup by Packaging Type:

● 500 ml

● 100 ml

● 1000 ml

● 250 ml

According to the report, 500 ml accounted for the largest market share.

Breakup by End-Use:

● Hospitals

● Clinics

● Ambulatory Surgery Center

● Home Care Center

● Others

According to the report, hospitals represented the largest segment.

Breakup by Application:

● IV Drips

● Nasal Drops

● Cleaning Wounds

● Eye Drops

● NaCl Inhalation

● Others

According to the report, IV drips accounted for the largest market share.

Regional Insights:

● North India

● West & Central India

● South India

● East India

According to the report, North India was the largest market for saline solution.

Research Methodology:

The report employs a comprehensive research methodology, combining primary and secondary data sources to validate findings. It includes market assessments, surveys, expert opinions, and data triangulation techniques to ensure accuracy and reliability.

Note: If you require specific details, data, or insights that are not currently included in the scope of this report, we are happy to accommodate your request. As part of our customization service, we will gather and provide the additional information you need, tailored to your specific requirements. Please let us know your exact needs, and we will ensure the report is updated accordingly to meet your expectations.

Get Your Customized Market Report Instantly: https://www.imarcgroup.com/request?type=report&id=5090&flag=E

About Us:

IMARC Group is a global management consulting firm that helps the world's most ambitious changemakers to create a lasting impact. The company provides a comprehensive suite of market entry and expansion services. IMARC offerings include thorough market assessment, feasibility studies, company incorporation assistance, factory setup support, regulatory approvals and licensing navigation, branding, marketing and sales strategies, competitive landscape and benchmarking analyses, pricing and cost research, and procurement research.

Contact Us:

IMARC Group

134 N 4th St. Brooklyn, NY 11249, USA

Email: sales@imarcgroup.com

Tel No: (D) +91-120-433-0800

United States: +1-201-971-6302

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release India Saline Solution Market Growth, Share, and Trends Report 2025-2033 here

News-ID: 4234258 • Views: …

More Releases from IMARC Group

India Plastic Pipes Market Outlook 2026-2034: Size, Share, Growth, Trends, Deman …

According to IMARC Group's report titled "India Plastic Pipes Market Size, Share, Trends and Forecast by Type, Diameter, End Use, and Region, 2026-2034" the report offers a comprehensive analysis of the industry, including market share, growth, trends, and regional insights.

India Plastic Pipes Market Report

The India plastic pipes market size was valued at USD 2.10 Billion in 2025 and is projected to reach USD 3.65 Billion by 2034, exhibiting a CAGR…

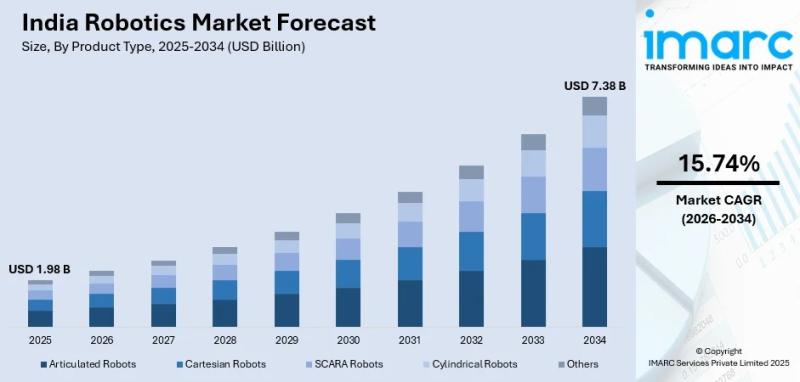

India Robotics Market Expanding at 15.74% CAGR by 2034, Driven by Make in India …

Summary

The India robotics market size reached USD 1.98 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by a massive push toward manufacturing modernization, rising labor costs, and robust government support for digital transformation, the market is projected to reach an impressive USD 7.38 Billion by 2034. This highlights a rapid compound annual growth rate (CAGR) of 15.74% during the forecast period (2026-2034).

Request a…

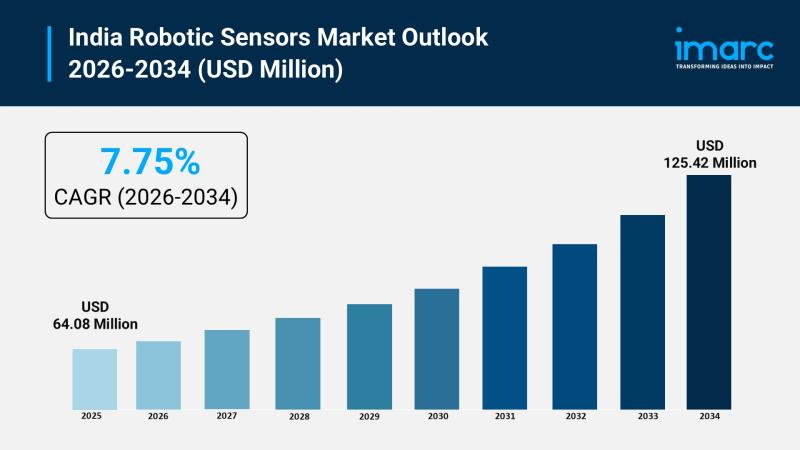

India Robotic Sensors Market Growing at 7.75% CAGR Through 2034, Driven by AI & …

Summary

The India robotic sensors market size reached USD 64.08 Million in 2025, according to the latest comprehensive industry analysis by IMARC Group. Fueled by robust government initiatives, escalating labor costs, and the rapid integration of artificial intelligence in industrial automation, the market is projected to reach USD 125.42 Million by 2034. This highlights a steady compound annual growth rate (CAGR) of 7.75% during the forecast period (2026-2034).

Request a Free Sample…

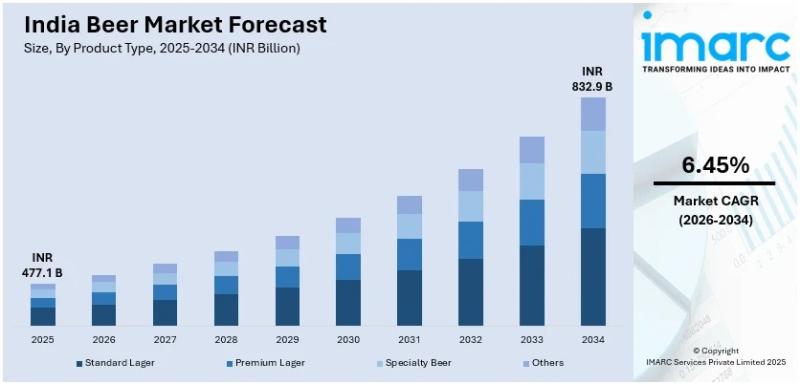

India Beer Market Size to Reach INR 832.93 Billion by 2034: Industry Trends, Gro …

Summary

The beer market size in india reached INR 477.05 Billion in 2025, according to the latest comprehensive industry analysis by IMARC Group. Driven by rapid urbanization, a burgeoning young demographic, and a massive cultural shift toward premium and craft beverages, the market is projected to reach INR 832.93 Billion by 2034. This represents a steady compound annual growth rate (CAGR) of 6.45% during the forecast period (2026-2034).

What are the Key…

More Releases for India

India Smart Air Purifier Market Set to Witness Significant Growth by 2035 | Phil …

India smart air purifier market was valued at $125.8 million in 2024 and is projected to reach $298.7 million by 2035, growing at a CAGR of 8.3% during the forecast period (2025-2035).

India Smart Air Purifier Market Overview

The Indian smart air purifier market is experiencing significant growth, driven by increasing concerns over air pollution and its impact on health. Consumers are increasingly adopting smart air purifiers equipped with advanced features…

Ayurvedic Service Market is Flourishing Like Never Before | Patanjali Ayurved Li …

RnM newly added a research report on the Ayurvedic Service market, which represents a study for the period from 2020 to 2026.

The research study provides a near look at the market scenario and dynamics impacting its growth. This report highlights the crucial developments along with other events happening in the market which are marking on the growth and opening doors for future growth in the coming years. Additionally, the…

Pasta Market Report 2019 Companies included Bambino (India), Nestle (USA), Field …

We have recently published this report and it is available for immediate purchase. For inquiry Email us on: jasonsmith@marketreportscompany.com

This market study includes data about consumer perspective, comprehensive analysis, statistics, market share, company performances (Stocks), historical analysis 2012 to 2017, market forecast 2019 to 2025 in terms of volume, revenue, YOY growth rate, and CAGR for the year 2019 to 2025, etc. The report also provides detailed segmentation on the…

Interior Designers India, Designers and Architects India, Interior Design Consul …

Synergy Corporate Interiors Pvt. Ltd. are offer Designers and Architects India Our architects, designers are working an national and international client base. The final design output is then integrated with the various technical and engineering aspects and taken into production. The expression is also individualistic, based on the communication of the correct corporate identity. Our designers, engineers and architects perform any plan successfully combine handy knowledge with creative ideas into…

Domain Registration India, Web Hosting India, VPS Hosting India , SSL Certificat …

All the Domain Registration services are at affordable price and assure you for the 100% quality.

India Internet offers cheap domain name registration for many domain extensions available. We are a full-service web site solutions provider. We offer a full range of web services including domain registration India, Web Hosting India, Web design, SEO marketing and etc.

We offer different standard and different Windows .NET low-cost, full-featured, all-inclusive web hosting and domain…

Domain Registration India, Web Hosting India, Payment Gateway India

Indiainternet.in is a Quality Web Hosting Company India, provide all web related support and Web hosting services like linux web hosting, windows web hosting, web hosting packages, domain registration in india, Corporate email solution, business email hosting, payment gateway integration, SSL with supports like free php, cgi, asp, free msaccess, free cdonts, free webmail, web based control panel, unlimited ftp access, unlimited data transfer.

During the domain registration process, you will…