Press release

Premium Outdoor Apparel Market to Reach USD 28,304 Million by 2031 Top 10 Company Globally

The global Premium Outdoor Apparel industry sits at the intersection of technical performance, lifestyle fashion and sustainability, serving consumers who demand durability, weather protection and refined styling for both backcountry use and urban wear. Manufacturers serve a layered value chain that begins with advanced textile suppliers (membranes, recycled fibers, technical insulations), moves through specialized cut-and-sew assembly and finishes with branded retail (direct-to-consumer and wholesale). Because the premium segment commands higher ASPs, margin structures at the factory level and supply-chain resilience are central commercial levers for brand owners and investors.In 2024 the market size for premium outdoor apparel amounted to USD 18,700 million with a growing at a compound annual growth rate of 6.1% through 2031 reaching market size USD 28,304 by 2031. With an ASP of USD 180 per unit, the implied total global units sold in 2024 is 103,900,000 units. At the factory gate, the industry commonly reports factory gross margins in the premium tier that are materially stronger than mass-market apparel; using the provided factory gross margin of 45% implies a factory gross profit of roughly USD 81 per unit and an implied cost of goods sold of approximately USD 99 per unit. COGS breakdowns for premium outdoor apparel is raw materials (including membranes and recycled textiles), direct labor, manufacturing overhead (finishing, quality control), and logistics/packaging. A single line full machine production capacity is around 200,000 units per line per year. Downstream demand is distributed across specialty outdoor retailers, mono-brand stores, premium department stores and e-commerce; within the premium segment, accessories and layering products absorb a material share of demand but hard-shells and insulated outerwear remain the largest value contributors.

Latest Trends and Technological Developments

Sustainability and circular-material innovations continue to dominate industry headlines in 2024 to 2025, from recycled-Gore-Tex initiatives and PFAS-free DWR formulations to carbon-neutral technical pieces recognized at innovation shows; trade and industry outlets reported multiple product launches and supplier partnerships showing recycled and PFAS-free membranes as of early and mid-2025. For example, ISPO and Outdoor Market event coverage highlighted jackets made from recycled Gore-Tex and fully recycled fabrics winning innovation recognition (Feb to Mar 2025). Major brands are also reconfiguring product R&D to reduce PFAS and increase recyclability while experimenting with electrospun membranes that improve breathability without toxic coatings (news and trade reports, 2025). On the commercial side, brands are localizing product assortments for Asia (exclusive China-focused collections) and accelerating direct-to-consumer digital strategies in markets like China and Southeast Asia (industry news, 2025). Several high-profile design and brand moves in 2025 also underline a push to merge technical heritage with urban style, including strategic creative hires and China-focused capsule collections.

Asia is now a structural growth engine for premium outdoor apparel driven by rising participation in outdoor recreation, expanding middle- and upper-income cohorts, and rapid e-commerce adoption in markets such as China, South Korea, Japan and growing pockets across South Asia. China, in particular, has become a dual market of scale and experimentation where global brands run China-exclusive product programs and domestic brands are investing heavily in premiumization and designer collaborations; these shifts are visible in multiple 2025 press stories about China-targeted collections and brand investments. Across Asia, consumers place strong emphasis on multifunctional garments that perform across seasons and urban contexts, which favors hybrid designs and premium lamination technologies. Supply-chain dynamics in Asia remain critical materials sourcing (specialty membranes, recycled yarns) typically occurs in East and Southeast Asia, while final assembly is concentrated in Indonesia, Vietnam, Bangladesh and parts of China depending on cost, lead-time and compliance considerations. Regional retail channels are fragmented: premium mono-brand stores and specialized outdoor retailers coexist with fast-growing omni-channel distribution through marketplaces and brand-owned e-commerce.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5185621

PREMIUM OUTDOOR APPAREL by Type:

Top Wear

Bottom Wear

Other Accessories

PREMIUM OUTDOOR APPAREL by Material:

Synthetic Performance Fabrics

Natural Fibers and Blends

Bio Based Materials

Technical Membrane Laminates

Others

PREMIUM OUTDOOR APPAREL by Features:

Waterproof and Windproof Apparel

Insulated and Thermal Layers

Breathable and Quick Dry Apparel

Stretch and Mobility Enhanced Design

Others

PREMIUM OUTDOOR APPAREL by Usage:

Mountaineering

Hiking and Trekking

Winter Sports

Camping

Others

PREMIUM OUTDOOR APPAREL by Size:

Compact / Light Weight

Standard Retail Range

Extended Sizing

Custom / Tailor Fit

Others

PREMIUM OUTDOOR APPAREL by Application:

Men

Women

Kids

Global Top 10 Key Companies in the PREMIUM OUTDOOR APPAREL Market

Columbia Sportswear

Adidas

Amer Sports

Anta Sports

Black Diamond Equipment

Canadian Tire

Equip Outdoor Technologies

Fenix Outdoor

Haglofs

Jack Wolfskin

Regional Insights

In Southeast Asia, the sports & outdoors category has shown particularly fast growth rates driven by rising fitness and outdoor participation, improving retail infrastructure and accelerating online penetration; regional market analyses from 20242025 point to sustained above-average growth for sports/outdoor segments across ASEAN. Indonesia stands out as a strategically important manufacturing and consumption market: its large population, improving logistics and evolving middle class make it both a production hub for cut-and-sew assembly and an increasingly relevant domestic consumer market for mid- to premium-priced outdoor goods. Brands targeting ASEAN often adapt sizing, color palettes and product construction to tropical climates lighter-weight shells, hybrid ventilation and sun-protective finishes while relying on Indonesia, Vietnam and Cambodia for scalable assembly capacity and competitive labor costs. Cross-border regional distribution (intra-ASEAN) and regional e-commerce platforms are accelerating sales cycles and enabling premium brands to test market assortments without the fixed cost of full retail roll-outs.

The premium outdoor apparel industry faces several concurrent operational and strategic headwinds. First, input-cost volatility especially for specialty membranes, advanced insulation and recycled polymers squeezes COGS and complicates pricing strategies. Second, regulatory shifts away from PFAS and other legacy chemistries force redesigns and new supplier qualification work, sometimes reducing waterproof performance or raising unit costs in the short term. Third, supply-chain complexity and lead-time risk remain material as brands balance nearshoring, cost and compliance; factories must invest in higher skillsets to produce premium technical garments, raising fixed costs. Fourth, market fragmentation and brand proliferation increase marketing and distribution spend, making customer acquisition more expensive even as lifetime value grows. Finally, sustainability demands create reporting and traceability burdens that require investment in materials tracking and circularity programs.

For brands and manufacturers, a multi-pronged strategy is recommended: invest in validated sustainable materials and transparent supply chains to meet regulatory and consumer expectations; focus R&D on membrane and seam-sealing solutions that maintain performance while reducing environmental impacts; prioritize a balanced channel strategy where direct-to-consumer offsets wholesale margin pressure; and maintain flexible production footprints (mix of ASEAN assembly and East Asian technical sourcing) to manage lead-time and cost trade-offs. Factories that capture premium margins tend to demonstrate higher technical capabilities (membrane lamination, precision seaming) and stronger compliance credentials. For established brands, collaborations with technical textile innovators and selective premium capsule drops in Asia can simultaneously protect brand equity and test higher ASP propositions. Trade show, innovation award and partnership activity through 2025 suggest that speed to market with sustainable technical upgrades is a key competitive differentiator.

Product Models

Premium outdoor apparel encompasses high-performance clothing and accessories designed for durability, comfort, and protection against diverse weather conditions. These products are essential for activities such as hiking, mountaineering, skiing, and camping.

Top wear designed to provide insulation, weather protection, and breathability. Notable products include:

Arc'teryx Beta AR Jacket - Arc'teryx: A waterproof GORE-TEX Pro shell offering exceptional breathability and alpine-grade durability.

Patagonia Nano Puff Jacket - Patagonia: Lightweight insulated jacket made from recycled polyester with PrimaLoft Gold insulation.

The North Face Summit L5 Futurelight Jacket - The North Face: High-end shell with Futurelight nanospun membrane for waterproof ventilation.

Mammut Eigerjoch Advanced Hooded Jacket - Mammut: Combines down and synthetic insulation for warmth in extreme cold.

Columbia Titanium OutDry Ex Reign Jacket - Columbia Sportswear: Uses OutDry Extreme technology for lasting waterproof protection.

Bottom wear crafted with stretchable, water-resistant, and windproof materials to support climbing, trekking, skiing, or general outdoor exploration while maintaining flexibility and protection. Examples include:

Rab Torque Pants - Rab: Durable softshell pants optimized for mobility during climbing or scrambling.

Mammut Courmayeur SO Pants - Mammut: Robust and stretchable pants for high-altitude mountaineering.

Mountain Hardwear Exposure/2 GORE-TEX Pants - Mountain Hardwear: Fully seam-sealed alpine pants for snow and ice expeditions.

Salomon Wayfarer Tapered Pants - Salomon: Lightweight and quick-drying hiking pants with stretch fabric.

Montane Terra Pants - Montane: Versatile and breathable trousers made for trekking and backpacking.

Black Diamond Alpine Light Pants - Black Diamond: Streamlined climbing pants with excellent abrasion resistance.

Accessories enhance comfort, safety, and performance by protecting against environmental conditions and improving overall efficiency in outdoor activities. Notable products include:

Outdoor Research Alti Mitts - Outdoor Research: Expedition-grade mittens built for extreme cold with GORE-TEX insert.

Buff Original Multifunctional Headwear - Buff: Versatile tubular fabric for sun, wind, and cold protection.

Arc'teryx Rho Balaclava - Arc'teryx: Lightweight thermal headgear for cold-weather layering.

The North Face Etip Gloves - The North Face: Touchscreen-compatible gloves offering warmth and dexterity.

Patagonia Beanie Hat - Patagonia: Recycled fleece beanie for warmth during outdoor adventures.

The Premium Outdoor Apparel market in 2024 presents a compelling combination of durable growth, higher ASPs and clear product-led differentiation opportunities driven by materials and sustainability. Asia and Southeast Asia represent both growth demand and critical nodes in the production footprint; success in the region requires brands to align product innovation with local consumer preferences while ensuring resilient and compliant manufacturing channels. Investors and industry participants who prioritize sustainable technical innovation, supply-chain flexibility and direct customer relationships are likely to capture disproportionate share gains as the category premiumizes further.

Investor Analysis

What investors should focus on: material-technology partnerships, factory capabilities for premium assembly, brand digital direct-to-consumer traction in Asia, and traceable sustainability credentials. How to evaluate opportunities: screen targets for (1) validated technical IP or preferred supplier relationships for membranes/insulations, (2) demonstrated margin expansion in premium lines (factory gross margin and ASP sustainability), (3) profitable digital channels in Asia/ASEAN, and (4) supply-chain diversification that reduces single-country concentration risk. Why these factors matter: premium ASPs and higher factory gross margins (the example 45% factory gross margin implies healthy per-unit factory profit) provide room to fund R&D and marketing while still delivering investor returns; meanwhile, Asia/ASEAN exposure offers both volume growth and production arbitrage if managed with governance and compliance creating multiple levers for scale. Investors should prioritize businesses where product performance improvements and sustainability credentials are defensible and can be monetized through price premium or higher retention.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5185621

5 Reasons to Buy This Report

It condenses the latest market sizing, pricing and unit economics into an investor-ready snapshot.

It explains regionally specific demand and supply dynamics for Asia and ASEAN where growth and production converge.

It synthesizes recent technological and sustainability developments with dated trade coverage to orient strategic R&D.

It provides operational benchmarks COGS split, factory gross profit per unit and typical sewing-line capacity bands useful for diligence and valuation modeling.

It lists the leading industry players and competitive positioning insights, accelerating comparable company analysis and partner identification.

5 Key Questions Answered

What was the premium outdoor apparel market value in 2024 and how many units were sold globally at the stated ASP?

What are the per-unit economics at the factory level (COGS, gross profit, and gross margin) for premium apparel?

What are the latest material and technology trends shaping performance and sustainability in premium outerwear?

How do Asia and ASEAN differ as consumption markets and production hubs for premium outdoor apparel?

Which companies currently lead the premium outdoor apparel category and what strategic assets should investors prioritize?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Premium Outdoor Apparel Market Research Report 2025

https://www.qyresearch.com/reports/5185621/premium-outdoor-apparel

Global Premium Outdoor Apparel Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5185619/premium-outdoor-apparel

Global Premium Outdoor Apparel Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5185620/premium-outdoor-apparel

Premium Outdoor Apparel - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5185622/premium-outdoor-apparel

Global Outdoor Apparel Market Research Report 2025

https://www.qyresearch.com/reports/4302160/outdoor-apparel

Global Outdoor Apparel Goods Market Research Report 2025

https://www.qyresearch.com/reports/4354929/outdoor-apparel-goods

Global Outdoor Apparel Fabric Market Research Report 2025

https://www.qyresearch.com/reports/3800051/outdoor-apparel-fabric

Global Outdoor Hunting Apparel Market Research Report 2025

https://www.qyresearch.com/reports/4466806/outdoor-hunting-apparel

Global Lightweight Outdoor Apparel Market Research Report 2025

https://www.qyresearch.com/reports/4620815/lightweight-outdoor-apparel

Global Outdoor Apparel & Equipment Market Research Report 2025

https://www.qyresearch.com/reports/4286183/outdoor-apparel---equipment

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Premium Outdoor Apparel Market to Reach USD 28,304 Million by 2031 Top 10 Company Globally here

News-ID: 4232834 • Views: …

More Releases from QY Research

From Drift to Precision: How Manganin Thin Film Redefines Stability in Aerospace …

Problem

Thales Group (France) relying on conventional metal films or bulk alloy resistors faced resistance drift, temperature sensitivity, and poor long-term stability in precision measurement and sensing applications. In current sensing, strain gauges, and high-accuracy electronics, temperature fluctuations and thermal cycling caused signal noise, calibration drift, and reduced measurement accuracy-especially in aerospace, power electronics, and scientific instrumentation.

Solution

Isabellenhütte adopted Manganin Thin Film, a precision alloy film composed primarily of Cu-Mn-Ni, deposited using…

Global and U.S. LiDAR Sensors for Self-Driving Market Report, Published by QY Re …

QY Research has released a comprehensive new market report on LiDAR Sensors for Self-Driving, high-resolution 3D sensing systems that enable autonomous vehicles to perceive their surroundings with precise distance, shape, and motion detection. By emitting laser pulses and measuring time-of-flight or phase shift, LiDAR sensors generate real-time 3D point clouds essential for object detection, localization, mapping, and safe navigation. As autonomous driving advances toward Level 3-Level 4 deployment, this report…

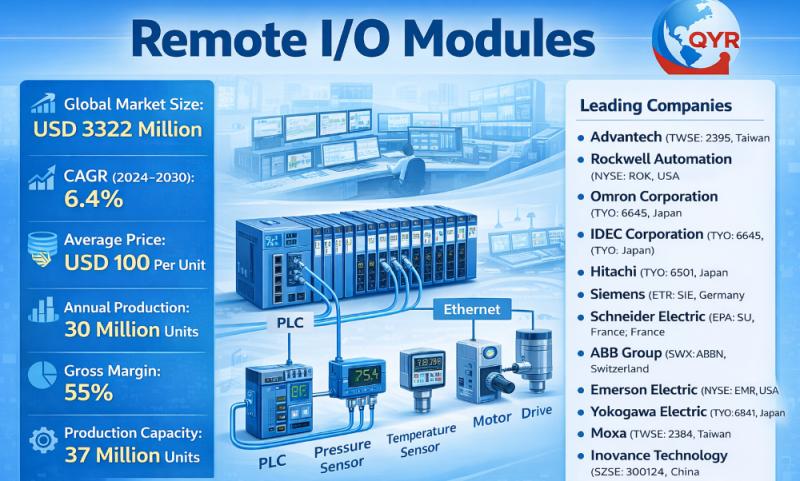

Global and U.S. Remote I/O Modules Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Remote I/O Modules, an industrial automation device that interfaces sensors, actuators, and field devices with a central controller (PLC, DCS, or PAC) over a network, allowing control and monitoring of distributed field devices without needing direct wiring to the main control cabinet. These modules transmit digital and analog signals between field devices and the central system, often using industrial communication…

Top 30 Indonesian Glass Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Asahimas Flat Glass Tbk (AMFG)

PT Mulia Industrindo Tbk (MLIA)

PT Arwana Citramulia Tbk (ARNA) related building materials

PT Cahayaputra Asa Keramik Tbk (CAKK) tile & partial glass products

PT Intikeramik Alamasri Industri Tbk (IKAI) ceramics & glass adjacencies

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Surya Toto Indonesia Tbk (TOTO)

PT Mark Dynamics Indonesia Tbk (MARK)

PT Indopoly Swakarsa Industry Tbk (IPOL) polymers for coatings

PT Sumi…

More Releases for Outdoor

Embracing Outdoor Living: Soka Home's New Outdoor Furniture Collection

Image: https://www.abnewswire.com/upload/2025/09/ff3bb43dfaf14e0ec9b83674a3315893.jpg

Home design has undergone a remarkable transformation over the last decade. No longer defined solely by interiors, living spaces now extend into the outdoors. Patios, gardens, balconies, and backyards are evolving into personal sanctuaries for relaxation, social connection, and entertainment. This shift has fueled rising demand for outdoor furniture [https://sokahome.com/collections/outdoor-collection], turning it into a vital category in the home furnishings industry.

For companies in the home and lifestyle sector, entering…

Outdoor Grilling and Fire Features: Outdoor Dream Space Redefines Outdoor Living …

Image: https://www.getnews.info/wp-content/uploads/2024/09/1726626876.png

Outdoor Dream Space redefines luxury outdoor living with personalized, high-quality grilling and fire features, offering custom solutions tailored to individual lifestyles and preferences.

Outdoor Dream Space has emerged as a leader in luxury outdoor living, setting itself apart through its dedication to creating personalized outdoor grilling and fire features [https://outdoordreamspace.com/] that enhance both function and aesthetics. Whether customers seek to create a cozy backyard retreat or a full-scale outdoor kitchen,…

Outdoor Planters Market: Increasing Trend of Outdoor Decor and Gardening Drives …

Global Outdoor Planters Market Overview:

The Outdoor Planters market is a broad category that includes a wide range of products and services related to various industries. This market comprises companies that operate in areas such as consumer goods, technology, healthcare, and finance, among others.

In recent years, the Outdoor Planters market has experienced significant growth, driven by factors such as increasing consumer demand, technological advancements, and globalization. This growth has created both…

Outdoor TV Market: Rise in Number of Outdoor Concerts, Events Fuels Demand for O …

Outdoor TV Market: Introduction

Transparency Market Research delivers key insights on the global outdoor TV market. In terms of revenue, the global outdoor TV market is estimated to expand at a CAGR of ~9% during the forecast period, owing to numerous factors, regarding which TMR offers thorough insights and forecasts in its report on the global outdoor TV market.

Companies are heavily investing in R&D to launch an exclusive collection of outdoor…

Rugged Outdoor Touch Screen Monitors for Outdoor Systems

(Arlington Hts., IL) TRU-Vu Monitors, a leading provider of industrial-grade monitors and touch screens, recently introduced a rugged outdoor panel-mount touch screen. It is ideal for use in outdoor kiosks, truck scale terminals, automated truck ticketing, load-out systems, check-in stations, and more.

Video monitors and touch screens are one of the most critical elements in any of these unattended systems. The user must be able to view data, routing instructions, ticket…

Outdoor Retail Brands Market Impressive Gains including key players: Equip Outdo …

Global Outdoor Retail Brands Market Research Report 2019-2025

The Global Outdoor Retail Brands Market report, a new addition in the catalog consist of a wide-ranging outlines of the current condition of the market and presents it development and other central factors across the provincial markets. It provides with massive amount of information to its readers that has been collected with the help of numerous primes and subordinate research procedures. The information…