Press release

US Crypto Asset Management Market Size to Reach USD 15.87 Billion by 2033 Driven by Institutional Adoption and Blockchain Expansion

The Global Crypto Asset Management Market is riding a digital revolution - soaring from USD 1.74 billion in 2023 to USD 1.89 billion in 2024, and projected to skyrocket to USD 15.87 billion by 2033, registering an impressive CAGR of 26.67% during the forecast period 2025-2033. This remarkable growth highlights the accelerating global shift toward blockchain-powered finance, digital asset security, and institutional-grade crypto investments.The market's momentum is fueled by the rising adoption of cryptocurrencies, NFTs, DeFi tokens, and stablecoins, alongside the increasing demand for secure custody, compliance, and automated portfolio management solutions. As financial institutions, hedge funds, and wealth managers embrace crypto asset management platforms, the sector is evolving into a key pillar of the next-generation digital economy. Moreover, advancements in AI-driven analytics, blockchain interoperability, and real-time risk monitoring are enhancing transparency and investor confidence, positioning the crypto asset management market as a cornerstone of future-ready financial innovation.

Get a Free Sample PDF Of This Report (Get Higher Priority for Corporate Email ID):- https://www.datamintelligence.com/download-sample/crypto-asset-management-market?sai-v

Crypto Asset Management involves platforms and strategies used to manage, monitor, and optimize investments in digital assets like cryptocurrencies and tokens.

Key Players:

=> Key players include Gemini, Coinbase, BitGo, Crypto Finance Group, Ledger, Anchorage Digital, Paxos, and Sygnum.

Key Developments: Crypto Asset Management (U.S. & Japan)

-October 2025: Japan's Financial Services Agency (FSA) began formal consultations to allow major banking group subsidiaries to offer cryptocurrency trading and custody services. This marks a significant step toward integrating traditional banking infrastructure with digital asset management and promoting institutional adoption.

-July 2025: The U.S. enacted the GENIUS Act, a landmark legislative framework establishing federal-level regulations for stablecoins and digital asset custody. The Act clarified compliance rules for registered asset managers and set new standards for institutional-grade crypto portfolios.

-March 2025: Japan's FSA proposed legislative amendments to classify crypto assets as financial instruments, extending insider trading and disclosure rules to protect investors and improve market transparency.

-March 2025: In the U.S., the federal government introduced a "strategic crypto reserve" mechanism, allowing law enforcement and regulatory agencies to manage seized or forfeited digital assets through approved custodians, streamlining the governance of state-held crypto holdings.

Recent Mergers & Strategic Moves: Crypto Asset Management (U.S. & Japan)

-October 2025: Coinbase acquired the digital investment platform Echo in a cash-and-stock transaction valued at around USD 375 million. The acquisition strengthened Coinbase's institutional asset management division, expanding its product suite to include structured yield products and automated crypto portfolios.

-September 2025: SBI Group's asset management arm, SBIGAM, completed a partial share exchange with SBI Okasan Asset Management, consolidating its crypto and traditional investment management businesses. The move aimed to centralize operations and position the company as a leader in hybrid asset management solutions in Japan.

-April 2025: Monex Group acquired a 20% stake in Westfield Capital Management Company, establishing a cross-border partnership to integrate crypto assets into diversified investment portfolios. This strategic alliance enhanced Monex's global reach and expanded its institutional crypto management capabilities.

Buy Now & Unlock 360° Market Intelligence: https://www.datamintelligence.com/buy-now-page?report=crypto-asset-management-market?sai-v

Key Segments:

➥ By Type: Cryptocurrencies, Stablecoins, Tokenized Assets, NFTs, DeFi Assets

➥ By Solutions: Custodial Solutions, Wallet Management, Portfolio Management, Fund Management

➥ By Deployment: On-Premises, Cloud-based

➥ By Application: Web-based, Mobile-based

➥ By End-User: Individual, Retail Investors, Institutional Investors, Enterprises

Market Drivers - Crypto Asset Management Market

Institutional Adoption: Growing participation from hedge funds, asset managers, and pension funds is legitimizing crypto as an asset class and driving demand for management solutions.

Technological Innovation: Advances in blockchain infrastructure, AI/ML analytics, and secure custody platforms enhance portfolio management and risk control.

Diversification Needs: Investors increasingly include digital assets in portfolios to hedge against inflation and traditional market volatility.

Regulatory Clarity & Frameworks: Emerging regulations and compliance standards are reducing uncertainty and attracting more mainstream capital.

Global Digital Asset Accessibility: Expansion of crypto markets globally and cross-border investment opportunities fuel the need for professional management services.

Industry Developments - Crypto Asset Management Market

Custody & Security Focus: Strong emphasis on robust custody solutions, insurance-backed storage, multi-signature wallets and enterprise-grade risk controls.

Tokenisation & DeFi Integration: Growing use of tokenised real-world assets and managed DeFi strategies within crypto asset portfolios.

Cloud-Based & Scalable Platforms: Shift toward scalable, cloud-deployed asset-management infrastructure tailored for digital assets.

Multi-Chain & Cross-Asset Platforms: Asset managers offering multi-chain support and unified dashboards for digital plus traditional investments.

Large Wealth and Institutional Entry: Major financial institutions and wealth-management firms launching crypto-asset product lines and dedicated divisions.

Speak to Our Analyst and Get Customization in the report as per your requirements: https://www.datamintelligence.com/customize/crypto-asset-management-market?sai-v

Research Process:

Both primary and secondary data sources have been used in the Global Crypto Asset Management Market research report. During the research process, a wide range of industry-affecting factors are examined, including governmental regulations, market conditions, competitive levels, historical data, market situation, technological advancements, upcoming developments, in related businesses, as well as market volatility, prospects, potential barriers, and challenges.

Unlock 360° Market Intelligence with DataM Subscription Services: https://www.datamintelligence.com/reports-subscription

Power your decisions with real-time competitor tracking, strategic forecasts, and global investment insights all in one place.

✅ Competitive Landscape

✅ Sustainability Impact Analysis

✅ KOL / Stakeholder Insights

✅ Unmet Needs & Positioning, Pricing & Market Access Snapshots

✅ Market Volatility & Emerging Risks Analysis

✅ Quarterly Industry Report Updated

✅ Live Market & Pricing Trends

✅ Import-Export Data Monitoring

Have a look at our Subscription Dashboard: https://www.youtube.com/watch?v=x5oEiqEqTWg

Contact Us -

Company Name: DataM Intelligence

Contact Person: Sai Kiran

Email: Sai.k@datamintelligence.com

Phone: +1 877 441 4866

Website: https://www.datamintelligence.com

About Us -

DataM Intelligence is a Market Research and Consulting firm that provides end-to-end business solutions to organizations from Research to Consulting. We, at DataM Intelligence, leverage our top trademark trends, insights and developments to emancipate swift and astute solutions to clients like you. We encompass a multitude of syndicate reports and customized reports with a robust methodology.

Our research database features countless statistics and in-depth analyses across a wide range of 6300+ reports in 40+ domains creating business solutions for more than 200+ companies across 50+ countries; catering to the key business research needs that influence the growth trajectory of our vast clientele.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release US Crypto Asset Management Market Size to Reach USD 15.87 Billion by 2033 Driven by Institutional Adoption and Blockchain Expansion here

News-ID: 4233558 • Views: …

More Releases from DataM intelligence 4 Market Research LLP

United States Comprehensive Metabolic Panel Market (2029): Growth Drivers, Inves …

Market Size and Growth

Comprehensive Metabolic panel market size growing at a CAGR of 7.1% during the forecast period (2022-2029).

United States: Recent Industry Developments

✅ February 2026: Quest Diagnostics expanded access to Comprehensive Metabolic Panel testing through enhanced at-home sample collection services.

✅ January 2026: Labcorp introduced AI-enabled analytics to improve interpretation accuracy and turnaround time for CMP results.

✅ December 2025: U.S. healthcare providers increased adoption of CMP testing in preventive health screenings…

Micro Irrigation Systems Market Set for Explosive Growth to US$ 40.69 Billion by …

The Global Micro Irrigation Systems Market reached US$19.57 billion in 2024 and is expected to reach US$40.69 billion by 2032, growing at a CAGR of 9.8% during the forecast period 2025-2032.

Market growth stems from escalating global water scarcity, which pushes farmers toward efficient irrigation amid depleting reserves and climate volatility. Precision agriculture adoption, including IoT-integrated drip and sprinkler systems, boosts crop yields while cutting water use by 40-60% compared to…

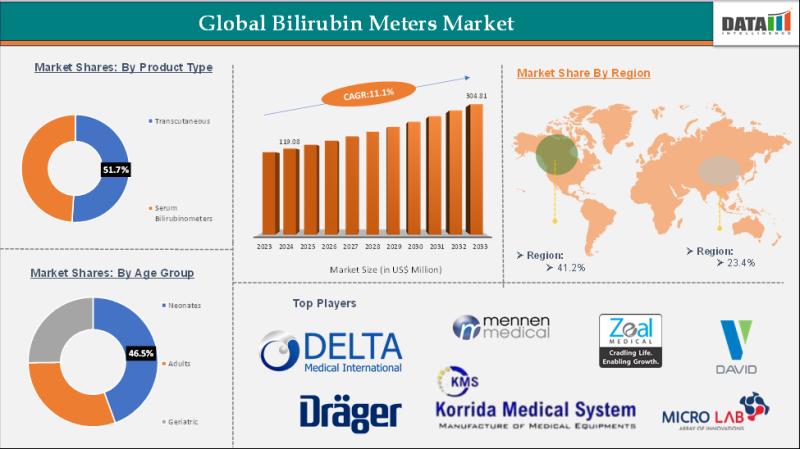

Bilirubin Meters Market (2025): Growth Drivers, Investment Opportunities

Market Size and Growth

Bilirubin Meters Market reached US$ 119.08 million in 2024 and is expected to reach US$ 304.81 million by 2033, growing at a CAGR of 11.1% during the forecast period 2025-2033.

United States: Recent Industry Developments

✅ February 2026: Leading medical device manufacturers introduced next-generation non-invasive bilirubin meters with improved accuracy for neonatal screening.

✅ January 2026: Hospitals expanded adoption of portable bilirubin testing devices to enhance point-of-care diagnostics in maternity…

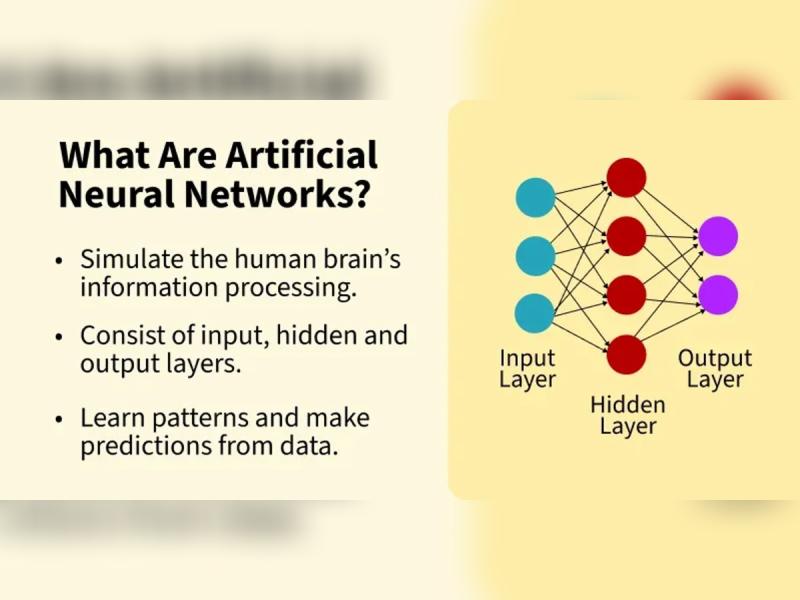

Artificial Neural Networks Market Forecast Shows Robust Growth to USD 600.3 Mill …

Global Artificial Neural Networks (ANN) Market reached US$ 164.3 million in 2022 and is expected to reach US$ 600.3 million by 2030 growing with a CAGR of 17.6% during the forecast period 2024-2031.The Artificial Neural Networks (ANN) market is driven by rising AI adoption, increasing big data analytics, growing demand for predictive modeling, advancements in deep learning, expanding cloud computing infrastructure, and wider applications across healthcare, finance, automotive, and cybersecurity…

More Releases for Asset

Klydex Global Inc Expands Asset Coverage with New Multi-Asset Listing Framework

The new listing structure accelerates asset onboarding and improves market diversification.

Colorado, United States, 1st Dec 2025 - Klydex Global, Inc introduced an expanded multi-asset listing framework that accelerates the onboarding of high-quality digital assets. The new structure enhances screening procedures, technical integration, and market-readiness evaluation to support global asset diversification.

Klydex Global, Inc announced the launch of its enhanced multi-asset listing framework, representing a significant step toward diversifying asset choices for…

Asset Performance Management Market Is Driven By Asset Performance Management In …

Asset Performance Management (APM) has emerged as a critical solution for industries aiming to enhance the performance, reliability, and efficiency of their assets. APM systems utilize data analytics, predictive maintenance, and monitoring technologies to optimize asset performance, minimize downtime, and maximize operational efficiency. The global Asset Performance Management market is characterized by key drivers and notable trends that are reshaping how industries manage and maintain their critical assets.

Download Free PDF…

Asset Management Software

In today's dynamic business landscape, efficient asset management is more critical than ever. Sunsmart Asset Management Software is designed to empower organizations of all sizes and industries to streamline their asset-related processes, enhance control, and maximize the value of their assets.

Key Features and Benefits:

Comprehensive Asset Tracking: Our software provides a centralized platform to track and manage assets, offering real-time visibility into asset location, condition, and history, reducing the risk of…

Asset Evaluation Service Market 2023-2030 Comprehensive Research Study and Stron …

Infinity Business Insights published a new research publication on Asset Evaluation Service Market Insights, to 2030 with 113+ pages and enriched with self-explained Tables and charts in presentable format. The worldwide Asset Evaluation Service market is expected to grow at a booming CAGR during 2023-2030. It also shows the importance of the Asset Evaluation Service market main players in the sector, including their business overviews, financial summaries, and SWOT assessments.

The…

Big Boom in Asset Recovery Software Market 2020-2027 |HPE , Terrapin Systems , C …

According to a report on Asset Recovery Software Market, recently added to the vast repository of Research N Reports, the global market is likely to gain significant impetus in the near future. The report, titled “Global Asset Recovery Software Market Research Report 2020,” further explains the major drivers manipulating industry, the possibility of development, and the challenges going up against the administrations and industrialists in the market. This research study…

Crypto Asset Management Market | Digital Asset Custody Company, Crypto Finance A …

Global Crypto Asset Management Market: Snapshot

The demand within the global market for crypto asset management has been rising on account of advancements in the field of crypto currency. The past years have been an era of advancements in the global digital industry and have paved way for several new technologies. In this stampede of digital transformations, crypto currency has emerged as a matter of discussion and recourse. Hence, the global…