Press release

Aluminum Canisters for Inhalation Aerosols Market to Reach CAGR 6,3% by 2031 Top 10 Company Globally

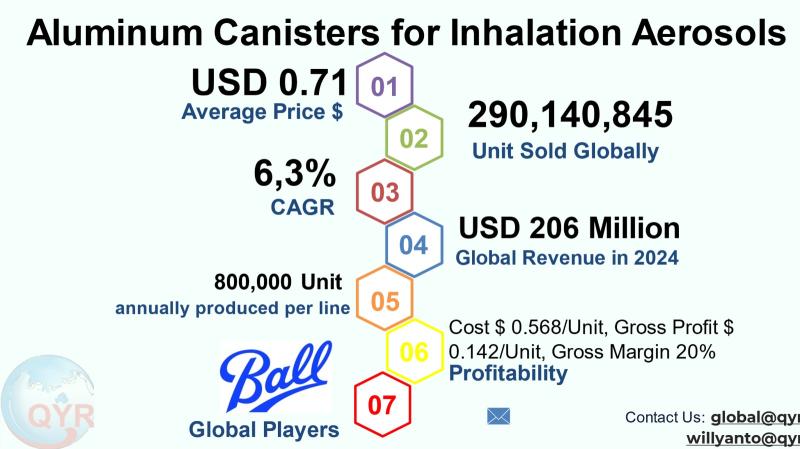

The aluminum canister used for inhalation aerosols (pharmaceutical metered-dose inhalers, nasal sprays and related drug-delivery aerosols) is a specialized segment of the broader aluminum aerosol-container market that supplies sterile, corrosion-resistant, lightweight, and fully recyclable metal packaging to pharmaceutical companies, contract packagers and device integrators. Aluminum canisters for inhalation are engineered to meet pharmaceutical-grade cleanliness, internal lacquer/coating compatibility with drug formulations, precise valve seating and metering requirements, and tight tolerances on internal volume and burst strength. These characteristics distinguish them from mass-market aerosol cans used in personal care or household products and create tighter supplier qualification processes, higher quality control, and a premium on validated surface treatments and barrier coatings.The global market size for aluminum canisters for inhalation aerosols in 2024 is taken as USD 206 million, with a growing compound annual growth rate of 6.3% through 2031 reaching market size USD 316 million y 2031. An average Selling price is USD 0.71 per unit implied estimated total units sold globally in 2024 are approximately 290,140,845 units. The typical factory gross margin assumed for production in this segment is 20%, which implies an average factory gross profit per canister of about USD 0.142 and an average cost of goods sold per canister of about USD 0.568. The COGS breakdown of aluminum canister manufacturing operation is: aluminum blank & primary materal, internal lacquer/coating & lining, direct labor & assembly, tooling/finishing and printing, energy/maintenance and utilities, and quality control/waste allowances. A single line full machine capacity production is around 800,000 unit per line per year. Downstream customers primarily consist of pharmaceutical companies, Contract Manufacturing Organizations (CMOs), and Contract Packaging Organizations (CPOs). This global production and demand observations are consistent with industry association and market-research reporting showing continuing unit growth in aluminum aerosol deliveries and the dominance of personal care end-uses.

Latest Trends and Technological Developments

Across 2024 to 2025 the aluminum aerosol and pharmaceutical can sector showed several converging trends: sustainability and recyclability continued to be front-of-mind for major producers and brand owners; consolidation and targeted acquisitions by leading packaging groups were used to expand capacity and technical capabilities for specialized cans; and investment in validated internal coatings and low-contamination finishing processes increased as inhalation and other pharmaceutical applications expanded. In a sector update dated February 2025, AEROBAL reported growth in global deliveries of aluminum aerosol containers and highlighted continuing unit growth across key market segments. In a November 2024 announcement Ball Corporation disclosed an acquisition intended to expand its capabilities in impact-extruded aluminum packaging and related aerosol technologies, a move that underscores consolidation and capability expansion by large suppliers in response to demand for specialty aerosol formats and sustainability commitments. Industry press and trade reporting in March 2025 summarized production and market dynamics for aluminum tubes and aerosol cans, noting modest volume growth in 2024 and continued regional investment to serve personal care and pharmaceutical customers.

Asia remains a pivotal region for aluminum aerosol containers because of two offsets: (1) very large and growing end-market demand in personal care and household categories in China, India and South Korea that drives high unit volumes and attracts global suppliers; and (2) a rising, specialized pharmaceutical manufacturing base in China, Japan and South Korea that sources pharmaceutical-grade canisters either locally or from nearby regional suppliers to shorten supply chains. China continues to be a production center for both commodity and higher-spec aluminum cans; local players and regional subsidiaries of global suppliers have expanded capacity and in some casesmoved to validated production for pharmaceutical customers. India is an important and growing market for aerosol cans, with domestic manufacturers serving regional personal care and pharma customers while also competing on cost. East Asian hubs, especially Japan and South Korea, sustain demand for high-specification pharmaceutical canisters tied to local pharmaceutical manufacturing and contract-manufacturing organizations. Regional differences in regulation (pharmaceutical device qualification, coating validation) and logistics mean that suppliers operating in Asia often maintain dedicated validated lines for inhalation canisters or offer secondary finishing (e.g., cleanroom lacquer application) to meet customer qualification requirements. Several regional reports and industry analysis note that Asia Pacific overall is forecast to grow at a notable pace among world regions for aerosol packaging demand.

Get Full PDF Sample Copy of Report: (Including Full TOC, List of Tables & Figures, Chart)

https://www.qyresearch.com/sample/5185013

Aluminum Canisters for Inhalation Aerosols by Type:

Fluorine Coating

No Coating

Aluminum Canisters for Inhalation Aerosols by Material:

Pure Aluminum

Aluminum Alloy

Low Carbon Aluminum

Composite Layer Canisters

Others

Aluminum Canisters for Inhalation Aerosols bySize:

Small Volume

Medium Volume

Large Volume

Custom Capacities

Others

Aluminum Canisters for Inhalation Aerosols by Shape:

Standard Cylindrical Deep Drawn Canisters

Necked In Canisters

Straight Wall Canisters

Reinforced Base Canisters

Others

Aluminum Canisters for Inhalation Aerosols by Usage:

Pharmaceutical Inhalation

Nasal and Topical Aerosol Frug Delivery

Veterinary Inhalation

Clinica Research

Others

Aluminum Canisters for Inhalation Aerosols by Application:

Respiratory Diseases

Allergic Conditions

Other Chronic Conditions

Global Top 10 Key Companies in the Aluminum Canisters for Inhalation Aerosols Market

Ball Corporation

Trivium Packaging

CCL Containers

TUBEX GmbH

Moravia Cans

LINHARDT

ALLTUB

ALUCON

Jamestrong

Aryum

Regional Insights

Within Southeast Asia, ASEAN demand patterns reflect rising personal-care consumption and selectively growing pharmaceutical manufacturing. Indonesia stands out for its large population, rising middle class and expanding domestic personal-care manufacturing base; these drivers support increased local demand for aluminum aerosol containers including an uptick in contract packaging and regional filling capacity for both OTC sprays and some inhalation products. ASEAN countries differ in the maturity of their pharmaceutical packaging qualification processes; countries with more developed pharmaceutical clusters (Malaysia, Singapore and Thailand) tend to source higher-spec containers and validated finishing services, while Indonesia, Vietnam and the Philippines present rapid unit demand growth for personal care and household aerosols and a growing but still smaller pharmaceutical inhalation segment. Regional trade and supplier networks mean manufacturers in ASEAN often import can blanks or finished canisters from China or regional converters and perform filling and packaging locally. Trade and logistics improvements across ASEAN are lowering lead times, but pharmaceutical customers in particular continue to favor nearshore qualified suppliers for inhalation canisters to reduce qualification risk.

Key challenges for the inhalation aluminum canister segment include raw material price volatility for aluminum and lacquer chemistries, the technical demands of qualified internal coatings for drug compatibility, increasingly stringent cleanroom and validation requirements from pharmaceutical customers, and environmental/regulatory pressure that is reshaping propellant and packaging choices. Supply chain disruptions and capacity tightness in high-spec lines can create long lead times for validated inhalation canisters, and securing supplier qualifications can take many months to years. Producers must also manage scrap/waste and regulatory reporting related to VOCs and propellants at downstream fill sites. Lastly, the industry faces an ongoing balance between low unit cost and the high quality controls required by pharmaceutical customers, which increases capital intensity and raises barriers to entry for validated production.

For suppliers and brand owners the strategic priorities include securing validated lines or qualified contract manufacturers near fill sites, investing in internal lacquer technology and quality systems to meet pharma validation, and building flexible production that can switch between personal-care and pharmaceutical runs while preserving changeover validation. Vertical integration either through acquisitions of specialized finishing or extrusion assets or via long-term supply agreements gives brand owners and leading converters better control over qualification timelines and supply security. For new entrants, partnering with established converters or licensing validated internal coating recipes and testing services shortens time to market for inhalation product supply. Sustainability programs (recycled aluminum content, lower-energy production and clear end-of-life recycling claims) are increasingly part of procurement decisions across Asia and ASEAN, especially among multinational brand owners.

Product Models

Aluminum canisters are essential components in inhalation aerosol systems, providing lightweight, corrosion-resistant, and high-barrier containers for metered-dose inhalers (MDIs). These canisters ensure product stability and precise dosage delivery in pharmaceutical aerosol formulations.

Fluorine coating which enhance compatibility with formulations containing aggressive propellants or drugs. Notable products include:

F-Guard MDI Canister Ball Corporation: Designed for sensitive formulations, offering superior chemical resistance and extended shelf life.

CCL FluoroShield Canister CCL Containers: Provides a robust internal coating minimizing drug adhesion and interaction.

Plasma/Fluorinated Nanolayer Canister H&T Presspart Manufacturing Ltd: A deep-drawn aluminium canister treated with a nanolayer/plasma process involving fluorocarbon polymer to reduce drug adhesion and degradation

Plasma Fluoro-Coated Canister Anomatic: Uses a fluorocarbon polymer plasma coating (FCP) to produce a hydrophobic interior surface (contact angle > 90°) in an MDI canister for better suspension stability

Aryum FluoroSafe Canister Aryum: Optimized for complex MDI formulations with high chemical reactivity.

No coating which are cost-effective solutions suitable for stable formulations that do not require extra protection. Examples include:

Trivium PureCan Trivium Packaging: Lightweight design ideal for large-scale production of non-reactive formulations.

CCL BaseLine Canister CCL Containers: Cost-effective solution with consistent wall thickness for reliability.

GulfCans MDI Aluminum Gulf Cans Industries: Provides stable performance for basic respiratory product packaging.

19 ml Aluminium Plain Canister Shanghai Esonics Technology Co., Ltd: A model AL19P0 plain aluminium inhaler can with no internal coating.

Aluminium MDI Canister (Plain) Pressteck S.p.A.: Deep-drawn aluminium canister for MDI use offered in plain (uncoated) condition

The aluminum canister market for inhalation aerosols is a niche but strategically important segment of the broader aerosol container industry. Unit growth is driven by rising respiratory-care needs, continued demand in personal care (which supports overall aluminum can supply chains) and regional manufacturing expansion across Asia and ASEAN. Suppliers that can combine validated pharmaceutical-grade finishing, strong quality systems, resilient regional supply and sustainability credentials will be best positioned to capture the higher-margin inhalation business as global demand grows at a mid-single-digit CAGR.

Investor Analysis

Investors evaluating this space should focus on three types of value signals: capacity and qualification (who owns validated lines near major pharma fill hubs), technology and IP (internal lacquer/coating know-how and low-contamination finishing processes), and customer concentration/supply contracts (long-term offtake or qualification agreements with pharma OEMs or contract-manufacturers). Capacity expansion announcements and targeted M&A among incumbent converters are meaningful because they reduce lead-time risk for pharmaceutical customers and often command a premium margin. Sustainability commitments and recycled-aluminum sourcing matter because multinational customers increasingly require circularity metrics, which can become a procurement gate for preferred suppliers. Finally, pricing resilience (ability to maintain gross margins near the industry benchmark level in the face of aluminum price swings) and operating discipline in validated production lines are indicators that a supplier can convert volume growth into predictable earnings. Investors should therefore prioritize firms with documented validated capacity, diversified end-markets including a strong personal care base to smooth volumes, and strategic partnerships with regional pharma fill houses.

Request for Pre-Order Enquiry On This Report

https://www.qyresearch.com/customize/5185013

5 Reasons to Buy This Report

Understand a focused addressable market: this report isolates the inhalation-grade aluminum canister segment within the broader aluminum aerosol market and provides unit and value estimates for 2024 plus growth through 2031.

Regional emphasis on Asia & ASEAN: the report explains where demand and qualification requirements differ across Asia and Southeast Asia and highlights opportunities in Indonesia and neighboring markets.

Cost, margin and capacity benchmarks: practical unit-level metrics (price per unit, COGS per unit, factory gross margin, typical per-line capacity ranges) enable quick commercial modeling for suppliers and investors.

Actionable strategic guidance: the strategic insights section recommends sourcing, partnership and investment approaches tailored for companies and private equity evaluating packaging or contract-manufacturing plays.

Curated, recent industry developments: the report compiles recent industry events and credible trade and market reporting to show where consolidation and technology investment are happening now.

5 Key Questions Answered

What was the estimated market size and units sold globally for inhalation aluminum canisters in 2024?

What are realistic per-unit pricing, gross margin and COGS breakdown benchmarks for a validated pharmaceutical-grade canister?

How does demand and supplier qualification differ between Asia, ASEAN and major regional markets such as Indonesia?

Which strategic moves (capacity investment, acquisitions, validated finishing) most reduce supply and qualification risk for inhalation customers?

Who are the major global and regional players and what recent industry events indicate consolidation or capacity expansion?

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (by region, product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: key insights, key emerging trends, etc.

Chapter 3: Manufacturers competitive analysis, detailed analysis of the product manufacturers competitive landscape, price, sales and revenue market share, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product sales, revenue, price, gross margin, product introduction, recent development, etc.

Chapter 5 & 6: Sales, revenue of the product in regional level and country level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and market size of each country in the world.

Chapter 7: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 8: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 9: Analysis of industrial chain, including the upstream and downstream of the industry.

Chapter 10: The main points and conclusions of the report.

Related Report Recommendation

Global Aluminum Canisters for Inhalation Aerosols Market Research Report 2025

https://www.qyresearch.com/reports/5185013/aluminum-canisters-for-inhalation-aerosols

Aluminum Canisters for Inhalation Aerosols - Global Market Share and Ranking, Overall Sales and Demand Forecast 2025-2031

https://www.qyresearch.com/reports/5185012/aluminum-canisters-for-inhalation-aerosols

Global Aluminum Canisters for Inhalation Aerosols Market Outlook, InDepth Analysis & Forecast to 2031

https://www.qyresearch.com/reports/5185011/aluminum-canisters-for-inhalation-aerosols

Global Aluminum Canisters for Inhalation Aerosols Sales Market Report, Competitive Analysis and Regional Opportunities 2025-2031

https://www.qyresearch.com/reports/5185010/aluminum-canisters-for-inhalation-aerosols

Global Inhalation Aerosol Market Research Report 2025

https://www.qyresearch.com/reports/3662862/inhalation-aerosol

Global Budesonide Inhalation Aerosol Market Research Report 2025

https://www.qyresearch.com/reports/4708184/budesonide-inhalation-aerosol

Global Ciclesonide Inhalation Aerosol Market Research Report 2025

https://www.qyresearch.com/reports/4945861/ciclesonide-inhalation-aerosol

Global Albuterol Sulfate Inhalation Aerosol Market Research Report 2025

https://www.qyresearch.com/reports/4285681/albuterol-sulfate-inhalation-aerosol

Global Salbutamol Sulfate Inhalation Aerosol Market Research Report 2025

https://www.qyresearch.com/reports/4944433/salbutamol-sulfate-inhalation-aerosol

Global Terbutaline Sulfate Aerosol Inhalation Solution Market Research Report 2025

https://www.qyresearch.com/reports/4653276/terbutaline-sulfate-aerosol-inhalation-solution

Contact Information:

Tel: +1 626 2952 442 (US) ; +86-1082945717 (China)

+62 896 3769 3166 (Whatsapp)

Email: willyanto@qyresearch.com; global@qyresearch.com

Website: www.qyresearch.com

About QY Research

QY Research has established close partnerships with over 71,000 global leading players. With more than 20,000 industry experts worldwide, we maintain a strong global network to efficiently gather insights and raw data.

Our 36-step verification system ensures the reliability and quality of our data. With over 2 million reports, we have become the world's largest market report vendor. Our global database spans more than 2,000 sources and covers data from most countries, including import and export details.

We have partners in over 160 countries, providing comprehensive coverage of both sales and research networks. A 90% client return rate and long-term cooperation with key partners demonstrate the high level of service and quality QY Research delivers.

More than 30 IPOs and over 5,000 global media outlets and major corporations have used our data, solidifying QY Research as a global leader in data supply. We are committed to delivering services that exceed both client and societal expectations.

This release was published on openPR.

Permanent link to this press release:

Copy

Please set a link in the press area of your homepage to this press release on openPR. openPR disclaims liability for any content contained in this release.

You can edit or delete your press release Aluminum Canisters for Inhalation Aerosols Market to Reach CAGR 6,3% by 2031 Top 10 Company Globally here

News-ID: 4232833 • Views: …

More Releases from QY Research

Market Overview - Ultra-low-k Dielectric Material

QY Research has recently published a comprehensive market study on Ultra-low-k Dielectric Material, a critical class of advanced insulating materials engineered to reduce parasitic capacitance and signal delay in advanced semiconductor interconnects. Ultra-low-k dielectrics are essential enablers for sub-7 nm logic nodes, advanced memory, high-performance computing, and AI accelerators, where interconnect RC delay increasingly limits device performance and power efficiency.

The market is transitioning from dense SiO2 and conventional low-k materials…

Global and U.S. Quadruped Mobile Robots Market Report, Published by QY Research.

QY Research has released a comprehensive new market report on Quadruped Mobile Robots, are four-legged robotic systems designed to move and operate in complex, unstructured environments by mimicking the locomotion of animals. They use a combination of advanced sensors, actuators, AI algorithms, and real-time control systems to maintain balance, navigate uneven terrain, climb obstacles, and adapt to dynamic conditions. Because of their high stability and mobility, quadruped robots are widely…

Global and U.S. Industrial Edge Cloud Devices Market Report, Published by QY Res …

QY Research has released a comprehensive new market report on Industrial Edge Cloud Devices, ruggedized computing platforms that bring cloud-native processing, storage, and AI analytics directly to the industrial edge-close to machines, sensors, and control systems. By executing latency-sensitive workloads locally while synchronizing with central or public clouds, these devices enable real-time decision-making, improved reliability, and secure data governance across factories, utilities, energy assets, and transportation infrastructure. As Industry 4.0,…

Top 30 Indonesian Ceramic Public Companies Q3 2025 Revenue & Performance

1) Overall companies performance (Q3 2025 snapshot)

PT Arwana Citramulia Tbk (ARNA)

PT Cahayaputra Asa Keramik Tbk (CAKK)

PT Intikeramik Alamasri Industri Tbk (IKAI)

PT Keramika Indonesia Assosiasi Tbk (KIAS)

PT Mulia Industrindo Tbk (MLIA)

PT Asahimas Flat Glass Tbk (AMFG) (glass & ceramic-adjacent)

PT Niro Ceramic Nasional Indonesia

PT Eleganza Tile Indonesia

PT Roman Ceramic International

PT Platinum Ceramics Industry

PT Granito (Citra Granito)

PT Diamond Keramik Indonesia

PT Indogress (Inti Keramik Sejahtera)

PT Indopenta Sakti Teguh

PT Sun Power Ceramics

PT Satyaraya Keramindo Indah…

More Releases for Canister

Nitrogen Canister Market Size 2024 to 2031.

Market Overview and Report Coverage

A nitrogen canister is a storage container used to hold and transport nitrogen gas. These canisters are commonly used in various industries such as healthcare, aerospace, food and beverage, and electronics for applications such as preserving food, medical procedures, and manufacturing processes.

The future outlook of the Nitrogen Canister Market looks promising with a projected growth rate of 7.60% during the forecasted period. The increasing…

Automotive Carbon Canister Market Outlook & Forecast [2029]

According to TechSci Research report, "𝐆𝐥𝐨𝐛𝐚𝐥 𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐂𝐚𝐫𝐛𝐨𝐧 𝐂𝐚𝐧𝐢𝐬𝐭𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 - Industry Size, Share, Trends, Competition Forecast & Opportunities, 2029", 𝐭𝐡𝐞 𝐆𝐥𝐨𝐛𝐚𝐥 𝐀𝐮𝐭𝐨𝐦𝐨𝐭𝐢𝐯𝐞 𝐂𝐚𝐫𝐛𝐨𝐧 𝐂𝐚𝐧𝐢𝐬𝐭𝐞𝐫 𝐌𝐚𝐫𝐤𝐞𝐭 𝐬𝐭𝐨𝐨𝐝 𝐚𝐭 𝐔𝐒𝐃 𝟏.𝟕 𝐛𝐢𝐥𝐥𝐢𝐨𝐧 𝐢𝐧 𝟐𝟎𝟐𝟑 𝐚𝐧𝐝 𝐢𝐬 𝐚𝐧𝐭𝐢𝐜𝐢𝐩𝐚𝐭𝐞𝐝 𝐭𝐨 𝐠𝐫𝐨𝐰 𝐰𝐢𝐭𝐡 𝐚 𝐂𝐀𝐆𝐑 𝐨𝐟 𝟔.𝟎𝟔% 𝐢𝐧 𝐭𝐡𝐞 𝐟𝐨𝐫𝐞𝐜𝐚𝐬𝐭 𝐩𝐞𝐫𝐢𝐨𝐝, 𝟐𝟎𝟐𝟓-𝟐𝟎𝟐𝟗.

An automotive part of the evaporative emission control system (EVAP) that is fastened to the fuel tank is the carbon canister. When the…

EcoPurge Pro: The Vapor Canister Solution

Automobile vapor canisters are components of the Evaporative Emission Control System (EVAP), filled with carbon or other materials. The primary function of the steam tank is to absorb unwanted pollutants from the fuel and supply the filtered fuel to the carburetor to ensure efficient engine operation and reduce emissions after fuel combustion. On a global scale, due to urbanization, industrialization and increased disposable income, the number of cars around the…

Automotive Carbon Canister Market Research Report 2023 - Valuates Reports

Carbon canister is usually placed between the gasoline tank and the engine.

The global Automotive Carbon Canister market was valued at US$ million in 2022 and is anticipated to reach US$ million by 2029, witnessing a CAGR of % during the forecast period 2023-2029. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

Get sample report - https://reports.valuates.com/request/sample/QYRE-Auto-5C7525/Global_Automotive_Carbon_Canister_Market_Insights_Forecast_to_2028

North American market for Automotive Carbon Canister is estimated to…

Sterility Test Canister Market Research Report 2023

Global Sterility Test Canister Market

The sterility test tank is a pre-sterilized, non-toxic, non-pyrogenic, ready-to-use sterility testing equipment. is a closed system that minimizes the risk of false positive and negative results, increases reliability and improves sterility testing workflows.

The global Sterility Test Canister market was valued at US$ million in 2022 and is anticipated to reach US$ million by 2029, witnessing a CAGR of % during the forecast period 2023-2029. The…

Activated Carbon Canister Market 2022 | Detailed Report

This report offers a detailed view about the challenging landscape of the international market. The exact and innovative information gave through this report helps organizations with getting mindful of the kinds of consumers, buyer's demand and preferences, their perspective, their purchasing aims, their reaction to a specific item, and their different tastes about the certain item already prevailing in the Activated Carbon Canister market. It includes a point-by-point illustration of…